Concerns about impact on the automotive and battery industry

Ministry of Trade, Industry and Energy “Not confirmed… “Discussions with the U.S.”

Reuters reported on the 14th (local time) that U.S. President-elect Donald Trump’s transition committee plans to abolish electric vehicle subsidies under the Inflation Reduction Act (IRA) introduced by the Joe Biden administration. This means that the subsidy system that provides up to $7,500 (about 10.5 million won) per vehicle to consumers who purchase electric vehicles produced in North America under IRA will be abolished. The purpose is to raise the trillions of dollars in financial resources needed to fulfill President-elect Trump’s pledge to “large-scale tax cuts” by reducing subsidies.

Some are concerned about the possibility that the ‘Advanced Manufacturing Tax Credit (AMPC)’ under the IRA, a subsidy provided to electric vehicle battery production companies, may be abolished. There are concerns that domestic automobile and battery manufacturers, such as Hyundai Motor Company and LG Energy Solution, which have aggressively increased their investments in the United States after the introduction of IRA, will inevitably take a hit.

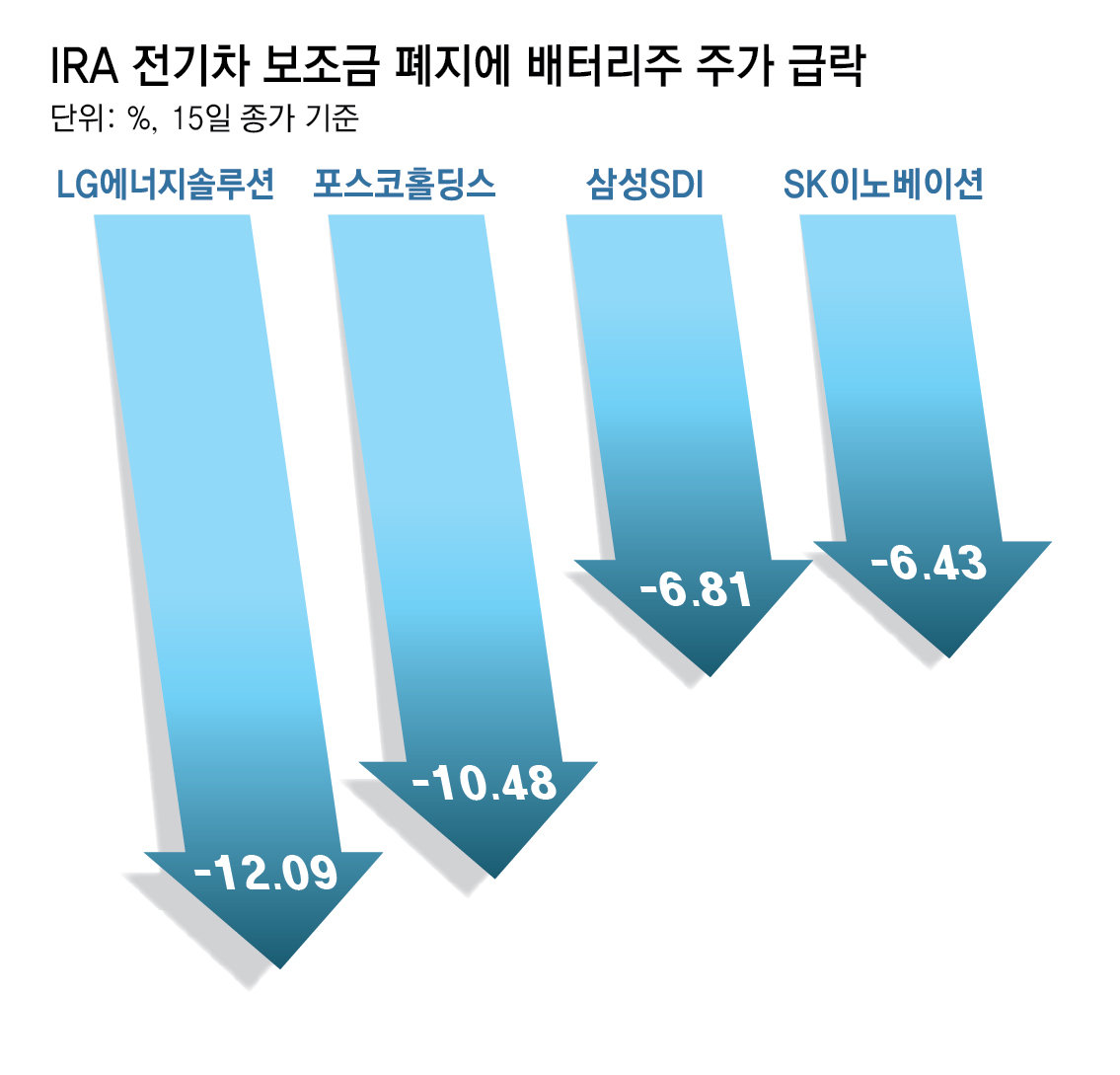

In particular, the battery industry made large-scale investments during the Biden administration, to the extent that some called ‘overinvestment’ to receive AMPC, but is in danger of being hit hard by the return to power of President-elect Trump, who is negative about electric vehicles. In the aftermath of this, battery-related stocks such as LG Energy Solution (-12.09), Samsung SDI (-6.81), and SK Innovation (-6.43) in the domestic stock market all fell significantly on the 15th.

However, an official from the Ministry of Trade, Industry and Energy said that whether or not the subsidy will be abolished has not been confirmed. “We have been in close communication with the industry and reviewing various scenarios to prepare for uncertainty.” “We plan to consult with the United States,” he said.

Domestic automobile and battery industry “embarrassed” due to increased U.S. investment… Musk supports “hitting competitors”

[트럼프 재집권] “Trump plans to abolish electric vehicle subsidies”

$7,500 subsidy for electric vehicles produced in North America… Trump criticizes “green fraud” during campaign rally

“Hyundai Motors’ electric vehicle sales in the U.S.… “When subsidies are eliminated, it will likely go down by up to 13%.”

Concerns over cascading effects even extend to the battery industry

On this day, the transition committee led

During his presidential campaign, President-elect Trump criticized the IRA as a “new green scam.” He claimed that “climate change is a fraud” and withdrew from the Paris Climate Agreement during his first term in office. He also said that there was no need to promote electric vehicles by providing subsidies, and that he could not agree that electric vehicles were an environmentally friendly means of transportation. Accordingly, the Biden administration has pledged to end the ‘electric vehicle mandatory’ policy, saying, “We will increase the proportion of electric vehicle sales in the United States to more than 50% by 2030.”

Elon Musk, the president-elect’s closest aide and CEO of Tesla, the largest electric car company in the U.S., also supported the abolition of subsidies in July this year, saying, “If the IRA is abolished, competitors such as General Motors (GM) will suffer a devastating blow, but the impact on Tesla will be light.” . The British Financial Times (FT) diagnosed, “Tesla is the only company that makes a profit from the sale of electric vehicles, but its competitors have been making up for the losses they incur while producing electric vehicles with subsidies.”

As competition in the North American electric vehicle market intensifies, Tesla’s U.S. market share fell below 50% for the first time in the third quarter of this year (July to September). As a leading company, it has achieved ‘economies of scale’, which can be interpreted as confidence that it has more capabilities than latecomers to withstand the ‘barley pass’ caused by the abolition of subsidies.

Additionally, during the presidential election, President-elect Trump announced large-scale tax cut pledges, including corporate and personal income tax cuts and tip tax exemption. There is a firm intention to reduce the amount of money spent on IRA subsidies in order to raise the enormous financial resources needed to implement tax cuts.

● Domestic battery companies “embarrassed”

The Korean battery industry is unable to hide its embarrassment. According to AMPC regulations, they have been receiving subsidies in the form of tax credits in proportion to battery production. Accordingly, there are concerns about chain effects such as abolition of IRA subsidies → decrease in demand for electric vehicles → decrease in demand for batteries.

The amount of AMPC received by three companies, including LG Energy Solution, SK On, and Samsung SDI, in the first half of this year (January to June) is estimated to be about 840 billion won. It is eight times the combined operating profit of the three companies (108.6 billion won) during the same period.

An official in the domestic battery industry said, “In the long term, the United States will not be able to go against the trend of electric vehicles (regardless of which president is in power),” but added, “It is true that there are concerns about a short-term decrease in battery demand.”

There are also great concerns in the automobile industry. Currently, Hyundai Motors and Kia do not receive subsidies for general consumer electric vehicles in the United States, but are receiving subsidies for commercial electric vehicles such as leases and rental cars. As of the end of last year, leased vehicles accounted for about 40% of the electric vehicles sold by Hyundai and Kia in the United States. In order to receive subsidies, Hyundai Motor Company has invested in its first electric vehicle production plant in Georgia and has begun pilot operations.

According to a recent report by the Dong-A Ilbo and the Korea Chamber of Commerce and Industry analyzing the impact on each industry following the launch of the second Trump administration, Hyundai Motor Group predicted a decline in electric vehicle sales of about -8.7 to -13.3% in the U.S. market when subsidies for commercial electric vehicles are eliminated. .

In addition, the size of the entire US electric vehicle market is expected to decrease by 27% from 1.184 million units per year to 867,000 units when electric vehicle subsidies are completely eliminated. In the general consumer market, demand for passenger cars priced at $55,000 (MSRP) is expected to decrease by 33.2%, and for sports utility vehicles (SUVs) priced at $80,000, demand is expected to decrease by 21.7%.

electric vehicles account for less than 10% of its total sales. Hyundai Motor Company has already decided to produce hybrid products at its newly built electric vehicle plant in Georgia.

● Large subsidies to Republican-dominant states… “It is not easy to abolish”

However, it is not realistically easy to completely abolish IRA subsidies. This is because many foreign companies have already built factories in the United States to receive IRA benefits. According to climate research non-profit group Berklears and climate action group Yale Climate Connection on the 14th, about 66% of IRA’s total spending went to Republican-dominant states such as Texas, Wyoming, Oklahoma, and Kansas. Accordingly, there are significant forces within the Republican Party that support the current subsidies.

To repeal a bill that has already been passed, 60 out of 100 senators must agree, but the Republican Party has secured only 53 seats in the next Senate, which will be inaugurated in January next year. Accordingly, the transition committee is considering including the IRA provision in a broader tax reform bill package. At this time, the ’budget adjustment (reconciliation)’ system can be used, which allows passage of a bill only if a majority (51 people) of the quorum is secured.

Reporter Hong Jeong-su [email protected]

Reporter Jeon Nam-hyuk [email protected]

Reporter Lee Ho [email protected]

What are the potential impacts of cutting electric vehicle subsidies on consumer buying behavior?

Interview Between the Time.news Editor and an Automotive Industry Expert

Editor: Thank you for joining us today. With the recent announcements from U.S. President-elect Donald Trump’s transition team regarding potential cuts to electric vehicle subsidies, there’s a lot to unpack. Could you start by shedding light on how significant these subsidies are for the automotive industry, particularly for electric vehicles?

Expert: Absolutely, and thank you for having me. The subsidies under the Inflation Reduction Act (IRA), which provide up to $7,500 for electric vehicles made in North America, are crucial for making these cars more affordable to consumers. They have effectively stimulated demand and encouraged manufacturers to invest in electric vehicle production. Without these incentives, we could see a significant drop in sales, particularly for manufacturers like Hyundai and Kia, who are increasing their presence in the U.S. market.

Editor: That’s a great point. Reports suggest that sales could drop between 8.7% to 13.3% for Hyundai in the U.S. if these subsidies vanish. Do you think the market is prepared for this sudden shift?

Expert: Not at all. Many companies, especially in the battery sector, made substantial investments anticipating these subsidies would remain in place. There’s a genuine concern about what the immediate fallout could be—lower demand for electric vehicles would directly impact battery production and investment, creating a ripple effect through the entire supply chain.

Editor: You mentioned battery production. Companies like LG Energy Solution and Samsung SDI have reportedly invested heavily in the U.S. due to these incentives. What implications could the potential abolishment of the Advanced Manufacturing Tax Credit (AMPC) have on their operations?

Expert: If the AMPC is indeed abolished, it could be catastrophic for these companies. They rely on those tax credits not only for feasibility but for profitability. For instance, during the first half of this year, they received approximately 840 billion won in subsidies, which is significantly higher than their operating profits. The withdrawal of these credits would likely lead to a recalibration of their investment strategies and could delay or even halt planned expansions.

Editor: The market has already reacted to these uncertainties, with substantial drops in stock prices for companies in the battery sector. What are the longer-term implications should the subsidy cuts be enacted?

Expert: While there might be short-term pain, I believe that the electric vehicle trend is unavoidable. The entire world is moving toward cleaner energy, and the market will adjust eventually. However, in the short term, we might see a contraction in both electric vehicle and battery sales. The U.S. EV market could decrease from approximately 1.2 million units per year to around 867,000, which is substantial.

Editor: It sounds like there could be a significant shift in consumer behavior as well. How might consumers respond if these subsidies disappear?

Expert: Consumers may revert to more traditional vehicles if electric cars become less financially attractive. The market’s affordability gap will widen, particularly for EVs priced above $55,000. This could stifle growth in the EV segment, especially since many consumers consider subsidies as a deciding factor in their purchasing decisions.

Editor: Elon Musk has voiced his support for the abolition of these subsidies, suggesting it may hurt competitors more than Tesla. How does Tesla’s market position play into this dynamic?

Expert: Tesla is in a unique position. They have achieved significant economies of scale and profitability that many other EV manufacturers have not. If the subsidies vanish, it might perfectly align with their business strategy, but it doesn’t negate the competitive challenges that other companies will face. Musk’s comments reveal a strategic play to weaken competitors while solidly positioning Tesla as the dominant player in the market.

Editor: what are you hearing from the Ministry of Trade, Industry and Energy here in South Korea? Are they actively preparing for this potential change?

Expert: Yes, they’re monitoring the situation closely and have been in communication with the industry about various scenarios. They understand the stakes involved, particularly for domestic manufacturers who have made significant commitments in the U.S. market. While they assert that nothing is confirmed yet regarding the subsidies, it is clear that they are bracing for a substantial impact if the cuts are implemented.

Editor: Thank you for your insights. It seems like a critical time ahead for the automotive and battery industries, and it’s essential to keep a close eye on how these developments unfold.

Expert: Absolutely. The transition to electric vehicles is a global movement, and while there are short-term challenges, the long-term trend seems inevitable. Thank you for having me.