Florentino Pérez has recently embarked on a race to stay in Atlantia, the Italian infrastructure group currently dominated by the Benetton family. Perez hired investment banks to help him with the offensive, and the Benettons – who don’t want to lose the company – have responded in the same way. These movements have raised a great cloud of dust, but if you look closely, what is revealed is that the dispute has a protagonist: the Catalan Abertis.

Benetton and Pérez joined forces four years ago to remain the historic Barcelona toll road concessionaire, during which time they have seen how Abertis is an extraordinary business.

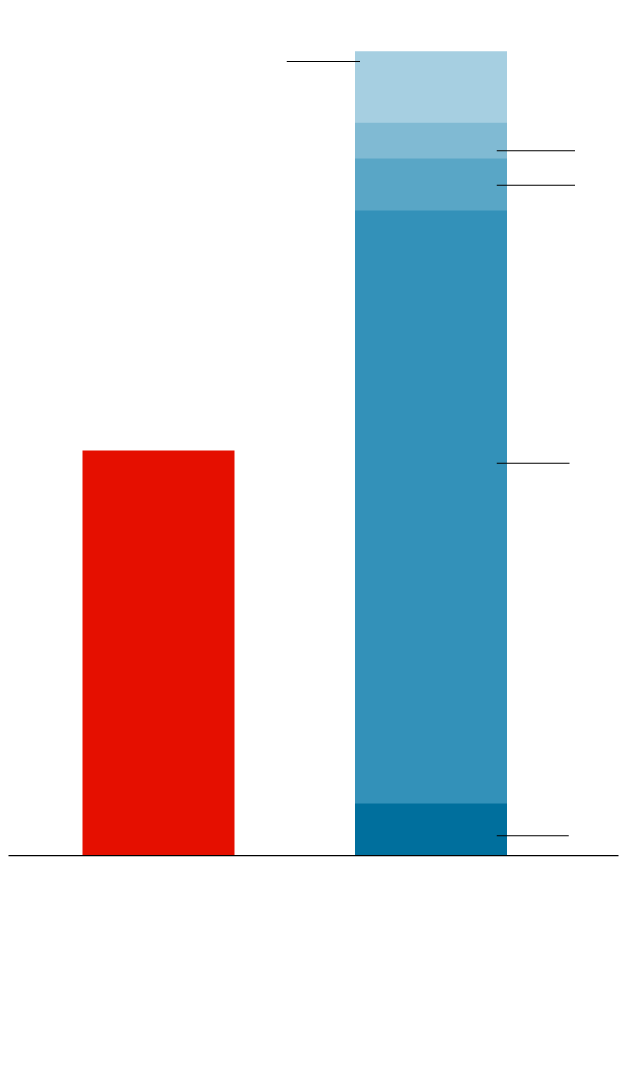

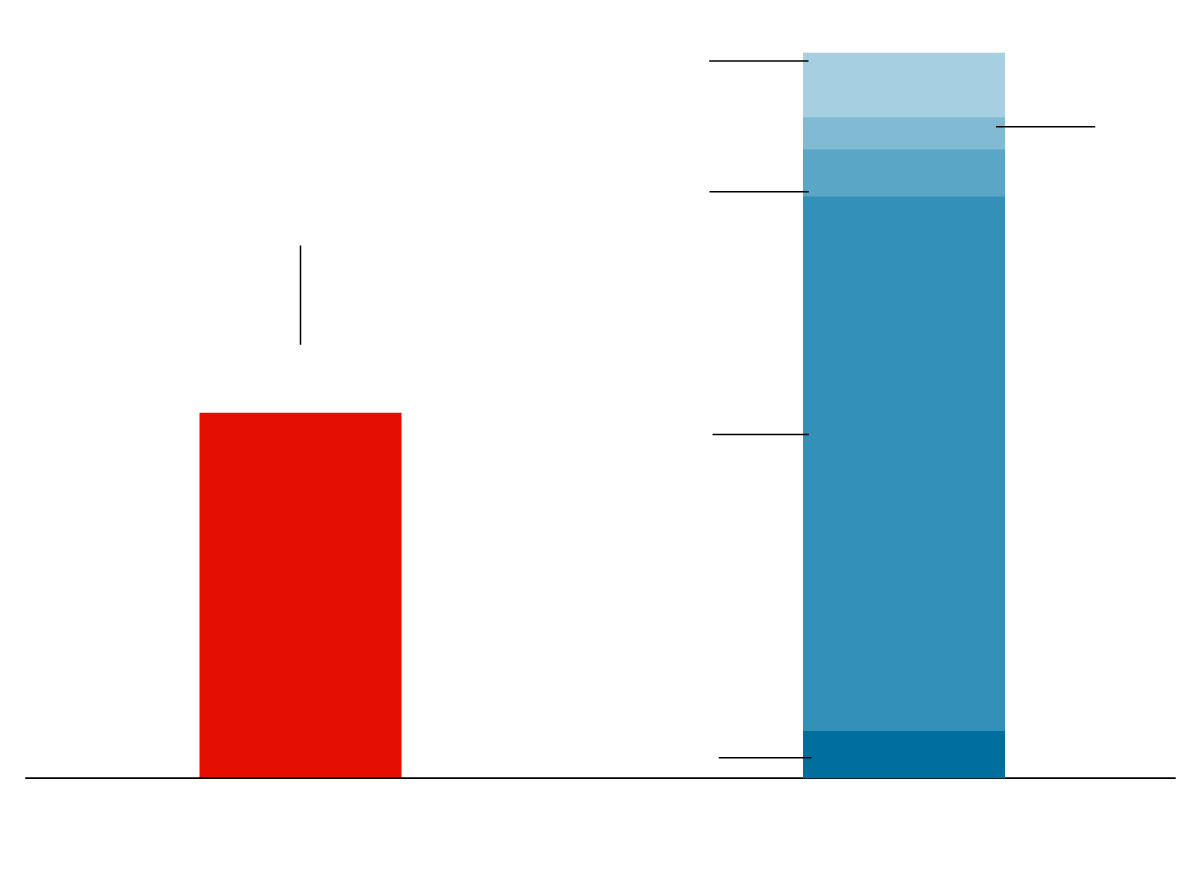

Let’s remember: ACS and Atlantia put 16.5 billion euros on the table to keep Abertis, but they really only paid 6,909 million (the rest was obtained with a bank macro-credit which they soon endorsed to Abertis itself).

Today, four years later, they have already withdrawn 12,917 million euros from Abertis thanks to the spectacular collection of dividends. In other words, they have almost doubled that initial investment.

In addition, Atlantia itself has explained that the rate of dividends will be maintained and that between 2023 and 2024 the Catalan concessionaire will pay 1.2 billion euros more, so that the money recovered will already exceed 14,117 million. Exactly double what ACS and Atlantia paid in 2018.

Florentino has to share half of the dividends with his Italian partner, and that may partly explain why he now wants to stay in control of Atlantia. As one Renta 4 analyst said last week, “there are few assets as greedy as Abertis.”

ACS and Atlantia cash in on Abertis

2022

(Capital reduction)

MONEY PAID FOR

BUY ABERTIS

*Cash paid directly by ACS and Atlantia (the remaining 9,824 million were paid with a loan later transferred to Abertis)

2022

(Capital reduction)

MONEY PAID FOR

BUY ABERTIS

*Cash paid directly by ACS and Atlantia (the remaining 9,824 million were paid with a loan later transferred to Abertis)

Cash paid directly by ACS and Atlantia (the remaining 9,824 million were paid with a loan later transferred to Abertis)

2022

(Capital reduction)

MONEY PAID FOR

BUY ABERTIS

Extraordinary dividends

The distribution of dividends is usually explained by the progress of the business, as they usually come from the profits generated the previous year by a company. This was traditionally the case at Abertis when it was controlled by La Caixa, but now it is no longer.

Since acquiring it, ACS and Atlantia have sucked it to the max. They quickly sold shares such as Cellnex and Hispasat (for nearly $ 2.5 billion) and dividends were distributed even when the dealership was losing money due to the pandemic’s downturn in traffic.

In 2020, for example, it lost 515 million euros, the first red numbers in its history, but that was no obstacle to delivering 875 million to Atlantia and ACS (half the amount for each) . And in 2018, a macro-dividend of 9,963 million euros was distributed (coinciding with the transfer to Abertis of the credit obtained to buy it).

But this logic cannot be maintained forever, which is why Florentino and the Benettons have decided that the dividend of 602 million that will be distributed this year will not come from the results achieved last year, but from a capital reduction. That is, they will subtract 602 million that the company has in the box and distribute them.

Creativity has been common since 2018. At the end of 2020, for example, the two shareholders decided to borrow it at 2 billion euros to shield the dividend. All this is not free, of course: in the sector, they believe that all the debt that Abertis has assumed will make it difficult for it to grow and that “a rise in interest rates would crunch it”.

€ 3,000 million pending from the Supreme Court

Abertis is still in hiding: since the 2008 crisis, it has been in a dispute with the state, to which it claims compensation for the drop in traffic it suffered. In February, the executive agreed to pay 1,070 million, but Abertis did not have enough and demanded 3,094 million more. The final decision will be up to the Supreme Court. Definitely another candy for its shareholders if they finally win the case.

By the way, last week the shareholders also agreed to move the headquarters from Passeig de la Castellana, 39, where it had a corporate building, to number 89 on the same avenue. Coincidentally or not, next to the Santiago Bernabéu, where the club governed by Florentino Pérez plays.

Protagonists

Although the sending of letters is in total decline, political parties continue to spend real fortunes on sending electoral propaganda. In the last Catalan elections, for example, this expenditure amounted to 13.5 million euros, according to a report just published by the Audit Office: 3.7 million that the parties spent directly, 7.2 millions that the Ministry of the Interior paid to the Post Office to subsidize shipments and an additional 2.7 million that were justified by the pandemic situation. “It simply came to our notice then mailing“, Warns the Sindicatura. “A new system could be implemented taking advantage of new technologies and avoiding the waste of material and economic resources.”

A bank’s risk manager is key. When an entity has a delinquent loan – because it is not collecting when it is due – it is obliged to provide (or cover) that amount in case it does not end up collecting it. Sabadell has regained Carlos Paz for the position of general manager of risks when the Bank of Spain has just warned of a rise in delinquency due to the crisis in Ukraine. Until now, he has held the position of TSB, a British subsidiary that has caused so many headaches for the Vallès bank since he bought it, but which now seems to be taking off.

Paz, who had started his career at Caixa Catalunya, moved from London to Barcelona to fill a position previously held by Xavi Comerma. He has become the territorial director of Catalonia, replacing a historian: Enric Rovira.