Thanks to its investment activity, Phoenix is at the top of the profitability table of the large traditional insurance companies, and shows growth in the overall profit line. This is despite a weakness in traditional insurance activity, which has affected all companies in the industry.

Read more in Calcalist:

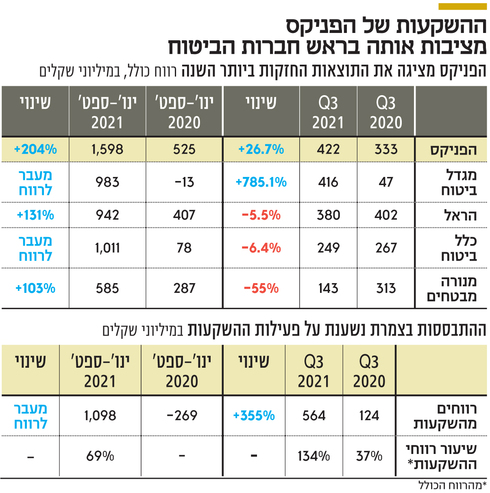

In the third quarter, the Phoenix posted a total profit of NIS 422 million, an increase of 27% compared to the corresponding period in 2020, and this is the highest quarterly profit among its competitors. The Phoenix is also at the top when looking at the results from the beginning of the year. From January, the Phoenix posted a total profit of NIS 1.6 billion – almost three times compared to the corresponding period, when the total profit was NIS 525 million.

In fact, Phoenix is one of only two companies that managed to show an increase in overall profit in the third quarter. The second company is Migdal Bituach, which is currently under management under the new CEO, Sagi Yogev, who was previously a senior executive at Harel. Migdal Bituach’s total quarterly profit was NIS 416 million, almost 10 times compared to NIS 47 million in the third quarter of 2020.

If the gap between Phoenix and Insurance Tower in the quarter is quite negligible, then in the first nine months of the year the gap is much more significant. In second place in the profitability table from the beginning of 2021 is Clal Insurance, with a profit of about NIS 1 billion – 60% lower than that of the Phoenix.

The Phoenix achieves these results mainly thanks to the high returns from investments it has made. Its total profit from investments and interest in the third quarter was NIS 564 million – higher than its total profit in that period – compared to a total profit of NIS 124 million in the corresponding period.

In the first nine months, the profit from investments was NIS 1.1 billion, while in the corresponding period a loss of almost NIS 270 million was recorded. Phoenix’s profit from investments is higher than Clal Insurance’s total profit.

Among Phoenix’s successful investments is the private cyber company Guardicor, which was sold at the end of September to the American company Akmai for $ 600 million. In addition, the Phoenix sold Ashtrom Properties and Acro Real Estate 25% of a project in the Alef complex in Rishon LeZion for NIS 128 million – 50% higher than the price it paid for its share in the complex. The Phoenix also owns about 20% of Marco Real Estate, which is preparing for an IPO in Tel Aviv and this month carried out a process to optimize the capital structure and the status of the projects. This move led to a revaluation in the maintenance of the Phoenix.

But there are also investments that are expected to spoil the celebration in the next quarter. Phoenix currently owns 3.5% of the Israeli fintech company RiskPayed, which develops payment systems and technology to prevent fraud in online commerce. The company’s share, which was listed on the New York Stock Exchange last July, has fallen 63% since then, and the company is currently traded at a market value of just under $ 1.6 billion. Following this, the Phoenix will record a loss of NIS 110 million in the fourth quarter.

However, it is still a good investment for the Phoenix. The insurance company invested NIS 30 million in RiskFayed in 2016. Prior to the company’s issuance, Phoenix performed a valuation, which led to a pre-tax profit of NIS 76 million in the second quarter of the current year. Today, its holdings stand at $ 55 million, which is about NIS 173 million. That is, the Phoenix is spaced close to 6 times its investment.

Phoenix CEO Eyal Ben-Simon referred to the expected loss in the investors’ conversation after the reports were published, and asked them to remember that in the fourth quarter the company is expected to enjoy a profit of NIS 220 million before tax due to the value flood created by Gamma clearing, which it continues to control. 60%).

The Phoenix results support its market value, which is close to NIS 10 billion and establishes its status as the insurance company with the largest market value in Israel. This is after a long period during which she played cat and mouse for the title against Harel. Since the beginning of the year, the Phoenix share has risen by 67%, while the Tel Aviv Insurance Index has risen by only 40%. Harel, which has the second highest market value, is traded at a value of NIS 7.5 billion.

The main beneficiaries of the situation are the controlling owners of the insurance company, the foreign funds Centerbridge and Glattin Point. The two acquired control (33%) from Yitzhak Tshuva’s Delek Group about two years ago for NIS 1.6 billion and a company value of NIS 5.3 billion, while their holding is currently worth NIS 3.2 billion – exactly 2 times.

In the third quarter, Phoenix adopted a dividend policy to distribute 50% of the total profit as a dividend, and therefore the shareholders will receive dividends of NIS 200 million for the reported quarter results.

.