2024-05-05 16:17:11

A few days ago, Tesla CEO Elon Musk’s surprise visit to China was a hot topic in the news. Tesla’s stock price soared at one point on the news that it would soon launch a fully autonomous driving (FSD) feature in China. There was also an analysis that Tesla, which was suffering from sluggish sales, “obtained a golden key from China.”

Can Tesla sweep the Chinese market again with FSD? Why on earth did the Chinese government reach out to Tesla? today Tesla and China’s autonomous driving marketLet’s take a look.

*This article is the online version of the Deep Dive newsletter published on the 3rd. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

Why Tesla is a technology company

“The day FSD is publicly launched will be the day of the biggest asset value increase in history.”

This is a post that Tesla CEO Elon Musk posted on the X (old Twitter) account in October 2021. He repeated the same thing at last year’s shareholders’ meeting. That’s how much he is fascinated by the enormous potential of autonomous driving technology. This is why Tesla has been betting so desperately on FSD (Full Self Driving).Tesla’s The future cash cow It will be FSD software sales and robotaxi service, not car sales.Musk is not the only one who sees this. Last year, Goldman Sachs predicted that Tesla’s FSD-related sales, currently about $1 billion per year, will increase to up to $75 billion by 2030. Morgan Stanley also analyzed that “Tesla’s biggest value driver is software and service revenue (rather than car sales).” Selling FSD software to Tesla customers (US purchase price of $8,000/monthly subscription fee of $99), selling FSD licenses to other vehicle manufacturers, and even running a driverless taxi (robotaxi) business comparable to Uber. That’s the future Tesla envisions.

Tesla released FSD beta version 1 in 2020. It has now evolved to version 12.3. This is level 3 (conditional automation), where the driver intervenes only when there is danger. Of course, contrary to the name (Full Self Driving), it is not a fully autonomous driving (level 5) that does not require human intervention, and it has not yet been labeled as a ‘beta (test version)’. Still, it is evaluated as the most advanced autonomous driving technology.

![Tesla found a golden key in China? Autonomous driving story[딥다이브] Tesla found a golden key in China? Autonomous driving story[딥다이브]](https://dimg.donga.com/wps/NEWS/IMAGE/2024/05/04/124786572.1.jpg)

However, market interest in FSD has waned this year. This is because, as the growth of the electric vehicle market slowed, bad news surrounding Tesla (slow sales, slowing performance, price cuts, layoffs) broke out one after another. The atmosphere changed on the 28th of last month when CEO Musk flew to China on a private plane and met with his second-in-command, Prime Minister Li Chang. Chinese authorities judge Tesla to be ‘satisfactory’ in data safety inspectionBy lowering the , the regulations that had previously prevented the release of FSD were lifted. In fact, the way to launch FSD in China has been opened.

Musk also signed a contract with Chinese IT company Baidu to use the navigation system. Starting on April 30, when purchasing a car on the Tesla China website, the FSD function can be added for 64,000 yuan (about 12 million won). Of course, the main functions (autonomous assisted driving in the city, traffic light recognition) are only announced as ‘soon to be released’. I don’t know exactly when, but it won’t be long before we launch a full-fledged FSD service in China.is a signal. China is Tesla’s second largest market after the United States. There are already 1.7 million Tesla owners in China.

Data transfer, should I approve it?

Now, all that remains is for Tesla to continue its success in the Chinese electric vehicle market with FSD. As many Tesla shareholders would hope, things aren’t as simple as they seem. There are two main reasons. ①Still remaining obstacles (regulations) and ②Surprisingly formidable competitors. ①What about Chinese vehicle data transmission?

As mentioned earlier, Tesla’s self-driving technology is top-notch. In particular, FSD received praise when it was upgraded to version 12. ‘End-to-End’ artificial intelligence (AI) systemThis is because it has changed drastically. This means that everything operates with pure AI technology from the beginning (video data input) to the end (control).

What’s different about this? Until version 11, there were over 300,000 lines of code. Countless rules were entered in advance by human developers. Version 12 has only 3000 lines of code. Even if you don’t have to code each scenario, FSD learns automatically as long as you have a large amount of video data.That’s the way to do it.

Thanks to this, FSD in version 12 is Drive much more like a humanI did it. For example, the car no longer automatically stops when there is an obstacle in front of it. Instead, we deviate outside the lane for a moment and avoid obstacles. The driving style has become more flexible. It feels like the chat GPT of autonomous driving.

Hundreds of thousands of lines of code are no longer needed, but instead Data has become more valuable. In particular, securing how much data from experienced drivers is the key to FSD training.

Originally, data was considered Tesla’s greatest strength. As of the end of the first quarter, Tesla FSD’s accumulated mileage reached a whopping 1.25 billion miles (about 2 billion km). It is far ahead of any competitors (e.g. Waymo, Cruise).

But there’s a problem. To train FSD for the Chinese market, we need driving data from Teslas in China. Currently, Chinese vehicle data cannot be sent overseas without government approval due to security regulations.. Tesla has also been storing all vehicle data collected in China only in the Shanghai data center since 2021. In other words, there is data, but it cannot be sent to the United States and used for FSD learning.

Will Musk be able to persuade the Chinese government to lift this regulation? Wedbush Securities analyst Dan Ives, a representative Tesla bull, said: If Musk could get approval from Beijing to transfer data overseas, “it would be a game changer.”I also expect this. As of yet, there has been no news of any advanced discussions in this regard. This is something we have to wait and see.

②Is Huawei a competitor? Xiaofeng?

Huawei, Xiaopeng, Rioto, Xiaomi, BYD, etc. According to Reuters, more than 10 Chinese manufacturers have introduced autonomous driving systems in the past two years. Competition is so fierce that “models priced over $30,000 in China must now have advanced driver assistance features to compete” (Maxwell Zhou, founder of Chinese startup DeepRoot.ai).

Chinese companies are still at level 2 autonomous driving (requiring driver concentration), but they are marketing it as ‘level 2.99’, claiming that it is close to level 3. This is because to survive in China’s slow-growing electric vehicle market, you need to be armed with the latest technology. Starting this year, China’s electric vehicle market has moved into the ‘smart car era’.comes the analysis.

What will happen if Tesla jumps in here? Will we conquer the market in an instant with our superior technology? Of course, Tesla has an overwhelming advantage in technology and accumulated data capacity. For example, the total driving range of Huawei’s ADS 2.0, which is said to have the most advanced autonomous driving performance in China, is one-thirtieth of Tesla’s. Chinese The level of algorithm technology is about 2-3 years behind Tesla.This evaluation also comes from within China.

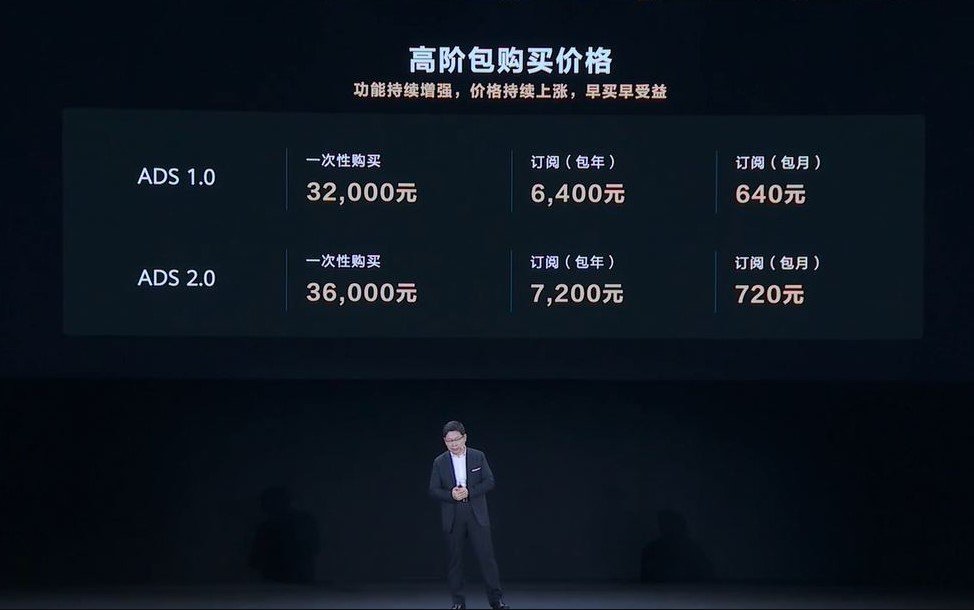

But there are some things that Chinese companies excel at. Cost-effectiveness and imitation abilityno see. These days, many manufacturers in China offer autonomous driving functions at no additional cost. Huawei ADS 2.0 is a paid service, but its price is around 36,000 yuan (about 6.45 million won). Compared to Tesla FSD (64,000 yuan), it is half the price.

In this situation, it is obvious what will happen if Tesla joins. Tou Le, founder of Sino Auto Insight, said in an interview with FT: If Chinese consumers show a preference for Tesla technology, local companies will immediately begin lowering prices.I predict this. He says: “Western analysts think Tesla will automatically win (in the Chinese self-driving market). (But) I can’t guarantee it.”

Also, China is quickly imitating Tesla technology. Previously, I explained Tesla’s ‘end-to-end’ FSD. Chinese companies are also starting to follow suit. For example, Nio plans to launch end-to-end active safety functions in the first half of this year. Xiaopeng also stated that autonomous driving technology will be an end-to-end model. Considering the crazy speed battle that Chinese electric vehicle companies have shown so far, it may be more difficult than you think.

Why is China growing Tesla?

Here we need to consider the Chinese government’s position. Why is China favorable to Tesla FSD?

There are various interpretations, but the answer can be easily found by considering the past relationship between Musk and Prime Minister Li Chang. Premier Li Qiang was Shanghai City Party Secretary when Tesla opened the Shanghai Gigafactory in 2018. At the time, the Chinese government approved the Tesla factory, aiming for the ‘catfish effect’ in the electric vehicle market. They thought that if they released the large catfish Tesla into the pond, other fish (Chinese electric car manufacturer) would swim faster.

And it actually worked. This can be seen from the fact that Chinese BYD’s pure electric vehicle sales, which were only 100,000 units in 2018, exceeded 1.5 million units last year.

Zhang Yu, chairman of Chinese consulting firm Automotive Foresight, believes the Chinese government expects the same effect this time. “Tesla’s launch of FSD will accelerate the research and development of other Chinese electric vehicle startups.”This is the Iranian outlook. Xiaopeng Chairman He Xiaopeng also posted a similar post on LinkedIn. “I wholeheartedly welcome this development (FSD’s launch in China) with open arms. (…) The introduction of top-level technology not only enriches customer experience, but also serves as a driving force for the development of the entire industry.”

If you look at it up to this point, it is a win-win for both Tesla and the Chinese government. Tesla will gain both the market and data to perfect autonomous driving technology, and China will foster its own industry.

However, other voices are also heard outside of China. Tesla could easily fall into the ‘China trap’is a concern. Dai Zhiyan, a researcher at the China Economic Research Institute, a Taiwanese think tank, said this in a recent interview. “Chinese manufacturers will form joint ventures (with foreign companies) to obtain products and then eat them up by competing to lower prices. This is a kind of ‘grow and eat’. “This is a common occurrence in Taiwan’s past business history.” This means that from solar modules to the LED industry, Taiwanese companies have already fallen victim to these Chinese tactics in the past. (Of course, Tesla is the first overseas automaker to open the Shanghai Gigafactory without a joint venture partner, so the story is a bit different.)

Xie Jinhe, chairman of Taiwan’s Caixin Media, also urges caution against Tesla in an interview with Voice of America. “If China opens up fully autonomous driving to Musk, In the future, all of his (Musk) data will be handed over (to China). “If Musk’s (autonomous driving) core technology is completely replicated in China, there may not be a Tesla in the future.”

How about this. Is this an overly biased claim from a Taiwanese expert? Maybe so. However, compared to the analysis by Chinese online media (Sina Science and Technology) that “(Musk) obtained the golden key from China,” it seems persuasive at first glance. By. Deep Dive

Competition among Chinese electric vehicle companies in autonomous driving has intensified in earnest this year. This may be because this is an important time for the Chinese government to release the catfish called Tesla. It feels like the second half of China’s electric vehicle race has begun. To summarize the main contents:

-The possibility of launching the FSD (Full Self-Driving) service that Tesla has been ambitiously developing in China has become very high. This is because the Chinese government has lifted related regulations. This is an opportunity for Tesla, which has been growing FSD as a future food source.

-The key, however, is whether the Chinese government will approve the transfer of vehicle data to the United States. Also, although its technological prowess is not that of Tesla, it has no choice but to compete with local Chinese companies that will follow with a cost-effectiveness + imitation strategy.

-The Chinese government joined hands with Tesla, hoping for a ‘catfish effect’. As of now, the needs of both sides are aligned. Can Tesla avoid falling into the ‘China trap’?

*This article is the online version of the Deep Dive newsletter published on the 3rd. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

Reporter Han Ae-ran [email protected]

2024-05-05 16:17:11