Read more in Calcalist:

The attack, carried out by Iranian UAVs operated by one of Tehran’s affiliated organizations, apparently the Houthis in Yemen, ended in three deaths and six wounded. From the important airports in the Gulf area, as well as in a fuel reservoir in one of the well-known industrial areas, a-Muzfah, located in the suburbs of the capital.

2 View the gallery

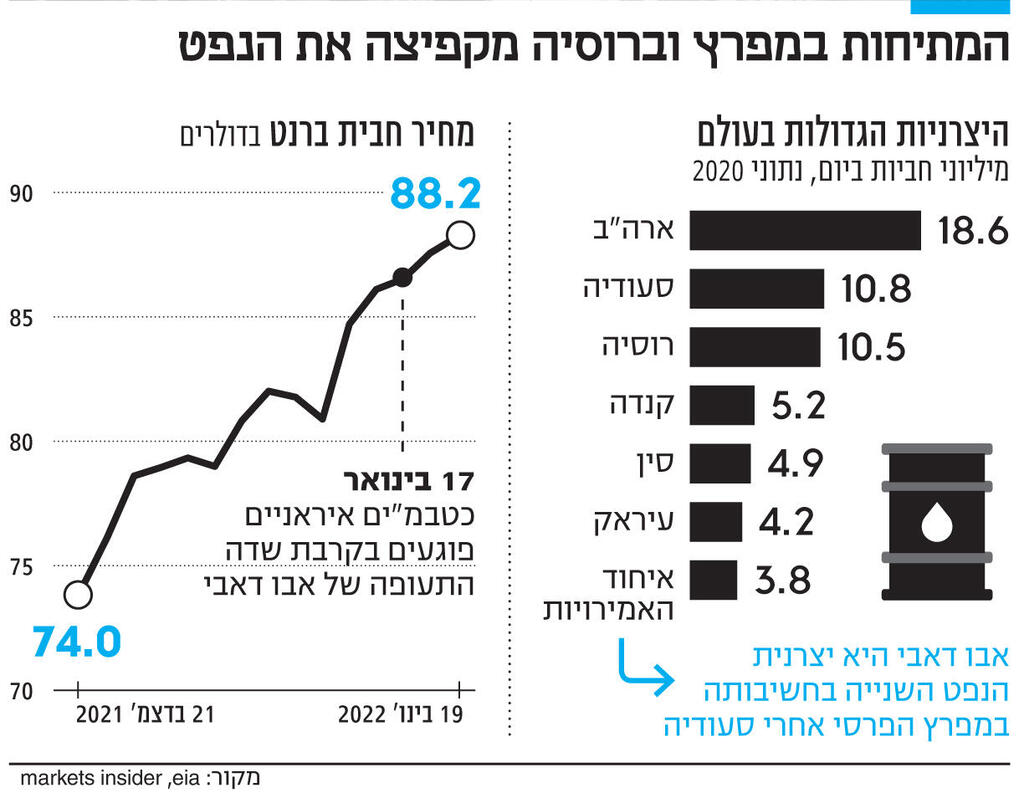

Tensions in the Gulf and Russia are boosting oil

The attack on one of the strategic points in the richest statements is a clear escalation, as so far Iran and its affiliates have contented themselves with harming Saudi Arabia, while for the Emirates they have contented themselves with ships en route from or to its seaports, also without taking responsibility.

Iranian signal to powers

There are two explanations for the timing of the unusual attack. The first is related to developments on the battlefield in Yemen. In recent weeks, forces backed by the Emirates and Saudi Arabia have been able to inflict painful blows on Houthi pro-Iranian forces and drive them out of the strategic Marib district, located east of the capital Sanaa.

Maariv district is rich in oil and gas and is a center for agriculture in Yemen. The district has a refinery – one of two in the country – with a production capacity of about 20,000 barrels a day, so it is significant for those who want to control the capital Sanaa. The Houthis warned the Emirates that the continued crushing of Marib would lead to attacks within the “Emirati depth”, and so it did.

A second explanation for the attack is in a broader aspect and is related to what is happening in Vienna, that is, the nuclear talks between Tehran and the powers. In these talks, Iran is under pressure to accept the West’s demands regarding its nuclear program, and the attacks in Abu Dhabi are intended to signal to the international community that Iran also has its own cards and means of pressure.

This scenario of the war in Yemen spilling over into the Emirates has been in the air since it broke out in 2015. According to previously published reports, a rift has formed in the top emirates regarding the need to intervene in the war alongside Saudi Arabia. According to one report, the Dubai ruler Sheikh Muhammad bin Rashid warned at the time the de facto ruler of the country, Sheikh Muhammad bin Zayd, that the war in Yemen had the potential to destroy Dubai’s economic interests, and warned of the dire consequences for the UAE economy in general. This is probably why in 2019 the Emirates withdrew most of its military forces from the battle-torn country, but continued to support local militias from outside.

2 View the gallery

The headquarters of the Abu Dhabi Oil Company

(Photo: Reuters)

If the very execution of the attack did not surprise the rulers of the Emirates, it can be assumed that its timing was surprising. All this in light of the fact that in recent weeks there have been high-level contacts between the Emirates and Iran, culminating in a meeting in Tehran between Sheikh Tahanun Ben Zayed, the ruler’s brother and who is considered number two in the emirates’ hierarchy, and Iran’s supreme leader Ali Khamenei.

Since the change of government in Washington, the Emirates have been trying to build a new mix that will secure its economic and security interests vis-à-vis Iran, and to prevent escalation, just as happened this week in Abu Dhabi. Despite the constant tension between Tehran and Abu Dhabi, trade and economic relations between the two countries have always flourished. At the time of the implementation of the nuclear agreement in 2017, the value of trade between the two countries reached about $ 13 billion.

Since the US withdrew from the 2018 agreement and re-enforced sanctions on the ayatollahs’ regime, official trade between the two countries has shrunk to about a third of that figure, but the emirates have remained the “backyard” of the Iranian economy in circumventing sanctions. Linking it directly to the latest attack, there is no impediment to continuing the extensive trade relations with the Emirates.

For the Emirates the situation is more complex. According to estimates by international bodies, the domestic market is expected to record growth of 3% – 4.2% this year. To meet this target, the UAE will need stability and ensure that the recent Houthi attack remains an isolated incident, otherwise its economy will be significantly harmed.

May be close to $ 100

The additional significance of the attack has to do with the global oil market, according to which as long as no new nuclear agreement is reached with Iran that will pave the way for an end to the war in Yemen, Gulf oil producers are under immediate threat.

About two years ago these were the facilities of Saudi Arabia Aramco, the world’s largest oil producer, which was attacked by one of the organizations affiliated with Iran and now it’s time for the second most important producer in the Gulf, the Emirates. All this is happening precisely at a time when demand for oil is expected to rise, with the global recovery from the Corona crisis.

The oil market seems to have internalized the message. On Tuesday, the price of a barrel of oil climbed by 1.2% to a record high of more than seven years – $ 87.51, and there is a fear in the market that during the year the price will already approach $ 100.

The announcement by the Abu Dhabi National Oil Company that its activities were not harmed by the attack failed to reassure traders. It should be noted that most of the country’s oil is concentrated in Abu Dhabi. The UAE is the third largest oil producer in the OPEC. It produces about 4 million barrels a day and is currently investing in capacity development so that it can produce another 400,000 barrels a day in the future.