Yen Weakness Deepens: Bank of Japan Rate Hike Fails to Boost Currency

Table of Contents

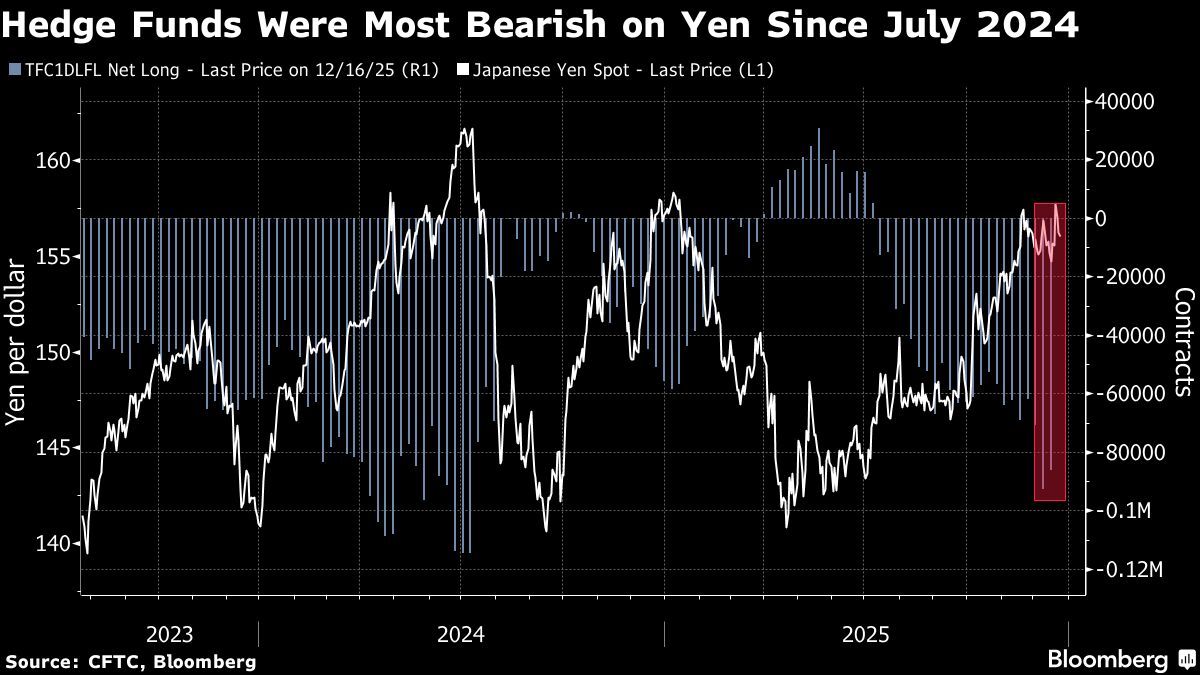

The yen continues to face critically important headwinds, with analysts increasingly pessimistic after the Bank of Japan’s recent interest rate increase proved insufficient to trigger a lasting recovery. This reinforces concerns that the Japanese currency’s struggles stem from deep-seated structural weakness, rather than temporary market fluctuations. The lack of sustained positive response is fueling a growing bearish chorus among investors.

The Bank of Japan’s move, intended to combat decades of deflation and stimulate economic growth, was closely watched by global markets. However, the initial bump to the yen’s value quickly faded, leaving observers questioning the effectiveness of monetary policy alone in addressing the currency’s underlying issues.

Structural Challenges to the Yen

The current depreciation isn’t simply a result of interest rate differentials. Experts point to a complex interplay of factors contributing to the yen’s vulnerability. These include Japan’s persistent trade deficits, its aging population, and the country’s role as a major provider of capital to global markets.

One analyst noted, “The basic problem is that Japan is a net exporter of capital. Japanese investors are constantly looking for higher returns abroad, which puts downward pressure on the yen.” This outflow of capital, coupled with a relatively low return environment within Japan, creates a challenging dynamic for currency gratitude.

Implications of a Weak Yen

A persistently weak yen has both positive and negative consequences for the japanese economy. While it can boost exports by making Japanese goods cheaper for foreign buyers, it also increases the cost of imports, potentially fueling inflation and eroding consumer purchasing power.

Furthermore, the yen’s decline raises concerns about the potential for imported inflation, particularly given the current global economic climate. This could force the Bank of Japan to reconsider its monetary policy stance, potentially leading to further adjustments in interest rates.

No Fast Fix in Sight

The prevailing sentiment is that a swift turnaround for the yen is unlikely. The Bank of Japan’s recent actions demonstrate the limitations of monetary policy in addressing the currency’s structural problems. A more extensive approach,involving fiscal reforms and structural adjustments to the Japanese economy,may be necessary to achieve a sustained recovery.

According to a senior official, “There’s a growing recognition that monetary policy can only do so much. Addressing the underlying structural issues is crucial for a long-term solution.” The lack of immediate impact from the rate hike underscores the complexity of the situation and the need for a multifaceted strategy.

The outlook for the yen remains uncertain, with the bearish chorus growing louder as investors brace for a prolonged period of weakness.

here’s the substantive news report answering the “Five Ws and How”:

Why: The yen is weakening due to deep-seated structural issues within the Japanese economy, not just temporary market fluctuations. These issues include trade deficits, an aging population, and Japan’s role as a net exporter of capital.

Who: The key players are the Bank of Japan (BOJ), Japanese investors, global markets, and the Japanese government. Analysts and economists are also providing commentary.

What: The yen has experienced significant depreciation despite a recent interest rate hike by the BOJ. This hike, intended to combat deflation and stimulate growth, failed to provide a lasting boost to the currency.

How: The yen’s weakness is driven by a combination of factors.Japanese investors seeking higher returns abroad are constantly sending capital overseas, putting downward pressure on the yen.A widening trade deficit and the BOJ’s long-standing negative interest rate policy also contribute. the recent rate hike was insufficient to counteract these forces.

How did it end? The situation currently shows no sign of a quick resolution.