It will be the largest commercial port in South America.

For years, China has been building a large port in Peru, destined to become a point of reference for the entire region and to revolutionize its trade with Asian markets.

The port complex of Chancay, about 70 kilometers north of Lima, opens this Thursday with great expectations from the Peruvian and Chinese governments and potentially beneficiary economic sectors.

It is a gigantic project led by Cosco Shipping Company, a Chinese state-owned company dedicated to maritime transport, with a total expected investment of 3.4 billion dollars, to build a complex of 15 docks, offices, logistics services and a highway 2 kilometers long tunnel to unload cargo.

Eight years after the start of work and coinciding with the visit of Chinese President Xi Jinping to Lima, the first phase of an infrastructure will be inaugurated this Thursday, the construction of which was not without controversy and whose effects will be felt beyond Peru.

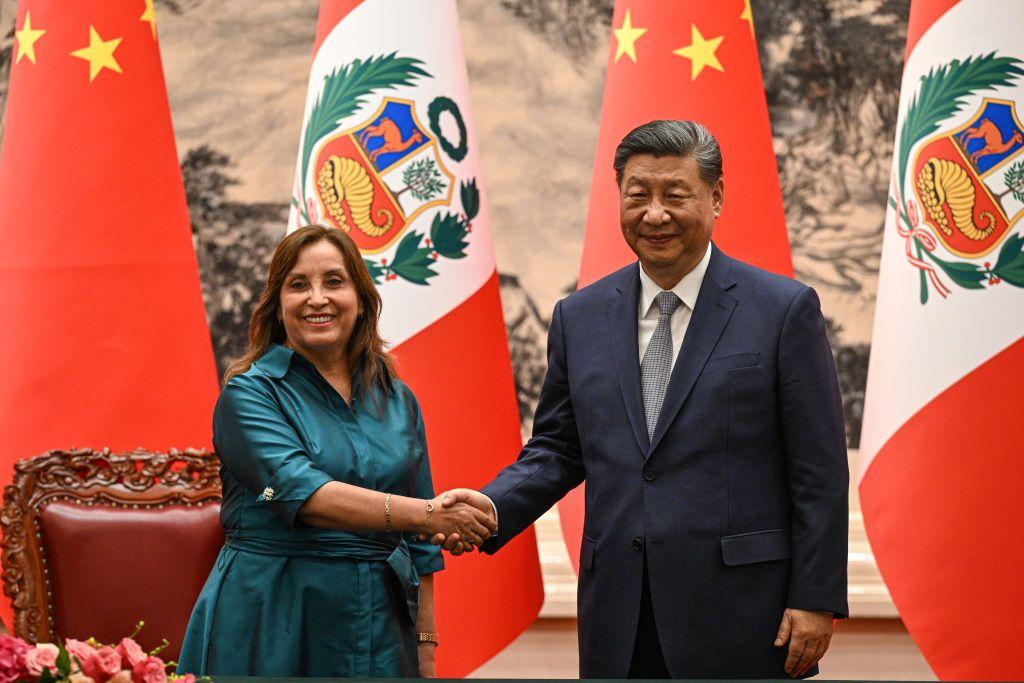

EPA The President of China, Xi Jinping, arrived in Peru this Thursday to attend the APEC summit and inaugurate the port of Chancay.

Why it matters

Getty Images The port of Chancay will allow ships with greater draft and loading capacity to dock.

The port represents a significant step forward in China’s presence in Latin America.

Conceived within the framework of the strategic “Belt and Road Initiative” that it has been developing for years to increase its presence and influence in the world, with it China increases its ability to land its goods in South America and ship those it imports from this region , mainly minerals such as lithium and copper and agricultural products such as soybeans.

Peru’s Minister of Communications and Transport, Raúl Pérez Reyes, said the megaport will allow his country to position itself “as a logistics hub throughout Latin America”.

The Peruvian government estimates that the new terminal will generate 7,500 direct and indirect jobs, although critics point out that elsewhere in Latin America, Chinese investments have employed more displaced workers from China than local labor.

Questioned by environmental advocates and neighborhood organizations, the megaport promises some distribution time and cost advantages that will make it particularly attractive to logistics operators.

According to estimates by the Peruvian government, its location makes it possible to reduce to 28 the 40 days that merchant ships currently take on average to transport goods by sea from Peru to Asia.

“Before, products exported from South America had to go north to ports like Manzanillo, Mexico, to be transshipped and sent to China,” Robert Evan Ellis, of the Institute for Strategic Studies, US Army, told BBC Mundo.

“With Chancay, a direct and faster route opens up. It’s like a bus line that used to make all the stops and now stops only when it reaches the destination,” he adds.

Getty Images The Peruvian government defends the benefits for its country resulting from large Chinese investments, but several experts warn that a dependency is being created.

Added to this is the fact that Chancay Bay’s deep draft gives the port the space to accommodate the world’s largest ships, capable of carrying up to 24,000 containers, known in the shipping industry by the acronym TEU (Twenty-Foot Equivalent). . Unit), thus offering shipping companies the ability to send larger freights at a lower cost.

As Juan Ortiz, from the Economic Environment Observatory of the Diego Portales University of Chile, told BBC Mundo, “Chancay will have operational advantages compared to the rest of the ports located in the Pacific Ocean in South America thanks to the high investments made in the said port. and the incorporation of cutting-edge technologies that will reduce costs and operating times at the port compared to others in the region.”

The impact in Peru

The effects of large infrastructures have already been felt at a local level.

Chancay, a small town where people traditionally engage in artisanal fishing, is experiencing a major transformation.

Now a tunnel runs through it that connects the large port with the North Pan-American Highway, and the price of land there has skyrocketed.

“There is an expectation that companies dedicated to logistics will establish themselves near the port,” Rubén Tang, founder of the Confucius Institute at the Pontifical Catholic University of Peru, told BBC Mundo.

The Ministry of Production estimates that the port and associated logistics centers will contribute approximately $4.5 billion to the Peruvian economy, equal to 1.8% of GDP, and the Central Bank estimates that only the initial phase now inaugurated will add 0.9% of GDP already next year.

The new port should serve to relieve the port of El Callao, the main entry and exit point for goods in Peru, whose current saturation damages and slows down the commercial flow.

But there are also shadows and doubts surrounding the project.

“In other investments in Latin America and Asia we have seen how China uses predatory techniques and ultimately ends up taking over natural resources and increasing the dependence of the countries where it establishes itself,” says Evan Ellis from the US.

Environmental organizations have raised their voices about the threat to the natural environment and the exclusive concession of the port’s management to Cosco has been challenged in court.

According to Tang, ”there is a gap pending for the port to satisfy the expectations created and that is to improve connections with the provinces of Peru” where the mines and deposits where the raw materials consumed by China and emerging Asian markets are produced are located .

Likewise, public services are being developed to serve an already growing population, one of the main reasons for protest by local inhabitants against other large-scale exploitations carried out with Chinese capital in Peru, such as the Las Bambas mine, in Apurimac department.

The impact of the port of Chancay in Chile

Both the Chinese and Peruvian governments believe the new port will help increase trade in the Asia-Pacific region.

In Chile, voices have emerged warning of the possible loss of competitiveness of its ports.

Former Chilean Minister of Transport and Telecommunications Germán Correa lamented in an editorial published in Biobiochile that “Chile will be irremediably left behind” for allowing Peru to take the initiative and that “others will be those who benefit from the enormous impact on development”. which will lead to “the gigantic Peruvian port of Chancay”.

Projects such as the modernization of the Chilean port of San Antonio have been on hold for years due to the need for several environmental impact studies and the lack of a decision on financing and the role of the state, which has prevented Chile from acquiring the capacity to accommodate the largest ships that will be able to dock in Chancay.

Economist Ortiz agrees that the launch of Chancay “could reduce demand for the use of Chilean ports both by local companies and those from other countries in the region, with those of San Antonio and Valparaíso handling around 70% of the national load, such as those most affected by greater competition”.

At a time when the drought that has affected the Panama Canal since last year makes navigation difficult and has diverted some maritime traffic to the Strait of Magellan, Chilean ports prove to be a formidable competitor.

But Ortiz points out that “lower transportation costs due to increased port competition or increased transportation options to external markets are positive for Chile’s trade flow.”

Andrés Bórquez, director of the Asian studies program at the University of Chile, told BBC Mundo that “the impact will be mixed. Some ports may have to adopt a new role, but other sectors will benefit.”

“Chile sends 90% of its cherry production to China, especially coinciding with the Chinese New Year, and for producers it will be an advantage to have a port like Chancay, which will allow the fruit to arrive there earlier.”

Despite the resulting competition for their logistics sector, Chilean exporters could benefit from the availability of a faster outlet for their products to Asia, which should lead to a reduction in logistics costs.

The impact of the port of Chancay for Brazil

Like Peru, Brazil is also a country that has increasingly close commercial and political relations with China.

The Asian giant is the main trading partner of Brazil, whose government has shown interest in the Chancay megaport.

The Minister of Planning and Budget, Simone Tebet, visited him last March, according to the official Peruvian note, “to learn about Peru’s plans and strategies to promote South American integration routes”.

If realized, it could have a large economic impact, as Brazil is the country with the largest volume of trade with China in the entire region.

But Dourado declares himself “skeptical” about this possibility.

“The distance between Brazil’s producing regions and Chancay is much greater than that between them and Atlantic ports like Manaus, and they will continue to prefer this option because it has lower costs than land transport to Peru.”

The expert recalls the example of the interoceanic highway, which connects Brazil to the Peruvian Pacific coast: “At the time it was presented as a way to facilitate Brazil’s trade with Asia and, after years of service, it did not had the desired effect.”

The question now is whether Chancay will have any, not just for Brazil, but for all of Latin America.

What are the potential job opportunities and challenges for local communities surrounding the Chancay megaproject in Peru?

Lts of the ongoing geopolitical and economic changes catalyzed by the Belt and Road Initiative, the Chancay megaproject represents both an opportunity and a challenge for Peru and its neighbors in the region, particularly Chile. The strategic significance of this new port, coupled with China’s increasing investment footprint in South America, highlights the complex interplay of development, local concerns, and international trade dynamics.

Economic Implications for Peru

The Chancay megaport is anticipated to bolster Peru’s logistical capabilities, allowing for a more efficient transport route from South America to Asia. Reducing shipping times from 40 to 28 days will likely make Peruvian goods more competitive in Asian markets, especially minerals and agricultural products like lithium, copper, and soybeans. With the promise of generating thousands of jobs and contributing significantly to Peru’s GDP, the project positions the country as a critical logistics hub in Latin America.

However, this rapid development raises concerns about reliance on foreign investments. Critics argue that while the initial influx of capital and infrastructure may seem beneficial, it could lead to a dependency on Chinese interests that historically have prioritized resource extraction over local development. The high concentration of investment and management by a foreign entity like Cosco could exacerbate these fears, leading to calls for a more balanced approach to infrastructure and development.

Social and Environmental Concerns

The transformation of Chancay from a fishing town to a burgeoning logistics center underscores the social ramifications of such large-scale projects. The community faces significant changes, including shifting job markets and the increased cost of living due to rising land prices. Although new jobs are promised, the local population worries about the sustainability and the nature of these jobs, particularly given historical trends where foreign investments have failed to sufficiently benefit local labor.

Moreover, environmental advocates have raised alarms about potential ecological degradation resulting from the port’s construction and operation. The delicate balance of local ecosystems may be threatened, mirroring concerns seen with other large-scale investments in the region.

Impact on Regional Competitiveness

The Chancay port’s operational advantages threaten to compromise the competitiveness of Chilean ports like San Antonio and Valparaíso. Chile has historically been a major player in regional trade, and the rapid development of Chancay could shift trade routes away from Chile, requiring it to adapt strategically. Prolonged delays in port modernization projects within Chile suggest that without timely action, Chile may lose its competitive edge.

However, the increased competition may also inject positive dynamics into the region’s trade environment. Economists suggest that more options for transporting goods and reduced costs might ultimately benefit traders and producers in both countries. For instance, Chilean exporters could leverage Chancay’s efficiencies to reach Asian markets faster, particularly for time-sensitive products such as cherries.

Conclusion

The Chancay megaport exemplifies the intricate balance between opportunity and risk that emerges as nations navigate their economic futures in a globalized world. For Peru, the port signifies a potential leap forward in economic development, even as challenges related to dependency, social change, and environmental impact loom large. For neighboring countries like Chile, it represents a call to action to innovate and compete, ensuring that they do not fall behind in a rapidly evolving trade landscape. the future of trade in Latin America will likely hinge on how these nations respond collectively to the profound shifts ushered in by this and similar initiatives.