Prime Minister Justin Trudeau (54), who led Canada for over nine years, announced his resignation on the 6th. Although it is the fall of Trudeau, who was known as an ‘icon of progress’, no one is surprised. A series of by-election defeats, a plunge in approval ratings (22%), and even the resignation of the finance minister, who was close to him. The signs of sinking were very clear.

As his term of office was long, there were many reasons for his fall. The biggest thing of all is this. I feel that it is becoming increasingly difficult for Canadians to make a living. The economy is almost stagnant with no growth, but the cost of living is rising at a scary rate. Values such as the environment and diversity are important, but right now, the people want a leader who can solve the problems of making a living. Canada’s economy seen through Trudeau’s downfallLet’s take a look.

*This article is the online version of the Deep Dive newsletter published on the 10th. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

Immigration as a driver of economic growth

There is a lot of talk these days about the Canadian economy being difficult. So are we in a recession? If you think about it, that’s not true. A recession is not simply a difficult economic situation, but a negative GDP (gross domestic product) growth rate for two consecutive quarters. Canada’s GDP growth rate in the second quarter of 2024 is 2.1% and 1% in the third quarter. It was all a plus.

Yet these days, Canadian economists say, “We are actually experiencing an economic recession.” Another indicator, Real GDP per capita has fallen for six consecutive quartersBecause I did it. This is the first time something like this has happened in 42 years since the 1982 recession. In just six quarters, GDP per capita shrank by 3.5%. When looking at the country’s economy as a whole, the pie has grown, but each citizen’s share has become smaller.

![The fall of a beloved progressive politician… Eating and making a living is the top priority[딥다이브] The fall of a beloved progressive politician… Eating and making a living is the top priority[딥다이브]](https://dimg.donga.com/wps/NEWS/IMAGE/2025/01/10/130840444.1.jpg)

Why does this happen? This is because the population has increased so much. Thanks to the unprecedented population surge, we were able to escape the economic recession even as per capita GDP decreased.

How much has it increased? In 2023 alone, 1.27 million people, or 3.2%, will be added.That’s it. It is the highest growth rate since 1957 (3.3%), and is a figure that is difficult to find in modern developed countries. Most of the increase is from immigrants. Among them, more than 800,000 are ‘temporary residents’ without permanent residency. These are international students, refugees, and low-skilled foreign workers.

Canada is known for being an open and tolerant country that is open to immigration. The underlying belief is that ‘immigration contributes to the national economy.’ And Prime Minister Trudeau, who came to power in 2015 with overwhelming approval ratings, succeeded in changing the government for the first time in 10 years. The door has been opened wider to immigration. They announced that they would significantly increase the number of immigrants (annual permanent residents: 260,000 in 2014 → 500,000 in 2024). Admit refugees in large numbers, lower the threshold for temporary work visas, provide better permanent residency, and make it easier to bring family members. Made it. This pro-immigration policy was seen as the solution to Canada’s economic growth problem. At that time, voters agreed.

In particular, the image of the young prime minister welcoming Syrian refugees at the airport in 2015 became a huge topic of discussion. Prime Minister Trudeau’s statement that “diversity is Canada’s strength” moved the world. He seemed like a hero of progressive politics. Of course, it remains a scene of Trudeau’s ‘showing politics’ that Canadians are now sick of.

There are not enough jobs and places to live.

The problem is that even though the number of immigrants has increased, it has grown too quickly. The number of immigrant inflows suppressed during the coronavirus pandemic in 2020-21 was By 2022, the number will exceed 1 million, and by 2023, it will exceed 1.2 million. thatAnd this sudden influx of people begins to put a huge burden on the economy.

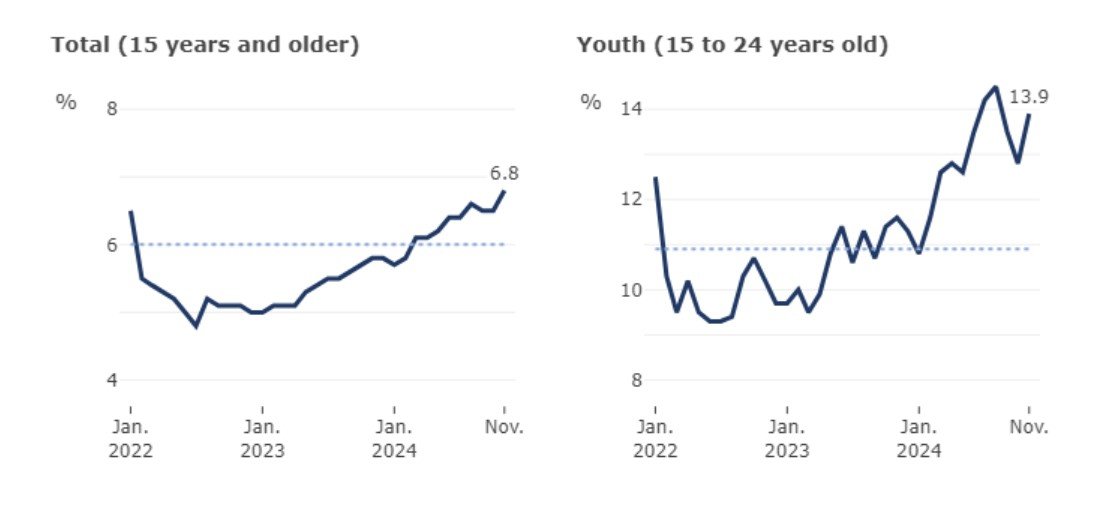

first Unemployment rate soars. Most young immigrants who enter the workforce immediately jump into the job market. However, the Canadian economy is not strong enough to accommodate them all. The problem is that the immigration threshold has been lowered, and as universities are attracting a lot of international students, there are too many low-skilled workers.

Canada’s unemployment rate in November 2024 is 6.8%. Excluding the coronavirus pandemic, it is the highest since 2017. The youth unemployment rate is close to 14%. Excluding the Corona period, this is the highest figure since 2012. It is a country that has the highest rate of higher education in the world, but it is in trouble because young people are unable to find jobs.

A video posted on Instagram by an Indian student living in Toronto shows the current situation in Canada. There is a long line of dozens of international students waiting to interview for a part-time job at a Tim Hortons coffee shop. Of course, the situation is equally hopeless for young Canadians who have to compete with these international students.

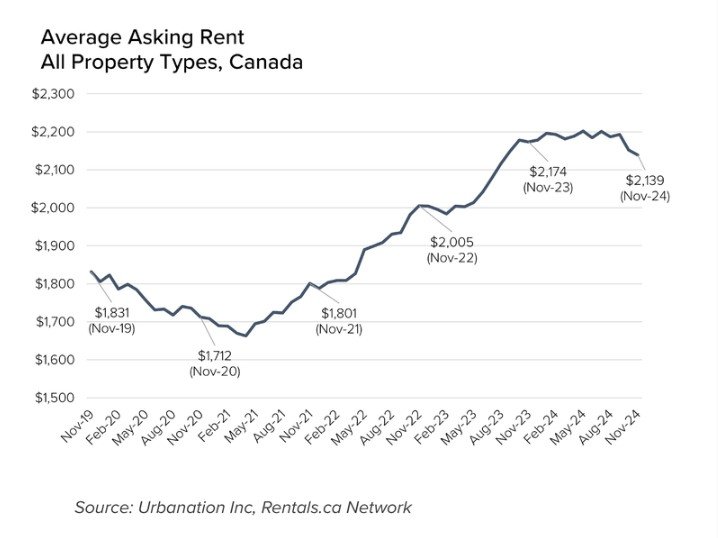

There is also considerable pressure on the housing market. In particular, the rental market, rather than the sales market, has been excited by excessive demand from 2022. Over the past three years, average rents have jumped 19%. Although rent growth has slowed in recent months as the supply of apartments has increased, young people are already tired of the skyrocketing rents. In fact, if you look at it calmly, the analysis that other reasons are more decisive for the shortage of rental housing is persuasive (high interest rates, rising construction costs, etc.). Still, it seems inevitable that we will blame the immigrants who flocked in.

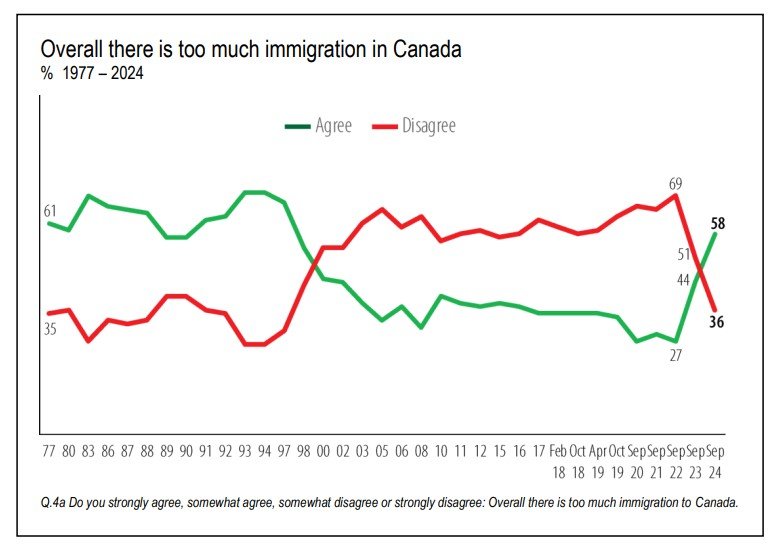

So much Even tolerant Canadians who were open to immigration are closing their hearts.. According to an Environics survey, only 27% of respondents agreed that there will be ‘too much immigration to Canada’ by 2022. Last year, it rose significantly to 58%. It is the highest since 1998.

In the end, Prime Minister Trudeau also had to surrender to public opinion. In October last year, the failure of immigration policy was officially acknowledged.I did it. He said, “We did not get the balance right,” and announced that the population growth target would be reduced by 21% (from 500,000 to 395,000 based on permanent residents).

Sammosa Cho The conclusion of the carbon tax

There is another policy that made Trudeau a leader who attracted attention, but actually eroded his popularity domestically. It is a ‘carbon tax (official name is carbon pricing).’

The carbon tax introduced by the Canadian government in 2019 is a fairly progressive environmental policy. First of all, taxes are imposed on all fuel purchases. It is companies such as gas stations and city gas companies that pay the tax, but this is ultimately passed on to consumer prices. Oil and gas prices rise accordingly. The carbon tax is 17.6 cents (about 179 won) per liter of gasoline.It was. It will increase slightly each year (about 3 cents or 30 won per year) until 2030.

Uniquely, taxes collected in this way do not go into government finances. It is collected as a fund and refunded to each household. The money is deposited directly into the head of the household’s bank account. The amount refunded varies from state to state. For a single-person household, it is 100 to 200 Canadian dollars (100,000 to 200,000 won) per quarter. If you have a large household or live in a rural area, you will receive more.

No, why did they introduce such a cumbersome system? This is to change consumption habits to use less fossil fuels without placing a large burden on households. Households that use less fossil fuels than others can receive more money back than they paid in carbon taxes. So wouldn’t each household naturally try to reduce their use of fossil fuels? It is not a punishment system that simply says, ‘If you spend it, you pay taxes,’ but it is an incentive system that says, ‘If you don’t spend it, you make money.’

These government-level efforts to reduce carbon emissions. The purpose is very good. It was praised as a global model of progressive environmental policy. Of course, the public also supported this at first.

The problem is that the important link that ‘taxes paid by consumers = refunds received by families’ is easily forgotten. In other words, the refund comes in every quarter, which is of course good. Every time I go to the gas station or get a gas bill, I instinctively get angry when I see the higher consumer prices.That’s what happens.

No one said, ‘Gas prices went up because of the carbon tax. So you can’t accept it and think, ‘Will my refund be higher next time?’ rather They vaguely feel aggrieved that the carbon tax they pay seems to be more than the refund they receive. In reality, such households only account for 20% of the total. Or, there are many cases where you completely forget that you received a refund. In other words, although it is a very reasonable system from an economic perspective, in reality it does not work as expected.

Another problem is that it is difficult to give a clear answer to the question, ‘So how much has carbon emissions been reduced thanks to the carbon tax?’ There are more than one policy to reduce carbon emissions. It’s not actually clear how much of that is due to the carbon tax.

Instead, the conservative camp is solidifying its logic for attacking the carbon tax. The Fraser Institute, a conservative think tank, said that the carbon tax would increase the burden on businesses. It would shrink Canada’s economy by up to 1.8% and lead to the loss of 180,000 jobs.‘I put forward this outlook.

In particular, Pierre Polieve, leader of the opposition Conservative Party, uses antipathy toward the carbon tax as fuel to fuel the fire. He is a 46-year-old populist politician. They claim that if the carbon tax continues to rise like this, it will “cause mass hunger and malnutrition.”do. Because food manufacturers use a lot of energy, the logic is that a carbon tax will ultimately lead to an increase in food prices. I also say this: “Elderly people will have to lower their heating temperature to 13 to 14 degrees to survive the winter. “Inflation will run rampant and people will not be able to leave their homes and drive.” At the same time, they put forward a simple and clear slogan, “AXE THE TAX.”

According to various opinion polls, more than half of Canadians now want to abolish the carbon tax. As prices rise and it becomes difficult to make a living, Protecting my wallet has become more important than the cause of the environment.Joe. Many of these voters will probably vote for the opposition party in the upcoming general election in October to end the carbon tax.

I think this is an example that shows that no matter how well-intentioned and good a policy is, it is of no use if it does not win the hearts of the people. People originally want a leader who takes good care of their difficulties and sympathizes with them. Politicians who do not know how to communicate and are stubborn about ‘I am right’ will have no place, whether progressive or conservative. At some point, the Trudeau government’s legacy may be reassessed, but not now. By. Deep Dive

We told you last year that inflation shocks often bring down regimes (‘I think prices will catch up with Biden…’ ‘Inflation shaking the regime’). Following the UK and the US, Canada was also added to the list. No matter how great the cause, nothing is more important than taking care of the people’s livelihood. Let me summarize the main points.

-Prime Minister Trudeau, who led Canada for over 9 years, announced his resignation. The fall of the progressive political star who once shone all over the world was due, more than anything, to the difficulty of making a living.

-Trudeau believed that immigration was the solution to Canada’s economy, and opened the door to immigration wide. But starting in 2022, immigration has surged beyond expectations and put pressure on Canada’s already weak economy. Canadians suffering from a rental housing shortage and youth unemployment are now closing their open minds to immigration.

-Trudeau’s progressive environmental policy, a carbon tax, quickly lost support. The idea of making money by using less fossil fuels is a great idea, but no one wants to see higher gas prices. In an era of high inflation, the carbon tax is a bad policy that adds to the suffering. stigmatizedvoters now call for ‘tax repeal’.

*This article is the online version of the Deep Dive newsletter published on the 10th. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’