Notice: Potential currency fluctuations can affect returns.

Notice: Past performance or simulations are not a reliable indicator of future performance.

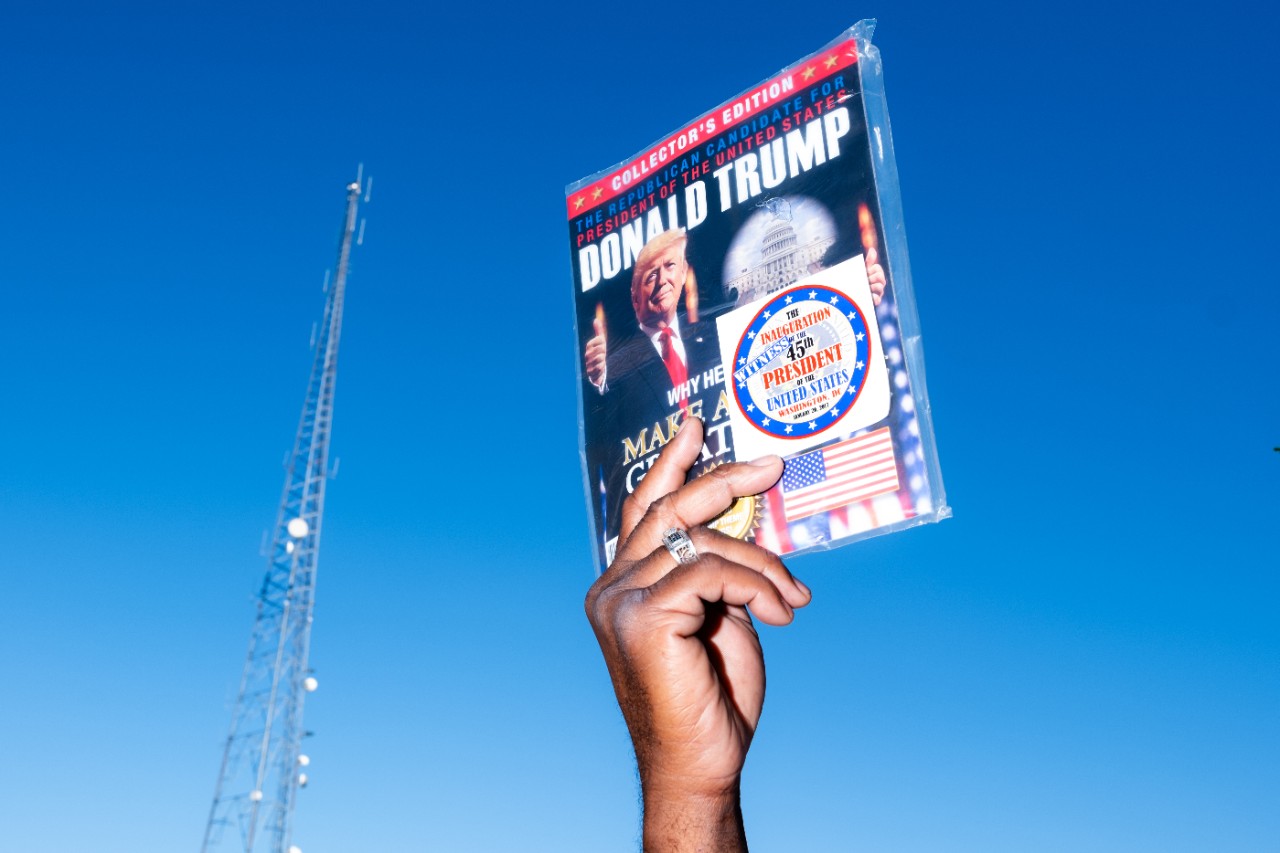

Bitcoin price rises above $76,000 – all-time high after Trump‘s US election victory

With Donald Trump as head of state, investors are expecting a crypto-friendly government in the future and therefore further price increases. Trump’s movement to include the industry has worked to gain additional voter favor and gain political capital. So Bitcoin is the winner of the US presidential election.

A new regulatory era for Bitcoin in the United States of America is envisioned – Trump must follow his promises with actions

A new era for the crypto industry in the United States will begin from January at the latest. The fact that Bitcoin (USD) and Co have found a place in the US election campaign for the first time again emphasizes the importance of the asset class and shows that it is here to stay.

Donald Trump must now be measured by the promises he makes. If, as announced, Trump fires SEC Chairman Gary Gensler, who has a restrictive stance towards Bitcoin and Co, and replaces him with someone who is friendly to crypto, this should be very welcome in the industry. The introduction of Bitcoin’s strategic reserve could also be grist for investors’ mills. Basically there are question marks attached to every plan. The bar is already very high and the potential for disappointment in this context is palpable.

Investors relieved by quick election results – $80,000 mark in sight

Firstly, investors are likely to be particularly relieved by a quick election result. There would be more uncertainty because of a stake and therefore there might be further turmoil in the market.

Investors may soon head for the psychologically important $80,000 mark. Clearly, investors didn’t seem to have enough crypto assets yet. Risk appetite may therefore remain high, particularly as capital market interest rates are likely to continue to fall globally. Already this Thursday, the US Federal Reserve (nourished) together to decide the future shape of monetary policy. Investors are currently betting on an interest rate cut of a quarter of a percentage point to 4.50 to 4.75 percent.

POSSIBILITIES OF IMPLEMENTATION WITH SNOW OUT CERTIFICATES

If you are on the seller’s side (put) (ISIN: DE000A22Y6M7) and think that Bitcoin will fall in the future, it may be interesting to confirm knocks from IG with a knocking level above the current resistance zone of the chart at $80,000. Conversely, Bullish (call) traders (ISIN: DE000A22ZFT5), on the other hand, could keep an eye on knock-out levels below $20,000.

Want to trade Bitcoin on your own? Decide whether you want to take a long or short position for yourself and open your own CFD trading account or practice trading with our CFD demo account.

Interview between Time.news Editor and Crypto Expert

Time.news Editor: Welcome to our live interview! Today, we have the pleasure of speaking with a distinguished expert in cryptocurrency, Dr. Linda Shaw. Thank you for joining us, Dr. Shaw!

Dr. Shaw: Thank you for having me! I’m excited to dive into the latest developments in the crypto space.

Time.news Editor: Let’s start with some exciting news—Bitcoin recently soared above $76,000, marking an all-time high, especially following Donald Trump’s election victory. What do you think contributed to this price surge?

Dr. Shaw: That’s a significant milestone for Bitcoin! The surge can largely be attributed to investor optimism around a potential crypto-friendly government under Trump. His campaign has increasingly embraced the crypto industry, which signals to investors that there could be favorable regulatory changes ahead.

Time.news Editor: Exactly. We’ve seen a shift in how mainstream politics interacts with crypto. How do you envision this new regulatory era under Trump, especially regarding the SEC?

Dr. Shaw: Well, if Trump follows through on his promise to remove SEC Chairman Gary Gensler, it could be a game-changer. Gensler has been seen as restrictive toward crypto, and replacing him with someone more open-minded about digital assets could generate a wave of confidence in the market. This could lead to clearer regulations and more innovation in the industry.

Time.news Editor: That’s a fascinating insight! Many investors are hopeful but also cautious. There’s a notice about potential currency fluctuations affecting returns. How should investors approach this volatility?

Dr. Shaw: Investors should always be mindful of volatility in the crypto market. This means having a diversified portfolio and not putting all their funds into one asset like Bitcoin. It’s also wise to stay informed about market trends and regulatory news, as these can have immediate impacts on prices.

Time.news Editor: Good advice! You mentioned the strategic significance of Bitcoin in the political landscape. What long-term impact do you foresee if cryptocurrencies gain more political traction?

Dr. Shaw: If cryptocurrencies continue to gain political support, we could see a significant evolution in their adoption and use. This could pave the way for integrating crypto into traditional financial systems, potentially leading to greater stability and mainstream acceptance. However, this depends on ongoing support from policymakers and regulators.

Time.news Editor: Given all this, what should investors look out for in the coming months, especially with Trump’s administration possibly making key decisions regarding cryptocurrency?

Dr. Shaw: Investors should closely monitor any announcements related to the SEC, as well as Trump’s specific plans for crypto regulation. Additionally, initiatives like the introduction of a strategic reserve for Bitcoin may warrant attention, as they could provide significant buying opportunities or introduce new operational dynamics in the market.

Time.news Editor: do you think we can consider Bitcoin a long-term asset, or is it still in a speculative phase?

Dr. Shaw: I believe Bitcoin is transitioning into a more established asset class. However, calling it fully mature may be premature. There will always be elements of speculation in cryptocurrency. But as regulatory frameworks solidify and adoption accelerates, I expect to see Bitcoin stabilize more within the investment landscape.

Time.news Editor: Thank you, Dr. Shaw, for your insights! The evolution of cryptocurrency, especially under the current political climate, will be fascinating to watch. We appreciate your time today!

Dr. Shaw: Thank you! It was a pleasure discussing these developments with you.