The corona epidemic, which broke out almost three years ago, changed almost every aspect of our lives: how we live, work, play and educate our children. But while many were hurt by the restrictions put in place to curb the epidemic, these changes actually helped to enrich companies and entrepreneurs who adapted to the new needs. But now that it’s almost completely back to normal, that capital he’s built up is quickly dwindling.

This is a small club of 58 billionaires whose fortunes rose at an astonishing rate during the pandemic, and fell even more quickly after it. This club includes the scientist Stephan Bensel, the CEO of Moderna which was one of the first companies to develop and receive approval for a vaccine against Corona and thanks to this the stock jumped nearly 2,400% and its fortune climbed to 15 billion dollars.

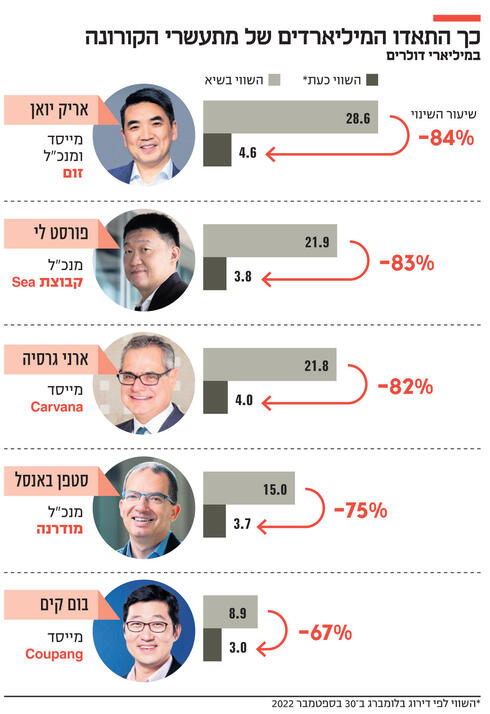

Other members are Eric Yuan, the founder of Zoom, whose US visa application was rejected eight times, and whose personal fortune jumped to $29 billion after his company became the world’s leading tool for video calls, as well as Ernest Garcia, one of the founders of Carvana, the online trading platform for used cars, whose fortune swelled to $21.8 billion. However, Bensal’s fortune has now shrunk by 75% to $3.7 billion, Eric Yuan Mazum’s fortune has fallen by 84% and now stands at $4.6 billion, while Garcia is now content with a fortune of $4 billion after which lost 82% of its value.

These 58 billionaires, who were nicknamed the “corona billionaires” because their fortunes soared thanks to ventures that were directly related to the epidemic and its consequences, are taken from the Bloomberg Billionaires Index, which tracks the fortunes of the 500 richest people in the world. According to an examination conducted by Bloomberg, the fortunes of 189 of them more than doubled at some point between December 31, 2019, when the World Health Organization was informed about an unidentified disease in Wuhan, China, and September 30, 2022. That is, apart from the 58 billion corona that the rates of increase and decrease in their capital Be particularly sharp, the other 131 billionaires whose fortunes doubled are those whose fortunes did not depend only on the way in which the Corona changed the way of life of many around the world.

For Kim Forrest, the founder of the Pittsburgh-based investment firm Bokeh Capital Partners, the exuberance surrounding the companies that profited from the shutdowns and restrictions recalled a replay of what she describes as the folly of the tech bubble of two decades ago, when capital poured into almost anything that included the term dot.com. “They filled a niche that desperately needed to be solved, but it wasn’t the kind of thing that stuck around for the long haul,” she said. “Investors are looking for growth and there is no more growth that can be taken from work from home.”

The list of 189 billionaires includes many who benefited from government aid programs and interest rates that were lowered in response to the crisis, including Tesla CEO Elon Musk who became the world’s richest man, Masiyoshi San, whose leveraged technology bets only increased, and Sam Bankman-Pride, the 30-year-old crypto tycoon who made Rally in a variety of areas such as Bitcoin and NFT. But none of these very rich entrepreneurs are immune to the joint efforts among the world’s central banks to curb rising inflation by raising interest rates. For example, the MSCI global index has fallen by 25% since the beginning of the year.

Although everyone is experiencing declines, this is particularly noticeable among the Corona Billionaires and the wealth they accumulated thanks to the closest connection to the pandemic has dissipated at a record-breaking rate, as has happened in other major major events such as the 2008 financial crisis and the Great Depression.

Out of the 58 Corona Billionaires identified, 26 are Asian nationals, 18 are from the US and Canada and 10 are from Europe. Only two are women: Falguni Nair, founder of India’s first female-led unicorn to be issued, cosmetics retailer Nykaa, and Denise Coates, co-CEO and the largest shareholder in Bet365.

Their businesses belong to 7 categories, with lifestyle changes following social distancing restrictions playing a big role: more than half of the tycoons are associated with habits associated with spending time at home, remote work and online commerce. A third are linked to companies in the pharmaceutical and health industries, which produce a variety of things from vaccines to ventilators. “The amount of economic good these people have done is enormous,” said Paige Ouimet, a professor of finance at the University of North Carolina, referring primarily to the vaccine developers. “So they should definitely be rewarded.”

The aggregate capital value of the Corona billions remains significantly higher than it was before the pandemic, but the impressive increases they experienced have evaporated. Capital shrank in each of the categories, led by online trading. The properties in this area fell by an average rate of 58% compared to the peak days, against the background of a decrease in investor interest and the return of many people to normal life.

On the other side of the scale, there are an additional 97 million people who are now subsisting on less than $1.90 a day because of the pandemic, according to a World Bank report.

Aid packages initiated by governments provided some relief, but failed to make up for all that was lost. This year, although it seems that the worst part of Corona is already behind us, more gloomy clouds are hovering above: the rising prices of food and energy, the high interest rates and the growing risk of a global recession. Even in the rich countries, economists warn that the crisis in the cost of living means that households with low incomes will find it difficult to finance both heating and food this winter, while in the poor countries, the World Bank warns, the epidemic has canceled years of efforts to raise millions of people above the poverty line, with high inflation and mounting public debts hurting in the abilities of these countries to curb the trend.

Due to this gloomy economic outlook, the voices for raising taxes on companies and the rich are increasing. Accordingly, last year the finance ministers of the G7 countries agreed to set a minimum corporate tax rate. At the same time, in Spain they recently revealed a new tax on property owners worth over 2.9 million dollars, while the new president of Colombia set a goal of raising taxes on the rich by 200%. However, these moves are not enough for Max Lawson, director of the inequality policy department at Oxfam International, who warned that without further actions, the corona virus could turn the gap between the rich and the poor into an unbridgeable abyss. “We saw both extreme wealth and extreme poverty rise at the same time,” Lawson said. “I’m not sure enough people internalized how extreme it was.”