“It changed the story about the Chinese economy.”

This is an assessment of the large-scale economic stimulus package announced by the People’s Bank of China on the 24th. This is because both the scale of the stimulus package and the format of the announcement were more powerful, groundbreaking, and unusual than expected. In fact, the ripple effect is so significant that the Chinese stock market rebounded 10% in three days.

So, is there any hope for the Chinese economy, which has fallen into a quagmire, to revive? How to boost the Chinese economyLet’s take a look at it.

*This article is the online version of the Deep Dive newsletter published on the 27th. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

People’s Bank of China releases money

First, let’s take a look at what the People’s Bank of Korea Governor Pangongsheng presented on the 24th. There are many, but the three biggest ones are:

1)The policy interest rate (7-day reverse repurchase agreement interest rate) was lowered by 0.2% points. → Loan and deposit interest rates will also be lowered one after another.

2)The reserve ratio will also be lowered by 0.5% point soon. → The reserve ratio means that commercial banks entrust a certain percentage of their deposits to the People’s Bank of Korea. As this goes down, the amount of money that banks can release into the market through loans increases. The reserve ratio may fall further within the year.

3)Existing mortgage loan interest rates reduced by 0.5% pointIt works.

![Will the stimulus package boost China’s economy? Xi Jinping finally awakens?[딥다이브] Will the stimulus package boost China’s economy? Xi Jinping finally awakens?[딥다이브]](https://dimg.donga.com/wps/NEWS/IMAGE/2024/09/27/130115971.1.jpg)

It is said that this is the first time that China has released such a large monetary policy package at once. This means that there is a great sense of crisis regarding the current economic situation. In particular, it is surprising that the three major financial leaders, including the governor of the People’s Bank of Korea, held a live press conference and even answered the reporters’ questions one by one. Usually, all you had to do was post a notice on the website.

The message of the policy is clear. I will lower the interest rate and release a lot of money, so please spend some money.That’s right. In China, there are clear signs of deflation (falling prices during an economic recession), with producer prices falling for 23 consecutive months. The goal is to somehow create an atmosphere in which money can be spent, thereby raising prices and the economy again. The goal is to maintain this year’s economic growth rate of 5%. Regarding this announcement “A sign of a growing sense of urgency among China’s top leaders to fight deflation.”(Economist Larry Hu of Macquarie Capital).

What stands out in particular is the ‘reduction in interest rates on existing home mortgage loans.’ This is because one of the obstacles to Chinese households’ consumption was the burden of housing mortgage loans.

Until 2021, the real estate craze was huge in China. As a result, the balance of household mortgage loans accumulated to 38.17 trillion yuan (about 7,200 trillion won) as of the end of last year. however This balance is decreasing. It is said that it decreased by 400 billion yuan (76 trillion won) in the second quarter of this year alone..

Wouldn’t it be a good thing if household debt were reduced? The opposite is true for the national economy. This means that instead of spending the money they earn, people are using it to pay off debt.Because this is it. In fact, in China, the number of people repaying at least part of their loans early is increasing rapidly, so much so that it is called the ‘early repayment craze’.

Why are you paying it back in advance? They say this is because the existing loan interest rates are too high. For those who have already taken out a loan, the average interest rate is 4.27% (as of the end of last year). As market interest rates have fallen, the average interest rate for new home mortgage loans has fallen to 3.4%, and in some cities to the 2% range. In this era of low interest rates, continuing to lower interest rates is too burdensome. If house prices were rising and the return on investment was high, I would have been able to hold on, but the opposite is true (new home prices have fallen the most in 9 years). Households are tightening their belts and beginning austerity measures to pay off burdensome debt.

So this time, the People’s Bank of Korea said, ‘We will also lower interest rates on existing loans. Then, even if you have debt, you will be able to live comfortably. So, it gave a signal to stop repaying early and loosen your belt. Will this work?

First of all, the People’s Bank of China boasts that 50 million households, or about 150 million people, will save 150 billion yuan (28.5 trillion won) in loan interest annually. However, if you calculate it, it means that one household saves an average of 3,000 yuan (570,000 won) per year. Although borrowers are happy, some say that in reality, not much will change.

Ultimately, stronger policies are needed to revive Chinese consumption. In the market now, seeing China moving so urgently, there is widespread anticipation that something bigger will come out soon. The reason stock prices have risen over the past few days is actually because of this change in atmosphere. What is the powerful herbal medicine that everyone is looking forward to? right away Fiscal policy where the government opens its treasury and releases moneyno see.

Wake up consumption. how?

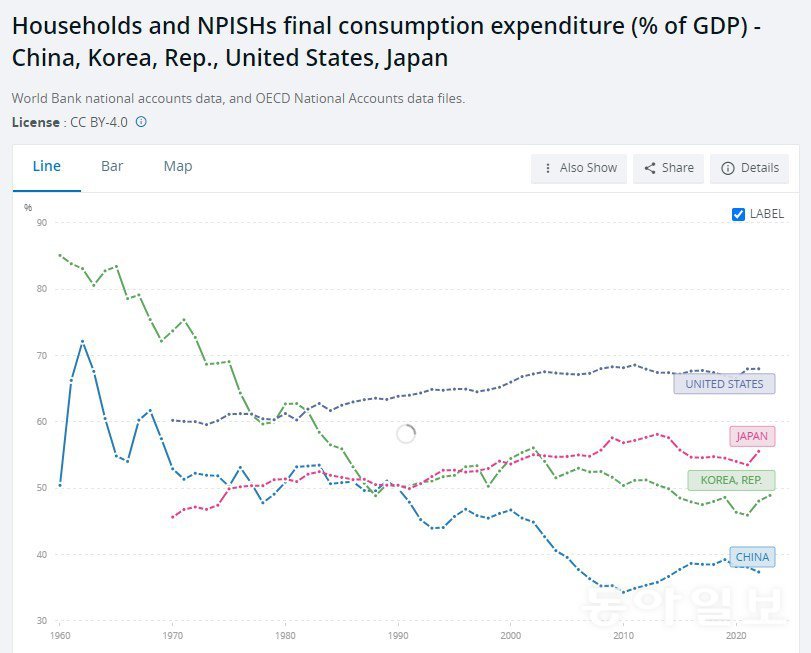

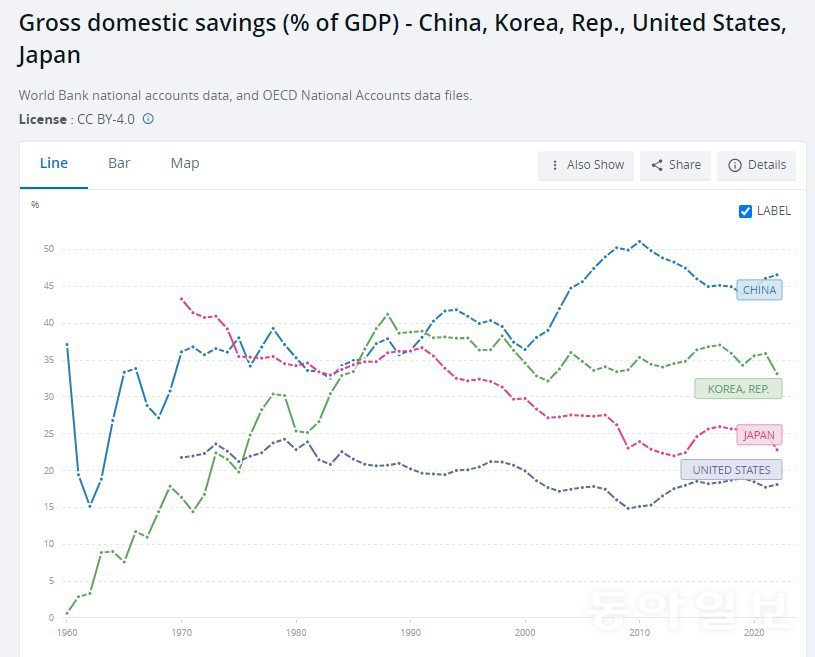

The Chinese economy is somewhat unique among major countries. The proportion of consumption in GDP (37%) is particularly low. There is a big difference compared to not only the United States (68%), but also Japan (56%) and Korea (49%). That’s how much investment (real estate, infrastructure, factories) and exports support the economy. As U.S. Secretary of State Antony Blinken said, “There is a mismatch in that China accounts for one-third of global production but only one-tenth of global demand.”

This model may be necessary in the early stages of economic growth, but it is not sustainable. Because other countries cannot continue to accept the huge export boom. In addition, the competition for hegemony with the United States has put a dark cloud on exports to China. The real estate market, which has been expanding, is also helplessly collapsing. The only way is to awaken the domestic market with its vast population. FT columnist Martin Wolff said: “This is a decisive moment in China’s modern economic history.”He says. This means that it is time to move away from the ‘low consumption, high investment’ economic model.

In fact, discussions regarding this have been going on for several years. Numerous reports and expert columns point to the solution. Here are some of them:

①Basic social safety nets such as health and social insurance must be strengthened.

China is Known for its high savings rateLet’s do it. The savings-to-GDP ratio is 46.6%, twice that of Japan (22.8%) and much higher than that of Korea (33.2%). Isn’t it good to save a lot? Back in the day when there were so many places to invest, you could handle that much savings, but now it’s different. Because high savings rates hinder consumptionThat’s right.

So why do Chinese people save a lot? In short Because I’m anxiousThat’s right. What about treatment costs if I get sick, and what will I eat when I retire? Because of these concerns, people accumulate cash until just before retirement. In addition, as the coronavirus pandemic and the real estate recession overlapped, the thought that ‘the only thing you can trust is your deposit’ has grown.

So the solution that emerges is that the government must increase welfare spending in line with the level of the economy. For example, China only spends 5.4% of its GDP on health. It’s only half the size of Korea or Japan. Xu Qiyuan, deputy director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences, also said that the government “There must be a significant increase” in financial expenditures for education, health care, and social security.is an opinion. It should not be just a small increase, but should be at a level where consumers can feel at ease and think, ‘Life will be a bit more comfortable now.’

②The tax and household registration system must be reformed to redistribute income.

Another way to effectively increase consumption is to increase the income of the poor. Even if you give 1 million won to a rich person, their spending will not increase significantly, but if you give 1 million won to a poor household, they will spend it all on consumption. This is why income redistribution is important.

To do this, we need to increase cash and in-kind welfare for the socially underprivileged. At the same time, tax reform is also needed. In China, the share of value-added tax (38%) in total tax revenue is too high, and the personal income tax (8%) is quite low. There is no inheritance tax or property tax at all. If we collect more taxes from the rich, we can use this as a source of funds for income redistribution.

We also need to reform China’s unique household registration system. It is a system that treats people differently depending on whether they are from a rural area or an urban area. Eliminating this discrimination is also a path to income redistribution.

The ‘welfare trap’

In fact, this is something the Chinese government knows. At the 2004 Central Economic Work Conference, the Chinese leadership publicly declared that it would ‘adjust the relationship between investment and consumption.’ From then on, I knew that a transitional period had come where we had to increase the proportion of consumption rather than investment. So I’m curious. Why has the share of consumption in the Chinese economy actually decreased after 20 years? Why didn’t the Chinese government take action during the coronavirus pandemic, when other countries were trying to stimulate consumption by distributing one-time cash (disaster relief funds)? Why does President Xi Jinping call for ‘new quality productivity’ as the guiding ideology of his official economic policy during his third term in office, even when he is suffering from a serious manufacturing overcapacity?

Interpretations vary. It is not easy to change the economic structure that is addicted to state-led investment, the more tensions with the United States increase, the more emphasis is placed on technology investment, security is prioritized over growth, the Chinese economy is not yet in systemic danger, so it is worth holding on, etc. . Among them, what I pay attention to is President Xi Jinping’s opposition to ‘welfarism’.

“We must not fall into the trap of welfareism that feeds the lazy.” When President Xi said this in 2021, I wondered what on earth he meant. If we were to summarize the commentary of Chinese scholars who study and interpret his thoughts, it would be as follows. ‘Have you not seen the cases of some South American countries whose finances collapsed due to populist policies? In order for that to not happen, the people should not be able to expect welfare from the beginning. If you start increasing social security just because the economy has grown, people will become more and more lazy, demands will only increase, and it will become difficult for the country to handle it later.’

In other words In order to prevent the people’s ‘spirit’ from weakening, we will deliberately stay at a low level of welfare.is stubborn. Doesn’t this idea that you have to go through some hardships to become stronger sound somewhat familiar? The Wall Street Journal explains that ‘Xi Jinping’s views were shaped by the hardships he faced living in a hole and digging ditches during the Cultural Revolution.’

However, it seems that even President Xi’s once-solid caution against ‘welfarism’ is now on the wane. At a meeting chaired by President Xi Jinping on the 26th, the Central Political Bureau of the Communist Party of China We will guarantee the necessary fiscal expenditures to achieve this year’s 5% economic growth target.I emphasized. According to Reuters, the Chinese government this year Plan to issue special government bonds worth 2 trillion yuan (about 378 trillion won)It is said that Additionally, China’s CCTV reported that the government will provide livelihood subsidies to the poor ahead of next week’s National Day holiday (October 1-7). A cash support policy that did not exist even during the coronavirus pandemic was introduced. In addition, Shanghai city authorities announced that they would distribute 500 million yuan (94.7 billion won) worth of consumer coupons to stimulate consumption. There is a sense of urgency in the policy relay that has never been seen before.

Although I think the Chinese government is in a real hurry, I look forward to seeing if it will finally change direction. HSBC economist Jing Liu says: “The frequency and scale of policy rollouts have exceeded our expectations. Things have changed. Get ready for more proactive initiatives.” By. Deep Dive

Is the sun finally going to shine on the Chinese economy, which has been full of gloomy news for a while? I am a little cautious, as I have repeatedly been disappointed after expecting a great stimulus package over the past two years. Let me summarize the main points.

-The People’s Bank of China has introduced a large-scale money release policy. It was decided to lower interest rates to reduce the burden of repaying home mortgage loans, which was eating away at consumption power. This is a bold move to escape the risk of deflation.

– But much more is needed to awaken consumption. The economic growth model itself, which was focused on investment and exports, must change. The social safety net must be strengthened to lower the ‘preventive savings rate’ and support for low-income families must be increased.

-The Chinese leadership has been hesitant to change direction. Not only did they prioritize security and competition for hegemony over growth, but President Xi Jinping’s ‘opposition to welfarism’ also played a role. Now, expectations are growing that we will begin to change direction and move forward.

*This article is an online version of the Deep Dive newsletter published on the 27th. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

2024-09-28 07:24:17