| Nadav Berkowitz, Real Estate Analyst, IBI Investment House

Blue Square Real Estate published on Tuesday for the fourth quarter and for the whole of 2021., with an improvement in all parameters and especially in FFO (net profit excluding revaluations and one-time expenses and income).

In addition, the company’s forecast for 2022 shows further improvement, with Square Real Estate estimating NOI (income from renting the company’s assets, plus income from asset management, less expenses related to their operation) in the range of NIS 346-356 million and FFO in the range of NIS 230- NIS 240 million, which also includes residential income.

The TLV fashion mall in Tel Aviv is still not showing a significant improvement, but we will mention that at the end of the year, the Carlebach light rail station is expected to open next to it and contribute to traffic in the mall. Revenues in the TLV mall recorded an increase to a level of NIS 2,000 per square meter, compared to an average of NIS 1,500 per square meter in 2019. Square Real Estate notes that there are lease agreements and memoranda of understanding regarding a total area of 4,400 square meters per rent. Of NIS 320 per square meter, when the average rent in the mall is NIS 233 per square meter.

In terms of future entrepreneurship, the company continues to advance with the “Made in Israel” project in Tel Aviv, where there are already 194 sales agreements and 17 purchase requests out of 390 apartments for sale.

The company also reports on two major deals that are under negotiation. The first transaction in the negotiations is for a mix of uses for the acquisition of rights in real estate in the city of Bat Yam, on the light rail axis (the “Red Line”), in the amount of rights of about 300,000 square meters for employment, residence and commerce, and for an estimated total of 250-700 NIS million, when the transactions can and will be through the purchase of land and / or in a combination or combination transaction.

The second transaction in the negotiations is for the purchase of rights in an office building located near the route of the light rail in Tel Aviv, in a total built-up area of approximately 45,000 square meters, main areas and service, for NIS 350-500 million.

According to the company’s FFO forecast for 2022, Square Real Estate is currently traded at a multiple of only 8-9. This is a historically low multiple for the company, even if we neutralize residential income (NIS 24 million in 2022).

Therefore, we at IBI Investment House maintain a target price of NIS 315 per square share of real estate (TASE 🙂 with the recommendation “Yield”.

Regarding the TLV mall, there is no revaluation in the mall, with the value remaining at NIS 1.7 billion with a NOI of NIS 80 million and an occupancy of 83%. The new contracts signed are at prices of NIS 318 per square meter, with the average price now being NIS 233 per square meter.

Revaluations: During 2021, Square Real Estate recorded positive revaluations in the amount of NIS 465 million. The value of the company’s assets amounts to NIS 6.5 billion, with a discount rate of 6.3%.

Activity results: Square NOI of Square Real Estate in 2021 amounted to NIS 315 million – a growth of 7% compared to NOI in the amount of NIS 295 million in 2020. The FFO in 2021 amounted to NIS 193 million – An improvement of 37% compared to FFO in the amount of NIS 140 million in 2020. The improvement is mainly due to the improvement in NOI, the completion of the process of adjusting the debt structure and the recognition of income in the “Made in Israel” project.

Forecast for 2022: The company’s NOI estimate for 2022 is NIS 346-356 million. The company’s real FFO estimate for this year is NIS 230-240 million.

*****

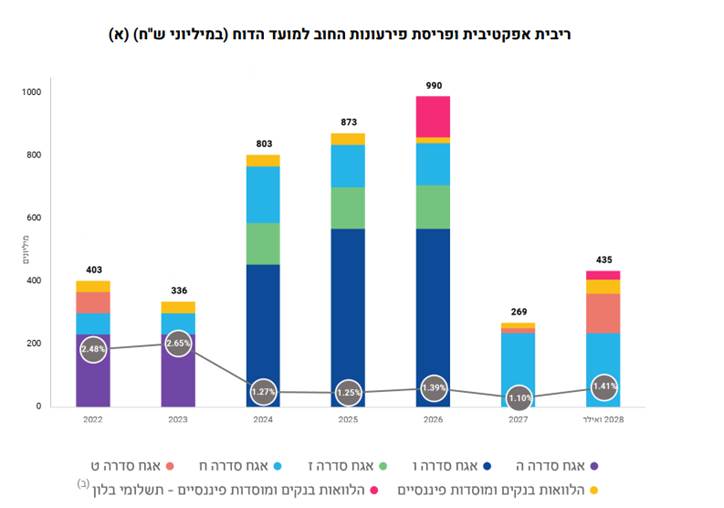

Debt and liquidity for the coming years: Square Real Estate has unencumbered assets amounting to NIS 3.3 billion and a cash balance of NIS 1.5 billion, with the company having repayments of NIS 400 million in 2022 and NIS 340 million in 2023.

The author is a real estate analyst at the IBI Investment House. With respect to information.IBI, the review writers and its editors are not responsible for the reliability of the information, its completeness, the accuracy of the data contained in it or any omission, error or other defect in it.This review does not constitute investment advice and does not constitute Therefore, the information contained therein should not be relied upon and is not subject to independent discretion and the receipt of professional advice that takes into account the data and special needs of each person. In review.