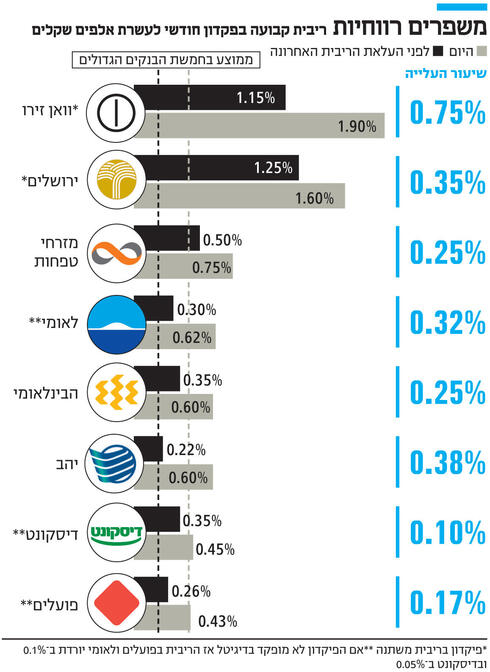

The interest rate in the economy is rising sharply, but the banks continue to raise the interest rate on deposits at a moderate rate, thereby improving their profitability. “Calcalist” analysis shows that the five largest banks on average transferred only one third of the recent interest rate increase to the interest rate on deposits. The average interest rate on a monthly deposit (fixed interest deposit) for an amount of NIS 10,000 at the five largest banks was 0.57% on average compared to 0.34% before the interest rate was raised last week by 0.75% to 2%. All this while the interest rate on deposits is low. For comparison, the yield of a short-term lender (MKM) per year, an instrument considered solid and an alternative to a deposit, already stands at 2.2%.

The Bank of Israel is not satisfied with the new interest rates on deposits. The supervisor of banks Yair Avidan said: “I expect the banking system to be more active when it comes to adjusting the existing banking products, so that they are adjusted to the environment of higher interest rates and inflation. I certainly expect to see a faster transmission mechanism for interest on deposits, and we are following the issue closely.” Avidan also called on customers to take advantage of the moves made by the Bank of Israel in recent years, such as the one-click account transfer reform, and to compare offers between banks.

In the banking system, they are defending themselves from the criticism that the interest rates remain low, and explain that it is not possible to expect the banks to raise the interest rate to the full extent of the Bank of Israel’s interest rate increase. According to them, they are exposed to changes in the bond yields; in the management of the average lifetime (MLA) of the liabilities side – the public deposits versus the assets side – the credit to the public; And exposure to liquidity and market risks requires them to maintain a certain gap in interest rates. The banks are indeed exposed to these risks, but does it still justify transferring such a low rate from the interest rate increase to the customer’s deposits? Especially when on the lending side they know very well how to collect the full amount of the interest rate increase.

Some banks also stated that customers with a higher amount, such as NIS 100,000 for example, are offered higher interest rates. This answer is outrageous. Because customers with higher amounts also have more alternatives – most of them receive advice from banks, and are exposed to more avenues of investment. Precisely for the small customers with savings of several tens of thousands of shekels, the deposit alternative is critical, and it is not appropriate or justified to discriminate against them compared to more affluent customers.

Those who offer relatively high interest rates are the small banks: Bank of Jerusalem and the new One Zero Bank, with interest rates of 1.6% and 1.9% respectively. In both banks, the deposits for the month are at a variable interest rate, meaning linked to the expected increase in the Bank of Israel interest rate. It is worth noting that One Zero has officially opened to the public, but the account opening process requires waiting on a waiting list, so the availability of deposits there is not immediate for those who are not yet bank customers.

The process of interest rate increases is positive for banks, and they are the main beneficiaries of it. The banks’ financial reports show that a 1% increase in interest means an increase of NIS 5.5 billion in the banks’ income. The interest rate has already increased by 1.9% in four months to a level of 2%, and it is expected to reach at least 2.75% in the coming year.

The increase in interest rates is good for the banks because it increases their income from lending activities, but this is not the only reason: what sets the banks apart is that they also determine the price increase they will have to absorb, that is, how much interest they will have to pay to depositors. Unsurprisingly, they usually do not volunteer to make this expense more expensive for themselves despite the public criticism and the banking supervisor’s appeal to them on the subject.

This means that the bank’s financial margin, i.e. the level of profitability from its financing activity, is getting better and better following the interest rate increase: on the income side it is fully passed on to the customers, and on the expense side very partially.

The beginnings of the trend could be seen in the results of the first half of the banks in which they earned over NIS 11 billion, thanks in no small part to the increase in inflation and interest. This is just the beginning of the trend, the full impact of which will be seen in the financial statements next year, when the trend of the interest rate increase will be reflected in its full force. So of course, the interest rate increase will also lead to more cases of loans falling into failure, which will increase the banks’ provisions for credit losses, but this will probably be Cancel in sixty compared to the improvement in the income line.

The volume of public deposits has increased greatly in recent years. It stands at NIS 1.2 trillion, and if you also add the funds lying in the current account with no interest at all, you already reach NIS 1.8 trillion, which is a very cheap source for the banks on the basis of which they can grant credit at adequate interest rates.

Banks must think carefully about whether the pricing of their deposits is correct: should they only look at the bottom line and maximize it, or should they still get out of the Excel tables and offer a significant improvement in interest rates. Otherwise, they may end up facing aggressive intervention – from the regulator or the Knesset.

The copycat profits that are expected next year will draw fire, and may ignite, for example, an initiative for a special tax on profits in the financial sector above a certain level. Sound far-fetched? Ten years ago, no one thought that restrictions would be imposed on the executive salary ceiling, and here it happened. Will the banks learn the lesson and advance a cure for the blow? So far it doesn’t seem to be happening.