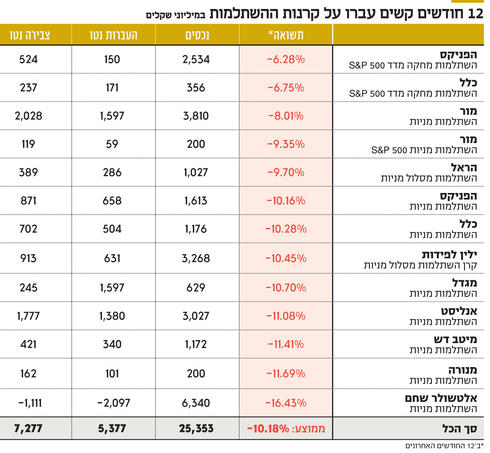

Against the background of the rise in inflation and the struggle of the central banks to raise prices by raising interest rates and reducing liquidity, the world’s stock markets are showing sharp declines. Thus, in the last 12 months, the Nasdaq index, which represents technology stocks in New York, fell by 30.2%, while the S&P 500 index fell by 16.4%. However, the declines in the American stock markets do not scare those saving in the education funds – at least for now. Following the declines In the value of American stocks, the training funds in the stock track also recorded sharp declines in the last 12 months. The 13 stock training funds, which manage approximately NIS 200 million or more, showed an average decrease of 10.18% in the period in question. But in fact, the training funds whose returns were less affected In the same period, they are the passive funds, which mimic the indexes. Thus, the Phoenix Pedalma, which tracks the S&P 500 index, fell in the last 12 months by 6.28%, and the included Palemat, which also tracks the S&P 500, shed 6.75%, and both recorded the smallest decrease among the funds that track the American stock index. The index has indeed fallen in the last 12 months by 16.4%, as mentioned, but the funds “benefited” from the strengthening of the dollar against the shekel, which helped to substantially moderate the decline in value in the index. In contrast, the stock fund with the smallest decline is Mor Shares that fell by only 8.01%.

The negative return of the stock tracks in the last 12 months did not cause the savers to flee the track, but rather its growth. As of the end of September, the 13 largest training funds manage more than 25 billion shekels, and in fact, throughout the stock market crisis, the assets of the stock training funds grew by almost 7.3 billion shekels. That means a growth of more than 40%. This is evident from the examination of the net accumulation funds as reported by the investment houses and insurance companies that manage the funds to the Gemalnet website, the official website of the capital market.

Why does the public continue to flock to the equity route, despite its weak results in the last year? Training funds that manage NIS 296 billion are the main means of saving for the working public in Israel for the medium to long term. Redemption of the funds after the sixth year exempts the owner of the fund from capital gains tax, an exemption that can sometimes even reach tens of thousands of shekels. Therefore, it is not impossible that those who save in the stock track in the training funds see the current crisis in the stock markets as a temporary crisis and an opportunity for long-term returns. Another possibility is that the savers draw confidence from the excess return that the local stock market presents over the American market. In the last 12 months, the Tel Aviv-35 index rose by 4%, while the Tel Aviv-125 index remained unchanged. The stability in the local stock market may be a refuge for investment managers in the stock training fund industry who will divert their investments to the local market.

“The declines in the last year come after in the last five years the route has jumped by 34.2%,” a senior investment manager in the training sector told Calcalist. “I recognize the maturity and recognition of savers that shares generate returns for the long-term investor, therefore savers do not fold after a difficult year. It is a market that is also biased by insurance agents. They are supported by the opinions of the investment house and convey this to the client that it is not worth going through a route, especially after you have already suffered the descents”.

According to Amit Oron, manager of the long-term savings and health division at Migdal, the growth of the stock track in a year of declines stems from psychological and economic reasons. “Today’s stock crisis is deeper than the crises of the last decade and a half because of inflation, which means that the forecasts for recovery will last longer than previous crises. However, stock market savers, who have already experienced in the past that the stock track tends to recover faster than the other tracks, prefer it. Throughout the crisis, the alternative investments also Like the bond tracks, there were declines, so if there are declines, it’s better to be on a track that will recover faster.”

The main beneficiary of the public’s trust is Mor Stock Training, which has experienced a positive momentum in recruitment, similar to the rest of Mor’s provident funds which grew to NIS 43.7 billion in four years. Mor’s stock fund grew by more than 2 billion shekels in the last 12 months, managed to transfer 1.6 billion shekels to it from competitors and today it manages 3.8 billion shekels and is close to becoming the largest training fund in the stock track. An analyst’s equity training fund has also been growing at a fast pace in the last 12 months – by NIS 1.8 billion – while transferring NIS 1.4 billion from competitors, even though the fund showed a decrease of 11.08%.

Among the equity funds, one bleeding fund stands out – that of Altshuler Shaham – with the worst negative return on the track, losing 16.43% in the last 12 months. In recent years, this fund has been dominant in the route and managed NIS 9.4 billion at the end of 2021, which accounted for 35% of the assets in the entire route. The investment crisis that plagued Altshuler Shaham since last year was due to the company investing in China and focusing on American technology stocks, two decisions that led it to show a lack of return compared to the rest of the market.

These decisions also erased the fund’s return in the long term, when in the last 5 years it yielded 23.16%, the lowest return in the market. The clients punished Altshuler’s fund when they transferred almost NIS 2.1 billion to competitors in the last 12 months, and the fund’s assets lost NIS 3 billion since the beginning of the year, but even today 27% of the assets in the route are managed by Altshuler Shaham’s fund.