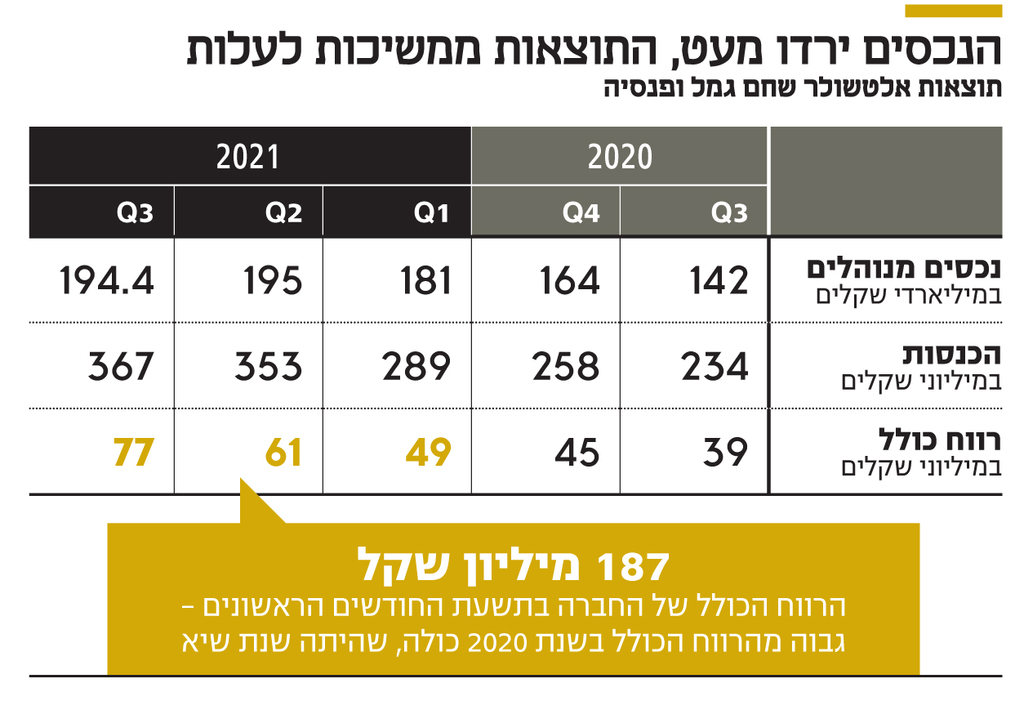

Altshuler Shaham Provident and Pension presents the best quarter in its history, with results that from the beginning of the year surpass those achieved in previous years in full. This is despite the fact that for the first time since 2016, the company’s assets were stagnant, and even suffered a minor decline.

The company’s reports, published yesterday, show that its revenues in the third quarter amounted to NIS 396.9 million – a jump of almost 70% compared to the corresponding quarter. These are the highest quarterly revenues for it. Most of them, NIS 394.1 million, came from (net) management fees collected from funds Provident and pension funds In the first nine months, revenues for the first time amounted to more than NIS 1 billion, and revenues from management fees also crossed this threshold.

This is a 60% increase compared to the corresponding period, and is due to increases in assets under management and deposits. These were offset by a decrease in management fees, mainly because Altshuler Shaham Provident and Pension Pension Fund is a default fund, selected in a state tender based on a low management fee offer.

Read more in Calcalist:

The increase in revenue is also attributed to the acquisition of Psagot, which increased the company’s assets. Last February, Altshuler purchased the investment house from the Apax Fund, which is managed in Israel by Zehavit Cohen, for NIS 910 million. And the pension of Psagot owned by Altshuler Shaham is NIS 44.2 billion, while the assets of Altshuler Shaham amount to NIS 194.4 billion, so that the company’s total assets amount to NIS 238.6 billion – an increase of 67% compared to the beginning of the year.

Excluding Psagot’s assets, the volume of managed assets of Altshuler Shaham Provident and Pension decreased by NIS 600 million in the third quarter of the year. At the end of the quarter, assets amounted to NIS 194.4 billion, compared with NIS 195 billion in the second quarter. Although this is a minor decrease of 0.3%, Altshuler Shaham is the provident company that has shown meteoric growth compared to competitors in the local provident market over the years, and customer departure is a new situation for it.

2 View the gallery

In the third quarter, Altshuler Shaham Provident and Pension presented negative net income and accumulation, mainly due to the departure of savers in the study funds, a significant means of saving for the medium term. The company’s total number of members at the end of the third quarter was 1.67 million active customers, compared to 1.65 million in the second quarter. At the beginning of the year, the number of customers was 1.55 million. In the third quarter, the number of customers in the study funds shrank slightly, from 389,000 savers to 387,000 savers. At the beginning of the year, their number was 368.5 thousand.

For the first time: the market share of pensions exceeds 5%

The provident funds, which constitute most of the company’s assets, increased to NIS 166.5 billion, excluding Psagot’s assets. This is an increase of 13% compared to the end of 2020 and a decrease of 1.5% compared to the previous quarter.

The company’s market share in the camel market, excluding peaks, is 25.6%. At the beginning of the year this share was 24% and in the previous quarter 26.5%. If Psagot’s assets are taken into account, then the market share of Altshuler Shaham Provident and Pension in the provident market is more than 33%. Each of the data positions it as the largest player in the field by a significant margin.

The company’s pension assets amounted to NIS 27.9 billion – an increase of 59.6% since the beginning of the year and 7.7% from the previous quarter. Its market share in the pension market rose for the first time to just over 5%.

Even after neutralizing a NIS 117.3 million contribution from Psagot to the line of income from management fees, Altshuler Shaham Gamel and Pension shows a significant increase in revenue to NIS 917.2 million in the first nine months, an increase of 42%.

The total profit in the third quarter was NIS 77 million, almost double compared to its counterpart, with NIS 38.9 million. This is the highest quarterly profit in its history. In the first nine months, the total profit was NIS 187 million – an increase of 96% compared to the corresponding period, and more than the total profit in all previous full years. For comparison, in 2020, which was a record year in this line, the total profit amounted to NIS 138.3 million.

Yair Levinstein, the company’s CEO and one of its partners, told Calcalist about the weakness in the provident fund that “data can not be argued”, but in the same breath he said that the company believes that pension growth will cover growth in provident fund and this will become the main growth engine in years Coming. Next year, he will also benefit from the synergy of merging Psagot’s provident funds, and we will show how beneficial this deal was. “

The company’s market value is one billion shekels far from the peak

Altshuler Shaham Provident and Pension shares responded to the reports moderately, against the background of concern in the Omicron markets. Since the beginning of the year, the share has risen by only 6%, while the TA-125 index rose by almost 25% and the TA-Finance index rose by 46 The source of the gap is the exit of funds from Altshuler Shaham due to weak returns from competitors this year. Altshuler Shaham Provident and Pension increased its exposure to the stock market by 1.5%, and reduced its exposure to foreign exchange by 4.5%.

The company’s market value, NIS 3.4 billion, is three times the value it was issued in 2019, but far from the peak it reached last May, NIS 4.4 billion.

2 View the gallery

Yair Levinstein, CEO of Altshuler Shaham Gamel

(Photo: Press)

.