Ethereum Nears $5,000 as technicals Signal Bullish Momentum, Despite Late-Day Rejection

Table of Contents

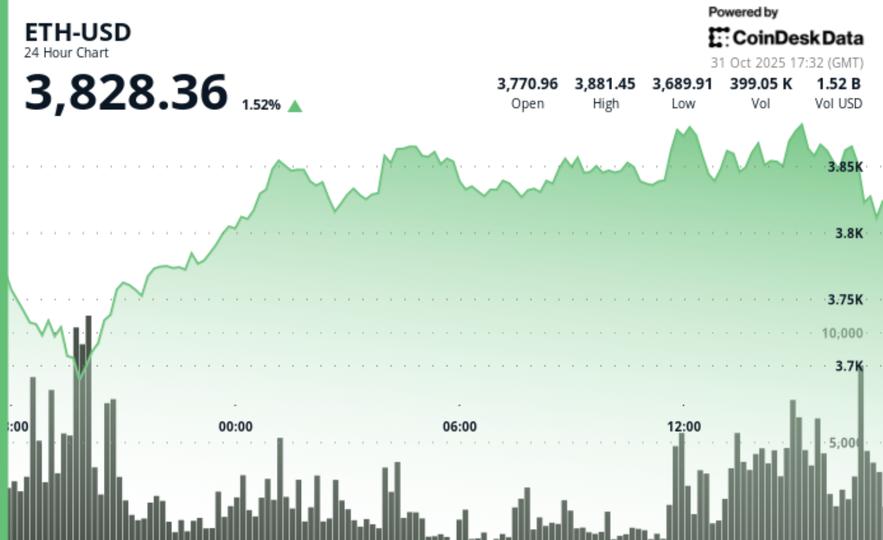

Ethereum (ETH) is showing increasing signs of strength, with analysts suggesting a push to a new all-time high above $5,000 is near, despite a late-day pullback on Thursday. According to CoinDesk Research’s technical analysis, ether advanced on heavier-than-usual trading before encountering resistance, leaving a tighter trading range and key price levels to watch.

Analyst Weighs In on Ethereum’s Potential

Crypto analyst Michaël van de Poppe stated on X (formerly Twitter) that Ethereum represents the most attractive ecosystem for investment currently. He believes the network’s robust developer activity, expanding product suite, and strong network effects are positioning ether for a meaningful price surge.

In essence, the argument centers on Ethereum’s fundamental strength and the potential for price action to mirror the conditions seen before previous record highs.

Chart Analysis: Buyers and Sellers Battle for Control

The technical model indicates buyer activity drove the price higher, but sellers remain active in the $3,860-$3,880 range. A sustained move above $3,880, followed by a break of $3,887.35, could signal further upside. however,the market is currently exhibiting an uptrend with a caution flag,as sellers are actively defending the upper end of the range.

- Current price: $3,865.

Key support and Resistance Levels

Currently, the $3,680-$3,720 zone is identified as a key support area, having absorbed early-session weakness. Resistance remains firm in the $3,860-$3,880 band, with $3,880 acting as a significant psychological level. The near-term trading range is compressed between $3,730 and $3,880. A reclaim of $3,880 would reopen the path to the $3,887.35 high.

Volume Signals Increased participation

Overall volume was up 19.01% compared to the seven-day average, indicating strong market participation. The strongest bullish signal came at 2 p.m. UTC with 446.7K in volume.Though, the drop from $3,869 to $3,820 on lower volume (21.8K) suggests increasing supply at the ceiling.

Patterns and Potential Scenarios

the market is exhibiting an uptrend with a caution flag. While higher lows indicate upward momentum, the lower high into the close suggests sellers are still actively defending the upper end of the range. The $3,730-$3,880 range currently defines the near-term trading landscape.

Next proof point: Bulls need a firm break and hold above $3,880, while bears will be looking for a drop below $3,720 to test the $3,680 support level.

Potential outcomes:

- If buyers press: Reclaiming $3,880 would open the door to testing $3,887.35, with sustained strength focusing attention on the upper band.

- If sellers regain control: A move below $3,720 could lead to a test of the $3,680 demand area.

With participation elevated but resistance respected, many traders are likely waiting for a definitive breakout from the $3,730-$3,880 range before committing to a stronger position.

CoinDesk 5 Index (CD5) Context

The CoinDesk 5 Index (CD5) experienced a range-bound session, rising from $1,878.33 to $1,901.52, peaking at $1,924.98 before reversing to $1,901.52.This movement aligns with observed profit-taking across major cryptocurrencies as they approach resistance levels.

disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more facts, see CoinDesk’s full AI Policy.