The Euribor is, in general terms, the price at which European banks lend money to each other. From January 3 to August 22, 2022, the daily data for one year has gone from -0.499% to 1.344%. Obviously, this is bad news for the budgets of Spanish households, especially if they have to face the payment of a mortgage at a variable interest rate.

Evolution of the 12-month Euribor between January 3 and August 22, 2022.

WHAT TO EXPECT IN THE SHORT TERM?

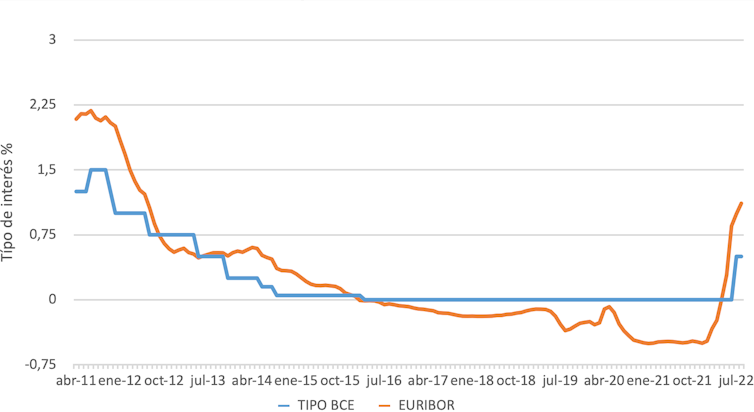

Evolution of the Euribor and the official ECB rate between January 2011 and August 2022.

If we look at the behavior of the Euribor since 2011, we see that it has oscillated around the official interest rate of the European Central Bank (ECB) and that, since the ECB rate entered negative territory in 2016 until April of this year, it remained for below this.

Given that the Euribor is the reference interest rate at which banks lend money to each other, the rises we have been seeing since April are nothing more than a preview of the rate rises that the ECB began to apply in July (and which are expected to continue).

- The market is anticipating further increases in interest rates, given the high levels of inflation in the euro zone.

- Financial institutions are foreseeing the end of the free liquidity bar at the ECB and are looking for alternatives to finance themselves, in this case in the interbank market. Greater demand in this market means that, logically, the interest rates required to lend in this type of operation increase.

FIXED OR VARIABLE RATE?

Two recommendations from experts can be useful:

- Do not dedicate more than 30% of the net family income to the mortgage.

- Make simulations of how the installments would be if there were increases in the Euribor to assess what rate hike could be absorbed by the family budget, in case of opting for a variable interest rate mortgage.

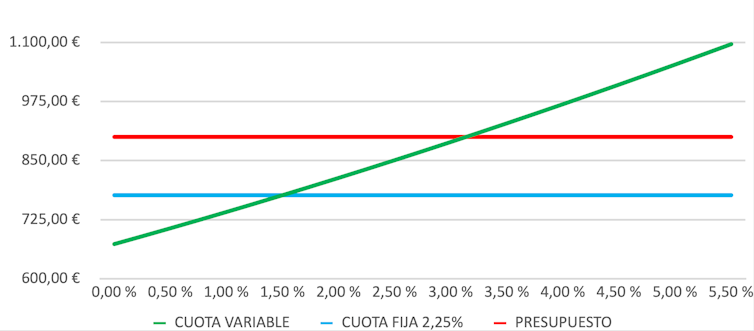

For example, if we think of a family with a monthly net income of 3,000 euros and apply 30%, there would be 900 euros available from their budget for the mortgage. If you plan to borrow with a loan of 150,000 euros over 20 years and the alternatives are: Euribor + 0.5% (variable rate) or a fixed rate loan at 2.25%, in a scenario with the Euribor at 1% they would pay 723.82 euros per month in the variable loan and 776.71 with the fixed loan.

Simulation of a fixed-rate or variable-rate loan.

With a rise in the reference interest rate to 1.75%, they would pay the same amount in both options.

If the Euribor rose to 3.5%, they would enter the danger zone and their fee would exceed 900 euros per month (908.97 euros). Obviously, it is up to the family that is going to get into debt to foresee what probabilities they assign to each of the scenarios and decide the best option for them, based on their aversion to risk.