“This whole legal story is a bit ‘delusional’. This morning we filed an appeal and a request to delay the execution of proceedings. We believe the verdict is based on ideology and beliefs and not on facts.” This is what Meitav Dash CEO Ilan Raviv said yesterday in a conversation with journalists, after the investment house presented a plan designed to deal with the financial consequences of the ruling in a class action lawsuit, which includes collecting management fees on provident funds purchased from Bank Hapoalim, contrary to the agreement signed by savers.

The amount set aside will be written off about half of the equity

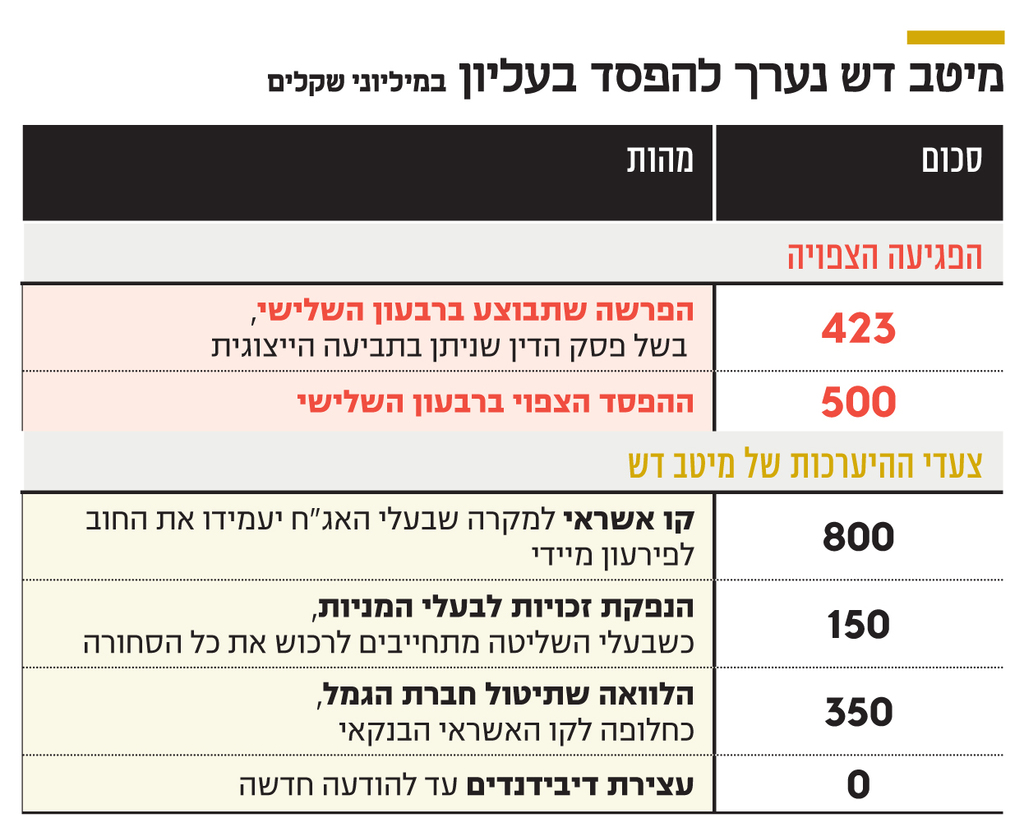

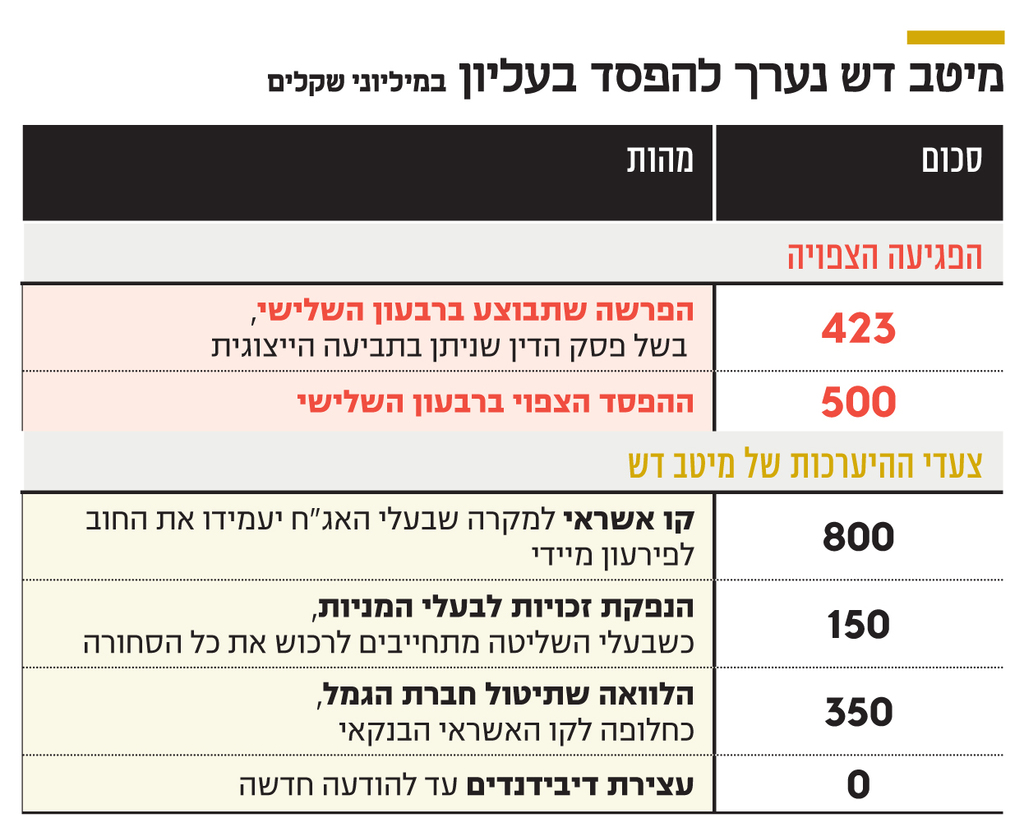

At this point it appears that the ruling – which is not yet final, because the investment house has appealed to the Supreme Court – is tantamount to sabotage for the investment house. Meitav Dash announced yesterday that it will set aside the full amount of compensation it needs in the third quarter of the current year – NIS 423 million. This amount joins the provision of NIS 27 million made earlier. The total provision will wipe out nearly half of the investment house’s equity, which as of the end of the second quarter of the year was NIS 976 million.

In addition, the investment house expects to post a loss of NIS 500 million in the third quarter, compared with a total profit of NIS 32 million in the third quarter of 2020. Excluding the provision, Meitav Dash’s net profit in the third quarter should be NIS 34-38 million. The expected loss in the third quarter erases the aggregate profit of the last 14 quarters, and it resets the profit of the years 2017–2020. In fact, since the investment house began trading on the stock exchange in 2007, it has not signed a single year in the loss, except for 2008, which was a year of global economic crisis, in which it lost NIS 104 million. That is, the expected loss in the reporting quarter will be almost five times greater than that recorded in the most difficult year in the history of the investment house.

2 View the gallery

Ilan Raviv, CEO of Meitav Dash

(Photo: Amit Shaal)

Although at best Dash is confident in their righteousness, and believes that the Supreme Court will reverse the district’s decision, but to prepare for this not to happen, the investment house has announced a series of measures.

First, the investment house stops distributing dividends until further notice. Second, the investment house was equipped with a credit line of NIS 800 million, which was intended to be an alternative to the company’s bonds, which, following the provision, could be repaid immediately by the holders. Meitav Dash currently has two series of bonds, C and D.

Series D, amounting to NIS 513 million, is due to be redeemed at the end of 2029, and according to the criteria that the investment house has committed to, its equity can not be lower than NIS 450 million. Also, the criteria state that the ratio of financial debt to operating profit cannot exceed 5.5. That is, the debt can not be 5.5 times greater than the operating profit. If the investment house does not meet these criteria for two consecutive quarters, the holders can repay the debt immediately.

Series C does not carry criteria that are affected by the current provision, however, if Series D is to be repaid immediately, the holders of Series C will also be able to place the debt towards them for immediate repayment.

2 View the gallery

The CEO of the investment house said that the management would ask the holders to consider its situation, since “the ratio between profitability and debt will not meet the covenants, neither a quarterly outline nor an annual outline. Therefore, we are in dialogue with the bondholders, and we will request an amendment to the series’ trust deed, along with the deviation of the current criteria from the terms of the series. ”

Alternatively, the investment house will apply for a loan of up to NIS 350 million for its provident company. If the option of opening a line of credit is chosen, it will become a long-term loan from two of the banks on the same loan terms as given in bonds with an interest rate of 1.8% to 2%, which will be repaid in 7 equal installments.

In addition, Meitav Dash will issue rights in the amount of NIS 150 million, with the controlling shareholders undertaking to purchase all the shares, if there is no response. The largest shareholders in Meitav Dash are the Baram Finance Group, owned by Nir and Eli Barkat (28.75%); Stepak family (28%); The Phoenix (5.4%); And Ilan Raviv (1.5%). An issue of rights is an issue of shares for existing shareholders only. If some shareholders choose not to participate, they can transfer their right to another shareholder. Either way, the share of those who do not participate in the IPO is diluted.

In the conversation, Raviv also said that “the event cannot hurt the strong momentum we are in. We will protect the shareholders, the employees, the debtors and the savers.”

It is clear that investors were not particularly impressed by the events. The stock opened the trading day with a sharp drop of more than 5% and ended it with a drop of more than 3 %.3. Since the beginning of the year, the share has risen by 23%, while the Tel Aviv Finance Index has climbed by 45.5%. The company’s market value is NIS 1.1 billion.

Last August, Tel Aviv District Court Judge Michal Agmon-Gonen ruled that the Meitav Dash provident fund must return to the members an amount of more than NIS 400 million – NIS 1,500 per saver. The ruling was made as part of a class action lawsuit filed against the investment house in 2015, claiming that Meitav Dash charged management fees in provident funds in violation of the historic agreement between the provident fund manager and savers. Meitav Dash, as stated, filed an appeal to the Supreme Court. “We have consulted with various legal entities, and we believe that the chances of the appeal being accepted are higher than being rejected,” Raviv said.

Meitav Dash in the process of exercising rights vis-à-vis the workers

The provident fund, in which Meitav Dash charged prohibited management fees, was purchased by the investment house from Bank Hapoalim in 2007 for NIS 31 million. The purchase was made by the investment house Dash, which later merged with Meitav and created Meitav Dash. In recent months, the investment house has been conducting a process of exercising rights with the bank, following an indemnity mechanism that was promised to Dash at the time of its acquisition. In the current time “each party reserves its rights. There is an arbitration mechanism in the agreement, which we will activate after receiving a response from the bank, in case our appeal is not accepted,” Raviv concluded.

The letter of appeal submitted yesterday by Meitav Dash to the Supreme Court is spread over 28 pages, and as part of it, the Investment House stands on the errors that it contained, in its view, the district court’s ruling. Meitav Dash’s main claim is that the provident fund savers (permanent military personnel), who enjoyed zero management fees when purchasing the fund, were subject to changes in management fees under the provident fund’s regulations. According to the investment house, although the historic agreement not to collect the management fee from the accumulation was made on the basis of an individual agreement with some of the savers, the provident fund manager has the right to change the agreement – as long as he notifies in advance.

Since the loss in court, more class action lawsuits have been filed against Meitav Dash. These lawsuits claim that the company’s shareholders suffered damage of NIS 141 million, as a result of Meitav Dash’s conduct since 2015 – the date on which the class action was received.

Meitav Dash’s share fell following the ruling given at the end of August by 13% within two trading days, and according to the new lawsuit filed by the shareholders, it has lost a total of about a quarter of its value since the day the lawsuit was filed. Defendants include Meitav Chairman Dash Eli Barkat, CEO Ilan Raviv, directors and controlling shareholders Zvi and Avner Stepak, and other senior executives at the investment house and the provident company. The plaintiffs allege that Meitav Dash misled the shareholders in several ways over the years of the lawsuit: The first way was in describing the class approval by the court in 2015 as a “marginal and unimportant” lawsuit. In addition, the investment house did not disclose the potential for destruction to the company and its chances of being accepted.

Meitav Dash is not the only investment house that purchased from a provident fund bank that had historical agreements, since the banks sold the funds as part of the Bachar reform. The interpretation taken by Judge Agmon-Gonen in her ruling, they believe to the best of their ability, would have thwarted this reform. In 2007, Psagot Investment House acquired the Gadish funds from Bank Hapoalim for NIS 630 million; Bank Leumi sold its provident funds to Prisma (which later sold to Psagot) for NIS 418 million; Mizrahi Tefahot funds were sold to Excellence and the Phoenix for NIS 343 million; And Discount funds were sold to Clal for NIS 607 billion.

If the best flap appeal to the Supreme Court is rejected, and the ruling against it becomes final, this may have a horizontal impact on other investment houses. Savings groups may be set up, which under individual agreements with the banks were given benefits in the management fees, which were changed during the management of the funds in the investment houses.

.