The Future of Bank Risk Management: Are We Ready for a Unified System After the Archegos Wake-Up call?

Table of Contents

- The Future of Bank Risk Management: Are We Ready for a Unified System After the Archegos Wake-Up call?

- Basel’s Reforms: A Necessary Evolution or overreach?

- Wrong-Way Risk (WWR): The New Center Stage

- Jumps-at-Default: From Theoretical to Essential

- The Convergence of PFE and XVA: A Unified Future?

- Basel’s final Guidelines: A Step Back or Strategic Realignment?

- Industry Sentiment: Are Banks Ready to Take the Plunge?

- Quantifi: A Platform for the Future

- The Future of Bank Risk Management: A Conversation with Dr. Anya Sharma

Did the Archegos Capital Management implosion change banking forever? It exposed vulnerabilities in how banks measure counterparty credit risk (CCR), particularly potential future exposure (PFE).Now, regulators are pushing for change, but are banks truly ready to embrace a unified approach?

Basel’s Reforms: A Necessary Evolution or overreach?

The Basel Committee on Banking Supervision‘s consultative document sent shockwaves through the financial industry. The core message? Outdated PFE approaches are no longer acceptable. The focus shifted to refined techniques like wrong-way risk (WWR) adn jumps-at-default, methods traditionally associated with valuation adjustment (XVA).

The Archegos Lesson: A $5.5 billion Wake-Up Call

Remember Credit Suisse’s $5.5 billion loss? That’s the stark reality of failing to adequately model WWR. archegos’ collapse highlighted how quickly exposure can spike when a counterparty’s creditworthiness deteriorates alongside the value of leveraged positions. This is a prime example of specific WWR, where risks are tied to individual trades.

Wrong-Way Risk (WWR): The New Center Stage

WWR is now a critical focus. Basel III defines it as exposure increasing when a counterparty’s credit quality declines. This can be specific (trade-related) or general (linked to broader market factors). The Archegos saga is a textbook case of specific WWR.

Effectively modeling WWR demands understanding a counterparty’s credit dynamics, including volatilities and correlations between credit quality and market factors. Standard PFE calculations often lack these crucial parameters.

Jumps-at-Default: From Theoretical to Essential

WWR alone isn’t enough. The Basel Committee recommends incorporating jumps-at-default into PFE calculations. This addresses the risk of sudden, significant market movements coinciding with a counterparty’s default.

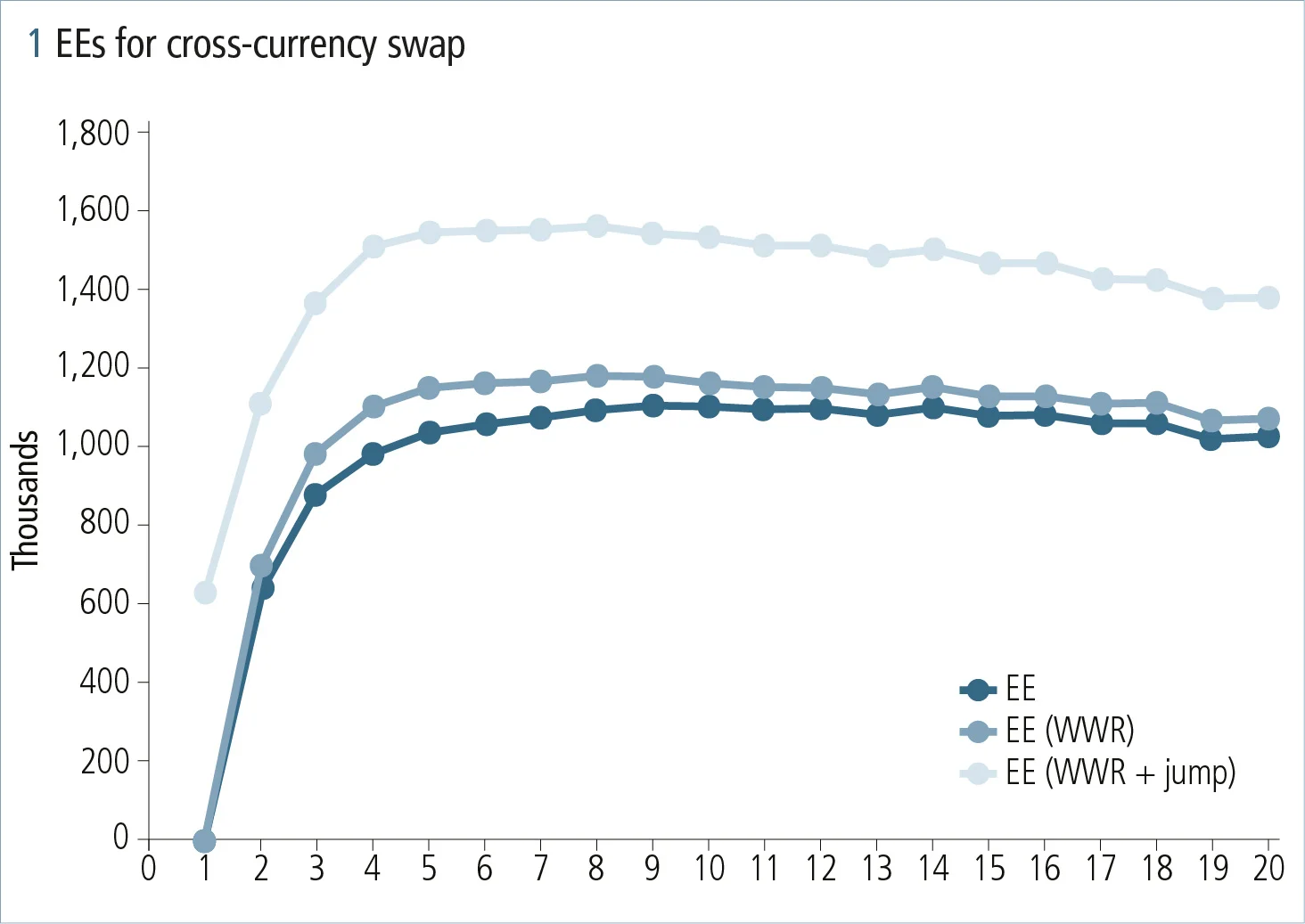

Imagine a five-year cross-currency swap. Introducing WWR increases the credit valuation adjustment (CVA). But applying a 5% FX devaluation-at-default amplifies the CVA even further. This illustrates the combined impact of WWR and jumps.

The Convergence of PFE and XVA: A Unified Future?

With WWR and jumps-at-default, PFE systems are increasingly resembling XVA systems. Quantifi, for example, advocates for calculating PFE and XVA within a single, unified system. Though, many banks still maintain separate systems due to past and organizational reasons.

Even among large institutions, not all XVA systems fully support WWR or jumps-at-default, let alone PFE systems. the hope is that regulatory pressure will drive adoption of these capabilities or, ideally, a single platform supporting both PFE and XVA.

Basel’s final Guidelines: A Step Back or Strategic Realignment?

The final guidelines for CCR management reflect industry pushback, particularly regarding WWR and jumps-at-default in PFE calculations. The original paragraph mandating WWR as a PFE component was removed. While WWR is mentioned more frequently, it’s primarily in the section on general exposure metrics, not PFE-specific guidance.

Incorporating WWR into PFE frameworks presents challenges, especially as many PFE systems don’t model basic counterparty credit characteristics. The industry hoped Basel’s proposals would encourage XVA system adoption, where counterparty dynamics are better captured. However, many banks aren’t ready to merge their XVA and PFE frameworks.

Industry Sentiment: Are Banks Ready to Take the Plunge?

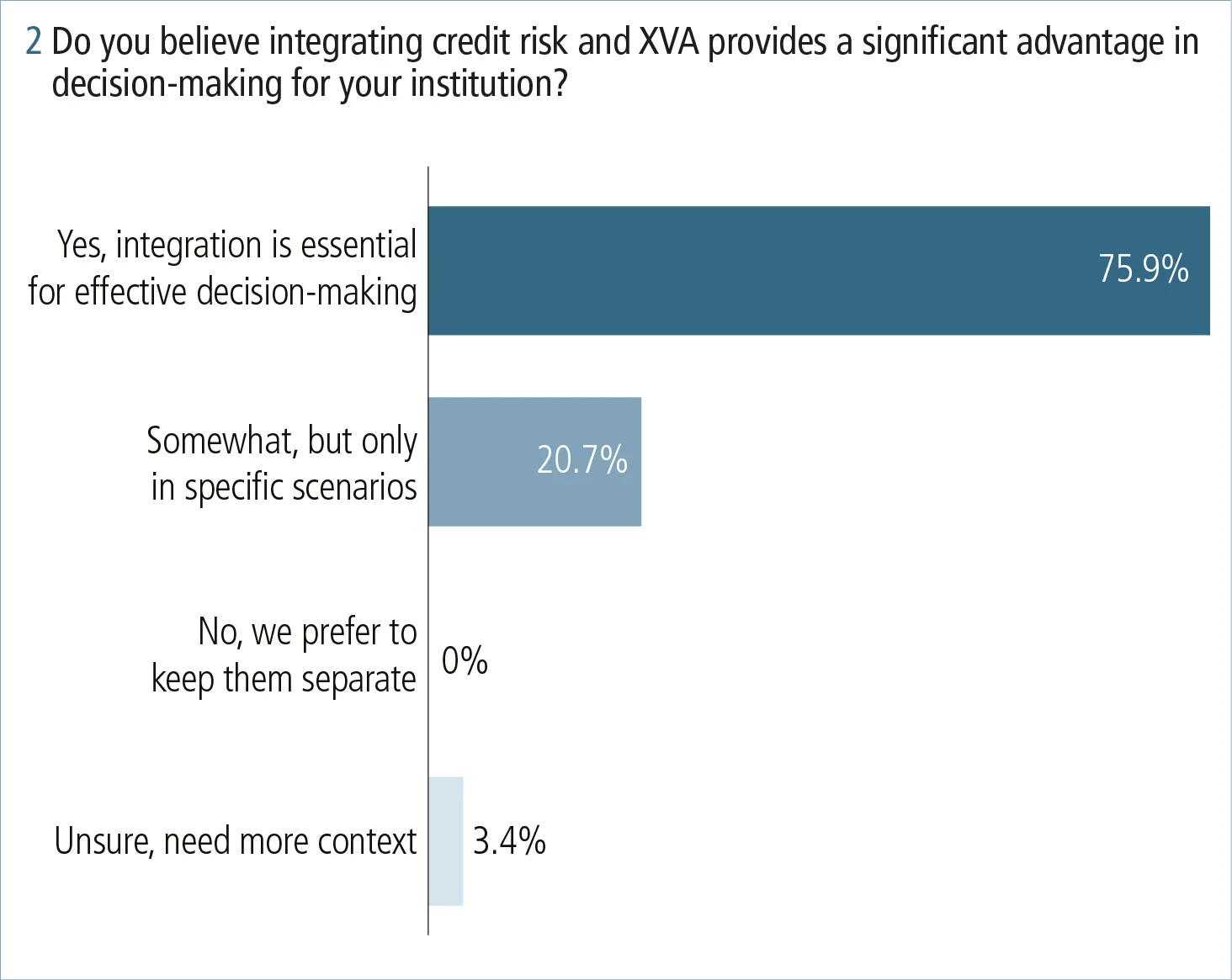

Despite the challenges,sentiment is shifting. A Quantifi & Risk.net webinar poll revealed that 76% of respondents see significant synergies in calculating PFE and XVA together. Only 3% disagreed or were unsure.

Many banks are increasingly willing to overlook the distinction between real-world and risk-neutral measures when calculating PFE,primarily due to the complexity of calibrating models under the real-world measure.

Another reason is that PFE isn’t a monetary metric like CVA. Its primary function is to support limit setting and enable exposure comparisons. Since the absolute value of exposure is less critical than its relative size, adding a consistent market price of risk to all exposures has minimal impact.

Quantifi: A Platform for the Future

Quantifi offers a robust Monte carlo engine supporting WWR and jumps-at-default for XVA and PFE calculations. They’ve seen growing demand from banks to implement PFE within the same system as XVA, using a shared calibration for market factors.

challenges of Integrating PFE into XVA

Integrating PFE into an XVA framework introduces challenges requiring advanced systems like Quantifi’s:

- Adding new trade types to XVA, such as interest rate and bond futures, and futures options.

- Addressing tail risk behavior,as PFE is a “tail” calculation and potentially more unstable than CVA.

- Implementing new or expanded CCR metrics, such as potential future bilateral exposure.

The future of bank risk management hinges on embracing these advanced techniques and potentially unifying PFE and XVA systems. The Archegos collapse served as a harsh lesson, and the industry must adapt to prevent similar disasters.

What are your thoughts on the future of bank risk management? Share your comments below.

The Future of Bank Risk Management: A Conversation with Dr. Anya Sharma

The Archegos Capital Management debacle sent shockwaves through the financial world, exposing cracks in how banks handle counterparty credit risk (CCR). Now, regulators are pushing for reform. But are banks truly ready? We sat down with Dr.Anya Sharma, a leading expert in financial risk modeling, to discuss the future of banking risk management and what it means for institutions of all sizes.

Time.news: Dr. Sharma,thanks for joining us. The article points to a major shift in how banks need to approach counterparty credit risk.What’s driving this change?

Dr. Sharma: The Archegos collapse was a major wake-up call. It vividly illustrated the dangers of inadequate potential future exposure (PFE) calculations, especially when wrong-way risk (WWR) is involved. Banks can’t afford to rely on outdated methods anymore. Regulators are right to push for more sophisticated approaches,incorporating WWR and even jumps-at-default into their models.

Time.news: For our readers who may not be deeply familiar with these terms, can you briefly explain wrong-way risk and jumps-at-default?

Dr.Sharma: Certainly. Wrong-way risk occurs when a counterparty’s creditworthiness deteriorates simultaneously occurring that the exposure to them increases. Archegos was a perfect example of specific wrong-way risk – their credit quality suffered as the value of their heavily leveraged positions plummeted, leading to massive losses for their lenders. Jumps-at-default refers to sudden, important market movements coinciding with a counterparty’s default. Ignoring these potential jumps can severely underestimate the true risk.

Time.news: The article highlights the Basel Committee’s reforms. Are these reforms a necessary evolution or an overreach?

Dr. Sharma: I believe they’re largely a necessary evolution. While the industry initially pushed back on some of the more prescriptive elements, the core message is sound: Current PFE approaches are insufficient.The fact that the Basel committee’s document referenced PFE 31 times, compared to only two mentions of XVA, speaks volumes about the urgency of the situation. Banks need to prioritize upgrading their PFE modeling capabilities.

Time.news: The article suggests PFE systems are increasingly resembling XVA (valuation adjustment) systems. Is a unified PFE/XVA system the ultimate goal?

Dr.Sharma: Ideally, yes. The argument for a unified system is compelling.A single platform simplifies implementation, improves consistency, and eliminates discrepancies between the two measures. As the article mentions, firms like Quantifi are already advocating for this approach. However, the transition isn’t easy, especially for larger institutions with legacy systems and entrenched organizational structures.

Time.news: What are the biggest challenges banks face in moving towards this unified approach?

Dr. Sharma: A key challenge is integrating new trade types and adequately addressing tail risk behavior.PFE, by its nature, is a “tail” calculation, making it potentially more volatile and harder to manage than, say, CVA (credit valuation adjustment). Also, many banks still use seperate systems due to established practices and concerns over the complexity of calibrating models under the real-world measure.

Time.news: The article mentions a survey suggesting that 76% of respondents see significant synergies in calculating PFE and XVA together. If the sentiment is so positive,why isn’t everyone making the leap?

Dr. Sharma: Sentiment is diffrent from action. there’s a gap between recognizing the potential benefits and actually investing the resources and time needed for a full overhaul.Moreover, some banks might lack the advanced systems required to handle the complexities of integrating PFE into an XVA framework.

Time.news: What practical advice would you give to banks looking to improve their risk management practices in light of these changes?

Dr. Sharma: First, prioritize understanding wrong-way risk and how it manifests in their specific portfolios. This could be specific WWR or even general WWR.Second, start exploring how to incorporate jumps-at-default into their risk models. While not always mandated, it’s a prudent step in ensuring a more accurate assessment of potential losses. carefully evaluate their existing systems and consider the long-term benefits of a unified PFE/XVA system. It may require a significant upfront investment,but the improved accuracy and efficiency will pay dividends in the long run. Don’t underestimate the importance of a robust Monte Carlo simulation engine.

Time.news: Any final thoughts for our readers on the future of bank risk management?

Dr. Sharma: The future of bank risk management demands a proactive and forward-thinking approach. The Archegos collapse wasn’t an isolated incident; it highlighted vulnerabilities that exist across the industry. By embracing advanced techniques, investing in robust systems, and fostering a culture of risk awareness, banks can strengthen their resilience and prevent future crises. The shift is not merely about regulatory compliance; it’s about safeguarding the financial system as a whole.