AI Power Shift: Google and Anthropic Challenge OpenAI’s Dominance

The once-uncontested reign of OpenAI and ChatGPT in the artificial intelligence landscape is waning, as Google’s Gemini 3 and Anthropic’s Claude models gain significant traction, fueled by user feedback and growing web traffic.

The start of the 2025 school year has brought a clear observation: the AI market is no longer dominated by OpenAI as it once was. Successive, and often disappointing, launches of GPT-5 and its variations have coincided with a surge in popularity for Google’s Gemini 3 and Anthropic’s Claude. This shift is reflected in web traffic data, with Gemini experiencing “meteoric growth” while ChatGPT sees a notable slowdown, according to analysis from mid-January. “Google has the models, the resources to improve them, and now the means to deploy them massively,” one analyst summarized.

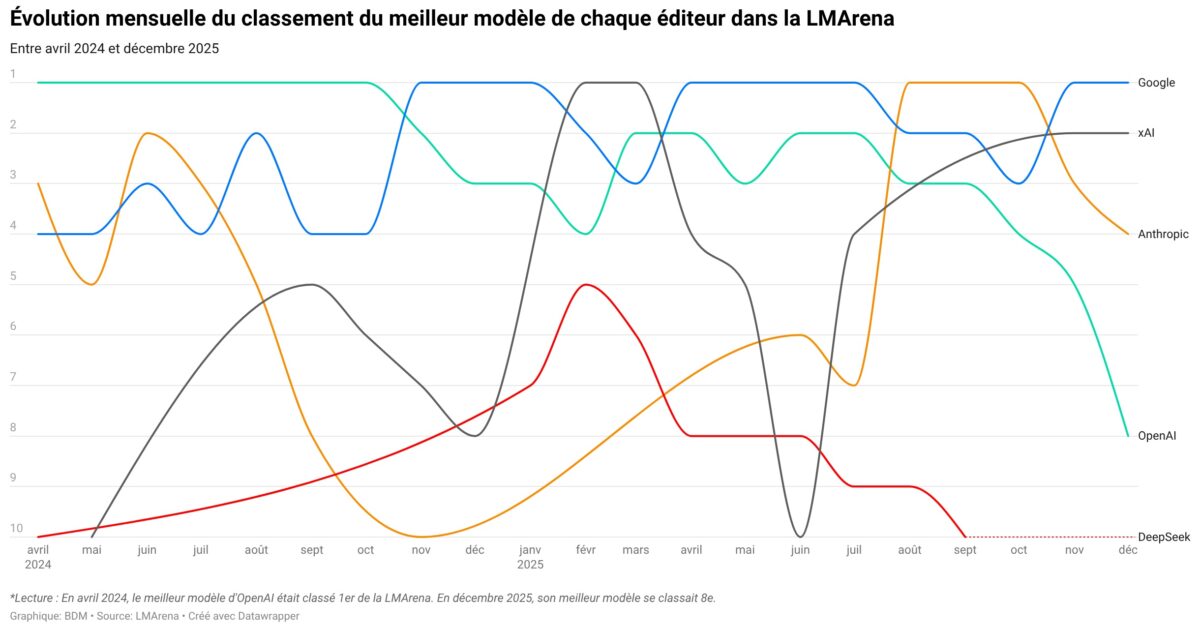

To quantify this changing dynamic, a detailed analysis of nearly two years of data from LMArena was conducted. This system ranks AI models based on performance, utilizing blind user votes compiled monthly by BDM since April 2024. The results reveal a striking evolution. While OpenAI remains a prominent force in the rankings with its various GPT versions, Sam Altman’s company has gradually relinquished its top position to competitors, most notably Google.

LMArena provides a weekly snapshot of the best AI models, based on user feedback. BDM has consistently shared these monthly snapshots with its readership, and this historical data has been used to analyze the evolution of the major AI model publishers over the past two years.

OpenAI’s Grip Loosens

Between April 2024 and December 2025, OpenAI established itself as the leading AI player and continues to be the most frequently ranked model in LMArena’s monthly assessments. Appearing in the top 10 a total of 80 times over the 21-month period, OpenAI significantly outpaces its rivals: Google (Gemini) with 56 appearances, Anthropic (Claude) with 21, xAI (Grok) with 15, and the Chinese DeepSeek with 10. Eight other publishers have achieved occasional appearances, including Alibaba (4 times), Meta (3 times), and Tencent (1 time).

OpenAI’s consistent presence in the top 8 reflects a historical reality. For much of 2024, GPT models simply outperformed the competition. Beyond their technical capabilities, OpenAI capitalized on the significant first-mover advantage gained with the launch of ChatGPT in late 2022. However, Google was initially slow to respond, while Anthropic lacked the same level of visibility for its Claude models.

The following year witnessed the emergence of increasingly fierce competition. Anthropic rapidly iterated on Claude 3 and Claude 4, establishing itself as a reliable alternative, particularly for editorial applications. xAI, despite initial criticism, launched Grok, gaining market share. Similarly, DeepSeek, a previously unknown Chinese company, made a remarkable entry into the AI race. This broader competition gradually eroded OpenAI’s technical advantage, transforming what appeared to be a monopoly into a genuinely competitive market.

Google and Anthropic Rise to the Challenge

While OpenAI remains the most frequently ranked, it is no longer consistently at the top. Between November 2024 and December 2025, Google secured first place nine times, compared to just seven for OpenAI over the entire period. xAI achieved two first-place rankings at the start of 2025, while Anthropic claimed three at the end of the year. However, the most telling indicator is the trend over time. In April 2024, the top OpenAI model held the first position. By December 2025, it had fallen to eighth place.

This decline is evident in the monthly evolution of each publisher’s top models. Until fall 2024, OpenAI consistently led the rankings. However, at the end of 2024, the descent began, with the company’s top model gradually overtaken by increasingly competitive offerings. Google seized first place and solidified its position, while xAI and Anthropic strategically challenged the established order. OpenAI attempted a resurgence in spring 2025 with the release of GPT-4.5, but a subsequent collapse at the end of summer saw its best model fall to eighth place in December 2025 – a dramatic decline for the former industry benchmark.

The start of the 2025 school year proved to be a pivotal moment. OpenAI announced numerous updates surrounding GPT-5 and its variations, but user feedback was mixed and often critical. The anticipated performance improvements failed to materialize, leading to widespread dissatisfaction. In contrast, Google’s Gemini 3 was lauded for its reasoning abilities and versatility. Anthropic continued to impress with its Claude 4 models, particularly favored for editorial and professional tasks, often sharing the top spots with Google. This dynamic is reflected in web traffic statistics, with Gemini experiencing substantial growth while ChatGPT’s traffic slowed.

The Geopolitics of AI: US Dominance, China’s Ambition

The AI race is currently dominated by the United States. Between April 2024 and December 2025, models developed in the US accounted for 88% of appearances in LMArena’s monthly top 10. This overwhelming dominance is attributed to the concentration of tech giants, their substantial resources, and relatively permissive regulations. OpenAI, Google, Anthropic, and xAI all operate from American soil. Meta, despite its considerable resources, has only managed to place its Llama models in the rankings three times. Apple’s struggles with its own AI efforts are also apparent, with the company now relying on Gemini to revamp Siri and other AI-powered features.

Despite this US hegemony, China has emerged as a significant player, accounting for 11% of top 10 appearances. This is particularly remarkable given the political tensions, technological restrictions, and limitations on access to advanced chips. DeepSeek, with its open-source models, has become the leading Chinese contender, appearing in the top 10 ten times, demonstrating the country’s capacity for developing competitive AI. 01.AI, Alibaba’s Qwen models, and Zhipu AI have also made occasional appearances, signaling Beijing’s determination to compete in the AI arena.

The rest of the world is largely absent from this intense competition. Canada has a limited presence with Cohere, but Europe is conspicuously missing. Mistral, often touted as Europe’s AI champion, has never appeared in the monthly top rankings and had completely disappeared from the top 20 by December 2025, unable to compete with the financial and computational resources of the American and Chinese giants.