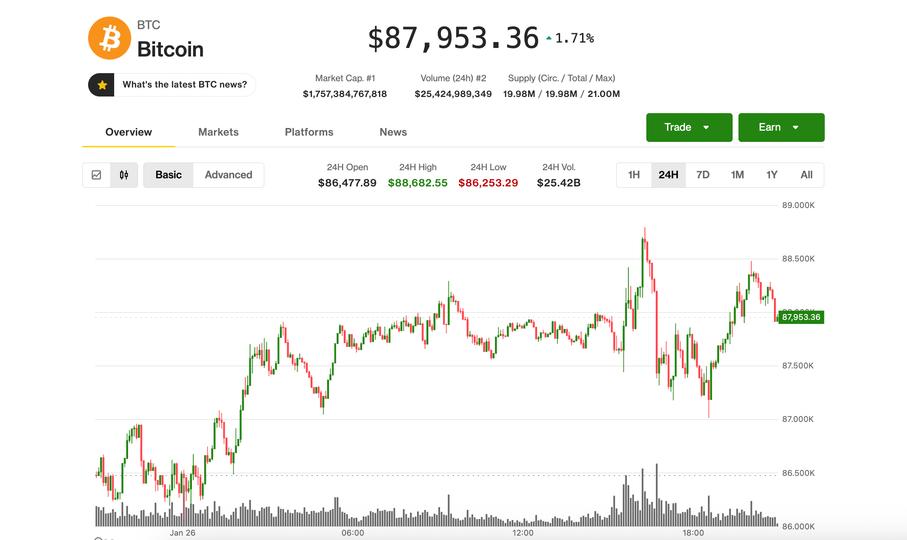

NEW YORK, January 29, 2024 – Bitcoin is stuck in neutral around $88,000, a curious pause as gold and silver recently blasted through record highs before easing back slightly, leaving crypto investors wondering what gives.

Gold’s glow-Up and Bitcoin’s Sidestep

Table of Contents

Precious metals are surging, while Bitcoin struggles to break free from a recent pattern of weekend sell-offs.

- Analysts predict Bitcoin will likely remain range-bound between $85,000 and $94,500 in the near term.

bitcoin is currently trading a bit higher than after a bout of “panicky weekend selling,” but remains below the roughly $90,000 mark it reached late Friday.The growing possibility of a government shutdown by january 31-and the resulting squeeze on market liquidity-was a major factor in Sunday’s selloff. but that same news barely registered with precious metals investors.

Gold surged past $5,000 and then $5,100 for the first time ever on Sunday and Monday, while silver raced as high as $118.Though, signs of exhaustion are emerging. Gold has retreated to $5,043, still up 1.3% for the day, and silver has fallen back to $108, a gain of 7%.

“Gold and silver casually adding an entire bitcoin market cap in a single day,” wrote crypto analyst Will Clemente on X, succinctly capturing the sentiment among many Bitcoin investors.

The U.S. dollar index (DXY) slid to its weakest level since September, as the U.S. Federal Reserve and the Bank of Japan reportedly collaborated to intervene in currency markets, aiming to strengthen the yen against the dollar. The dollar is down more than 1% on Monday,trading at 154.07 per yen.

Bitcoin’s Range-Bound Future?

The lack of upward momentum in Bitcoin,despite the weakening dollar,has made traders cautious,according to analysts at Swissblock. “Recent price action has reinforced the bearish outlook,” they said in a Monday note. They warned that a decisive drop below $84,500 could trigger a deeper correction toward $74,000. However, they added that if this support level holds while risk metrics subside, it could present a buying opportunity.

Bitfinex analysts echoed this cautious view, predicting that Bitcoin will likely remain range-bound between $85,000 and $94,500. They also noted shifts in the options market, with traders reacting tactically to short-term risks rather than anticipating long-term volatility. This suggests traders are “pricing transitory risk rather than a sustained disruption to market structure,” they wrote in a monday note.

Persistent selling from spot Bitcoin ETFs is adding to the downward pressure. Cumulative outflows have exceeded $1.3 billion over the past week,indicating a lack of investor appetite for risk.

Shutdown Threat Looms Over Crypto Legislation

Jim Ferraioli, director of crypto research and strategy at Schwab, doesn’t foresee a sustained price increase beyond current levels without improvements in on-chain activity, ETF flows, derivatives positioning, and miner participation.

He believes the passage of the clarity Act could be a notable catalyst, but that’s now threatened by the potential government shutdown. Until the legislation is approved, he anticipates trading will remain confined between the low $80,000s and mid-$90,000s, as major institutional investors stay on the sidelines.

What factors could move Bitcoin beyond its current trading range? According to Schwab’s Jim Ferraioli, a sustained price increase requires improvements in on-chain activity, ETF flows, derivatives positioning, and miner participation, alongside the passage of the Clarity Act.