Tel Aviv has the highest income from non-residential property taxes with NIS 1.85 billion in 2020. This has a dramatic effect on the quality of life of the residents, and even on the amount of their property taxes

1 Viewing the gallery

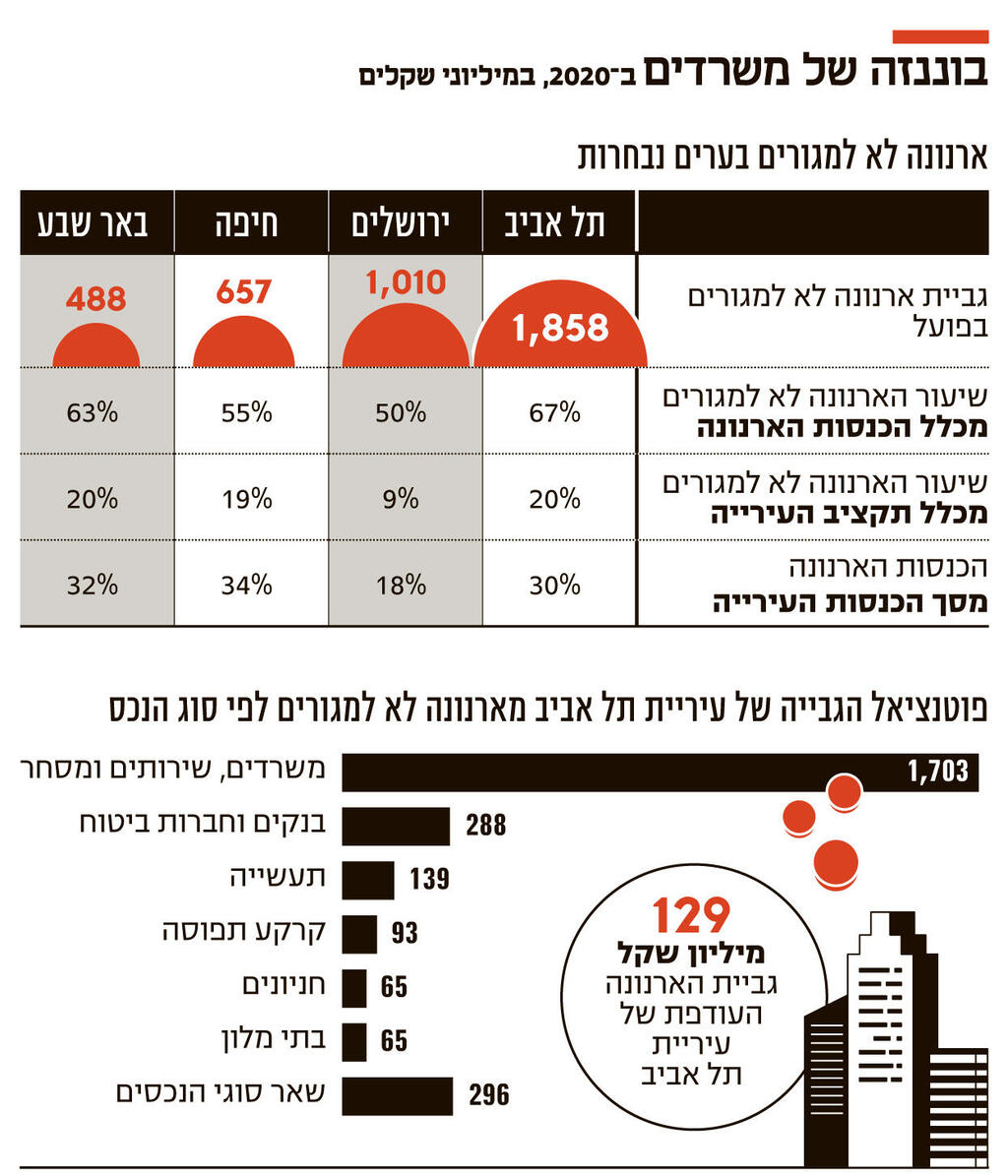

The income disparity between the municipalities from property taxes has many implications for the quality of life of the residents in the various municipalities. Thus, for example, authorities whose income from non-residential property tax is high can reduce residential property tax rates, something that is very noticeable in Tel Aviv. Moreover, the municipality has the possibility to provide better services to its residents. Thus, the annual expenditure per person in the normal budget of Tel Aviv stands at NIS 14.2 thousand compared to NIS 10.5 thousand in Haifa, NIS 9,134 in Be’er Sheva and NIS 7,085 in Jerusalem. The property tax is indeed only one of the sources of income for the municipalities from which the per capita expenditure is derived, but it is a major source of income. In Tel Aviv it is 30% of the city’s total income, in Be’er Sheva 32% and in Haifa 34%.

An in-depth look at the distribution of the authorities’ non-residential property tax revenues by property type reveals the reasons for the disparity in the municipality’s revenues. Thus, for example, the municipal property tax order allows a special property tax rate for banks and insurance companies. In 2020, the Tel Aviv Municipality’s income from property taxes for banks amounted to NIS 288.1 million, 4.6 times more than Jerusalem, which is next on the list.

In general, the two types of income that generate the authorities the most non-residential property tax income are offices, services and commerce and industrial buildings. As far as property tax income from industrial properties is concerned, Tel Aviv and Haifa are similar: in Tel Aviv the income is NIS 136.3 million and in Haifa NIS 135.3 million. However, the income from property tax from offices, services and commerce is 1.8 billion shekels in Tel Aviv compared to only 512.2 million shekels in Haifa – 3.6 times.

Authorities collect property taxes from residents and business owners in the city, but in many cases they are also obligated to return excess collection. However, contrary to the ease of collection, the municipalities are in no hurry to inform those entitled to a refund. Data revealed following a request submitted by the movement for freedom of information reveals that some authorities have right balances of collection amounting to millions of shekels. In practice, this is money from residents or business owners who paid property tax beyond what was required (for example, when an annual payment was made in advance but the business closed or changed address). As of June 2022, the Tel Aviv Municipality’s coffers have approximately NIS 129 million in excess waiting to be returned to their owners, NIS 85 million of which belong to companies and business owners. In Be’er Sheva this figure stands at NIS 6.7 million and in Haifa they refused to transfer the data due to a trial that is ongoing on this issue these days.

The Tel Aviv Municipality stated in response: “Any property tax account holder who has a right balance in that property tax account, the balance is automatically deducted from the current charges in the account. As long as a balance remains, a notice appears on the current property tax slip and the balance will be offset from the following current charges or transferred to him at his request. In many cases company owners And businesses wish to keep the balance of the right in the account and offset it from the current charges in the account or transfer it to their other property tax accounts – and in this matter they are in constant contact with the representatives of the collection department who handle their accounts. To receive the balance of the right to the bank account or to transfer it to another property tax account, you can contact the municipality and the request will be processed immediately “.