Already yesterday, Mizrahi Bank published in its macroeconomic review that “a salary agreement with the teachers is expected to lead to additional increases in the public sector, and in our estimation is an important component in the fear of falling into an inflationary spiral.” The bank’s economists are referring to the same mechanism that feeds itself and works like this: the price increases in certain products, “stick” to the other sections of the index, inflation increases, the purchasing power of the workers is eroded, the workers demand a wage increase (compensation for the loss of purchasing power), wages rise (the cost of production inputs ), the firms’ profits decrease, as a result the firms raise prices, this causes inflation to rise and God forbid. This is the macroeconomic risk in the agreement signed yesterday.

2. This week, the OECD gathered the growth data for the second quarter of 2022 for the member economies of the organization. Israel was ranked second with a 1.7% increase in GDP (compared to the first quarter of 2022, quarterly rate) after the Netherlands (2.6%). The figure was not surprising since the Central Bureau of Statistics published two weeks ago Israel’s growth compared to developed countries and ranked it in first place (Holland was not included there).

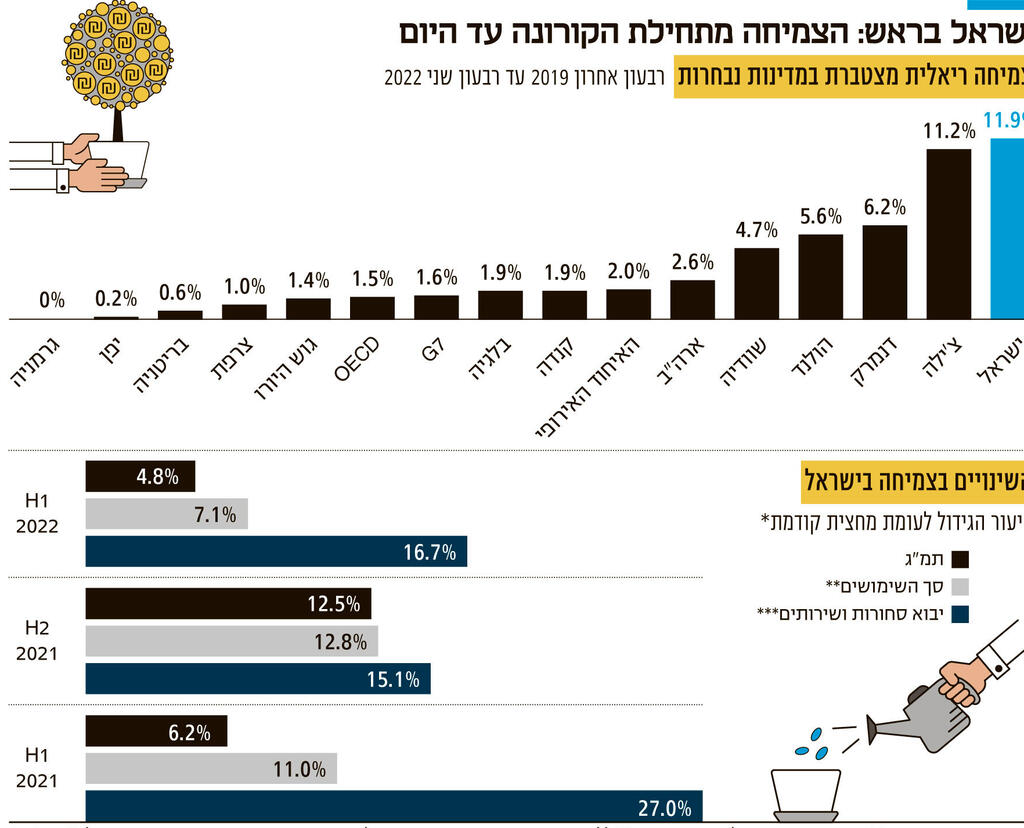

The OECD also calculated the “cumulative” real growth rate since the outbreak of the corona virus (end of 2019) until today (second quarter of 2022), and for good reason. Since the outbreak of the epidemic, the global economy has already experienced the sharp ups and downs of the last century. After an epidemic that has not been seen for more than 100 years and also a war that has no parallel in the last 70 years, the OECD wants to follow the developments “from then until now” while deducting and neutralizing the sharp shifts and noises in the middle. The calculation is made for several large economies and for the entire organization.

“Calcalist” turned to the OECD and asked to receive the “cumulative growth index” for Israel as well. The assumption is that Israel will be ranked very high: after all, it was hit relatively little in the months when the closures hit hard, and recovered quickly in the months of the opening of the economy. This is because of the surge in high-tech demand and the very expansive fiscal policy: mainly the surge in government spending for both medical needs and support for employees and companies.

The results obtained are not surprising: Israel ranks first in the West with a cumulative growth of about 12% over the entire period compared to an average growth of only 1.5% (some individual countries have not yet provided data).

1 Viewing the gallery

3. The increase in the GDP growth rate is particularly evident when looking at halves. Such a view makes it possible to ignore the changes between quarters, where there are much more shifts like in the first quarter of the year when there was a real decrease in GDP compared to the previous quarter. In the last three halves (first half of 2022 and the two halves of 2021) the growth rate reached 6%, 12.5% and 5% respectively, and this is a very fast rate.

On the eve of the Corona (until the beginning of 2020) the real growth rate between the halves (the last of 2018 and the two halves of 2019) ranges from 2.8% to 3.7%. That is, not only is the Israeli economy growing, but it is growing more than the long-term growth rate, or what is known as its potential growth.

Therefore, there is a fairly broad consensus that a “Positive Output Gap” has been created in the Israeli economy, a situation that occurs when the actual output is higher than the potential output. “This happens when the demand is very high, and in order to meet this demand, factories and workers operate far above their capacity and maximum efficiency point”, define it the economists of the International Monetary Fund (IMF).

Goshpanka for this situation could be found in the explanation given by the members of the Monetary Committee of the Bank of Israel in the announcement of the dramatic decision to increase the interest rate by 0.75%, a rate not seen here for 20 years. “In the Israeli economy, robust economic activity continues and the labor market continues to be tight and in a full employment environment,” they wrote.

Indeed, it seems that what is known as Economic Slack, a term that describes the amount of resources in the economy that are not being used, is zero. Also the phenomenon of a historic low in unemployment when at the same time the employment rates and vacancies in the economy are increasing at the same time points to the same direction: warming. According to the book, the result of all things together is one: inflation.

4. The question that has arisen in recent times and concerns the economic community quite a bit – and we saw this last weekend at the annual Governors’ Conference in Jackson Hole – is whether this excess demand and the inflation that followed it are the product of a supply shock (a shortage of raw materials and workers, a disruption in the supply chains) or It is still largely explained by high demand whose roots still lie in the Corona crisis (a very expansive budget policy and pent-up demand that can still be financed against the background of the excess money created at the time).

The answer depends on the country. Dr. Julian Di Giovanni from the Central Bank of New York published a study this week in which he found that in the case of the USA, about 60% of the inflation in the USA is explained by high demand and only 40% by the supply crisis due to the epidemic and the war in Ukraine. Israel was not included in the study, but according to the latest data from the Central Bank, it is evident that alongside the shock to the supply, the demands in the economy are extremely strong, including the demands from abroad, including for our high-tech: the total uses (demands) have increased in the last three halves at rates higher than the product itself – 11%, 13% and 7% respectively. how? Because imports jumped at a dizzying rate (27%, 15% and 17%). That is, what is not produced in Israel is purchased from abroad. This means that even in Israel inflation is mainly driven by demand.

In terms of this policy, we were the same, as the “high priest” of monetary policy, Fed Chairman Jerome Powell, defined it this weekend: “It is true that the current high inflation is a product of high demand but also of limited supply when the Fed’s tools are mainly working on demand. But all this does not reduce our responsibility to carry out the task assigned to us, and without conditions: price stability. Therefore, the task is clearly to moderate demand so that it better aligns with supply. We are committed to doing this work.” Therefore, in the US as well as in Israel, the interest rate will continue to rise for some time to come.

The second important message in this context is the one given by Prof. Gita Gopinath, number 2 at the IMF, in the same hall in Jackson Hole a few hours before Powell: “Inflation risks increase significantly in a hot economy.”