This week the market’s attention is focused a meeting of the world’s leading bankers which will be held next Thursday and Friday in Jackson Holethe valley located in the rocky mountains of Wyoming, USA. The expectation is high, since the host, Jerome Powellthe president of the Federal Reserve, he will give some indication of what his decision on interest rates will do for the September meeting, whose correlation in the stocks of the United States, therefore, will undoubtedly be in Cedears.

The market looks very tense in the coming days, as in addition to Powell’s speech next Friday, investors will also be cautious minutes of the July meeting of the Fedwhich will be published on Wednesday evening, as well as the preliminary details of the applications weekly unemployment benefits which will be known on Thursday morning.

To begin with, analysts expect Powell to set the tone for an interest rate cut in September. However, if the talk takes another direction, This could jeopardize the recent stock market rally. These are the cases.

Jackson Hole: what the historical data says

Available data shows that US stocks historically tend to rise around the annual Jackson Hole symposium. The S&P 500 has rallied in the two weeks before and after the Fed conference, with larger rallies after the Fed chairman’s speech For example, if the S&P 500 widens the green this Tuesday, it would be his ninth consecutive day of gainswhich would have been his longest winning streak since 2004, according to Factset.

Strictly speaking, Powell is scheduled to speak about the economic outlook on Friday morning. And while Jackson Hole is not usually where Fed chairs dwell on future interest rate decisions, the chairman’s speech keeps the market on edge.

One fact to keep in mind is that, over the past 20 years, the S&P 500 has averaged a return of 0.4% during the conference, according to data from Dow Jones Market Data. The index showed an average gain of 0.1% in the month following the conference and an average return of 1.8% in the three months following the event.

S&P 500.jpeg

On occasion, however, nutrition chairmen have made comments that have provoked a disproportionate reaction. For example, the S&P 500 fell 3.4% on August 26, 2022, after Powell dashed investors’ hopes for a quick end to the rate hike campaign.

Among the most optimistic options in the market, Powell is expected to highlight the fact that inflation is moving in the right direction, giving the Fed more confidence that it will reach its 2% target. This could indicate that there is a slowdown in inflation it allows the central bank to combine its efforts with its other taskthat is to maximize employment.

However, negative scenarios can also be seen, and there are those who believe that investors may have set their expectations too high for Powell’s speech. So, the question arises What if Powell says he may want to adjust interest rates a little lower, but we don’t need to cut them significantly?

This would be negative for the market, as traders are pricing in Fed rate cuts at each of its three remaining meetings this year, according to the CME FedWatch tool. In any case, Powell’s speech could threaten the stock market’s reversal since the crash earlier this month. And unsurprisingly, as fears of a recession grow, the market is at a stage where bad news is taken very seriously.

Jackson Hole under the scrutiny of analysts

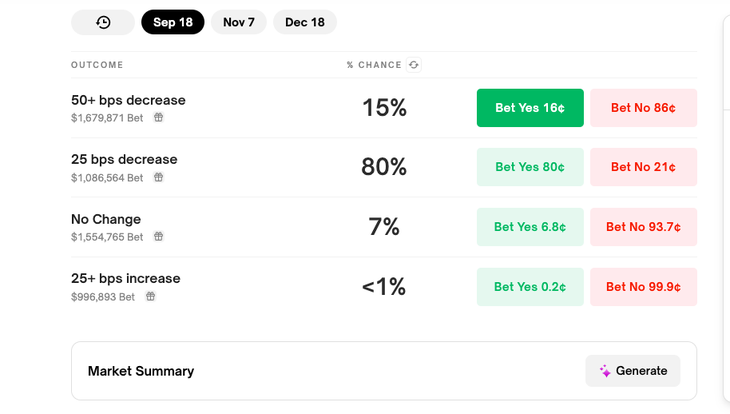

In an interview with Scope, Pedro Morera, director of Guardian Capitalexplains that markets are pricing in a 100% chance of a 25 basis point rate cut at the September 17-18 Federal Open Market Committee (FOMC) meeting and a 24% chance of a 50 basis point cut in that same meeting. “In short, there is a consensus that there will be cuts, but the extent is uncertain,” he says.

As for the annual symposium in Jackson Hole, Moreyra argues that this is the main event of the week, in a context where the markets have just recorded the best week of 2024. “In our opinion the best case scenario is the first signs. confirmation of the cuts expected in September,” he says. What is more likely, however, is that a constructive message will be issued “that emphasizes the long-term objective, which would still be positive, although it would be a less direct commentary,” analyzes Moreyra .

For her, Juan Manuel Francochief economist of SBS Groupto ensure that the international market will closely follow the news arising from the traditional symposium, where most will expect Powell’s word.

Feed rate Polymarket.png

Specifically, Franco asserts, “investors will be wary of what Powell might say regarding the future of monetary policy, particularly the interest rate path.” According to their analysis, this is supported by the fact that the labor market and some activity indicators no longer show their robustness from a few months ago and “suggest a possible depletion in the upward dynamics of the economy.”

“Regarding market expectations, Fed Funds Rate futures are implied to see cuts of at least 25 bps in the reference rate in the three remaining FOMC meetings this year, although the probabilities of any of them are 50 bps at 75% for a month of Christmas,” concludes Franco.

Finally, and according to data from the Blockchain-based market prediction platform, Polymarketinvestors see a 15% chance the Fed will cut rates by 50 bp in September; 80% cut of 25 bp and 7% bet as there will be no changes in that game.

Cedars: what to bet depending on Powell’s words

Ignacio SniechowskiHead of Equity del IEB Groupexpressed in statements to this medium that today it seems that after Black Monday, the market factors in or predicted a soft landing for the US economy. In this context, he analyzes that the investor should look for companies that generate a lot of money and take advantage of that situation. “But because of the prices of tech companies, I would put together a well-diversified portfolio through ETFs. I would do S&P 500 (SPY) and Nasdaq (QQQ) in particular.”Especially if buying Cedears, since they have a lot of liquidity“, he declares.

The strategist points out that if the situation that comes out of Jackson Hole, “is not out of the question, but it does not look like what the market sees today,” that is, a negative one that does not put light on rates available, “perhaps the investor should be a little calmer and build the portfolio with stocks with low volatility and good dividends: like Coca-Cola (KO), Berkshire Hathaway (BRKB) and Johnson & Johnson (JNJ). “And then diversify also with some of the Dow Jones ETF (DIA) and a small part of SPY,” He concludes.