2024-08-02 18:37:58

‘Big Tech Bubble Theory’ Adds to Worsening U.S. Manufacturing

KOSPI 2700 collapse, KOSDAQ plunges 4.2%

Japan’s Nikkei Index Drops Most in 36 Years

US employment slumps, unemployment rate rises to 4.3%

Global stock markets, including Korea, were hit hard by fears of a U.S. recession, and their indices plunged across the board, creating a “Black Friday.” The previous day, the U.S. Federal Reserve (Fed) had announced a major interest rate cut in September, but the market sentiment changed drastically in just one day as U.S. economic indicators, including employment, were weaker than expected. In addition, bubble theories about the artificial intelligence (AI) industry and global big tech companies were raised, spreading anxiety that the real economy and corporate performance were worsening faster than expected.

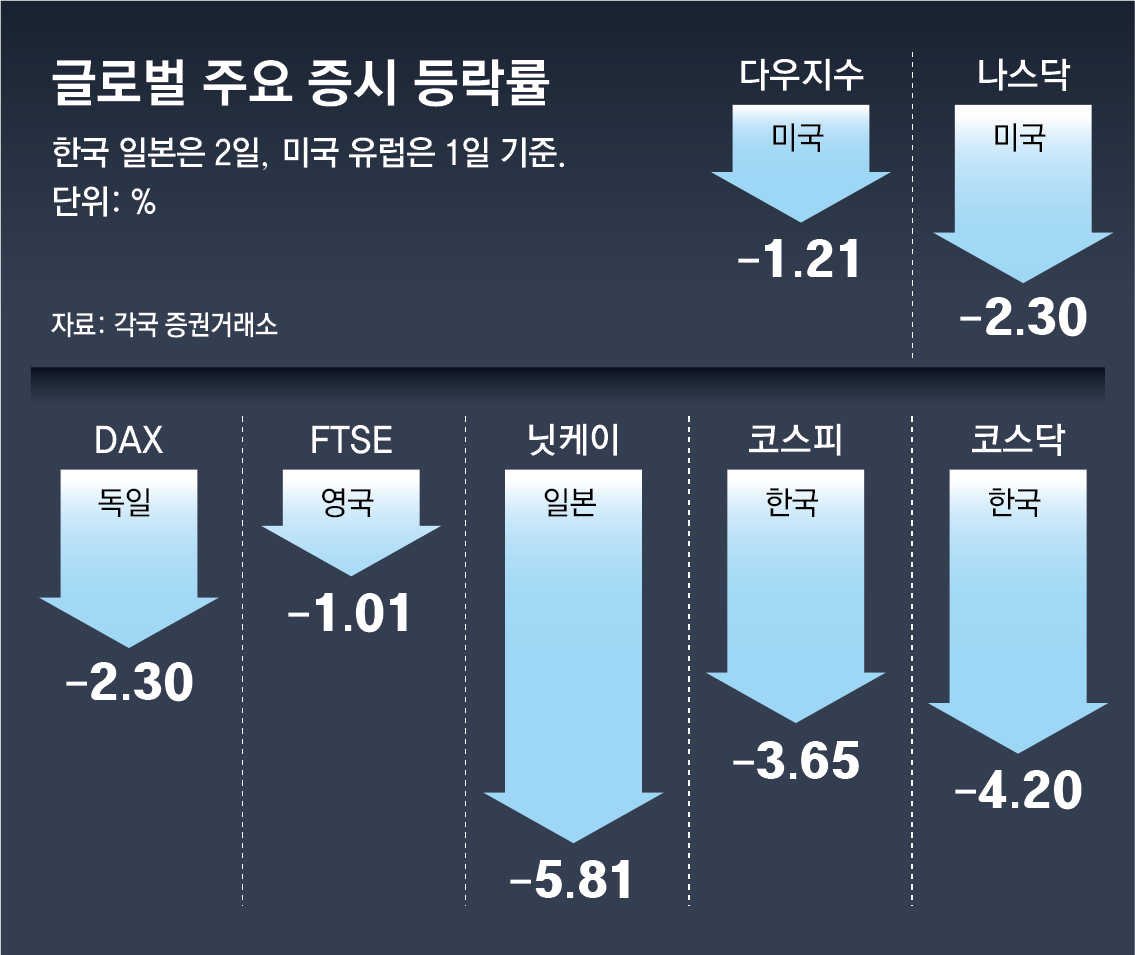

On the 2nd, KOSPI closed at 2,676.19, down 101.49 points (3.65%) from the previous day. This is the largest drop in 4 years and 4 months since March 19, 2020 (down 133.56 points), when COVID-19 first spread. KOSDAQ also plunged 4.20% to close at 779.33. In particular, Japan’s Nikkei Stock Average, which was hit by concerns about a U.S. recession and the strengthening of the yen, plummeted 5.81% on the day. The drop on the day (2,216 yen) was the largest in 36 years and 10 months since October 20, 1987 (down 3,836 yen), also known as ‘Black Monday.’ There are concerns that Japan’s recent decision to raise its base interest rate alone, amid interest rate cuts being seen in the United States and other countries around the world, could pour cold water on its own economy.

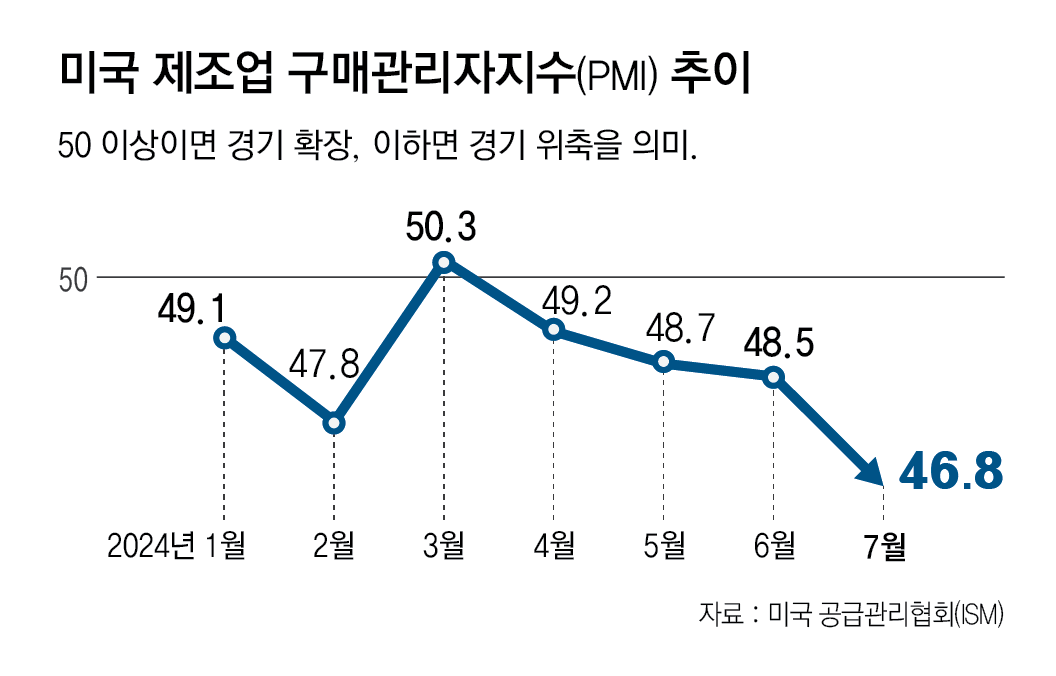

The plunge in Asian stock markets that day was the direct result of concerns about a U.S. economic slowdown the previous day. On the 1st (local time), the Nasdaq index plunged 2.3% and the Dow Jones Industrial Average plunged 1.21% on the New York Stock Exchange. In particular, the Philadelphia Semiconductor Index, which is comprised of semiconductor-related stocks, fell 7.14%. The non-farm payrolls for July announced by the U.S. Department of Labor on the 2nd increased by 114,000 from the previous month, falling far short of the average increase (210,005) over the previous 12 months. In addition, the unemployment rate in July was 4.3%, the highest since October 2021. The July manufacturing purchasing managers’ index (PMI) announced by the Institute for Supply Management (ISM) fell 1.7 points from the previous month to 46.8, and was also far below market expectations (48.8).

As anxiety about an economic slowdown grows, the so-called “fear index,” the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), rose to 19.48 during trading on the 1st, the highest in three months since April 19.

AI Bubble Theory – Stock Market Fluctuations Due to Worsening US Manufacturing… KOSPI Market Cap Evaporates by 78 Trillion

US ‘R’ fear, financial market turbulence

Big Techs’ Earnings Misses Investors Leave… US Unemployment Benefit Claims Highest in a Year

Hard landing fears swallow up ‘interest rate cut’ windfall… Samsung 4%, Hynix 10% stock price plunge

As fears of a ‘R (Recession)’ swept over the world economy, centered around the United States, global stock markets were devastated. This is the opposite of the market’s delight just the day before when the Federal Reserve, the central bank of the United States, suggested a rate cut.

Analysis suggests that the reason for such a drastic change in atmosphere is that the market’s attention is quickly shifting from prices to the economy. Previously, when bad economic indicators were released, there was speculation that the Fed would quickly lower interest rates, and the stock market rose, but now it is being interpreted as meaning that the economic situation is not good enough, and fear is spreading in the market. Some are even pessimistic that even if the Fed lowers interest rates sufficiently, it will not be able to prevent a hard landing for the U.S. economy.

● Semiconductor and Big Tech stocks plummet due to AI bubble theory

The core of the anxiety about the U.S. economy is the concern about the performance of Big Tech and AI companies that have supported the U.S. stock market. As the Big Tech companies that have been living up to the market’s expectations are causing a series of ‘earnings misses,’ the AI bubble theory is becoming a reality, and investor exodus is accelerating.

Amazon, the world’s largest e-commerce company, announced on the 1st (local time) that its second-quarter sales were $147.98 billion and its third-quarter sales forecast was $154 billion to $158.5 billion. Both figures fell short of market expectations. As investor disappointment grew, Amazon’s stock price plunged 7% in after-hours trading immediately after the earnings announcement. Brian Olsavsky, Amazon’s Chief Financial Officer (CFO), said on the same day, “We spent $35 billion on data centers and other things in the first half, and we will increase that amount in the second half,” which amplified the market’s perception that AI investment costs are excessively high.

Recently, Microsoft (MS) performance has also fallen short of expectations. The sales growth rate of MS’s cloud service ‘Azure’ business division, which is directly related to AI profits, was 29%, falling short of the market forecast (31%). In a situation where corporate performance is not supporting it, excessive investment in AI has raised concerns that it will come back as a boomerang when the economic downturn spreads in the future.

Consumer goods companies are no exception to the anxiety over performance. McDonald’s also announced that its second-quarter sales fell 1% year-on-year to $6.49 billion due to slowing global consumption. This is the first time in three years and six months since the fourth quarter of 2020, when McDonald’s sales were down during the pandemic.

On the 1st, the New York Stock Exchange continued to see a selloff in technology stocks, with Nvidia falling 6.7% and Tesla falling 6.6%. Due to the plunge in U.S. semiconductor stocks, stocks of Samsung Electronics (-4.2%), SK Hynix (-10.4%), and Japan’s Tokyo Electron (-12.0%) also plummeted on the 2nd. The total market capitalization of KOSPI evaporated by more than 78 trillion won in one day.

“AI technology is still far from being useful,” Jim Covell, a Goldman Sachs technology analyst with 30 years of experience, warned in a recent report. “Overbuilding things the world doesn’t need or isn’t ready for can have bad consequences.”

● The Fed may increase the pace of rate cuts

Concerns about a real economic slowdown are also weighing on the stock market. The July Purchasing Managers’ Index (PMI), which indicates the U.S. manufacturing sector, came in at 46.8, far below market expectations (48.8). The index, which is above 50, indicates economic expansion, while below indicates economic contraction. It has been below 50 since March. The job market has also cooled, with the number of new unemployment benefit claims in the U.S. reaching a yearly high of 249,000 last week. As fears of a recession spread, the yield on 10-year U.S. Treasury bonds fell below 4% for the first time in six months.

The market is expecting that the Fed may increase the pace of rate cuts to respond to the rapidly cooling economy. According to the Chicago Mercantile Exchange (CME) FedWatch on the 2nd, the probability that the Fed will cut the base rate by 0.50% in September has jumped to 29.5%. The probability has more than doubled from just one day ago. Some experts are also arguing that the Fed should have preemptively cut rates in July.

Experts predict that global stock market volatility could increase for a while due to geopolitical risks such as the U.S. presidential election and the escalation of the Middle East war. Ahn Dong-hyun, a professor of economics at Seoul National University, said, “It can be said that the U.S. stock market has entered a correction phase after rising excessively.”

Reporter Lee Dong-hoon [email protected]

Reporter Lee Ki-wook [email protected]

Tokyo = Correspondent Lee Sang-hoon [email protected]

Reporter Kim Hyeon-su [email protected]

2024-08-02 18:37:58