Bavaria‘s Biopharma Boom: A Glimpse into the Future of Biotech

Table of Contents

- Bavaria’s Biopharma Boom: A Glimpse into the Future of Biotech

- the Power Players driving Growth

- Infrastructure Investments: Building the Foundation for Tomorrow

- Employment: A stable Workforce, But Cracks Are Emerging

- A Strong Founding spirit: Nurturing the Next Generation of biotech Innovators

- Oncology: Leading the Charge in Biotech Innovation

- Future Outlook: Cautiously Optimistic

- The Location: A Differentiated Landscape

- Is Bavaria the Next Biotech Powerhouse? An Expert Weighs In

Is Bavaria poised to become the next global biotech powerhouse? Recent data suggests a resounding “yes,” but beneath the surface of record investments and stable employment lies a more nuanced reality.

A new report, “Biotech in Bavaria 2024/25-One World for Innovation,” reveals a staggering €910 million in financing for the Bavarian biopharma industry in 2024, nearly double the previous year’s €470 million.But where is this money going, and what does it mean for the future of biotech innovation, not just in Bavaria, but globally?

the Power Players driving Growth

Four companies – Catalym (€188 million), Tubulis (€139 million), Scirhom (€128 million), and ITM (63 million EUR) – account for a important 60% of this risk capital. This concentration of investment raises a critical question: Is this growth sustainable, or are we seeing a bubble forming around a select few players?

The IPO of radiopharmaceutical company Pentixapharm, generating around €20 million, further underscores the financial activity. But IPOs are just one piece of the puzzle. What about the smaller startups struggling to get off the ground?

Infrastructure Investments: Building the Foundation for Tomorrow

Beyond private financing, Bavaria is investing heavily in research and production infrastructure. Roche’s new gene therapy center in Penzberg and Daiichi Sankyo’s planned expansion into a leading innovation center in Pfaffenhofen an der Ilm (a €1 billion investment!) signal a long-term commitment to the biotech sector.

Quick Fact: Oberschleißheim will soon be home to the One Health & Technology Cluster, a 15-hectare campus dedicated to biotechnology, medicine, and IT research, slated for completion in 2027.

the American Angle: Lessons from the US biotech Scene

The US biotech industry, particularly hubs like Boston and San Francisco, offer valuable lessons. While large investments are crucial, a thriving ecosystem also requires robust support for early-stage companies.The Bavarian model, while promising, needs to ensure that funding reaches beyond the established players.

Expert Tip: Consider the SBIR (Small Business Innovation Research) and STTR (Small business Technology Transfer) programs in the US, wich provide critical seed funding for startups. Bavaria could implement similar initiatives to foster a more diverse and resilient biotech landscape.

Employment: A stable Workforce, But Cracks Are Emerging

The number of biotech and pharmaceutical companies in Bavaria has increased slightly, reaching 540. However, a closer look reveals a concerning trend: a decline in biotech employees, offset by growth in the pharmaceutical and CRO (Contract Research Association) sectors.

did You Know? While total employment remains stable at around 57,000, the loss of 2,500 biotech jobs is a warning sign, particularly for young technology companies with volatile financing cycles.

The Morphosys Exit: A Cautionary Tale

The recent acquisition of Morphosys by Novartis and the subsequent closure of its Munich location,resulting in the loss of over 300 jobs,serves as a stark reminder of the risks involved. This highlights the vulnerability of even established biotech companies to international capital flows and strategic decisions made by global corporations.

Real-World Example: This situation mirrors similar concerns in the US, where acquisitions of promising biotech firms by larger pharmaceutical companies can lead to job losses and a shift in research priorities.

A Strong Founding spirit: Nurturing the Next Generation of biotech Innovators

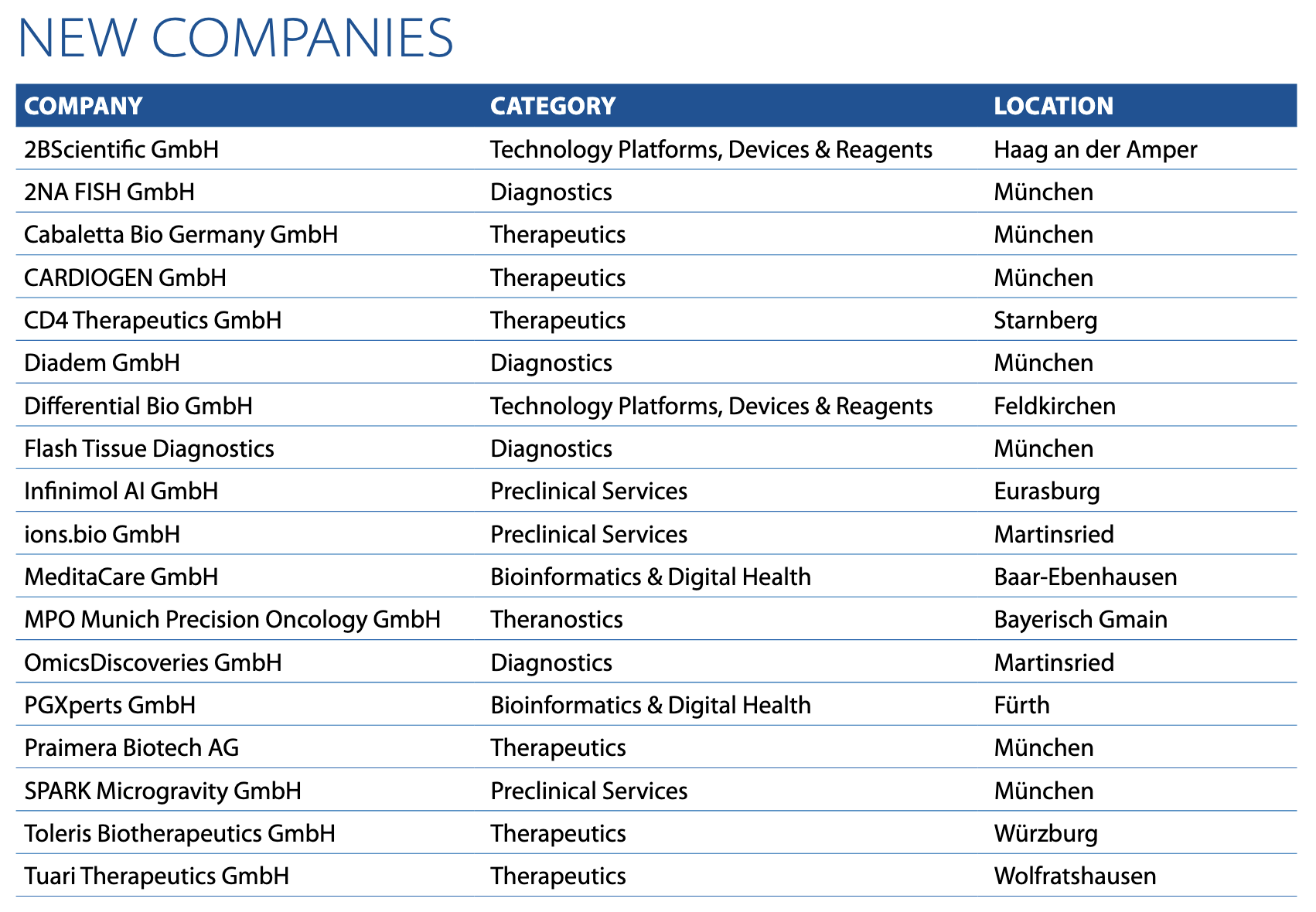

Bavaria boasts a vibrant startup scene, with 18 new foundations and settlements, a significant increase from the previous year. To further support this growth, BioM has launched the “maxl” incubator (Munich Accelerator Life Sciences & medicine).

Quote: “With Maxl, we create a specialized environment for early biotech and health tech projects – with individual support, tailor-made infrastructure, and access to our expert network,” says Prof. Dr. Ralf Huss, Managing Director of BioM.

The Role of Incubators and Accelerators: lessons from Silicon Valley

Silicon Valley’s success is partly attributed to its robust network of incubators and accelerators, which provide startups with mentorship, funding, and resources. Bavaria’s “maxl” incubator is a step in the right direction, but its long-term impact will depend on its ability to attract top talent and secure follow-on funding for its graduates.

Oncology: Leading the Charge in Biotech Innovation

The innovation pipeline of Bavarian biotech companies is heavily focused on new cancer therapies, followed by research in central nervous system disorders, infectious diseases, and autoimmune diseases. This focus reflects a global trend in biotech research, driven by the urgent need for more effective treatments for these diseases.

The Future of Cancer Treatment: A Bavarian Perspective

Bavaria’s focus on oncology aligns with the growing importance of personalized medicine and targeted therapies. companies like Catalym and Tubulis, which have secured significant funding, are likely at the forefront of developing these innovative treatments.

Future Outlook: Cautiously Optimistic

While the assessment of the current business situation has declined slightly, with only 55% rating it as good or very good, there is confidence in the future. 49% of companies expect betterment by the end of 2025, and 75% are optimistic in the medium term (three to five years).

The Importance of Long-Term Vision

the biotech industry is inherently long-term,requiring significant investment and patience. Bavaria’s commitment to infrastructure and research suggests a willingness to play the long game, but it must also address the challenges facing early-stage companies and ensure a sustainable ecosystem for innovation.

The Location: A Differentiated Landscape

The Bavarian biotech landscape is characterized by contrasts. While large deals are driving overall financing numbers, early-phase startups are struggling to secure follow-up funding. This “critical gap” between scientific idea and marketable product remains a significant challenge.

Addressing the Funding gap: A call to Action

To ensure the long-term success of its biotech sector, Bavaria must address the funding gap facing early-stage companies. This could involve government initiatives, private investment funds, or partnerships with US-based venture capital firms.

Call to Action: Share this article and join the conversation about the future of biotech innovation in Bavaria and beyond. What steps can be taken to ensure a sustainable and equitable ecosystem for all biotech companies?

Is Bavaria the Next Biotech Powerhouse? An Expert Weighs In

Keywords: Bavaria Biotech, Biotech Investment, Biopharma, Biotechnology, Cancer Therapies, Biotech Startups, Biotech Funding, Pharmaceutical Industry, Germany Biotech, Biotech Innovation

Bavaria is experiencing a biopharma boom, with investments nearly doubling to €910 million in 2024. But is this growth sustainable, and what does it mean for the future of biotech innovation? To delve deeper, Time.news spoke with Dr. Anya Sharma, a leading expert in biopharmaceutical economics and innovation strategy.

Time.news: Dr. Sharma, the “Biotech in Bavaria 2024/25” report highlights a critically important surge in funding. what are your initial thoughts on this level of investment?

Dr. Anya Sharma: The increase in financing is undoubtedly a positive sign. It indicates a strong belief in Bavaria’s potential as a hub for biotech innovation. However, the concentration of funding – with 60% going to just four companies (Catalym, Tubulis, Scirhom, and ITM) – warrants careful consideration. It’s essential to ensure that this investment translates into a broad, sustainable ecosystem and doesn’t become a self-contained bubble.

Time.news: The report mentions the IPO of Pentixapharm. Does this signal a broader trend or is it an isolated success?

Dr. Sharma: While any triumphant IPO is encouraging, it’s just one data point. The report rightly points out that we need to look beyond the headlines and assess the health of smaller biotech startups. IPOs are part of the ecosystem,but true success is measured across companies,not just one specific listing.

time.news: Major pharmaceutical companies like Roche and daiichi sankyo are investing heavily in Bavarian infrastructure. How vital are these investments for the region’s long-term biotech future?

Dr. Sharma: These infrastructure investments are absolutely crucial. They demonstrate a long-term commitment to the sector and provide the necessary foundation for innovation to flourish. Roche’s gene therapy center and Daiichi Sankyo’s expansion are significant votes of confidence in Bavaria’s potential. The upcoming One Health & Technology Cluster in Oberschleißheim is another fantastic progress that will foster collaboration and drive innovation.

Time.news: The report draws comparisons to the US biotech scene. What lessons can Bavaria learn from hubs like Boston and San Francisco?

Dr. Sharma: The US biotech industry offers valuable lessons, particularly regarding support for early-stage companies. Bavaria can consider implementing initiatives similar to the US SBIR and STTR programs, which provide vital seed funding for startups. A diverse and resilient biotech landscape requires nurturing innovation at all levels. Think about fostering networks, mentorship, and access to expertise, which are hallmarks of thriving ecosystems like Silicon Valley.

Time.news: Surprisingly, the report indicates a decline in biotech employment despite the increased investment. What underlying trends might be causing this divergence?

Dr. Sharma: This is a concerning trend. It suggests that while the overall life science sector in Bavaria is stable, the pure-play biotech segment might be facing challenges. Companies are expanding employment in CROs and in overall pharmaceutical businesses, but we are seeing shrinkage in biotech employment. This could be due to factors like acquisitions, strategic shifts within companies, or difficulties in scaling up early-stage ventures. The Morphosys acquisition and subsequent job losses is a prime example of this risk.

Time.news: What can be done to address this loss of biotech jobs and foster a more stable employment environment?

dr. Sharma: We need to ensure funding is accessible to early companies which can led to greater opportunity. Incentivize companies to grow and stay within Bavaria. Creating an environment where scientists and entrepreneurs establish and grow their business within bavaria is the goal.

Time.news: What role do incubators and accelerators like BioM’s “maxl” play in supporting the startup scene?

Dr. Sharma: Incubators and accelerators are vital. They provide startups with critical resources,mentorship,and access to networks. “Maxl” sounds like a positive step, but its long-term success will depend on its ability to attract top talent and secure follow-on funding for its graduates. It’s not just about providing initial support; it’s about creating a sustainable pipeline of funding and expertise.

Time.news: The Bavarian biotech sector is heavily focused on oncology. Is this a smart specialization, or does it risk limiting innovation in other areas?

Dr. Sharma: Oncology is a high-need area,and Bavaria’s focus aligns with a global trend. Companies like Catalym and Tubulis are at the forefront of a new wave of cancer treatments. Specialization can be beneficial, but diversity is also important. Encouraging research in areas like central nervous system disorders and infectious diseases ensures a more resilient and comprehensive biotech landscape.

Time.news: The report notes a “critical gap” between scientific ideas and marketable products.What steps can be taken to bridge this gap and ensure that innovation translates into real-world impact?

Dr.Sharma: This “critical gap” is a common challenge in biotech. Bridging it requires a multi-faceted approach. We need to ensure a clear path from research to commercialization, provide support for regulatory hurdles, and foster strong collaborations between academia, industry, and government. Addressing the funding gap for early-stage companies is crucial – it requires greater access to capital. Additionally, mentorship programs can play a vital role in guiding startups through the complex process of bringing a product to market.

Time.news: what is your outlook for the future of biotech in Bavaria?

Dr. Sharma: I’m cautiously optimistic. Bavaria has a strong foundation, with significant investments, a skilled workforce, and a growing startup scene. Though,it’s crucial to address the challenges facing early-stage companies,ensure a sustainable funding ecosystem,and foster a diverse research landscape. If Bavaria takes these steps, it has the potential to become a true global biotech powerhouse.