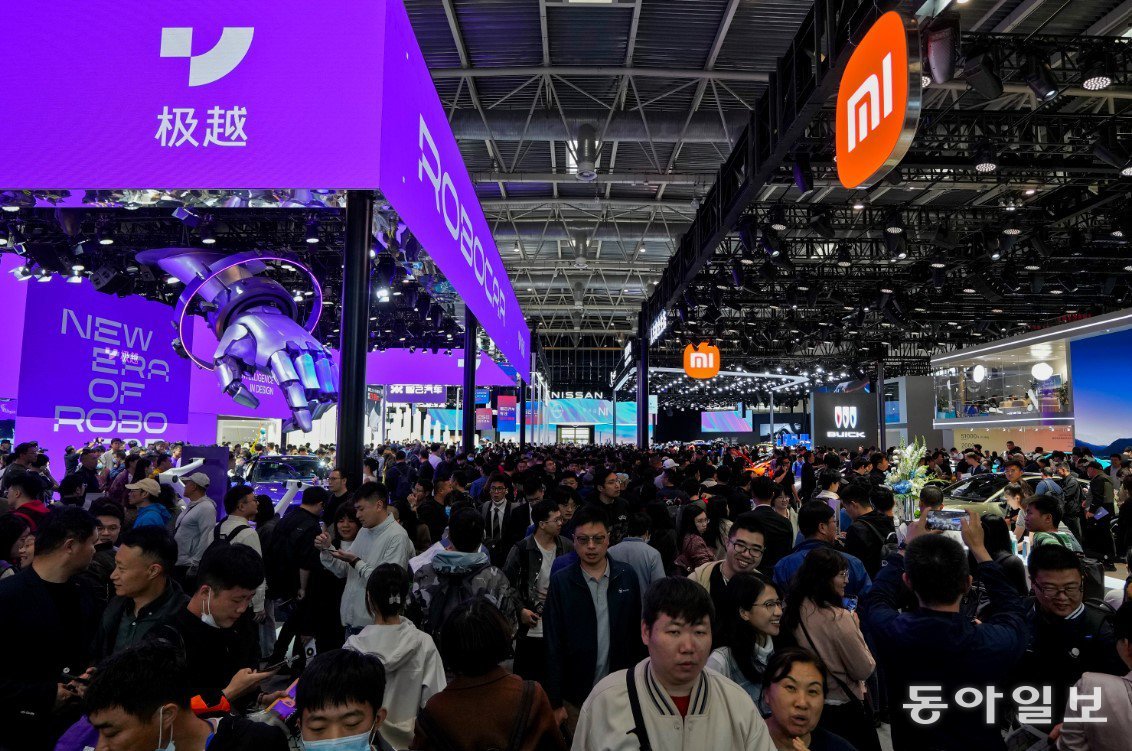

23 million units. This is the number of passenger cars sold in China in 2024. Even with China’s economy in a slump, passenger car sales grew by 6%. China is the largest market, accounting for more than half of global automobile sales.

But isn’t it strange? Even though cars are selling well, why are more and more Chinese car manufacturers failing and why are overseas brands withdrawing one after another? It is said that Volkswagen’s large-scale restructuring and the merger between Japan’s Honda and Nissan are largely due to the sluggish performance in the Chinese market.

The biggest reason is the ruthless ‘price competition’ in the Chinese automobile market that has been going on for three years. There are even warnings that endless price competition can make everyone a loser. A price war without a winner in the Chinese automobile marketLet’s take a look.

*This article is the online version of the Deep Dive newsletter published on the 3rd. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

Cut again, cut again… . ‘Price war’ for 3 years now

Honda Civic sells for 100,000 yuan (about 20 million won), Volkswagen Passat sells for 130,000 yuan (25 million won). At the end of last year, a ‘big bargain’ took place in the Chinese automobile market. Limited-time price reductions, new car purchase subsidies, point payments, interest-free down payment benefits, etc. Almost all car brands offer various discounts on car prices. Statistics show that 224 passenger car models were offered price discounts between January and November last year. Especially popular car models Tesla Model Y is priced at 239,900 yuan (about 48 million won), the lowest price ever.It was sold to.

![These theories will be destroyed… Why China’s car market is ‘bad'[딥다이브] These theories will be destroyed… Why China’s car market is ‘bad'[딥다이브]](https://dimg.donga.com/wps/NEWS/IMAGE/2025/01/03/130787202.1.png)

Bargain sales like this continue even from year to year. Already a Chinese electric vehicle manufacturer BYD is temporarily reducing prices of major models by up to 12% for the upcoming Lunar New Year holiday.I said yes and came out. As the leading company becomes so aggressive, other competitors will follow suit. Already Nio, Xiaofeng, Leap Motor, etc. Executives at major electric vehicle manufacturers are making ambitious plans to double last year’s sales volume (or revenue) by 2025.

The surprising thing is This price war has been going on for three years already.no see. It started with the official sales price reduction (up to 9%) of Tesla’s Model 3 and Model Y in October 2022. Other brands, which had been paying attention and mugging at this time, were surprised when Tesla lowered prices further three months later and joined the price competition. In particular, BYD, China’s largest electric vehicle company, jumped in most fiercely, raising the slogan, “Electricity is cheaper than oil.” The prices of almost all models have been lowered by 5-20%. In particular, the company surprised the industry by setting the price of the new small electric vehicle Qin hybrid at 79,800 yuan (16 million won), 20,000 yuan lower than the previous model.

Ultimately, by 2024, most companies, from Chinese electric car startups to European premium brands, will have to engage in a price war. A harsh brawl and a cruel elimination match began. To borrow an expression from He Xiaopeng, the founder of Chinese electric vehicle company Xiaopeng: Chinese automobile market “enters knockout round”, wading through “sea of blood”I did.

Bankruptcy and withdrawal due to competition to cut my weight

An appropriate price cut has the effect of increasing sales volume and thus increasing corporate profits. However, the price war in the Chinese automobile market goes far beyond that level. The entire Chinese automobile industry from January to October last year Sales increased by 2% compared to the same period last year, but profits decreased by 3.2%.I did it. The profit margin compared to sales, which was 6-7% in the past, shrank to 4.5%. It’s because of price competition that eats away at my weight.no see.

There are more than 200 car brands sold in China (137 of them are electric car brands). As the fierce competition for survival continues, more and more people are eliminated.do. Honda’s premium brand ‘Acura’ and Japan’s Mitsubishi have already withdrawn from the Chinese market in 2023. Chinese electric vehicle startups such as Gaohe Automobile, Hechuang Automobile, and T&G Automobile shut down last year. Jiwie Automobile, which had been attracting attention as a joint venture between Geely Automobile and Baidu, also suddenly announced in December that it would scale back its business. In fact, among the many Chinese electric vehicle manufacturers, BYD and Liauto are the only ones that make an annual profit. Now, there is a list going around of ‘Who will be the next electric vehicle startup to fail?’

There are many manufacturers that survived but suffered significant damage. Hyundai Motor Company sold the Beijing Hyundai Chongqing plant at a 20% discount in January last year. Honda and Nissan closed some plants and carried out large-scale layoffs in China.

If you are confident in your product, don’t you think you can avoid price competition? German luxury car brand BMW also thought so. So in July of last year, we stopped the price discount and returned it to the regular price. Then? August sales immediately halved. In just one month, BMW has to return to the price discount battlefield again I did. No one can easily escape the vortex of this price war.

a fight without a winner

In fact, it is natural for many automobile brands to be eliminated after competition and only a few survive. The smartphone market, which once had over 700 brands around the world, also went through a similar process. According to consulting firm Alix Partners, Among 137 Chinese electric vehicle brands, only 19 are likely to make a profit within 10 years. The rest are doomed to disappear or merge.

However, the problem is that the impact of this extreme price competition does not stop at automobile manufacturers. Last November, the content of an e-mail sent by a BYD executive to a partner company was made public and became a hot topic. the car market Calling for a 10% reduction in parts prices by 2025, saying it has entered a ‘knockout match’ and ‘decisive battle’I did it. Following this, there were reports that Chinese state-owned automobile manufacturer Shanghai Automotive Corporation (SAIC) also requested a 10% reduction in parts prices from its partners.

Of course, it is an annual event where automakers squeeze out their partner companies. However, in the past, it was cut by about 3-5% every year. Now, the range of cuts has increased, and there are demands for price cuts 2-3 times a year. They say it is unusual. However, the situation is already so difficult that even major auto parts companies such as Bosch, ZF, Valeo, and Brose initiated large-scale layoffs in China last year. Small and medium-sized suppliers with weak negotiating power are increasingly being pushed to the edge. An official from a parts company said this in a media interview. “We are definitely losing money on the project. but It’s a vicious cycle because you can’t win a project without losing money.no see.”

What should we do if the reduction in component prices exceeds the level that can be achieved by increasing production efficiency? at last The only way left is to lower the material grade. If the first-tier supplier, who has been requested to reduce the delivery price, reduces the second-tier supplier’s supply price, and the second-tier supplier passes this on to the third-tier supplier, the third-tier supplier will eventually have no choice but to find cheaper raw materials. This will ultimately lead to a decline in the quality of finished vehicles. As car prices fall, consumers are paying invisible costs.

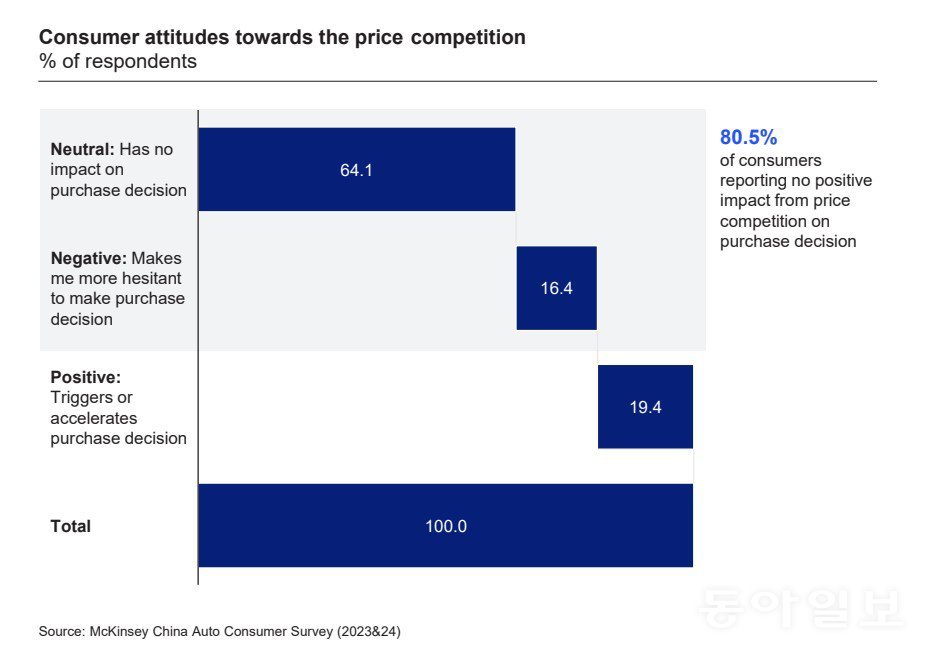

If car prices continue to fall like this, will it be beneficial to consumers? Chinese consumers are more annoyed by the car price war than you might think. According to the Mackenzie report For more than 80% of Chinese consumers, price cuts do not play a positive role in their car purchasing decisions.He says. If you rush to buy a car and the price falls further, you will be in trouble, so there is no reason to buy it now. There is also less desire to buy option packages that come with newer vehicles. If you wait, there is a high possibility that expensive driving assistance features will be installed for free. More than anything, I’m worried about what will happen if I buy a car and the manufacturer goes bankrupt. If an automobile company goes bankrupt, the owners of that brand’s vehicles will have to bear significant losses.

Automobile manufacturers, parts suppliers, and automobile consumers. Until now A strange war continues in which none of the three are winners.no see.

Although the government called for “comprehensive correction”

Can we just leave this price war like this? The Chinese government, which was no better, began to take action. This phrase came out at the Central Economic Work Conference held in December last year. “‘Degenerative competition’ must be completely corrected.” The intention is to seek government-level measures to correct excessive price competition in the market. This is because extreme price competition is believed to hinder technological innovation and industrial development.

Of course, the government did not specify which industries were targeted. But everyone knows it’s the auto industry story. Li Shufu, Chairman of China’s Geely Automobile, also said this in an in-house speech as if he had been waiting for it. “We are firmly opposed to evil and degenerative competition. Instead of a price war, we must focus on technological innovation, quality, branding, service, and business ethics.”

However, promises of a ‘truce’ in price competition in the Chinese automobile industry have been made in the past and were easily broken. It is still unclear how we can prevent this this time.

However, there have been cases of ‘degenerative competition’ in the past where extreme price wars between Chinese companies led to devastating results. A representative industry is motorcycles.

As always, Southeast Asia is a motorcycle paradise, and Japanese brands dominate the market. However, for a short time, Chinese motorcycles surpassed Japanese brands in this market. It was the late 1990s.

At that time, Japanese brand motorcycles such as Honda and Yamaha were sold for about $2,000 in Southeast Asia. Chinese products that are half the price are starting to flow in. In the case of Vietnam, more than 20 Chinese brands entered the market as of 1999. Thanks to their overwhelming cost-effectiveness, Chinese brands pushed out Japanese brands and quickly took over 80% of the Vietnamese motorcycle market.do.

And yet the price war continues. A bloody fight broke out between Chinese companies. The price of a 100cc motorcycle drops from $1000 to $800 and then to $500. There are records showing that when the price war reached its peak, the average selling price of Vietnamese motorcycles fell by $70 every month.

And of course, along with the price, the quality also dropped. Cheap Chinese motorcycles had frequent minor breakdowns and required major repairs after just 2-3 years, and were on the verge of being scrapped after 4-5 years. As some brands neglected after-sales service, the image of Chinese products rapidly deteriorated. The conclusion is a defeat for all Chinese brands. Meanwhile, Japanese brands that released new models and loan products at mid- to low-priced prices are sweeping the market again based on trust in quality. Now, the Southeast Asian market share is 67% for Honda and 22% for Yamaha. Chinese products account for only 1%. The tragic end of extreme price competition that sacrifices even quality.no see. This is also the reason why the Chinese automobile industry is recently reflecting on the lessons learned from the motorcycle market 20 years ago. By. Deep Dive

Is the automobile industry really this dynamic? Since there is no global automaker that is not influenced by the Chinese market, we need to pay closer attention to the situation in China. Coincidentally, the news on the 2nd (local time) that Tesla’s annual deliveries have decreased for the first time in 13 years attracts attention. Let me summarize the main points.

-The ‘price war’ in the Chinese automobile industry is intensifying. At the end of last year, the Tesla Model Y was discounted again and the Honda Civic was sold for less than 100,000 yuan, surprising the industry. BYD continues its discount offensive even into the new year.

-The automobile industry’s profitability is deteriorating, electric vehicle startups with growing losses continue to go bankrupt, and overseas brand joint ventures are withdrawing. It’s a cruel elimination match. No matter how high-end a brand is, price wars are inevitable.

-The impact extends to automobile suppliers. Profitability is deteriorating due to demands from automakers to reduce delivery prices. This is a negative for the industry as a whole because it is obvious that it will ultimately lead to a decline in product quality. The cost ultimately goes to the consumer.

-The Chinese government declared that it would “completely correct degenerative competition.” But how can we sort out this confusion? Lessons learned from the Southeast Asian motorcycle market 20 years ago are being revived.

*This article is the online version of the Deep Dive newsletter published on the 3rd. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’