The major suppliers implemented a significant price increase at the end of 2022, which was made possible by Shufersal in exchange for improving the trading conditions for the chain, which according to estimates raked in about NIS 150 million into its coffers. In doing so, those suppliers strengthened their position in the network, which is responsible for a fifth of the sales in the food retail market. The high spending paid off for the major suppliers, who realized that the competition for shelf space would soon increase a notch with the launch of the Carrefour and Spar chains, which have private brands.

In this way, the suppliers ensured that they are not the ones who will pay a price for exposure on the sales floor, but the small and medium-sized suppliers, who will have to make room for the new brands.

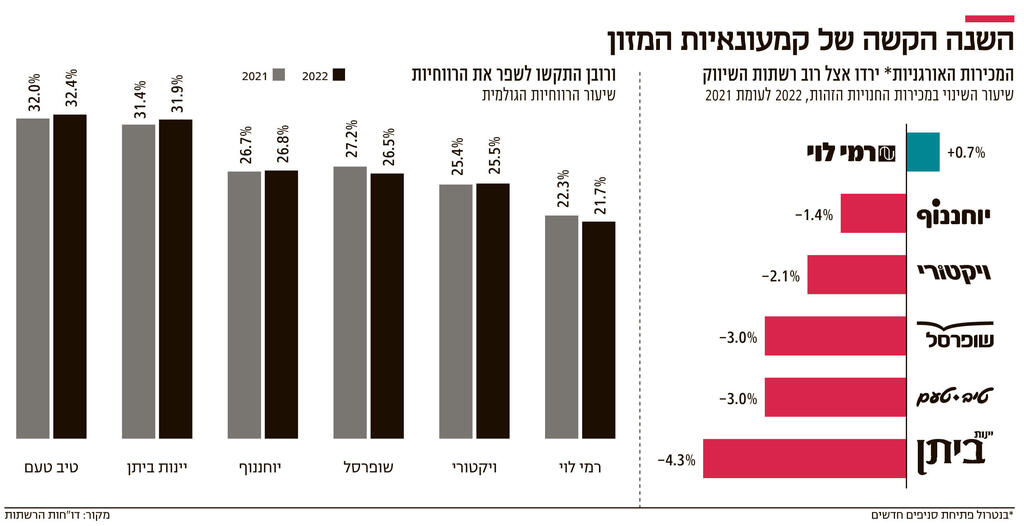

The horizontal price increase, which affected dozens of food and consumer product companies, which came into effect towards the end of December 2022, is expected to take care of the sales line, which was at a standstill last year. Shufersal and Beitan wines faced the closing of unprofitable stores, which hurt sales. At Shufersal they led a fight against the price increase demanded by the suppliers, and sacrificed for this purpose some of the shelves in the stores and on the online website, which were left without goods, mainly Unilever’s. As a result, sales of the same stores, those that operated in both 2021 and 2022, recorded a decrease in all public chains, with the exception of Rami Levy which recorded a marginal increase of 0.7%. Price increases of up to 20% will naturally lead to an increase in cash sales. The improvement of the trade agreements, which in the Shufersal chain were a condition for the approval of the price increase, will allow the chains to improve the gross profitability, which was also marked by stagnation, with erosion or a slight increase, in relation to 2021.

One of the major challenges faced by all food retailers concerned adjusting the scope of expenses to the decrease in consumption after the exit from the Corona crisis. The increase in the rate of expenses, after a decrease in gross profitability, placed the chains in front of a severe erosion of operating profitability. A prominent example in this context can be found in the Shufersal chain, which in 2022 faced a 2.2% drop in food chain sales and a 3% drop in sales in identity stores, which also operated in 2021. The decrease was reflected in a sharper rate of 3.45% in the gross profit which amounted to NIS 3.8 billion. This led to the erosion of gross profitability to 26.5% of sales compared to 27.2%.

2 Viewing the gallery

The chain, which in the two years of the Corona crisis enjoyed record demand and abnormal profitability, did not adjust its expenses to return to a routine that was characterized by a decrease in sales, so that the proportion of sales, marketing, management and general expenses rose to 23.8% compared to 22.3%, which led to a sharp decrease of 45.7% in operating profit and the erosion of operating profitability to 2.7% of sales last year compared to 4.9% in 2021.

Shufersal operates through neighborhood chains, which make up 20% of sales, with the core of the activity being 80% in the discount chains and online sales. The neighborhood store arm, which enjoys high profitability, recorded a drop in operating profitability in 2022 from 4.6% of sales in 2021 to only 2% of sales. However, the more difficult problem was recorded in the discount arm, which went from an operating margin of 2.3% to an operating loss of 0.2% of sales.

In an attempt to correct the mistake that was made with the mismatch of expenses to sales, the chain carried out an efficiency plan in spending about NIS 182 million. Now it seems that this was not enough and the company will continue to cut expenses, while at the same time working on a new strategic plan, which will be presented in the second half of the year. The one that still had to make a sharp move to streamline is the Beitan Wines chain under the management of Uri Kilstein. However, even in this case, the efficiency plan was not enough and the network had an operating loss of NIS 112.1 million.

Even the premium chain Tiv Taam, which does not struggle in price battles with its competitors, had difficulty coping with the challenges of the past year and recorded a decrease in organic sales. Although it was able to present a slight improvement in gross profitability which rose to 32.4%, Tiv Taam was not able to provide a full response to the increase in labor costs, the increase in the index and the increase in inputs in light of the increase in service prices.

The efficiency plan that Shufersal and Beitan Wines took was chosen not only as a correction for the failure that occurred last year, but mainly as a preparation for the challenges of this year, which will most of all be characterized by the fact that international retail brands will enter the local market for the first time. Next month, Beitan Wines will launch the Carrefour brand, through the conversion of dozens of branches, which it renovated and adapted to the brand’s format. Shufersal rushed to act, with the aim of preventing Beitan wines from enjoying the international aroma alone, and signed an agreement to enter into a partnership with Amit Ze’ev, who received the franchise to launch the Sapar chain in Israel.

Each of the chains will launch a private brand, and try to increase the share of the brand at the expense of the suppliers. Shufersal set a goal of a 35% sales share for the private label, within a few years, and promised that this would not come at the expense of the small suppliers. The international brand that has already entered Israel is Saban Ilvan, which brought in Electra and has already opened the first three convenience stores, with the intention of opening dozens of stores of the brand. It can be estimated that the competitors in the food market will try to find a response to the interest generated by the international brands, and to their purchasing power, which will allow Shufersel and Carrefour to present a cheap alternative to the leading food brands.

2 Viewing the gallery

From the right: Chairman of Shufersal Itzik Abarkhan, CEO of Beitan Wines Uri Kilstein and the controlling owner of Sycamore Marketing Rami Levy. “The story of leading the event in front of the public is over”

(Photographs: Elad Gershgorn Inbal Marmari)

However, at least half of the shopping basket is based on the local produce of the Israeli food suppliers and the exclusive importers of the leading international brands. This will not allow making a substantial change in the height of the shopping basket. This, especially when these suppliers are already preparing for another wave of price increases. As revealed in “Calcalist”, immediately after Passover the main company (Coca-Cola Israel) will raise the prices of soft drinks, after already raising the prices of beer and alcohol last month. Estimates are that its competitors, who waited with the increase in price until the abolition of the sugar tax, will join it, and will cause that the abolition of the tax will hardly be felt in the price of the products.

Immediately after the beverage companies, it will be the turn of the big dairies. These are waiting for the month of May for a 15% price increase in the dairy products under the price control order. Even if Finance Minister Bezalel Smotrich succeeds in moderating the increase and dividing it into two pulses, it is still a significant burden on the consumer. The jump in input prices is also reflected in the results of Angel Bakeries, 24% of its operations are under supervision and have been dragging the company into an operational and net loss for several years. Therefore, even though it raised the prices of supervised breads by about 10% last July, the company is preparing to raise prices one more time soon.

To all of these we must also add the political crisis in Israel, which intensified with the government’s intention to carry out a coup d’état and led to the weakening of the shekel, which reduces the purchasing power of importers, who are also expected to pass on the price hike to consumers. The one who has already prepared public opinion for the upcoming price increase is a diplomat. The food importer stated in its annual reports for the conclusion of 2022 that in view of the increase in the prices of products from its suppliers and the increase in the cost of inputs that the company bears during the period of the report, the challenges in raising the prices of its products, and also in view of its assessment that some of its suppliers intend to continue raising prices next year, “the company will be forced to pass on these price increases For its customers, if not, it will have a material impact on its financial results.”

While in the previous wave of price increases Shufersal stood as a wall between the suppliers who demanded the price increase and the consumers, this time the company made it clear that this is not its role and will not do so again. With the publication of its financial reports for the 2022 summary, Shufersal CEO Uri Waterman told “Calcalist”: “In the end, the responsibility for the cost of living is not Shufersal’s. We are a retailer, you saw how much we earn in the last quarter and next year we will earn more, but it is still a few percentages . There are bodies that are their job. We conveyed a message and the message was conveyed. The story of leading the event in front of the public is over.”

The government, to which Wettermann directed the responsibility, abandoned its main election promise – to take care of the cost of living, so that the consumer is actually left alone in a battle in which he has no way of winning.