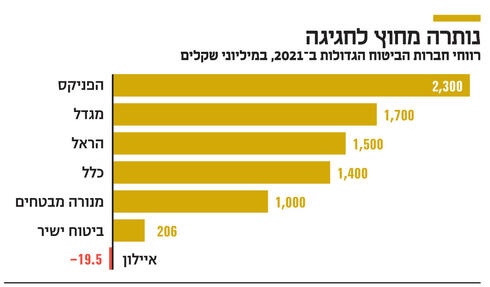

Insurance companies will be happy to capture 2021 – while the five largest companies in the industry have recorded profit records. The Phoenix recorded a profit of NIS 2.3 billion, Migdal with a profit of NIS 1.7 billion, Harel earned NIS 1.5 billion, Clal Insurance with a profit of NIS 1.4 billion, and Menora Mivtachim concluded 2021 with a profit of almost NIS 1 billion. To them must be added the direct insurance, which closed a year with a handsome profit of NIS 206 million, which is only 3% lower than the company’s historical record.

However, the celebration of profits was not common to all, and the insurance company Ayalon recorded a net loss of NIS 114 million in 2021, compared with a loss of NIS 64 million in 2020. This is the second year in a row that Ayalon has recorded a net loss. The company has lost about NIS 178 million in the last two years. Although the revaluations made by the company under the item “Net change in the fair value of available-for-sale financial assets” reduced its total loss, it still remained high and amounted to NIS 19.5 million in 2021, compared with a total loss of NIS 44.2 million in the previous year.

Ayalon’s losses in such a positive year for the insurance industry stem primarily from its choice to disengage almost completely from the capital market. The company’s management decided in 2016 to eliminate its activity in the long-term savings industry, by merging its provident funds and pension funds (which managed NIS 7 billion) into Meitav Dash – with Ayalon remaining with only 20% of the merged company. In addition, the company sold its stake in Ayalon Investment House in 2018 for NIS 12 million.

The provident industry registers high income during periods of capital market tide, and insurance companies enjoyed a jump in their management fees last year amid the sharp rises. Therefore, while the other insurance companies presented huge profits in the field of life insurance and long-term savings – in Ayalon these amounted to only NIS 51 million, compared to a loss of NIS 26 million in 2020.

Beyond that, in its main activity – general insurance, which includes car, apartment and liability insurance (third-party insurance, professional liability insurance) – Ayalon lost NIS 57 million. In health insurance, the company managed to register a balanced year, with a loss of NIS 0.3 million, resulting from a loss on policies it sold in long-term care insurance, which amounted to NIS 10.3 million.

Ayalon’s subsidiaries also contributed to the loss in 2021. The companies, which are mainly agencies, lost NIS 1.2 million, compared with a loss of NIS 2.6 million in 2020. Ayalon’s management also explains the loss by mimicking a negative investment made last year by a subsidiary of its, the permanent insurance agency, which invested in its granddaughter “Member of the Consumer Finance and Investment Member Club” which was liquidated.

Ayalon did not record a significant change compared to 2020, and the policies it sold amounted to NIS 3.2 billion. However, its losses reduced its equity from NIS 700 million to NIS 681 million. Despite its poor performance and two consecutive annual losses, Ayalon shares have returned 42% in 2021 and 4.2% since the beginning of the current year. The company’s traded value is estimated at NIS 496 million. It is clear that investors are mainly pricing the potential acquisition of the company to the digital insurance and alignment company led by Emil Winshel, which is expected to close at a value of NIS 690 million by the end of June.

Winshel was able to raise two strategic investors based solely on the investment potential and at a price that is 40% higher than the company’s traded price on the stock exchange. Last month, the Barak family announced that it would join the controlling interest in the digital insurance company Vishor and would hold 39% of its shares. Barak, the controlling shareholder in Caesarea, will cash in NIS 270 million by purchasing shares in a private placement at a share price of NIS 6.3. The private placement will dilute Hugh Digital, which currently controls (65.7%) in Visor, to 41%, so that Visor and Caesarea will hold Ayalon almost equally. Winshel has recruited another investor, the Ben Yishai family, who will inject NIS 20 million into alignment, through a private allocation, if the Ayalon acquisition materializes. The share price according to which the Ben Yishai family will purchase the Vishor share is the same as the price paid by the Barak family: NIS 6.3.

How much should new investors in alignment with Ayalon’s bleeding worry about? Vishur acquires 67% of Ayalon’s shares at a price equal to the value of its equity, which does not represent any upside in Ayalon’s insurance operations. The low price was due, among other things, to its ability to present losses even in a year that is considered dreamy for other insurance companies. The price also stems from the disgust experienced by Levy Rahmani’s heirs towards former company executives. It is evident that the heirs were happy to get rid of that inheritance, even at the cost of the company’s equity. Apparently, the new investors recruited to the company believe this, understanding that a dominant controlling shareholder in Ayalon should demand significant efficiencies in the company.

Vishor last week published the report for 2021 in which it presented a profit of NIS 5.3 million – 137% higher than in 2020. The company’s revenues increased by 30% to NIS 310 million, compared to NIS 238 million in 2020. Vishor shares Has risen by 9% since the beginning of the year and is traded at a value of NIS 286 million, after being issued in March 2021 at a value of NIS 385 million (after the money).