2 Viewing the gallery

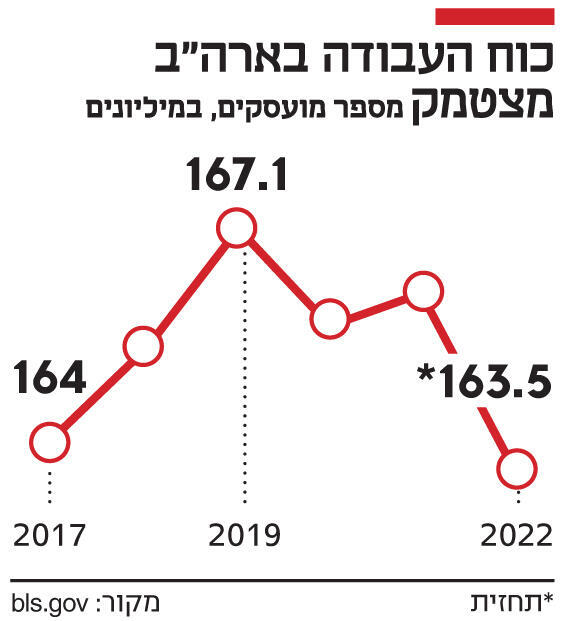

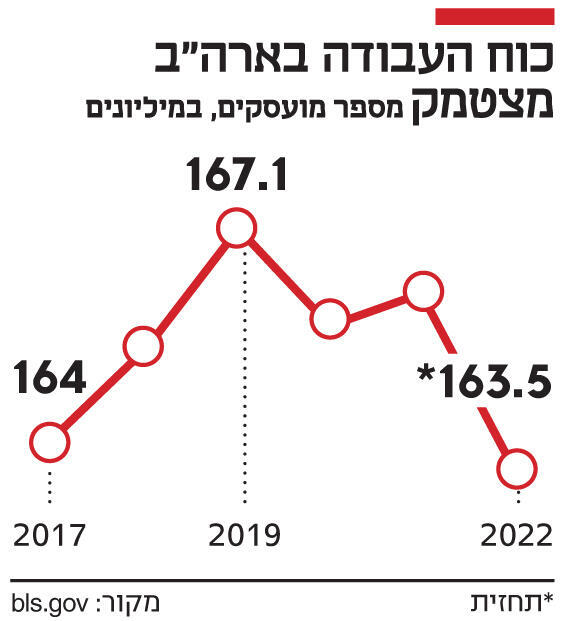

1. As far as the most advanced chips are concerned, the production capabilities of the USA are significantly behind. In response to this, the Biden administration is promoting and investing in the establishment of local production infrastructures. As part of this, Intel is currently building in Ohio what will be one of the most advanced chip production facilities in the world. The cost of establishing the factory valued at $20 billion, some of it courtesy of the federal government. But even though there is money and clear support from all the important authorities, according to a report by Bloomberg Intel is facing a significant difficulty: finding enough workers for the plant’s 7,000 construction jobs and 3,000 manufacturing jobs, when completed

This shortage of workers is expected to ignite a struggle to recruit skilled and talented personnel for physical jobs, a struggle in which the US is at a significant disadvantage. Countries like China and India have a huge population, a large part of which is still employed in agriculture. They have an inexhaustible potential pool of possible workers for factories Production and assembly of technological and other products, although extensive training procedures may be necessary for it. In the USA, where the standard of living is higher and the population is more educated and smaller, this pool is much smaller.

In order to find the necessary workers, not only for the new chip factories but also for the implementation of national infrastructure projects or to promote moves such as the establishment of renewable energy infrastructure nationwide – two stated goals of the Biden administration – the US will be required to reform its immigration policy. It will be forced to return to the policy The relatively open that characterized it in the first half of the 20th century, the one that allowed many immigrants to enter the country and created the industrial base that allowed it to win the Second World War and become a global economic power.

2 Viewing the gallery

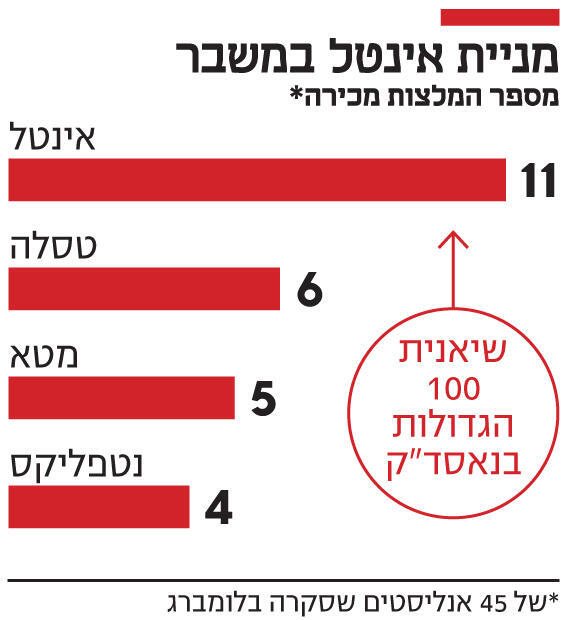

2. A lack of workers is not the only problem clouding the U.S. chip strategy. Difficulties at Intel, a central pillar of this strategy, constitute another significant challenge. These difficulties are reflected most clearly in analysts’ recommendations for Intel stock, which, according to a Bloomberg survey of 45 analysts, currently holds 11 Sell recommendations — the largest number among the 100 largest stocks on the Nasdaq. By comparison, companies with much more publicized difficulties, such as Tesla, Meta and Netflix, have respectively only six, five and four sell recommendations. In addition, it is also one of only three companies in the index that have more sell recommendations than buys (9).

The difficulties also stem from a fundamental difference in the way Intel works compared to other chip manufacturers. Intel designs and manufactures all its own chips. Other major players, such as the Taiwanese TSMC and the Korean Samsung, serve as contractors for other companies that only design and design chips (such as Apple or AMD), and it is this activity that has made them dominant in the field. The current CEO, Pat Gelsinger, is trying to initiate a strategic change, with the company establishing factories, including in Ohio, that will be used to produce chips for other companies. However, the market has not yet shown confidence in these moves. In the last year, Intel’s stock fell by 41.5%, and if the trend continues , it is expected to soon fall below a market value of 100 billion dollars for the first time in a decade.

Market confidence is a critical component in the execution of significant strategic moves. If the stock falls, the CEO’s mandate to promote expensive moves with a significant risk component is reduced. He may also be forced to make significant cuts in order to please investors, cuts that could harm the strategic plans. The company’s financial performance in 2022 certainly did not contribute to the market’s confidence in the CEO “L and its actions: revenues decreased by 20% compared to 2021 to 63.1 billion dollars, and the net profit by 60% to 8 billion dollars. In the fourth quarter, revenues decreased by 32% compared to the corresponding quarter to 14 billion dollars, and in the bottom line the company went from a net profit of 4.6 billion dollars to a loss of 700 million dollars.

3. If Intel does not find a way out of the current crisis, if Gelsinger fails to restore investor confidence, the larger strategic move of the Biden administration will run into fundamental difficulties, perhaps even be on the verge of collapse. The administration is probably aware of this, and therefore scatters its chipped eggs among other baskets, and in particular Turkey.

India, potentially, has many of China’s capabilities, with one clear difference: unlike China, it is a democratic country (albeit a flawed democracy), whose long-term interests are more in line with those of the US. Under Prime Minister Narendra Modi, the country is working to establish itself as a manufacturing center A global technology that competes with China. In terms of volumes, the gap is still large, but India has already recorded some important quality achievements, such as the production of some of Apple’s latest iPhone models.

The US is working to connect and realize the Indian potential when it comes to chip manufacturing, and last week the US Secretary of Commerce, Gina Raimondo, announced that the two countries signed a memorandum of understanding designed to increase cooperation and coordination between them. “We want to see India realize its ambitions to play a bigger role in the supply chain of technology products,” Raimondo told a news conference after a meeting with senior public and private sector officials in New Delhi.

The Commerce Department is the spearhead of the Biden administration’s chip strategy, and Raimondo is the one who is leading the distribution of the $52 billion budgeted by the administration to strengthen domestic industry, as well as a belief in the implementation of trade restrictions designed to prevent the arrival of advanced chip manufacturing technology to China. Raimondo hopes that the new agreement will promote investments by companies such as Intel in setting up factories in India. “There is great enthusiasm and optimism about our ability to create jobs in both countries and together enjoy the benefits of a strong supply chain,” she said.

With an economy of 3.2 trillion dollars, which in the coming years is expected to grow at one of the fastest rates in the world, India is perhaps the secret weapon that the US needs in order to overcome its domestic difficulties and ensure greater control over the industry that underpins all other modern industries.