Is the American Dream Fading? Unpacking the US Economic Puzzle

Table of Contents

- Is the American Dream Fading? Unpacking the US Economic Puzzle

- Is the American Dream Fading? An Expert Unpacks the US Economic Puzzle

Are storm clouds gathering over the US economy? While headlines tout consumer resilience, a closer look reveals a more nuanced, and potentially troubling, picture. Let’s dissect the key indicators and see what the future might hold.

1.Consumer Confidence: A Mirage of Stability?

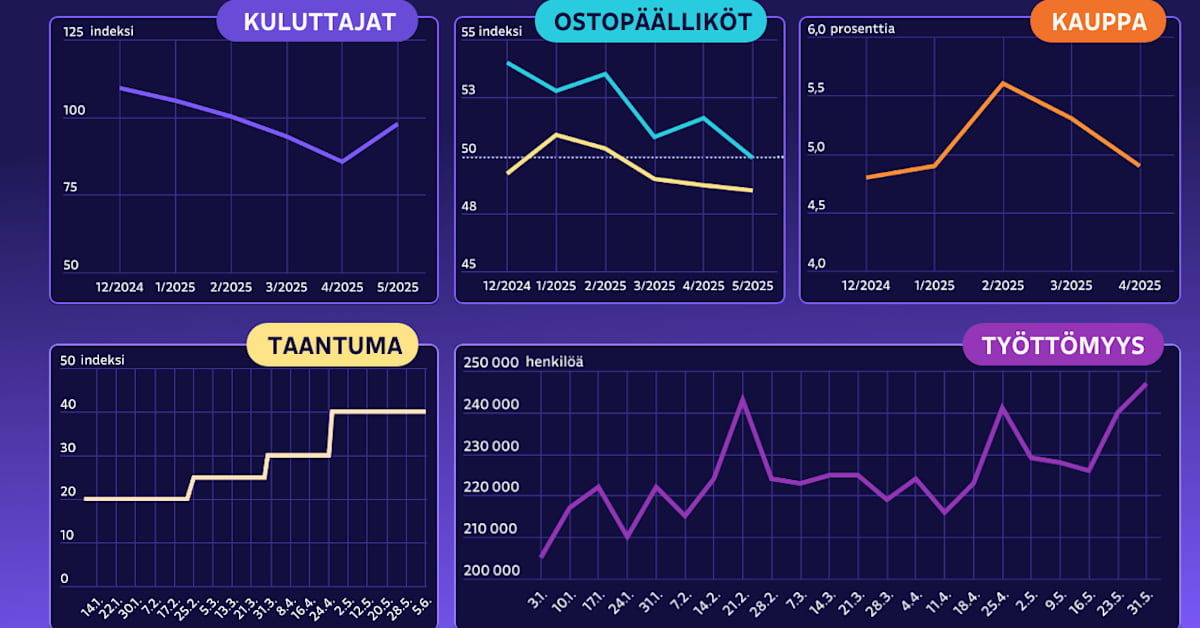

Consumer confidence, that elusive barometer of economic health, has shown moderate strength, even spiking upwards in late May. But is this optimism justified, or a fleeting illusion?

According to recent surveys, Americans feel better about their *current* situation than their *future* prospects. This disconnect raises a critical question: are consumers living in the moment, oblivious to potential headwinds?

2. Purchasing Managers: The Canary in the Coal Mine

Purchasing Manager Indexes (pmis) offer a real-time glimpse into the minds of companies. these professionals, responsible for procuring goods and services, are acutely sensitive to economic shifts.Their anxiety is a warning sign.

Currently,industrial purchasing managers are particularly nervous. The industrial index has been declining since January, although it remains above last fall’s levels. The critical threshold? 50. An index below this mark signals contraction.

The PMI Breakdown: What’s Really Happening?

A PMI below 50 indicates weakening production, dwindling new orders, and declining employment. The only thing on the rise? Prices. This paints a picture of stagflation – a stagnant economy wiht rising inflation.

The service sector isn’t faring much better. While not as dire as industry, growth is stagnant. Job creation is minimal, prices are inching upwards, and new orders are shrinking. Purchasing managers are scaling back future investments, signaling a lack of confidence in the near-term outlook.

3. Retail Sales: A Deceptive Signal?

Retail sales, frequently enough seen as a reliable gauge of economic activity, have shown continued growth, albeit at a slower pace. But is this growth genuine, or artificially inflated?

Peter Lindahl, Evlin Fund Director of the US economy, suggests that consumers may not yet be feeling the full impact of rising prices. Furthermore, fears of impending tariffs may have spurred consumers to make purchases sooner rather than later.

The Tariff Time Bomb: Pre-Purchasing and its Consequences

Lindahl warns that this “pre-purchasing” phenomenon could lead to a sudden drop in sales in the coming months. Think of it as borrowing from the future – the iPhone bought today won’t be purchased again next month.

4. Employment: Cracks in the Foundation

The employment situation, while currently stable, shows signs of weakening. The number of new unemployment benefit applications,a sensitive indicator,is being closely watched.

While job numbers don’t instantly reflect economic downturns, they eventually catch up. and when they do, the impact is profound. New job creation has slowed down in recent months,and unemployment benefit applications are showing a cautious uptick.

Business Leaders Sound the Alarm

Lindahl points to concerning feedback from business leaders,indicating a bleak outlook for future employment. “We have seen the levels that were about five years ago,” he notes, suggesting a significant deterioration in hiring prospects.

5. Recession Fears: The Probability is Rising

Economists are increasingly concerned about the possibility of a recession. A “recession probability multimeter,” factoring in unemployment, GDP, consumer confidence, and stock market performance, is flashing warning signs.

The estimated probability of a recession in the US this year is around 40%. While opinions vary, the consensus is that economic growth is slowing, raising the specter of a more severe downturn.

The key question is how the fear of tariffs will ultimately impact consumer and business behavior. Tariffs act like taxes,reducing consumption and investment. While the economy has shown resilience thus far,future expectations are darkening.

Lindahl aptly describes Trump’s tariffs as a “corona show,” highlighting their disruptive and unpredictable nature.

So, when will these anxieties translate into concrete economic weakness? “We know that weak development will come at some point in the end of the year, but we do not know exactly when and how great that weakness will be,” Lindahl concludes.

While a deep recession is unlikely due to relatively stable unemployment, economic growth is undoubtedly slowing. Whether this slowdown begins in the fall or later in the year remains to be seen. For now, the US economy appears to be holding its own, but the future is far from certain.

Is the American Dream Fading? An Expert Unpacks the US Economic Puzzle

Time.news wants to know: What’s really going on with the US economy?

We sat down with Dr. Anya Sharma, a leading economic analyst and professor at the prestigious wharton School of Business, to dissect the nuances of the current economic climate. Dr. Sharma brings a wealth of experience in macroeconomic forecasting and consumer behavior analysis to the table, making her uniquely positioned to shed light on the “US economic puzzle”.

Time.news: Dr. Sharma, thank you for joining us. Headlines often paint a mixed picture. Are storm clouds really gathering over the US economy?

Dr. Sharma: Absolutely. While there’s undoubtedly resilience in some sectors, a closer examination reveals underlying vulnerabilities. It’s not a straightforward boom; it’s a more complex and perhaps fragile situation.

Time.news: Let’s start with consumer confidence. It seems to be holding up, but some reports suggest Americans are more optimistic about thier present than their future. Is this a red flag?

Dr. Sharma: It’s certainly a cause for concern. When consumers feel good about now but not later,it suggests a lack of faith in long-term economic stability. They may be spending now due to pent-up demand or a “live for the moment” mentality, rather than confident, enduring growth.This disconnect presents a risk to overall consumer spending.

Time.news: The article highlights Purchasing Managers’ Indexes (PMIs) as a “canary in the coal mine.” Can you elaborate on that?

Dr. Sharma: PMIs provide real-time insights into business sentiment. Purchasing managers, responsible for procuring goods and services, react quickly to economic shifts. A declining PMI, especially the industrial index, signals contraction. The critical level to watch is 50. Anything below that indicates a weakening economy. The fact that the industrial PMI has been declining since January raises concerns about future production and economic activity.

Time.news: The article draws attention to the fact that the PMI breakdowns indicate stagflation. Can you explain the implications?

Dr.Sharma: Stagflation is characterized by stagnant economic growth coupled with rising inflation. A PMI below 50 means weakening production, dwindling new orders, and declining employment alongside rising prices. Stagflation creates arduous choices for businesses and consumers alike.

Time.news: Retail sales have been growing, but the article questions whether this growth is genuine. What’s behind that skepticism?

Dr. Sharma: There’s reason to believe some of the recent retail sales growth may be artificially inflated by pre-purchasing, driven by fears of rising prices or impending tariffs. Consumers might be buying goods now that they woudl have purchased later, leading to a potential drop in sales in the coming months. Keep in mind that tariffs act like taxes and will reduce consumer spending.

Time.news: The employment situation seems relatively stable for now, but the article points to “cracks in the foundation.” What should we be watching for?

Dr. Sharma: While job numbers are a lagging indicator, meaning they react slower, they eventually reflect economic realities. We’re seeing a slowdown in job creation and a cautious uptick in new unemployment benefit applications. More concerning is the feedback from business leaders. Declining hiring prospects are a clear warning sign.

Time.news: Recession fears are on the rise. What factors are contributing to this increased anxiety?

Dr. Sharma: Several factors point to a heightened risk of recession. The increase in unemployment, declining GDP growth, a decrease in consumer confidence, and stock market volatility all contribute to this apprehension. While a severe downturn isn’t inevitable, the probability of a recession in the US this year is significantly high.

time.news: What’s your expert advice for individuals navigating these uncertain economic waters?

Dr. Sharma: First, stay informed. Monitor key economic indicators like the PMIs, inflation rates, and unemployment figures. Second, be cautious with spending and prioritize essential needs. Consider building an emergency fund to cushion against potential job loss or unexpected expenses. Third, diversify your investments and consult with a financial planner for personalized advice. Lastly, remember that economic cycles are normal and downturns are frequently enough followed by periods of growth.