2023-04-24 04:00:00

Frankfurt For the chemical company BASF, 2022 turned out to be a year of nasty surprises. It started out strong operationally, but ended painfully: Sales and earnings in the chemicals business fell, plants had to be shut down and the record amount of more than six billion euros on the Russian activities of the energy subsidiary Wintershall Dea had to be written off.

For the second time in just three years, company boss Martin Brudermüller has to present a loss to the shareholders at the general meeting on Thursday. Bitter is: For 2023 there are signs of further operational losses.

With sales of EUR 87 billion and operating profit of EUR 6.5 billion, BASF can still present itself as the largest and nominally most profitable company in the Western chemical world.

However, the chemical giant no longer lives up to its claim of being a company with profitable growth. The Handelsblatt balance sheet check makes this clear. Between 1990 and 2012, BASF was able to triple its sales and increase its operating profit approximately sixfold. But since then the group has made practically no progress.

While the use of capital increases, the earnings trend tends to be downwards. In Europe, the group now has to adjust to permanently higher energy costs, and in the business with basic chemicals and plastics there is a risk of a longer phase of weakness due to overcapacities.

At the same time, the geopolitical risks put the BASF business in a new light. The expansion strategy in China, which was still undisputed a few years ago and where BASF wants to build a new large chemical complex, is now being pursued with greater skepticism by analysts and investors due to the experiences in Russia and the tensions between China and the USA.

There is much to suggest that the chemical giant can only buy new growth with greater risk and greater uncertainty. All of this is ultimately reflected in the modest stock market performance. Since Brudermüller took office five years ago, the group has lost around 42 percent of its value on the stock exchange – even more than the Bayer group, which was plagued by glyphosate lawsuits.

The BASF boss, whose contract expires at the 2024 AGM, has a lot of hard work ahead of him in his last year at the top of the group in order to lay the basis for a trend reversal and regain some trust.

1. Earnings development: Value correction leaves red numbers

The chemical company was able to increase its sales by a strong eleven percent in 2022. But this growth masks the weaknesses. Because it resulted exclusively from rising prices and positive currency effects.

Sales, on the other hand, fell by seven percent, due among other things to the shutdown of plants as a result of the energy crisis. Over the past five years, BASF has achieved virtually no increase in sales volumes, while the global economy has grown by around 11 percent and global chemical production by 13 percent over this period.

In addition, the price increases were not enough to fully pass on significantly increased raw material and energy costs to customers. The operating profit before special items therefore fell, contrary to sales, by 11 percent to 6.9 billion euros, while earnings before interest and taxes (EBIT) were 15 percent below the previous year at 6.5 billion euros. The operating margin deteriorated by more than two points to 7.5 percent.

In the meantime, the huge write-down of 6.5 billion euros on Wintershall Dea’s activities in Russia was reflected in the net profit. In addition, there were rising financing costs and a slightly higher tax burden. Overall, the bottom line was a deficit of almost 400 million euros before and 627 million euros after third-party shares.

If one excludes the Wintershall effect and a few smaller one-off charges, from BASF’s point of view, however, there is a slight increase in adjusted earnings of three percent to EUR 6.96 per share.

The bottom line is that the group should close the current year with a clearly positive result of more than three billion euros. Operationally, however, further losses are becoming apparent. Operating profit before special items deteriorated by around 31 percent in the first quarter.

For the year as a whole, the Group is once again forecasting a sharp drop in earnings for its basic chemicals and plastics businesses and a predominantly moderate drop in earnings for the specialty chemicals divisions. Only the agricultural sector is likely to grow slightly thereafter.

On this basis, analysts have so far assumed a decline in adjusted operating profit by around a quarter to 5.1 billion euros. The operating margin of the BASF Group should then deteriorate to around six percent.

2. Sectors: plastic margins are falling, agriculture is increasing

As far as the performance of the individual business segments is concerned, the emphasis has shifted in favor of the specialty chemicals areas. In the traditionally profitable business with basic chemicals, the operating profit fell by more than a third, the plastics division (Materials) earned around a quarter less than in the previous year.

In contrast, the agricultural division, which had been rather disappointing in previous years, shone with a 25 percent increase in sales and a good 70 percent increase in operating earnings. For the first time, it has reached the earnings level of 2017, when BASF expanded the business by acquiring parts of the Bayer seed business.

Despite higher raw material prices, the Group is also posting increases in earnings for the Surface Technologies (paints, catalysts), Nutrition Care (precursors for food and cosmetics) and Industrial Chemicals divisions. However, the operating margins have also declined in some areas in the specialty chemicals area and continue to appear unsatisfactory in relation to the capital employed and earlier expectations.

3. Wintershall Dea: From profit maker to burden factor

The oil and gas business has long been a lavish source of income for the BASF Group. However, exiting the business is proving to be difficult, and the war in Ukraine suddenly made the majority stake in the energy subsidiary Wintershall Dea 2022 a stress factor.

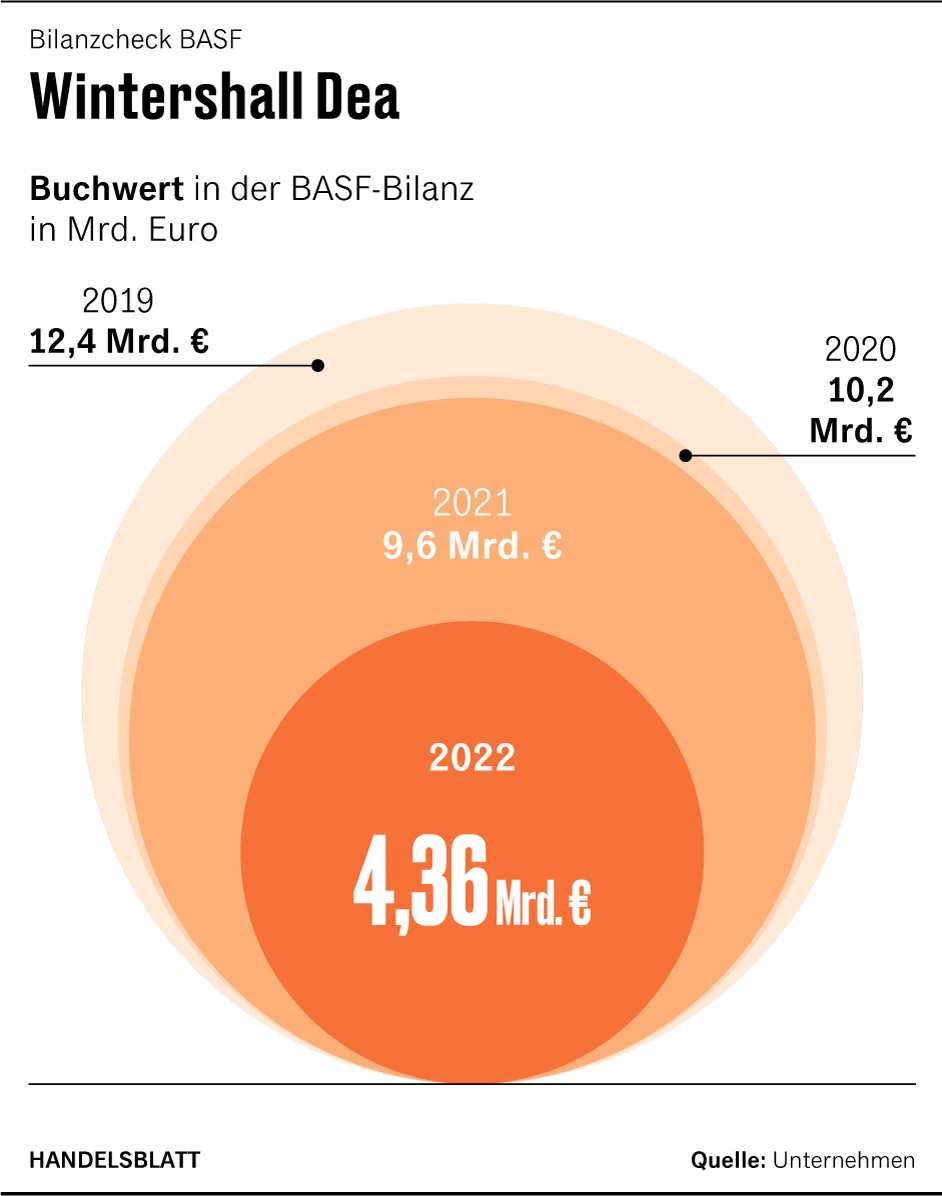

BASF had to react to the de facto expropriation of the Russian activities with a severe value adjustment of 6.5 billion euros on its almost 73 percent stake in Wintershall Dea. In the balance sheet, the participation is now only 4.4 billion euros.

However, there is some evidence that Wintershall Dea’s actual loss in value is not quite as severe as the write-down suggests. After all, the company’s non-Russian activities have tended to increase in value and earning power due to the sharp rise in gas prices.

Measured against the current valuation ratios of other medium-sized oil and gas producers, Wintershall Dea could theoretically achieve a low double-digit billion valuation in the event of an IPO. For BASF, that would still result in proceeds of seven to eight billion euros.

4. China: Growth opportunity with risk

With the construction of a large new plant in the southern Chinese city of Zhanjiang, BASF is driving forward its expansion in China without making any compromises. The ten billion project will be a focus of investments in the next few years.

The huge market volume in China and the expected further growth of the Chinese chemical market speak in favor of expansion. Since 2017, BASF’s sales in China have almost doubled to 11.6 billion euros. Operating income has weakened recently, but was higher than the BASF average.

On the other hand, there are the growing geopolitical risks that could arise, for example, from a conflict over Taiwan. In the BASF financial statements, the Chinese plants and investments are currently valued at almost 6.5 billion euros. This corresponds to around 17 percent of the comparable total assets of the group.

A loss of engagement in China, for example due to a conflict over Taiwan, would therefore be bitter for the chemical giant, but still manageable on its own. However, the financial commitment will increase significantly with the construction of the new plant over the next few years.

5. Finances: free cash flow under stress test

BASF traditionally generates a relatively strong cash flow and was able to demonstrate this again in 2022 with an increased cash inflow from operations of EUR 7.7 billion. Despite the energy price crisis, free cash flow (after investments in property, plant and equipment) only fell by a tenth to EUR 3.3 billion and was therefore sufficient to finance the dividend.

In the next few years, however, the operative financial strength of the BASF Group will be put to the test. Because while the margins in important parts of the chemical business continue to deteriorate, the group is planning significantly increasing investments in property, plant and equipment, including for the new plant in China and the expansion of capacity for battery materials.

For 2023 alone, around 6.8 billion euros have been budgeted for new property, plant and equipment, around 50 percent more than in the previous year. Almost 29 billion euros are planned by 2027, compared to 19 billion euros in the last five years.

This poses the risk that the free cash flow will no longer be sufficient to finance the previous amount distributed. If BASF wants to keep the dividend, the group will either have to generate additional funds from partial sales or it will have to take on more debt.

6. Competitor comparison: return and valuation deficit

With a drop in operating profits of only 15 percent, the BASF group ultimately mastered the energy crisis better than many of its competitors. As a result, the Group’s operating margin has fallen less than the industry average and is still respectable in relation to the domestic competition.

In an international comparison, however, there is still a drop in returns, especially compared to many specialty chemical companies.

In the business with higher-value chemical products, for example in the Nutrition & Care area, the Group continues to struggle overall to raise profitability to a higher level. So far, Brudermüller’s strategy of giving the BASF divisions greater flexibility has had little effect. The restructuring programs lag behind the cost trend. There is much to suggest that important parts of BASF’s business are managed suboptimally and that the corporate structure may no longer be right.

Ultimately, this also reflects the disappointing market valuation. With a market capitalization of EUR 45 billion, BASF is hardly rated any higher than smaller competitors such as Dow or Corteva. Compared to the MSCI World Chemical Index, BASF shares have underperformed by a full twelve percentage points per year over the past five years.

In order to make up for this deficit, the chemical company needs a sustainable turnaround in earnings development. But that is hardly in sight for the time being.

More: Corporations still believe they can separate business and geopolitics. This naivety will take revenge

#Balance #sheet #check #chemical #giant #BASF #growth #dilemma