Growth rates and profitability rates taken from the high-tech worlds, purchase rates from the private equity worlds and the volume of IPOs of the subsidiaries would not embarrass even a small underwriting company. This entire show is signed by Harel Wiesel, the chain’s owner and CEO.

Read more in Calcalist:

Wiesel has been supplying the goods since Fox was listed on the Israeli Stock Exchange at a value of about NIS 250 million in 2002, until it brought it to the value of NIS 7 billion at which it is currently traded. In a business venture that the retail market did not recognize before, he built an empire.

3 View the gallery

Fox CEO and owner Harel Wiesel. Aggressive dividend policy

(Photo by Dima Tliansky )

But Fox’s financial statements are worth looking at more broadly. Like what did Wiesel do with the gains he made from the weakness of the shekel and whether he shared with the loyal consumers of his chains some of them.

Fox’s figures show a preference to chain these profits to the company’s profit lines, as it rushes to distribute that profit as a dividend to shareholders. And for dessert, Fox also enjoys tax benefits following the corona crisis that include discounts or tax exemptions of NIS 11 million.

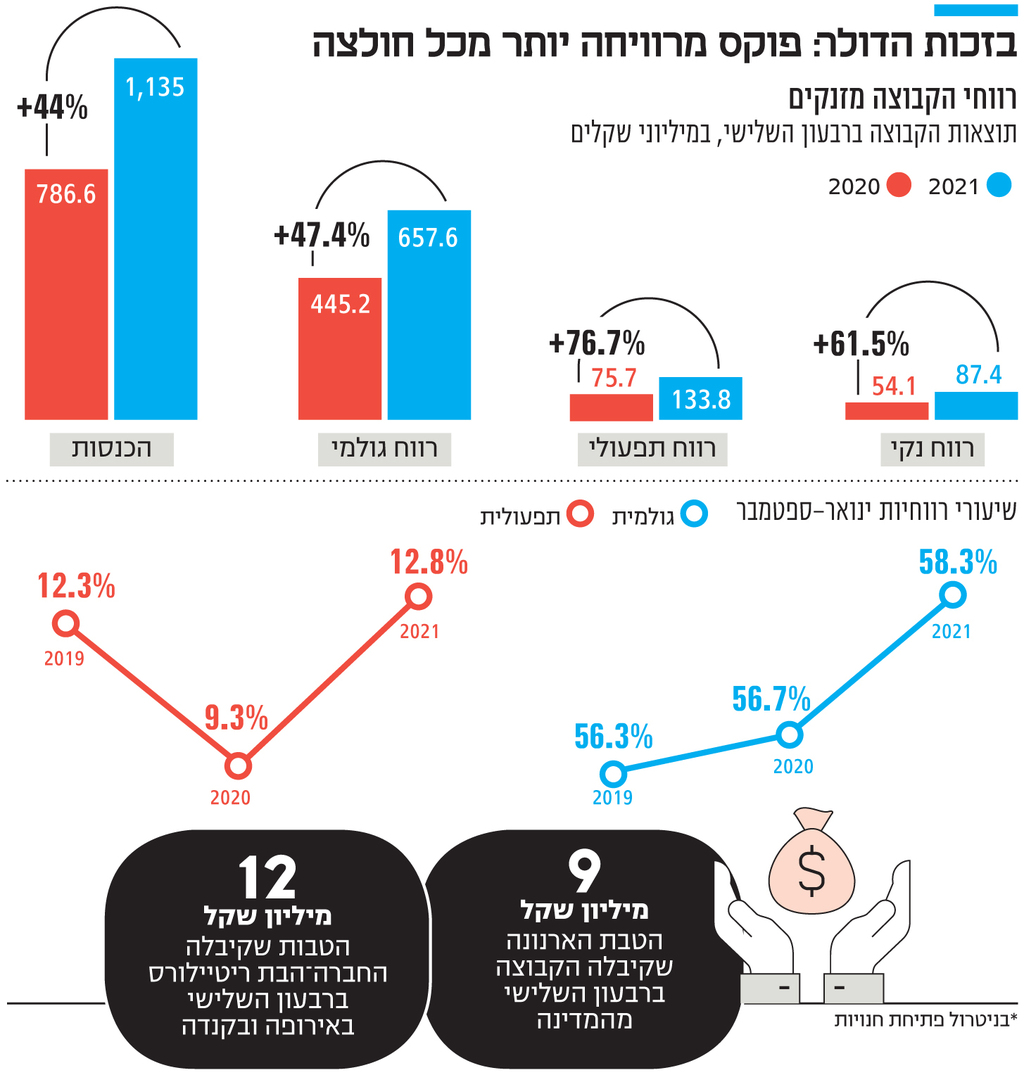

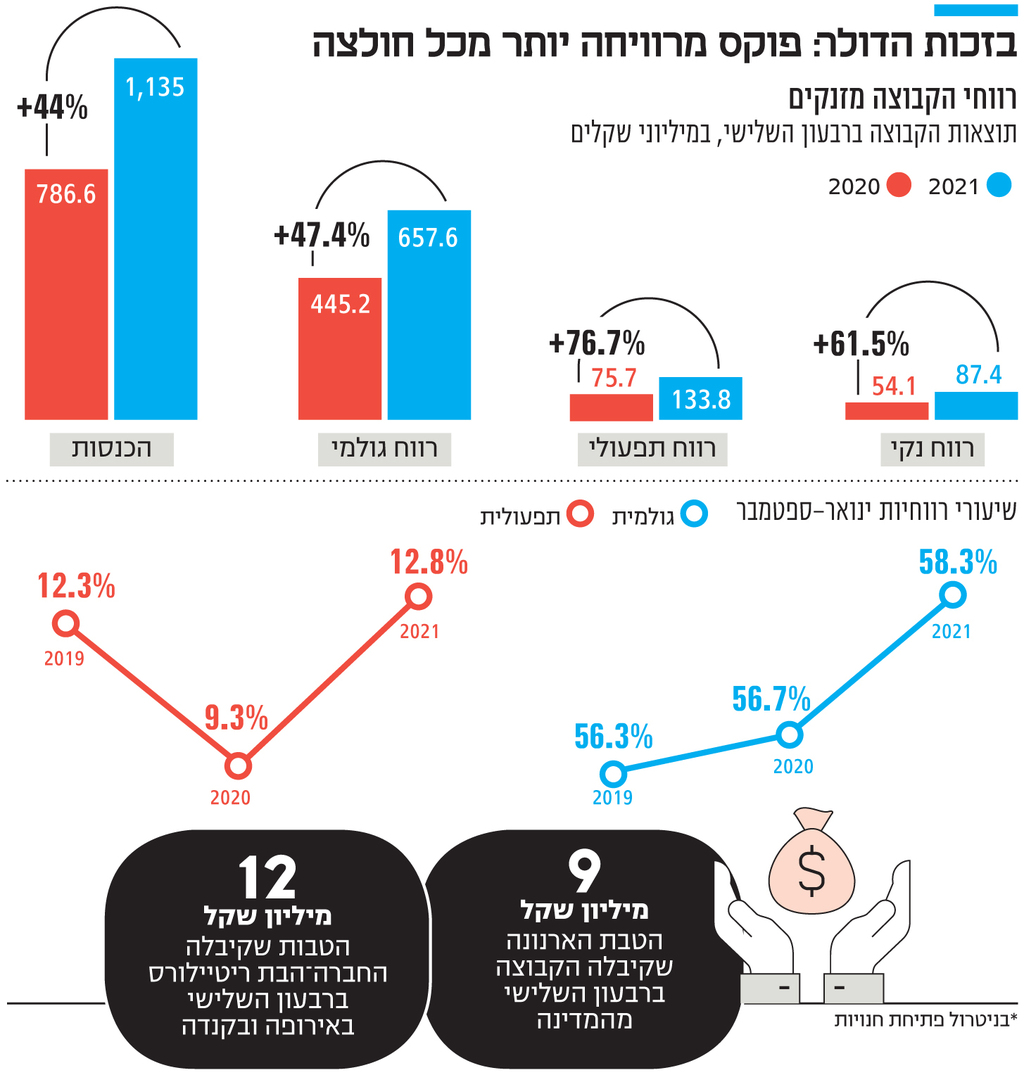

1. The company’s revenues are soaring to new highs

The group’s revenues in the third quarter amounted to NIS 1.13 billion, an increase of 44% compared to the corresponding quarter last year. This is attributed to a jump in sales in the same stores (stores that were also tested in the previous quarter, and therefore neutralize new stores) along with increased retail space, a slowdown in sales in the corresponding quarter last year due to store closures from September to December, and last year. Closure period.

A great many logical reasons related to the timing of the quarter that justify such a big jump in the top line of the company. But even if you look at Fox in a wider window of time, which includes the first three quarters, Fox’s numbers point to a huge jump: sales reached NIS 2.9 billion, 45% more than in the same period last year.

But the real story in Fox lies in the number of identical stores, which also includes the company’s online sales: in the first nine months of 2021, sales in identical stores in the fashion and home fashion sector rose by 23%, in Ballin by 25.6% and in sports by 39.3%. Well, in the same period in 2020 some of the stores were closed but it was natural to see such jumps in the same stores.

But Fox notes in its reports that the rise in this figure neutralizes the acute closure period. And all this without taking into account Fox’s expected expansion in the third quarter that includes the opening of 47 new stores to 770 in total, the launch of the RED cellular network and the offline yoga clothing chain.

And if all that was not enough then Fox is expected to launch the Flying Tiger brand from Denmark in the first quarter of 2022, and in the first half of the year the group is expected to open stores of the stock brand Jumbo Greece.

2. Profitability rates are also soaring

After seeing the meteoric jump in the group’s revenues, it is not surprising to find that the company managed to present enviable numbers in its profit margins, so that in the first nine months of the year operating profit doubled, and net profit jumped 98% to NIS 203 million. Here it is worth stopping for a moment and also examining the company’s profitability rates, ie how many shekels reached the company’s profit line out of every 100 shekels of sales. If in 2019 the company’s operating profitability rate was 12.3%, in 2020 it dropped to 9.3% and in 2021 it managed to surpass even the pre-corona year and reach 12.8%. Out of every NIS 100, NIS 12.8 reached the company’s operating profit line.

3 View the gallery

Fox’s store. Assistance with property taxes following the corona

(Photo: Yuval Chen)

This miracle occurs when the stormy day is outside. The prices of the raw materials are climbing, the transport prices are going out of the atmosphere and yet Fox manages to earn more for every NIS 100 it sells. A closer look at the financial statements and examining the company’s profitability by sector reveals that the dominant fashion and home sector in the company’s revenue showed an operating profitability rate of 13.1% (or 11.5% if a certain accounting standard is taken into account), compared to 7.9% in the same period last year (or 4.8 % Considering the accounting standard.) This is not a jump that a retail company is used to making.Even when comparing this figure to 2019 the numbers tell a story of a leap.

When looking at the company’s explanations for this sharp rise, it explains that the strong shekel is the one that played into its hands and also the change in the product mix. The improved profitability achieved thanks to the strong shekel was offset by the high shipping prices, Fox writes, and yet after lowering all of these, the company was able to improve its gross and operating profitability.

These numbers mean that Fox, which buys some of its products abroad, pays in foreign currency, imports it into Israel and sells it in shekels, earns more on each product. The question is what does it do with it and Fox chose to put all this surplus profit in the company’s pocket As a dividend to its shareholders.

3 View the gallery

Thanks to the dollar: Fox earns more than any shirt

3. How did Fox get tax benefits in the third quarter?

One line in Fox’s reports illustrates the distortion of the state’s grant policy, which concluded that Fox, whose cash flow from operating activities in the first nine months of the year was NIS 479 million, is also entitled to property tax benefits. Assistance to businesses affected as a result of the Corona crisis, some of the company’s subsidiaries have applied for a grant to participate in fixed expenses for the months of January and February 2021, which amounted to NIS 1.4 million. “Fox notes that those entitled to a fixed expense grant from the tax authority will be given a discount or full exemption from property taxes for a period of two months from the period of eligibility for the grant,” which earned Fox a total of NIS 1.7 million.

In addition, Fox writes in reports for the third quarter that “on June 29, 2021, the government approved aid for property taxes for large businesses with an annual turnover of over NIS 400 million. Accordingly, the company and its subsidiary recognized a decrease in property tax expenses in the total amount of NIS 9.2 million. ”

How does Fox, which is considered the strongest retail player in Israel, manage to receive NIS 11 million in tax deductions and exemptions from the state and distribute these amounts as a dividend to its shareholders? The State of Israel has solutions.

Fox is not the only company to have received grants from the State of Israel in 2021. Retailers, the company’s operating arm abroad, and Lalin recognized in Europe and Canada a decrease in sales and marketing expenses of NIS 12 million for assistance provided by the countries in wages, loss of income and one-time expenses. The trustee for its dividend distribution policy stated that it sees no reason to stop doing so despite enjoying Corona grants, the company was forced to announce that it was giving up these grants.A year later the aggressive dividend distribution continues, grants from Israel and abroad continue to flow and their return votes are not heard.

.