2024-04-06 03:44:47

The American conglomerate General Electric (GE) disappeared into history 132 years after its founding. This is because the spin-off into three companies (GE Aerospace, GE Vernova, and GE Healthcare) was completed as of April 3. In the stock market, the ticker name ‘GE’ is inherited by GE Aerospace. The large company with the company name ‘General Electric (GE)’ is no longer anywhere.

The end of GE also means the end of this man’s story. Even though it has been 20 years since he retired and 4 years since his death, it is still a powerful name. Former Chairman Jack Welch and the rise and fall of GETake a look into.

*This article is the online version of the Deep Dive newsletter published on the 5th. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

A charismatic leader of the century

What kind of person do you remember former GE CEO and Chairman Jack Welch as? The most widely known modifier is this. ‘Manager of the century’. In 1999, Fortune magazine selected it as such.

Jack Welch was the most star CEO of his time. His popularity was greater than that of Elon Musk now. Wall Street loved him, and executives respected him. He could be said to be the beginning of ‘CEO idolization.’ It had to be that way. Because of the amazing management results (= numbers) he made during his tenure as CEO (1981-2001). Let me introduce a few.

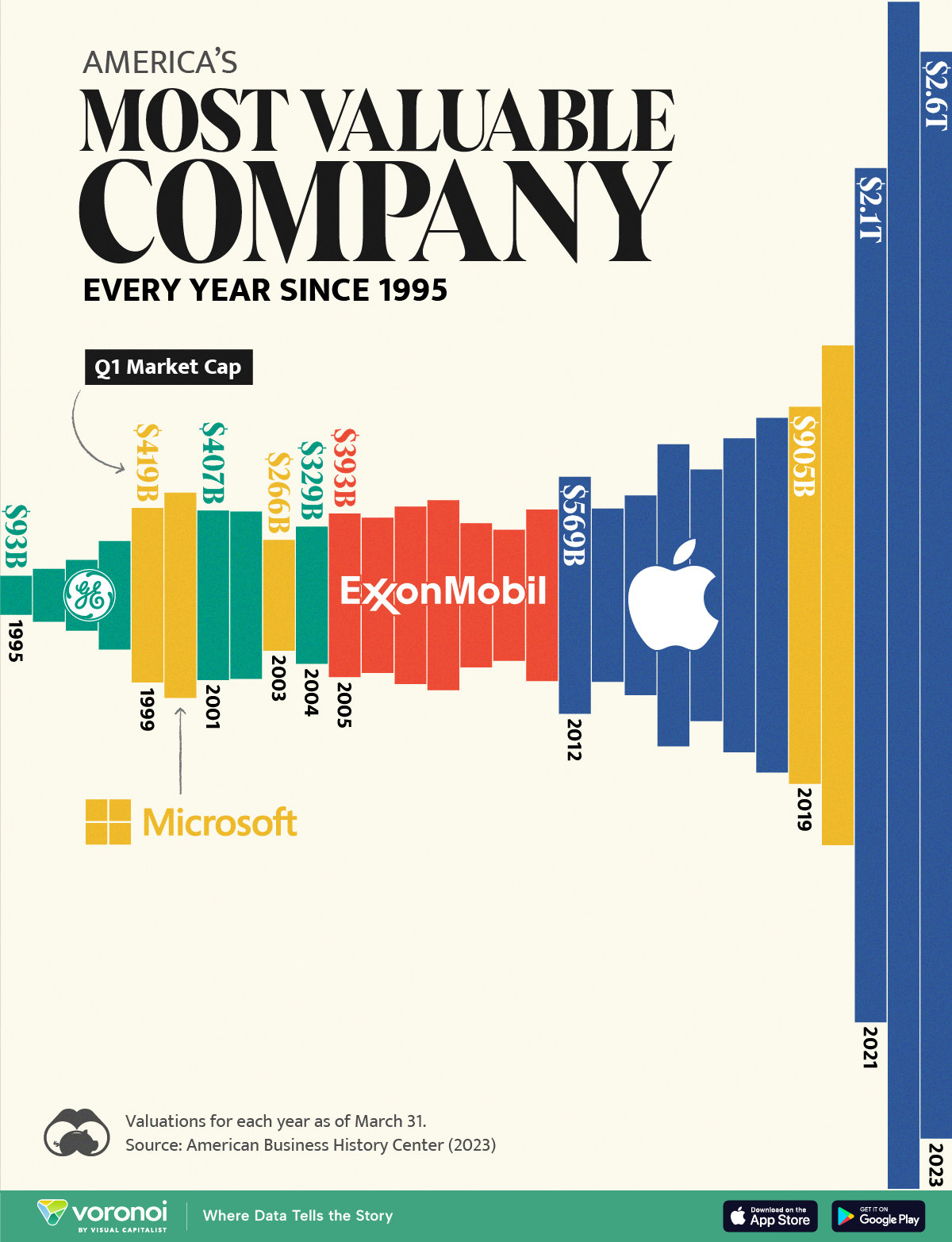

GE stock price rose approximately 3,000% during Jack Welch’s tenure.I did. The corporate value jumped from $14 billion to $450 billion. This is 9 times the increase rate of the S&P 500 (about 330%) over the same period.

GE in September 1993 1st place in market capitalization among American companiesClimbed to . After that, we were in the lead for quite some time. After losing the top spot to Microsoft in 1999, it fell into a downward spiral, and was last ranked first in 2004.

GE Incredibly stable profit growthshowed. From 1995 to 2004, in both good and bad times, GE met or beat analyst estimates on every quarterly earnings call.

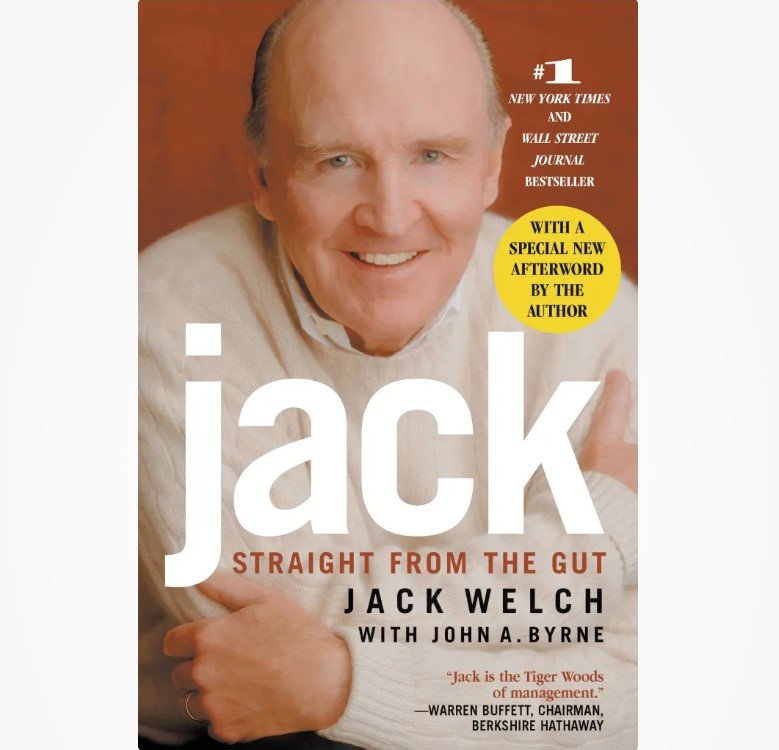

His outstanding management performance and charismatic management style were objects of admiration. The book he wrote immediately after leaving office (Jack: Straight from the Gut) received the highest manuscript fee ever ($10 million) at the time. Many people have probably tired of hearing the story of GE’s success model. He’s heard of Six Sigma, right?

A charismatic leader of the century

Let’s remember GE a little further back, before the Welch era. GE, predecessor to Edison’s light bulb company, was a famous manufacturer of light bulbs and home appliances. It also had a high reputation in industrial products such as power generation turbines and aircraft engines. It was a typical American large corporation that was both familial and bureaucratic at the same time. CEO Reginald Jones, who led the 1970s, was a gentle leader who personally called employees to console them when they received an award.

And surprisingly, Jones chooses Jack Welch, a combative man who is the exact opposite of himself, as his successor. There is a famous anecdote. Jones calls his successor, Welch, into his office and says: “Jack, I’m giving you the Queen Mary (the world’s largest cruise ship). “It was designed not to sink.” Then Welch replies: “I plan to blow up the Queen Mary. I want a speedboat.”

And as soon as Jack Welch became CEO, he almost blew up GE. He started cutting, saying he would create a ‘fast and honest organization’.

First, we introduce ‘Stack Ranking (ranking as if stacking layers)’. All employees are evaluated as A (20%), B (70%), and C (10%), and those with grade C are fired.I did it. In the first five years, 100,000 people, or one in four of all employees, were laid off. his nickname ‘Neutron Jack’It was created at this time.

We boldly liquidated underperforming businesses through sale or factory closure. From toasters to coal mines, as many as 408 businesses were sold during his tenure. It follows the strategy of “all businesses rank first or second in the global market.”

We also used outsourcing. Security guards and other simple jobs have been replaced by low-paying dispatch contract jobs. Many manufacturing jobs have moved overseas, where low-wage labor is abundant.

What do you think of this management style? Too ruthless? Or is it inevitable to increase productivity?

Evaluation will vary from person to person, but what is certain is that this method Quite effective in boosting short-term performance and stock priceIt was. Even now, American companies often resort to layoffs to satisfy shareholders. I learned this from Jack Welch 40 years ago.

From manufacturing company to financial company

Jack Welch’s management goals were simple and clear. It shows performance that meets market expectations. why? Because shareholders want it. The stock market always wants good ‘numbers’, and the idea that such numbers can be created through management.It was.

To achieve this, he is cutting costs ruthlessly and at the same time boldly expanding his territory. During his tenure, approximately 1,000 acquisitions were completed. New fields such as medical services, media, communications, and finance were added. GE, famous for its washing machines and refrigerators, became increasingly distant from manufacturing. Beth Comstock, a former marketing executive at GE, puts it this way: “The model Jack had was the ‘Pacman (a cookie-eating game) model.’ Eat up businesses and achieve growth.”

Isn’t it great ability and pioneering ability that can eat up a growing industry? Yes, of course, it was evaluated that way at the time. So how was GE able to mobilize that much money? as soon as The power of finance represented by GE CapitalIt was.

GE Capital was originally a small division responsible for financing the purchase of aircraft engines and power generation turbines. Jack Welch transformed it into a powerhouse that encompasses almost all financial services, from mortgages to credit cards and insurance.

Unlike banks, capital companies are exempt from various regulations. Instead, capital companies generally incur high funding costs because they do not receive customer deposits. GE Capital, under the strong GE umbrella, was an exception (credit rating AAA). GE Capital was virtually an unregulated bank. ‘The world’s largest non-bank financial company’is growing rapidly. GE Capital has become the largest source of revenue supporting GE. When Jack Welch Retired The financial sector accounts for 40% of GE’s total sales and 60% of profits.do. GE transformed from a manufacturing conglomerate into a financial company. Jack Welch was proud of this, saying, “There was no need to build a factory.”

Dramatic conclusion to the numbers game

As mentioned earlier, Jack Welch was obsessed with numbers and short-term results. And the most useful tool for creating good-looking numbers was GE Capital.

CNN Money Magazine in 2000 “GE’s enormous profits are a mystery,” he said, criticizing GE’s ‘numbers game’I do. GE is posting strangely consistent profit growth, and this is it. Matching numbers using financial techniquesThat was the point. When profits were too high, GE Capital hid reserves in the name of ‘loan reserves’, and when performance was sluggish, it suddenly issued a large amount of mortgage-backed securities at the end of the quarter to boost quarterly profits. It was a kind of ‘performance massage’.

Investors were enthusiastic about GE, which delivered solid performance regardless of whether the economy was good or bad. In the stock market, companies that consistently grow by 10% every year are preferred over companies whose performance increases by 30% in one year and then decreases by 10% in the following year. Jack Welch knew how to give shareholders what they wanted.

But this approach cannot be sustainable. After a few years, it finally exploded. Direct hit by the 2008 subprime mortgage crisisYou got hit. GE Capital, which was on the verge of bankruptcy in an instant, was reduced to receiving bailout funds from the federal government. When GE Capital, the group’s source of money, collapsed, GE as a whole went down the path of collapse. It was in 2015 that CEO Jeffrey Immelt, Jack Welch’s successor, sold most of GE Capital’s business, saying he wanted to go back to his roots.

Boeing and Jack Welch’s Descendants

The downfall of GE, which was doing so well, was not due to technological progress or changes in the times. The cumulative result of myopic obsession with short-term profitsIt was. Although he never admitted it (instead calling his successor a ‘shit’), Jack Welch sowed the seeds of GE’s downfall.

And there are still Jack Welch’s descendants repeating his failures. American aircraft manufacturer Boeing is a representative example. As many as three current and former CEOs, including current CEO David Calhoun, are from GE, or the ‘Jack Welch Kids.’

Last January, an accident occurred where the door of a Boeing 737 Max aircraft was torn off during flight. I was shocked to find out that it was because a screw had been completely removed during the assembly process. It was also surprising that nothing had changed despite the uproar caused by the 737 Max airframe defect issue in 2019. As Boeing expanded outsourcing significantly over the past 20 years to cut costs, skilled engineers left, ultimately leading to a serious decline in aircraft quality.It led to. Management focuses on maximizing shareholder profits rather than product quality and safety. This is Jack Welch’s legacy.

Boeing CEO Calhoun announced last week that he will step down at the end of this year. And this week, GE was completely broken up into three companies. It feels like even the last traces of Jack Welch have been completely erased. Now, when you access the GE.com site, this message will appear on the front page. ‘Today we begin again’. And you won’t find the name Jack Welch anywhere on the pages of GE history (though his predecessor, Reginald Jones, is even pictured). Goodbye Jack Welch. By. Deep Dive

Personally, I don’t like Jack Welch. This is because they are the party that spread the relative employee evaluation system adopted by most Korean companies. In fact, it is said that GE already changed its evaluation method to absolute evaluation 9 years ago. Jack Welch’s descendants may remain in Korea rather than in the United States. To summarize the main points:

-General Electric, a large corporation representing the United States, disappeared into history on the 3rd. The story of former GE Chairman Jack Welch, who was called the ‘Manager of the Century’, has completely come to an end.

-Jack Welch was revered for his amazing management achievements and charismatic leadership. He was called ‘Neutron Bomb Jack’ for firing the bottom 10% of low performers and shutting down underperforming businesses.

-He achieved remarkable results by transforming manufacturing-based GE into a de facto financial company. Wall Street cheered the solid performance expressed in numbers. But he was an illusion created by financial techniques. When the financial crisis hit in 2008, it began to collapse.

-The short-term performance-oriented management method preached by Jack Welch remained for quite a long time, hindering the long-term performance of companies. A representative example is Boeing, whose CEO recently announced his resignation due to the missing screw door incident. I hope this is the final failure of Jack Welch’s legacy.

*This article is the online version of the Deep Dive newsletter published on the 5th. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

Reporter Han Ae-ran [email protected]

2024-04-06 03:44:47