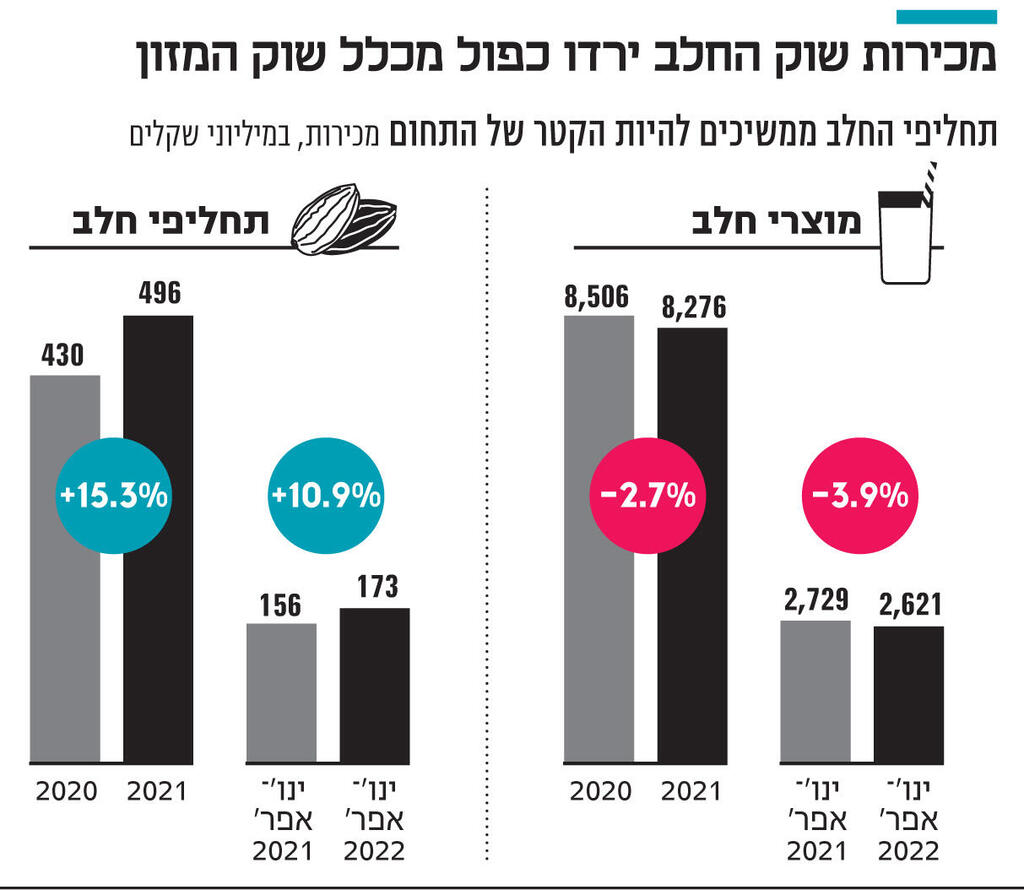

The surprising decline in sales was not recorded in expensive premium products, but is exceptionally noticeable in sales of basic products. Thus, sales of Nigerian milk beverages fell by 7.4% from January to April this year compared to the same period last year. The buds of the trend were already visible in 2021, when sales of dripping milk fell by 5.4%, precisely in the year in which the Corona crisis was recorded, which led the food market to a record sales. Sales in 2021 were only 3.1% higher than dairy sales in 2019, and it has already been difficult to reflect an adjustment to the natural growth rate of the population, which stands at about 2% per year.

2 View the gallery

Gad Ezra Cohen, the controlling owner of the dairies, and Tnuva CEO Eyal Melis. According to the Ministry of Economy, since 2005 there has been a 19% decrease in milk consumption

(Photos: Eyal Fischer, Uriel Cohen)

At the same time as Niger milk, sales of white cheese decreased by 9.4%, sales of packaged salted cheeses decreased by 10.8% and sales of packaged specialty cheeses decreased by 6.3%. The cottage, which is considered a flagship product in the category, lost 4.1% of its sales this year and the yogurt category lost 3.3%, despite the development of protein-enriched yogurt, whose prices are higher than the prices of basic yogurt. The decrease in sales was also recorded in the category of sweet fats, which lost 10.7% of sales compared to the same period last year. Butter, until two years ago the most sought-after product in the milk refrigerator, lost its luster and its sales fell by 5.4%, while cream cheeses fell by 2.1% and cheeses with a creamy texture lost 3.5% of sales.

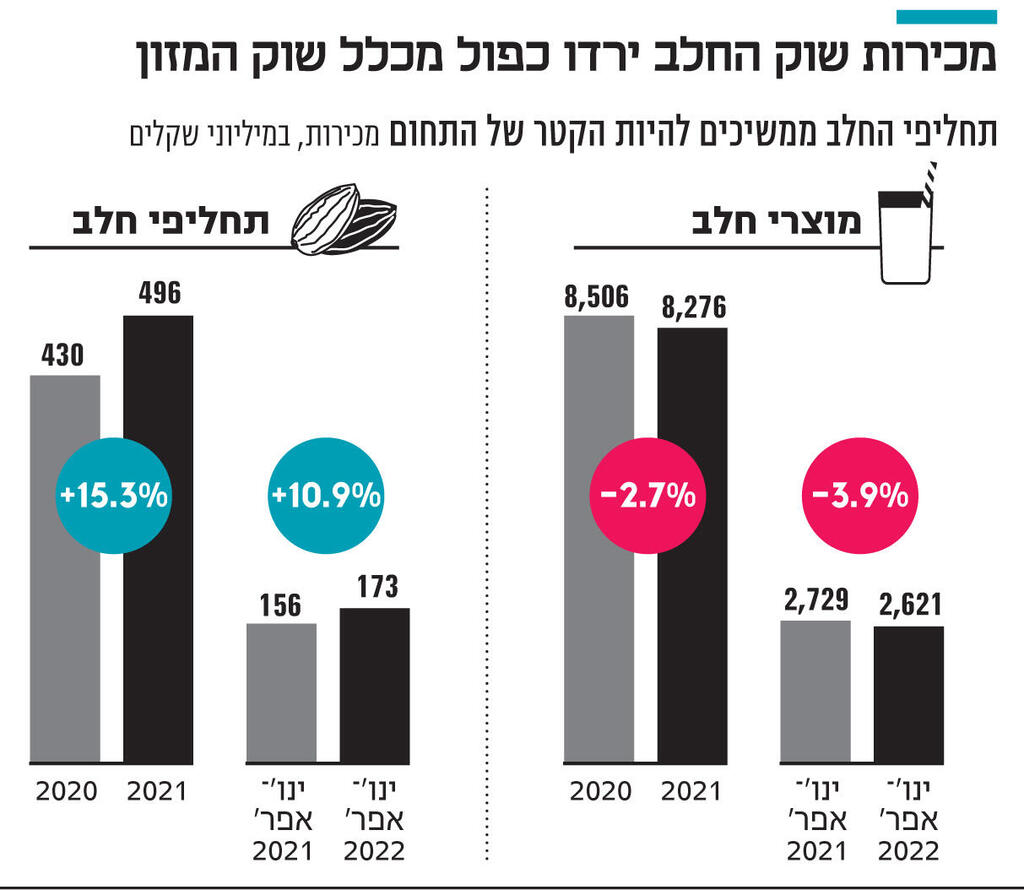

The sharp decline in basic products can be partly explained by the shift of consumers to milk substitutes, whose sales have been on a steady growth trend in recent years. Sales of milk substitutes grew by 58% from 2019 to 2021 and reached an annual volume of about half a billion shekels. Since the beginning of the year, these have grown by 10.9%.

The trend continued to be led by sales of non-soy-based substitute dairy beverages, such as almond, rice and oat milk drinks. Their sales have jumped 31% since the beginning of the year, following a 45.7% increase in 2021. Soybean sales, which jumped 23% in the corona year (2020), maintained their strength last year with a slight increase of 5% and from the beginning of the year increased slightly by 1.2 %.

2 View the gallery

Data from the Research, Economics and Strategy Division of the Ministry of Agriculture reveal that the decline in milk sales is deeper and more lasting than the emergence of milk substitutes. Thus, while the consumption of milk substitute drinks per capita in Israel jumped by about 300% between 2020 and 2005, the consumption of Niger milk and its drinks in those years fell by about 19%. The ministry’s data show that the price of milk substitute drinks, which is tens of percent higher than the price of regular milk, is on the decline in the long run – in the last decade rice-based drinks have fallen by 28%, oat-based drinks have fallen by 27% and milk-substitute drinks On the basis of almonds were reduced by about 17%. This is probably due to increased competition in this area.

The ministry’s data also shows that similar to the prevailing perception among the public, the central area is a leader in the consumption of milk substitutes, with the Tel Aviv area and its surroundings leading the way with a consumption of about 5.44 liters of milk substitutes per capita. This is compared to only 1.9 liters in the southern region, and only 1.2 liters per capita in the northern region (excluding Haifa). The data also show that among the ultra-Orthodox sector, which constitutes about 13% of the Israeli population and grows at twice the rate of increase in the general public, the consumption of milk substitutes is significantly reduced than among the general public: milk substitute drinks accounted for only 3%. – 8% in the general public.

Tnuva is leading the growing market for substitutes, with an alternative brand based on fresh products, which holds 63.2% of sales. By a large margin, Strauss stands with the Alpro brand, which offers durable products and holds 17.8% of sales. The main company’s Terra Dairy (Coca-Cola Israel) has not yet become a significant player in the replacement arena and it holds a 2.6% share of sales, a decrease of 12% since the beginning of the year.

In an attempt to bite into Tnuva’s sales, Strauss is now investing NIS 150 million in setting up a factory to produce fresh milk substitutes, while Tnuva has invested NIS 50 million last year in building a second floor for its Sui Magic milk substitute factory. The high investments of the companies are due, among other things, to the high profitability that the milk substitutes provide them with, unlike the regular dairy products.

While Tnuva is leading the growth in the milk substitute market, whose sales are close to half a billion shekels, it is losing market share in the dairy market, which rolled in 8.3 billion shekels last year, in favor of Strauss. The latter is almost inactive in the categories under the price control order, so it enjoys high profitability in dairy operations. Tnuva, which dominated the dairy market over the years and held 57.2% during the social protest about a decade ago, gradually lost market share, until in August 2018, its market share fell below 50%, and in 2019 it held 49.5% of the market.

Since the beginning of the year, Tnuva’s market share has fallen to 48.4%, compared with 48.7% in the corresponding period last year. Strauss, on the other hand, did the opposite and grew from 25.9% in 2019 to 27.2% since the beginning of the year. Thus, for example, the decline in Niger milk sales was led by Terra with a 10% decline in sales, while Tnuva fell by 8.5%. In the lucrative delicacy arena, which has been on a downward trend in recent years, Tnuva Vetra lost 14.9% and 7.3%, while Strauss scooped the whipped cream with 7.2% growth in sales.

The one who experienced the sharpest decline of the three largest dairies is Tara, which is having a hard time rising even after 9 years since the establishment of the new dairy in the Negev with an investment of about NIS 1 billion. The dairy, which held a market share of 11.8% in 2019, dropped to a share of 10.5% this year. In an effort to improve its profitability, the dairy has reduced activity in supervised categories and tried to focus on more profitable categories. The results of the strategy were reflected in certain categories, such as a 24% increase in terra sales in the milk beverages category, which fell by 2.4% from January to April compared to the same period last year. In the yogurt arena, too, Tara grew by 1.7%.

Another victim of the decline in the dairy market was Gad Dairy, the fourth largest in the market, which operates only in the arena of premium products. Gad enjoyed the transition of consumers to home cooking in the corona year, and was significantly hurt by the return to routine. The dairy’s sales fell by 10.5% from January to April this year, and the company’s market share decreased to 4.4% compared to 4.7% last year.

On the other hand, the private labels of the chains and the importer of net yellow cheeses were not affected by the decline in market sales. Net sales recorded a marginal decline of 0.4% from the beginning of the year, so that its market share rose to 1.5% of the total market. Private label sales jumped 3.9% and its market share to 2% of sales, compared to 1.8% last year. Of the small players in the dairy market, Willy Food, controlled by brothers Zvika and Yossi Williger, suffered the hardest blow. Willy Food’s market share, which jumped from 1.4% to 2% in the corona year, has fallen to just 1.5% since the beginning of the year.

The “arms race” of the two market leaders in Israel, Tnuva and Strauss, is based, among other things, on the growth data of milk substitutes in the world. According to the Ministry of Agriculture, in 2020 milk substitutes were sold worldwide for about $ 16.9 billion, an increase of 4% from 2019. Despite a 2% decrease in consumption of milk substitutes in Asia, it is still the leading region in the volume of milk substitutes sales, with about – $ 9.4 billion in 2020. In North America, as in Western Europe, milk substitute consumption jumped by about 17% and 11%, respectively, with sales of about $ 3.2 billion and $ 2.6 billion in 2020. In the United Kingdom, the rate of increase was high. Most in the consumption of milk substitutes among European countries, while in Germany the consumption in terms of monetary sales is the highest (396 million euros).

The growth of the milk substitute market, although still a niche in relation to the volume of regular milk activity, makes it easier for dairies to cope with a continuous rise in the price of raw milk, which has already led the Prices Committee to recommend to finance and agriculture ministers to raise the price by 8%.

But the ministers have refrained from adopting the recommendation that has been on their table for about three months, with another threat to the price imminent. It is estimated that due to the sharp rise in the prices of food mixes for cows, the price of milk will jump sharply in the next update in early July, which will jump the price of a liter of raw milk to about NIS 2.4 per liter. The dairies will then be forced to reach an outline agreed with the state on the rate of increase in the prices of regulated products, or they will petition the High Court against the ministers who refuse to make a decision.