Financial Influencer Arrested in South Korea for $1.7 Million Stock Manipulation Scheme

A popular financial influencer operating a Telegram channel with 40,000 subscribers has been arrested in South Korea for allegedly generating $1.7 million in illicit profits through a refined stock manipulation scheme. The case highlights the growing risks associated with unregulated financial advice disseminated through social media and the vulnerability of investors to prior trading and misleading data.

The Seoul Southern Prosecutors’ Office announced the arrest on Thursday, following an inquiry into a “scalping” operation that exploited investor trust. Four of the influencer’s acquaintances have also been prosecuted for their alleged involvement in the scheme, which violated the Capital Markets Act.

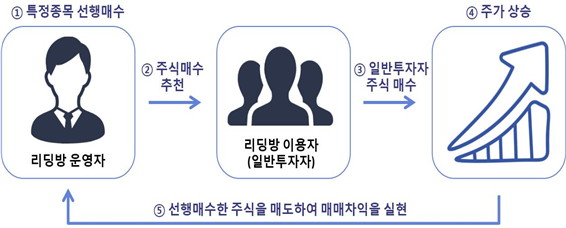

According to investigators, the influencer – identified only as “A” – built a dedicated following by engaging in so-called “reading acts,” sharing what appeared to be insightful and exclusive information about securities and market trends. Though, this information was demonstrably false and exaggerated, designed to artificially inflate stock prices.

From April 2018 to August 2023, “A” reportedly purchased stocks before recommending them to channel subscribers. This allowed him to capitalize on the subsequent surge in demand and price increases triggered by his recommendations. The scheme involved a total of 482 instances of prior trading,resulting in an estimated $2.2 billion won (approximately $1.7 million USD) in illegal gains.

“Mr. A committed a crime using a total of 17 accounts of himself and accomplice,and planned and executed the crime carefully by using the Vietnamese telephone number,” a senior official stated. This purposeful attempt to obscure his activities underscores the calculated nature of the fraud.

The prosecution collaborated with the Financial Services Commission and the Financial Supervisory Service (FSS) to swiftly secure evidence and track the flow of illicit funds.Authorities are now working to seize all criminal proceeds generated by the scheme.

“In the future, the Seoul Southern Prosecutor’s Office will try to establish the openness, soundness, and fairness of the securities market through the principle of independence of financial and securities crimes that take advantage of the loss of general investors,” the official added. This case serves as a stark warning to both financial influencers and investors alike, emphasizing the importance of due diligence and skepticism when relying on information from unverified sources.

The investigation is ongoing, and further details regarding the extent of the network involved in the scheme are expected to be released in the coming weeks.

Why, Who, What, and How did it end?

Why: The scheme was perpetrated to generate illicit profits through stock manipulation, exploiting investor trust and violating the Capital Markets Act.

Who: The primary perpetrator was a financial influencer known as “A,” who operated a Telegram channel with 40,000 subscribers. Four of his acquaintances were also prosecuted for their involvement.What: “A” engaged in a “scalping” operation, falsely and exaggeratedly promoting securities to inflate stock prices. He purchased stocks before recommending them to his subscribers, capitalizing on the subsequent price increases through 482 instances of prior trading.

How did it end?: The influencer was arrested by the Seoul Southern Prosecutors’ Office following an investigation. Authorities are working to seize the $1.7 million (2.2 billion won) in illegal gains. The investigation is ongoing, with further details expected to be released. The prosecution collaborated with the Financial Services