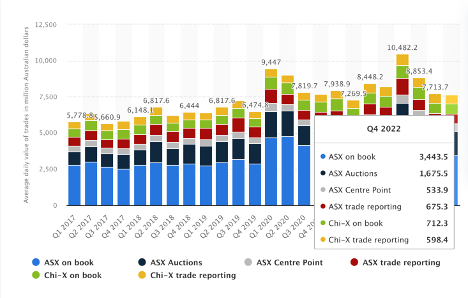

According to Statista, the average daily trading value in Australia, from Q1 2017 – Q4 2022, has shown steady increases. A sharp increase was noted in Q1 2020, rising to AU$9,447 million from AU$6,474 million the previous quarter. A period of consolidation followed during the pandemic years, with suppressed levels of overall equities trading – in line with global trends.

The average daily equity trading value hovered between AU$ 7,269.5 million and AU$ 8,448.2 million between Q2 2020 and Q4 2021. Subsequent to that, Q1 2022 was a breakout year for Aussie daily equity trading, at AU$10,482.2 million.

Now that the pandemic has subsided somewhat, the Australian equities markets are attempting to wage a sustained recovery. The figures indicate thatbetween 80% and 85% of total trading volume was related to the ASX (Australian Securities Exchange). The remaining 15% -20 % of total trading activity is directly attributed to the Chi-X Australia trading platform.

Of course, a growing contingent of traders in the retail arena is comprised of online trading accounts at premier brokers. Australian clients tend to select highly regulated operators with a strong global presence. The top online trading platform providers tend to feature a wealth of financial instruments with around-the-clock access to cryptocurrency trading.

Source: Statista Average Daily Equity Trading Value in Australia Q1 2017 – Q4 2022.

The Paradigm Shift in Trading Tools and Resources

AI’s shaking up online trading in Australia is a game-changer. No more just gut feels and guesswork; we’re talking smart, data-driven moves now. It’s all about using AI tools for sharper decisions and better risk management. Aussie traders are exploring a variety of options concerning online trading platforms. Foremost among the resources in their tool kit is cutting-edge AI:

- Predictive Analytics: Utilizing AI-powered data analysis tools, traders can now process enormous volumes of data in real time. This rapid processing allows for fast and informed decision-making, helping traders accurately predict price movements based on market data and financial news.

- Algorithmic Trading Enhancement: AI has transformed algorithmic trading, enabling traders to use advanced mathematical models and computer programs that adapt to changing market environments. This approach ensures the employment of the most fitting strategies at different times.

- AI in Risk Management: AI-powered solutions enhance risk management by optimizing strategies and minimizing the need for human intervention. They enable traders to make better-informed decisions on risk management, hedging, and diversification by simulating changing market conditions.

- Revolutionizing Pattern Recognition: Combining AI with machine learning has revolutionized pattern recognition in online trading. Traders can quickly scan price charts to identify key break-out patterns that indicate market changes, isolating profit opportunities.

- Sentiment Analysis Advancements: AI has made sentiment analysis more accurate and efficient. By analyzing news articles, social media posts, and other sources of information, traders can gauge the market sentiment and make educated decisions based on the collective mindset of the market.

- Trade Surveillance: AI is crucial for trade surveillance, aiding traders and regulators in ensuring fair forex market conditions. AI systems are trained on market trends, compliance practices, and historical trading data to effectively generate accurate alerts and identify false positives.

Integrating AI into Australian online trading has provided traders with a suite of advanced tools. These innovations streamline the trading process and open new avenues for strategic, data-driven decision-making.

Important Stats for Australian Online Traders

| Statistic | Data |

| Percentage of Australians investing in the stock market | 53% (Finder, 2021) |

| Number of online stockbrokers in Australia | At least 40 (Finder, 2023) |

| Percentage of investors using micro-investment apps | 16% (Finder, 2021) |

| Percentage of Australian children under 12 with a share account | 7% (Finder, 2021) |

| Percentage of Australian investors using robo-advisors | 7% (InvestmentTrends, June 2020) |

| Stock trades by online platforms in 2001 | 18% (RBA, 2001) |

| Australian customers using share platforms in 2001 | Just over 1 million (2001) |

| Available share trading platforms in 2001 | Around 10 (2001) |

| Australians invested in stocks today | More than 9 million (ASX) |

| Australian investors using online platforms | Approximately 70% (ASX) |

| Online trading platforms in Australia today | Around 40 |

| Australians not using share trading apps | 64% |

| Australians using share trading apps | 19% |

| Australians investing in the stock market without apps | 17% |

| Men using share trading apps | 29% (Men) |

| Women using share trading apps | 10% (Women) |

| Millennials using mobile-based share trading | 31% (Millennials) |

| Gen Z using mobile-based share trading | 12% (Gen Z) |

| Baby boomers using mobile-based share trading | 6% (Baby Boomers) |

| Average number of finance apps on smartphones | 2.5 |

| Smartphone users regularly using finance apps | 73% |

| Australians using micro-investment apps | 16% |

| Children under 12 with a cryptocurrency trading account | 2% |

Source: Online trading in Australia: Statistics and facts (2023)

Australia’s trading scene is bouncing back stronger, powered by a renewed zeal for financial instruments at top-notch brokers. Both retail and institutional traders flex their trading muscles, blending tactical savvy with d