3 View the gallery

Prof. Amir Yaron, Governor of the Bank of Israel

(Photo: Uriel Cohen)

If that is not enough, the housing price index has indicated a further rise, which is already reaching a rate of more than 16%, which is a very high rate. The Bank of Israel does not have the ability to control supply since it has no powers in the world of planning and construction, but it can curb the price by curbing demand, by negative incentives through the increase in mortgage prices. This is not the ideal way to deal with the housing crisis but the omelet is prepared with the eggs that are there and not with the ones that are not.

The new inflation has turned out to be cunning and the last thing the Bank of Israel and the Treasury want is for it to be fixed here. Certainly not through a price-wage spiral that is very difficult to stop after it is ignited

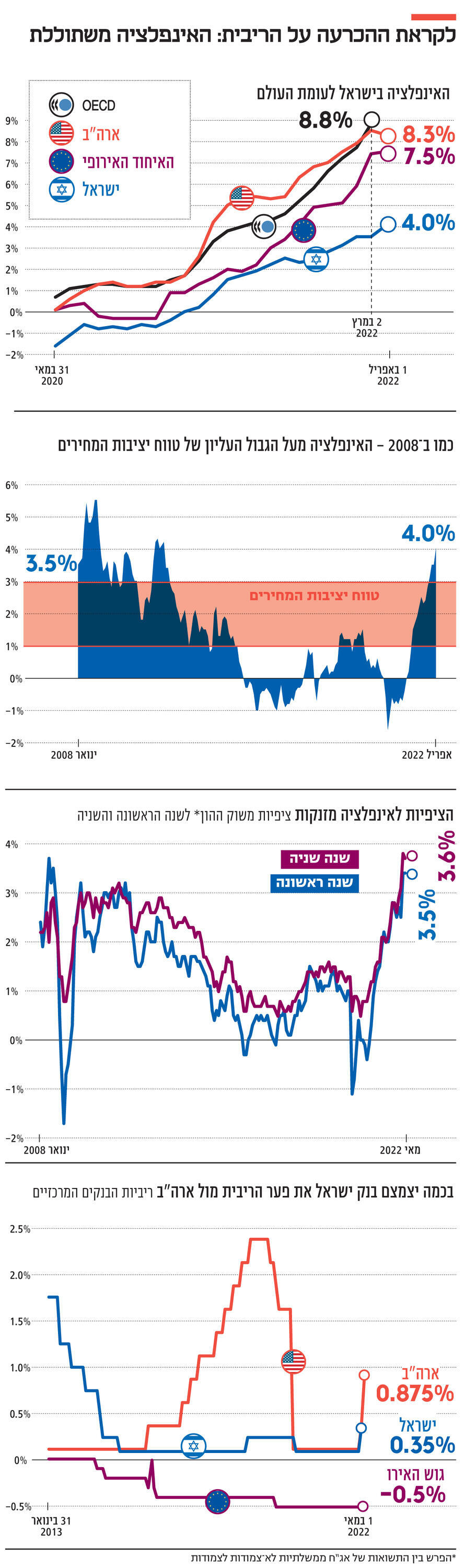

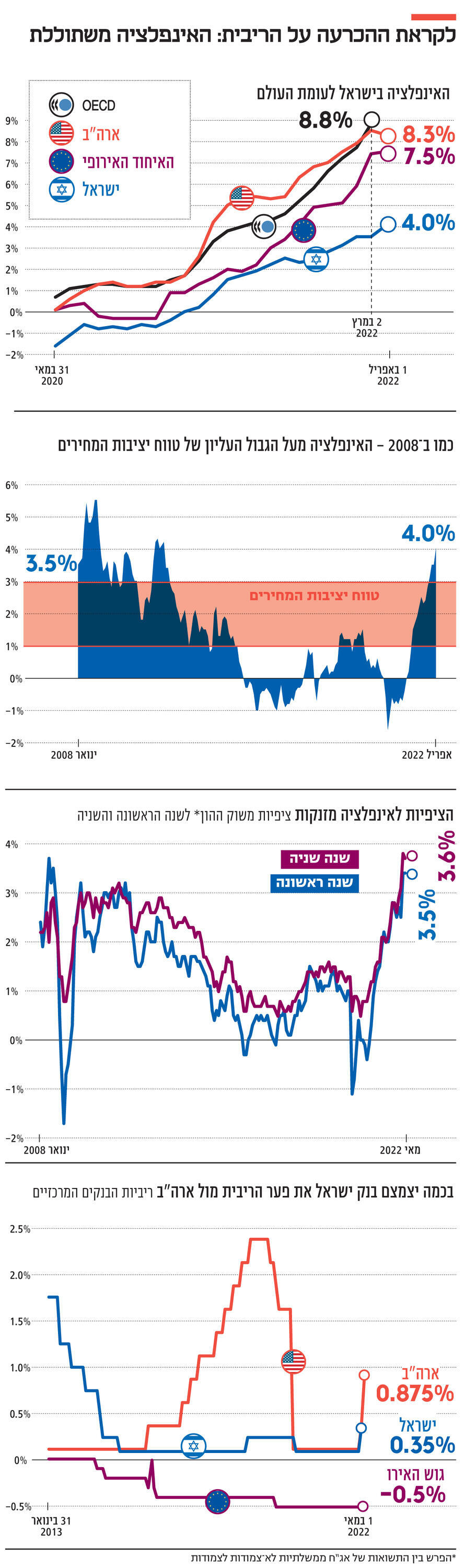

In addition, there is a new inflationary force that has joined the equation and has not been seen for a long time: the devaluation of the shekel. The reason for this phenomenon that has not been seen here almost since 2008, similar to inflation, is in the sharp falls in New York stock exchanges. Since no one can sign that the avalanches in global capital markets have come to an end, the devaluation process has not necessarily ended. The weakening of the shekel increases the value of imported inputs and services, which translates into strengthening inflation. Therefore, the point is clear: there is no reason for the Bank of Israel to stop the process it began to carry out in the previous month. The opposite is correct. And if that was not enough, now it turns out that the market is also expecting it. He is already taking the next raise for granted so the governor will not shock any player.

But the monetary dilemma of the Bank of Israel has not disappeared, nor has it diminished. She just changed. The question now is not whether the interest rate will rise but by how much. It turns out that this is an equally complex question. According to Reuters data, as of the weekend most forecasters (11) believe that the increase will be only 0.25% but there are still three forecasters who believe that the Monetary Committee will increase the pace and already raise the interest rate by 0.5% to 0.85%. Although they are in the minority, the big raise scenario exists and should be taken seriously.

3 View the gallery

Jerome Powell, Chairman of the Fed

(Photo: AP)

2. It is important to clarify already: both 0.85% and 1% interest rates still reflect a very expansionary monetary policy as the real interest rate in the economy – the nominal interest rate minus inflation or inflation expectations of 3.7% -3.4% – is still deep in negative territory. what is the meaning? That if you apply for a loan of NIS 100 given an interest rate of 0.85%, you return at the end an amount of money that reflects purchasing power equal to about NIS 97 – less than the amount taken. A few days ago there were more forecasters who thought that the Bank of Israel would imitate the Fed and also make a 0.5% increase as Jerome Powell and his friends did in early May. But some of them changed their position after seeing the national accounts data released last week and pointing to a 1.6% drop in GDP in the first quarter of 2022.

Much has been written about the illusion that the same data has produced, since when you dive into the details, you realize that the Israeli economy is still boiling. The reason for the slight decline in GDP, amounting to about NIS 1.5 billion for an economy of more than NIS 1.5 trillion, stems from a technical decline in car purchases brought forward to the last quarter of 2021 and the welcome decline in government spending after the 2020 surge due to the corona. Still, the data reflect domestic demand that has soared by 8.5% despite the decline in public consumption; Current private consumption of durable goods per capita that has risen despite the decline in car purchases; Investments that continue to rise, including residential construction.

3 View the gallery

This decline occurred solely because the last quarter of 2021 was a record quarter in which 16% growth was recorded. But even when insisting on a comparison with the previous quarter, it is important to remember that in many countries, including the US, there was a negative growth rate during that period. After their publication, they decided to raise the interest rate by 0.5%, so it would not be a big surprise if Yaron and his friends, who are very influenced by the Fed’s tone, follow in the footsteps of their American counterparts, and a week after the CBS published the growth figures. %.

Still, the decision of the Governor and other members of the Monetary Committee is easy for several reasons. When compared to the corresponding quarter last year, growth in Israel jumped by 9%, from the highest rates in the West, while the US, for example, grew by only 3.6% according to this method. If that was not enough, just before the publication of growth data Historical unemployment of about 3%. This is an unemployed rate that is not recognized in Israel, when the participation rate in the labor market is still high and stands at over 60%. Against the background of the government deficit reset, government debt is falling – expected to return below 70% of GDP – and credit rating companies continue to praise the Israeli economy when one of them, Moody’s, decided to raise its rating forecast. Only benefits with exporters who see how their real revenues have risen by about 7% without batting an eyelid.

3. So it is clear why most forecasters think that the Bank of Israel will ask not to increase the pace. First, because they estimate that the Bank of Israel will not want to broadcast panic. A 0.5% increase could be interpreted as contrary to Governor Yaron’s repeated message that “our situation is very different” from that of the US and Europe in terms of the extent and nature of inflation. Second, the credibility of central banks, And his friends will decide to surprise and shock. But this is only one side of the coin. There are winning considerations also on the side of the 0.5% betting group that make this alternative not only plausible, but some will also say the obvious: This does not mean that there will be a recession, but there will be a slowdown. In 2022, the Israeli economy is expected to grow by 5% – a huge rate in international comparison – but lower than the unusual 8.3% of 2021. Moreover, the expectation for 2023 is another slowdown: Growth of between 3.5% (IMF) and 4% (Bank of Israel).

The initial signals of a certain halt in the activity of start-ups due to the rise in money in Israel and around the world should not be underestimated. In the international arena the end of the war in Ukraine is not in sight, and estimates are that for next winter, in the last quarter, Putin will again take advantage of the winter to improve positions, which will continue to overshadow Europe’s economy and world inflation. China’s economy is also signaling a sharp slowdown, if not a real recession, with its zero tolerance policy towards the corona only making it more difficult.

The landing power of the US economy – the largest in the world – is unclear. One of the golden rules of monetary policy should not be ignored: it is much easier to raise interest rates when everything is rosy than when the macro picture begins to get gloomier. Especially if it is difficult – when the body is still healthy and strong. They will reduce and stop the process of raising interest rates, at the expense of the continued intensification of inflation and its rooting.

In general, it believes that central banks have difficulty raising interest rates compared to the ease with which they lowered them, especially after the global crisis of 2008. And there is also a simple arithmetic issue: The Bank of Israel will have more leeway to lower interest rates to encourage activity, the higher the interest rate. It must not be forgotten that when a central bank raises interest rates, it also produces a future monetary tool: lowering interest rates – a tool that has disappeared in the last decade. In fact, once interest rates are zero, central banks lose interest rate tools as a key policy tool.

If the slowdown in the Israeli economy continues in the wake of a global recession, the Bank of Israel will have more room to maneuver to lower interest rates to encourage activity, the higher the interest rate

The strong raise can also give a stronger blow to inflation expectations and bring them back into the target and thus bring the inflationary breast back into the bottle. According to data from the Bank of Israel, capital market inflation expectations in the first year – the difference between the yields of unindexed government bonds – stand at 3.5%, above the upper limit of the price stability range (3%), for the third month in a row. This is the highest rate recorded since 2008. Even for the second year, expectations are above the target and even close to 4%. There is a fairly general consensus that as long as inflation expectations do not fall, inflation will not fall.

There is another point that is directly related to growth: although there is widespread agreement that current inflation is the product of severe disruptions in supply chains and supply shortages – at least in the case of Israel – it is not the only reason. An analysis of items in the consumer price index such as that of the national accounts – a breakdown of private consumption – also shows that demand in Israel is awake and some of the inflation in Israel comes not only from a decline in supply but also from demand. Anyone who finds it difficult to understand this on a theoretical level will give a jump to Ben Gurion Airport and understand how much the Israelis have not yet compensated themselves for the restrictions on the freedom and liberty of the Corona. And if that’s not enough, Israelis are sitting on a mountain of cash: about NIS 591 billion in current account. Vigilant demand along with piles of hot money are a safe format for inflation. In contrast to inflation that comes from supply shortages, interest rates are very effective in curbing inflation that comes from strong demand.

4. And there is another equally important issue: inflation is extremely regressive. That is, it hurts excessively and disproportionately at the weakest in the economy. Simply put, if food goes up by 10%, the rich will not eat less and if fuel goes up by 50%, they will not stop traveling and flying. But such increases in electricity and basic basket tariffs could push entire populations around the globe into difficult moral dilemmas in which they must decide whether to purchase food or medicine. This is also the reason why we are seeing more and more social unrest in the world. There is also a fairly broad consensus coming from the BIS, the central bank of central banks, that central banks must include inequality considerations in setting their policies and therefore restraining inflation plays a key role in this context in reducing inequality and minimizing harm to the weak through monetary policy. Therefore, although the direction of the next decision of the Bank of Israel is completely clear, its scope is arousing great curiosity and promises to be no less critical than the previous decision.