It is widely believed that the increase in interest rates will moderate housing prices, and will also slow down activity in the mortgage market. However, in the meantime, the volume of new mortgages continues to be high and stands at NIS 11-12 billion per month. In the financial system, it is estimated that the month of July will also end with a strong performance of over NIS 11 billion.

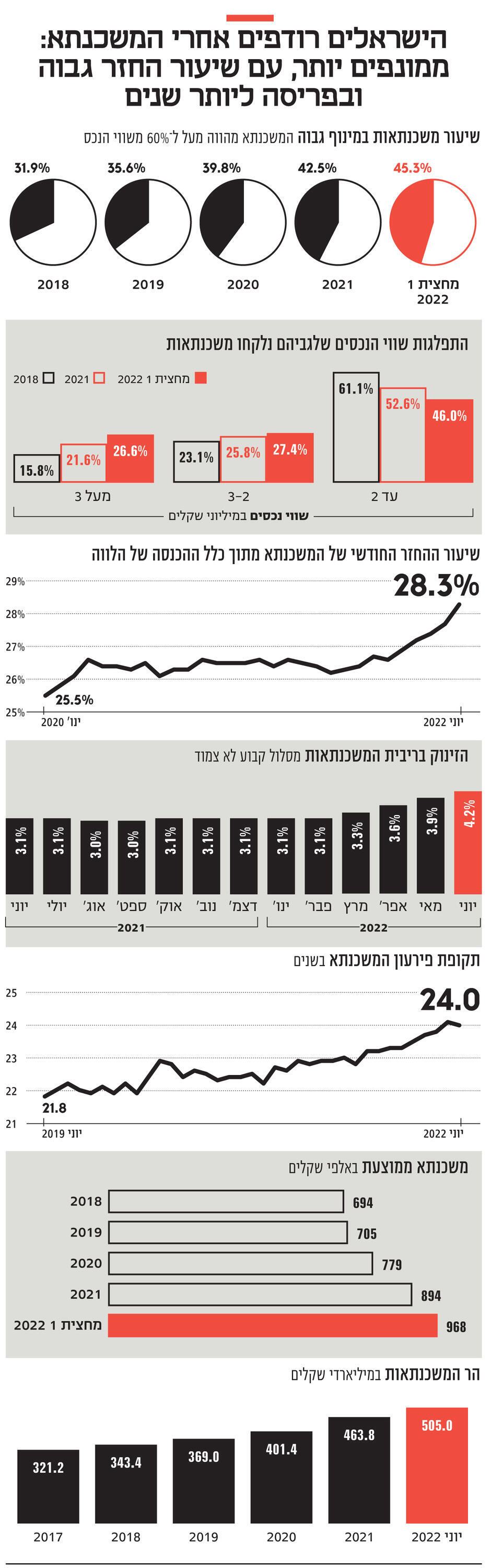

The summary of the data for the first half of the year shows that the housing market, and as a result the mortgage market, is rushing forward: in the first half of 2022, mortgages were taken to the extent of NIS 69 billion, a jump of 33% compared to the corresponding half in 2021, a year that was a record year itself, and more than the mortgages In all of 2018 they were NIS 63.1 billion, meaning a doubling rate within 4 years.

2 Viewing the gallery

The sharp increase in the volume of mortgages is mainly due to the increase in housing prices, which jumped by more than 15% in the last year. As a result, the average mortgage in the first half of the year stood at NIS 968,000, a jump of 40% compared to 2018, when it stood at NIS 694,000.

The increase in housing prices is also reflected in the distribution of mortgages according to the value of the purchased property. In 2018 (only four years ago) the majority of mortgages (over 60%) were intended for the purchase of properties worth up to NIS 2 million, while in the first half of the year their share dropped to 46%.

The mirror image is of course in the more expensive properties. Thus, for example, properties worth over NIS 3 million, which were considered luxury properties, accounted for only 15.8% of all mortgages in 2018, while in the first half of 2022 this figure is already becoming more mainstream, when almost 27% of mortgages are for financing properties of such a high value.

And as if all this was not enough, the economic storm of the outbreak of inflation and the increase in interest rates also arrived. The macroeconomic changes are bad news for mortgage borrowers. After several years of relative stability in the level of interest rates in the mortgage market, in recent months it has registered a sharp increase, which has not been seen for a long time. Thus, for example, while only in February the average interest rate in the non-linked fixed route was 3.1%, in June it had already jumped by 35% to a level of 4.2%, and this trend is expected to continue.

When you look at parameters related to the mortgage market, you see that the common denominator is that the mortgage burden on apartment buyers is becoming heavier and heavier: the most prominent figure is the extent of leverage. Rising housing prices are forcing buyers to take out a higher leveraged mortgage to be able to complete the purchase. A mortgage with a high level of leverage is considered one where the amount of the loan is higher than 60% of the value of the property. Bank of Israel data shows that while the scope of these mortgages was only 31.9% in 2018, in the first half of 2022 they already constituted 45.3% of the mortgages taken out in that period.

Another parameter that reflects the increase in the level of risk is the rate of the monthly repayment of the mortgage from the total income. While at the beginning of 2020 the mortgage repayment accounted for an average of 25.5% of the borrowers’ income, in the first half of 2022 this figure increased, and in June it was even over 28% of the income. However, the increase in this parameter is more moderate compared to other parameters such as the rate of highly leveraged mortgages.

A possible solution to the increase in the level of risk is to impose restrictions on taking out mortgages, just as the Bank of Israel did a decade ago. But this time their effectiveness will be less. The reason for this is that in recent years a non-bank credit market has also been created in the mortgage sector, to which the Bank of Israel’s restrictions do not apply. Imposing restrictions on taking out mortgages in banks will only divert borrowers to this market, whose interest rates are considered higher than those of the banks anyway.

The banking system is not bothered by the creeping devaluation of the parameters that reflect the level of risk in mortgages. “We do not see a dramatic risk in the market. For example, the average financing rate is approximately 56% of the property’s value, this is not a drama,” Uri Yunisi, head of the mortgage division at Bank Leumi, told Calcalist.

“We are in a situation where if a customer goes into default, he sells his apartment, and is still left with an amount. We are very far from a crisis of a wave of insolvency, and a fear of a drop in property values, which will result in customers being left without a home and with debts. The regulatory guidelines that the Bank of Israel issued before A decade still affects risk reduction in the banking system,” he claims.

The monthly repayment of the mortgage from the total income did not increase dramatically (in contrast to the increase in other parameters such as the average mortgage amount). So how do the apartment buyers deal with the price increases and the higher mortgage rates? Simply spread the loan over a longer period.

While the average mortgage repayment period was less than 22 years in 2019, in the last two months it has already reached 24 years. This is apparently an easy and available solution, but there are no free meals – the meaning of extending the mortgage period is an increase in the amount of mortgage payments, and also taking it until a later age.

Another method to deal with the current situation is to increase the prime component. Much has been said about the fact that the prime component became significantly more expensive due to the sharp increase in the Bank of Israel interest rate (this route is fully linked to the interest rate increase), but according to Yunisi, if a few months ago the prime route accounted for 40% of the mortgage, now it has already risen towards 42%.

“I was surprised to see this increase, I thought that customers would run away from the prime, but this is not happening. The reason for this is that the prime is still the cheapest route, because the other interest rates have also increased. Increasing the prime component is also the way to extend the duration of the mortgage, without committing to a high and fixed interest rate for the term Long. You can see the prime component as a regulating factor – if the market calms down in three years, it will be possible to refinance the mortgage more easily, since there is no early repayment fee on the prime component,” says Yunisi.

In addition to this, there are other methods to deal with the rise in prices, and according to estimates they are gaining momentum, but there is no official data regarding them: the reference is of course to assistance from the parents, and taking additional (and more expensive) loans, as a supplement to equity – a method that becomes more problematic as the interest rate rises and these loans will become more expensive.

According to the rules of classical economics, the increase in interest rates that has begun and will continue, is supposed to cool demand and curb the increase in prices, but Unisi does not share this forecast. “I don’t see a significant moderation in demand,” he says.

2 Viewing the gallery

Head of the mortgage division at Bank Leumi, Uri Yunisi

(Photography: Yossi Azolai)

“Real estate has become more expensive by more than 20% in two years, the interest rate rises and makes the mortgage more expensive, the inflation rears its head and affects the construction costs, so that every deal of buying an apartment in Israel becomes more difficult, and despite this the public is there because of the psychological variable. In Israel, the culture is a culture of buying an apartment and not renting, and when you see that this is automatically running away from you, you will do everything to complete the purchase of the apartment now. Psychology defeats the rules of classical economics.”

According to him, “In the last year we have seen a rate of price increase of 16%. The basis for the price increase is a lack of supply of 100,000 units, but I think that this surge that we have seen in the last year is due to dispersal. There is no government program on the horizon that will be broadcast that is worth waiting for. The homeless estimate that in a year the apartment prices will only be higher, so they are doing everything they can to buy an apartment now, and it is the dramatic excess demand that we are seeing that is causing the sharp increase in prices.”

“This does not mean that there is a decrease in demand. A decrease in transactions may be because the supply has run out.”

Yunisi adds that the rising interest rate doesn’t deter investors either: “They haven’t taken their foot off the gas. What affects them more is changes in the purchase tax. Although the interest rate is rising, the investment alternatives are still not attractive enough, certainly when rental prices are rising, and they can improve the yield that way. The share of investors in the mortgage market is still significant, and they do not feel a slowdown in their activity.”