Financial Planning: Are You Ready for Life’s Curveballs?

Table of Contents

Are you truly prepared for life’s financial journey? From buying your first home to securing your retirement, a solid financial plan is your roadmap. But what does “correct” financial planning really mean in the American context, and how can you adapt it to your unique circumstances?

Understanding Your Financial Lifecycle

Financial planning isn’t a one-size-fits-all solution. It’s about aligning your financial decisions with your life stages and goals. Think of it as building blocks: each stage requires a different set of strategies.

The Single professional (35): Building a Foundation

For a 35-year-old single individual, the focus is often on building a strong financial foundation.This includes paying off student loans, saving for a down payment on a home, and maximizing contributions to retirement accounts like a 401(k) or Roth IRA.

Consider this: According to a recent study by Northwestern Mutual, millennials are prioritizing experiences over material possessions. While travel and entertainment are vital, don’t let them derail your long-term financial goals. A balanced approach is key.

The Young Family (40s, with Children): Juggling Priorities

The 40s, especially with young children, present a unique set of financial challenges. Suddenly, you’re juggling mortgage payments, childcare costs, and saving for college. It’s a financial tightrope walk.

did you know? The average cost of raising a child in the US to age 18 is over $300,000, according to the USDA. This doesn’t even include college expenses!

Prioritize creating a budget that accounts for all these expenses. Explore 529 plans for college savings, and consider life insurance to protect your family’s financial future. Don’t forget to review your estate planning documents,such as wills and trusts.

The Empty nesters (55+, No Children): Retirement on the Horizon

For those in their mid-50s without children, the focus shifts squarely to retirement planning. This is the time to maximize retirement savings, pay off debt, and consider downsizing your home.

Explore different retirement income strategies, such as annuities or dividend-paying stocks. Consult with a financial advisor to create a personalized retirement plan that addresses your specific needs and goals.

the Importance of Measuring Your Savings Capacity

No matter your life stage,understanding your savings capacity is crucial. This involves tracking your income and expenses, identifying areas where you can cut back, and setting realistic savings goals.

Income vs. Expenses: The Foundation of financial Health

Start by creating a detailed budget.Use budgeting apps like Mint or YNAB (You Need a Budget) to track your spending and identify areas where you can save. Are you spending too much on dining out or entertainment? Small changes can make a big difference over time.

Future Income Projections: Planning for the Unexpected

Consider potential changes in your income. Will you receive a raise in the future? Are you planning to change jobs? Factor these possibilities into your financial plan. Also, prepare for unexpected expenses, such as medical bills or car repairs. An emergency fund is essential.

Finding the Most Efficient solutions

Once you understand your needs and savings capacity, it’s time to explore the most efficient financial solutions.This may involve investing in stocks,bonds,real estate,or other assets.

Investment Strategies: Diversification is Key

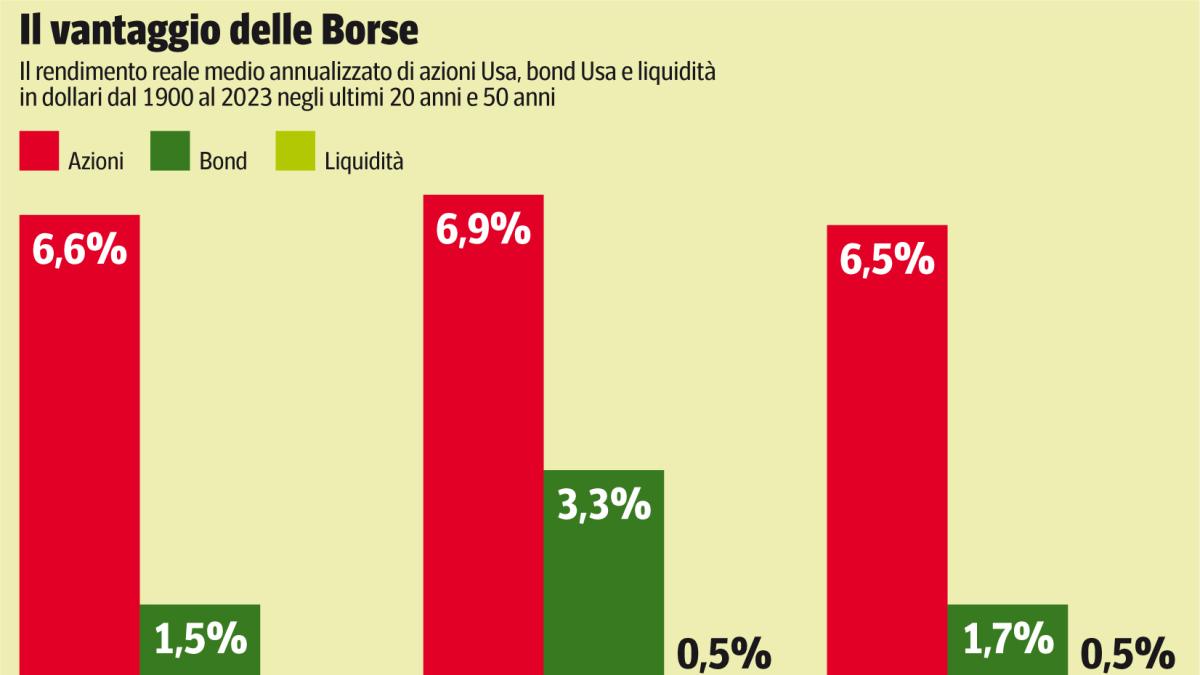

Diversify your investment portfolio to reduce risk. Don’t put all your eggs in one basket. Consider investing in a mix of stocks, bonds, and real estate. Work with a financial advisor to create an investment strategy that aligns with your risk tolerance and time horizon.

Insurance Coverage: Protecting Your Assets

Ensure you have adequate insurance coverage to protect your assets. This includes health insurance, life insurance, homeowners insurance, and auto insurance. Review your policies regularly to ensure they meet your current needs.

The Need for versatility

Life is unpredictable. Your financial plan should be flexible enough to adapt to changing circumstances.Be prepared to make adjustments as needed.

Regular Reviews: Staying on Track

Review your financial plan at least once a year, or more frequently if you experience a major life event, such as a job loss, marriage, or birth of a child.Make sure your plan still aligns with your goals and adjust it as needed.

Adapting to Change: Staying Ahead of the Curve

Be prepared to adapt to changes in the economy, the stock market, and your personal circumstances. Stay informed about financial trends and seek professional advice when needed. Remember, financial planning is a lifelong journey, not a one-time event.

Keywords: Financial Planning, Retirement Planning, Investment Strategies, Savings, Budgeting, Life Stages, Emergency Fund, Insurance, Financial Advisor

Are you prepared for life’s unexpected twists and turns? Financial planning isn’t just for the wealthy; it’s a crucial tool for everyone, irrespective of income. To delve deeper into this vital topic, Time.news spoke with Eleanor vance, a Certified Financial Planner and Principal at Vance Financial Strategies, bringing over 20 years of experience to the table.

Time.news: Eleanor, thank you for joining us. This article emphasizes that financial planning isn’t a static, one-size-fits-all solution.Coudl you elaborate on why it’s so meaningful to tailor financial strategies to different life stages?

Eleanor Vance: Absolutely. Think of yoru financial life as a journey with distinct milestones. A 35-year-old single professional has very different priorities than a family juggling childcare and college savings, or empty nesters nearing retirement. The single professional is focused on building a foundation – tackling student loans, saving for a down payment, and starting retirement contributions.For families, the focus shifts to balancing immediate needs like childcare with long-term goals like college savings. Empty nesters are looking at maximizing retirement contributions and solidifying their income strategy for their golden years. Each stage demands unique strategies,making personalized financial planning essential.

Time.news: Speaking of the single professional, the article highlights the trend of millennials prioritizing experiences. How can they balance enjoying life now with securing their financial future?

Eleanor Vance: It’s a common struggle! Enjoying life shouldn’t come at the expense of long-term security.Automate your savings.It’s almost painless. Set up automatic transfers from your checking account to your savings and investment accounts instantly after each paycheck. Even small, consistent contributions can make a huge difference over time. Think of it as “paying yourself first.” Also, create a budget that distinguishes between needs and wants. Maybe you can reduce dining out expenses or find affordable travel options.

Time.news: the financial strain on young families with children is significant. What are some crucial steps they shoudl take to manage their finances effectively?

Eleanor Vance: Prioritize a detailed budget that accounts for every expense, from mortgage payments to extracurricular activities for the kids.Explore tax advantaged college savings plans,such as 529 plans,early. Time is your biggest asset when it comes to compounding returns. And, seriously consider life insurance. It’s difficult to think about, but it’s vital to protect your family’s financial future in the event of an unexpected tragedy. ensure will and other important estate documents are set and accurate.

Time.news: For the empty nesters on the cusp of retirement, what are the most critical aspects of financial planning they should be focusing on?

eleanor Vance: the pre-retirement years are about maximizing contributions to retirement accounts, paying off high-interest debt, and realistically evaluating your retirement income needs. Many people underestimate how much they’ll need. explore various retirement income streams, such as Social Security, pensions, annuities, and investment withdrawals. It’s wise to work with a qualified financial advisor to develop a personalized retirement plan that addresses your unique circumstances and goals.

Time.news: The article emphasizes the importance of measuring your savings capacity. Can you provide some practical tips on how individuals can improve their savings habits?

Eleanor Vance: The first step is tracking where your money goes. Use budgeting apps like Mint or YNAB, or even a simple spreadsheet.Identify areas where you can cut back. Even small adjustments, like skipping a daily latte, can add up considerably over time. From there, set realistic savings goals. Don’t try to do too much too soon. Start small and gradually increase your savings rate. Don’t forget about building an emergency fund. Aim for three to six months’ worth of living expenses in a readily accessible account.

Time.news: Investment strategies are mentioned, with diversification highlighted as a key element. What does diversification mean in practice for the average investor?

Eleanor Vance: Diversification is essentially about spreading your risk. don’t put all your eggs in one basket by investing solely in one stock or one type of asset. Instead, diversify across different asset classes, such as stocks, bonds, and possibly real estate. Within each asset class, further diversify across different sectors, industries, and geographies.This helps to mitigate losses if one particular investment performs poorly. It is worth it consulting a financial professional to achieve balance personalized to your situation.

Time.news: The final point underscores the need for versatility in financial planning. How often should individuals review their financial plans, and what triggers should prompt a more immediate review?

Eleanor Vance: At a minimum, review your financial plan annually. However, major life events, such as a job loss, a marriage, the birth of a child, or a significant change in income, necessitate a more immediate review. The economy and financial landscape are ever-changing, so staying informed and adapting your plan accordingly is crucial for long-term financial success. Remember, financial planning is a continuous process, not a one-time action.

Time.news: Eleanor, thank you for sharing your expert insights with our readers. This has been incredibly informative.

Eleanor Vance: my pleasure. I hope this helps people take control of their financial futures.