Garmin‘s Q1 2025 earnings call revealed record profits but also addressed concerns about upcoming tariffs. Teh company earned $1.54 billion,an 11% increase,primarily driven by its “Outdoor” and “Auto” segments,achieving a “record” $330 million operating income.Though, the stock dipped by about 10% following the report, signaling investor apprehension.

How Garmin Plans to Tackle Tariffs

Table of Contents

CEO Cliff Pemble stated that Garmin is prepared for “higher tariffs and more complex trade structures.” A quarter of Garmin’s U.S. revenue comes from products assembled in Taiwan, facing a potential 10% tariff. While the company doesn’t source a “significant amount of material” from China, reciprocal tariffs could “weaken the U.S. dollar,” impacting 60% of their profits.

Garmin’s CFO estimates a $100 million increase in costs due to tariffs in 2025, but they anticipate offsetting this through “favorable foreign currency impacts and planned mitigations.” The company expects non-U.S. dollar currencies to strengthen, boosting the value of their EMEA and Asia business.

Garmin’s Mitigation Strategies: A Closer Look

While Pemble remained vague about specific mitigation plans, stating that Garmin is “pursuing mitigations, some of which have already been established, while others will take more time,” analysts speculate on potential strategies.

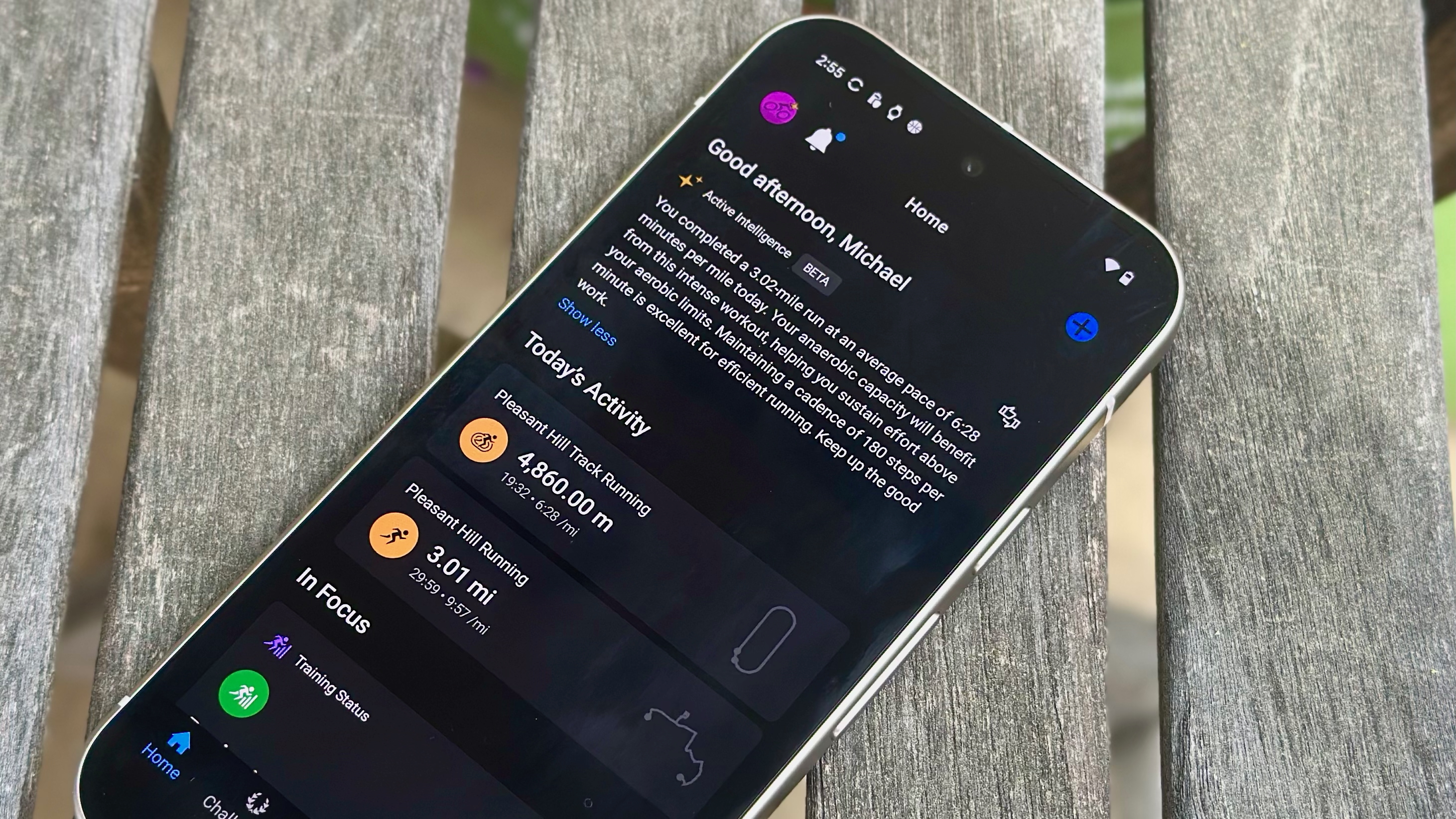

One apparent strategy is the introduction of subscription services like Garmin Connect Plus. Despite some negative customer feedback, this subscription model provides a new revenue stream, possibly making post-launch updates more profitable.Pemble emphasized that the AI boom made it the “right time” to launch Connect plus and that its a “very significant part of our Fitness segment going forward.”

The success of the Outdoor category, with a $72.3 million revenue boost, also plays a role. The continued popularity of the Garmin Fenix 8 and the launch of the Instinct 3, which offers an AMOLED display and improved battery life, contribute to this growth.

Pros and Cons of Garmin’s Approach

Pros:

- Diversified Revenue Streams: Subscription services like Garmin Connect Plus offer a buffer against tariff impacts.

- Currency Hedging: anticipating stronger non-U.S. dollar currencies can offset some tariff costs.

- Popular Products: Strong sales of flagship products like the Fenix 8 and Instinct 3 provide a solid financial foundation.

Cons:

- Customer Backlash: Subscription models can be unpopular and may alienate some customers.

- Vague Mitigation Plans: Lack of transparency regarding specific strategies raises uncertainty.

- Dollar Weakness: Reliance on the U.S. dollar for a significant portion of profits makes Garmin vulnerable to currency fluctuations.

Expert Insight: “Garmin’s move towards subscription services is a double-edged sword,” says industry analyst Sarah Miller.”While it provides a predictable revenue stream, it risks alienating customers who prefer one-time purchases. The key will be offering compelling value that justifies the ongoing cost.”

Ultimately, Garmin’s ability to navigate the tariff landscape will depend on the effectiveness of its mitigation strategies and its ability to maintain customer satisfaction while adapting to a changing global economy.

Time.news: garmin recently announced its Q1 2025 earnings, revealing record profits but also investor apprehension about potential tariffs. To understand what this means for Garmin and consumers, we spoke with financial analyst, Dr. Elias Thorne, specializing in the tech and consumer electronics sectors. Dr. Thorne,thanks for joining us.

Dr. Thorne: It’s my pleasure.

Time.news: Let’s start with the big picture. Garmin reported a strong Q1, yet the stock dipped. What’s the underlying cause?

Dr. Thorne: Exactly as you mentioned, the positive earnings – $1.54 billion in revenue, driven by “Outdoor” and “Auto” segments –were overshadowed by concerns about upcoming tariffs and the potential impact on profitability. While they reported a “record” $330 million operating income, the market is forward-looking. Investors are factoring in the anticipated challenges from trade complexities.

Time.news: Garmin’s CEO Cliff Pemble mentioned being prepared for “higher tariffs and more complex trade structures.” A important portion of their U.S.revenue comes from products assembled in Taiwan, which coudl face a 10% tariff. How significant is this threat?

Dr. Thorne: A 10% tariff on a quarter of Garmin’s U.S. revenue is undoubtedly concerning. Their CFO estimates a $100 million increase in costs due to tariffs in 2025. The direct financial impact is significant, but the potential for reciprocal tariffs impacting the U.S. dollar, and thus 60% of their profits, looms larger.

Time.news: Garmin hopes to offset these tariff costs through “favorable foreign currency impacts and planned mitigations.” How realistic is this?

Dr. Thorne: Currency hedging can be effective, especially if Garmin anticipates a strengthening of non-U.S. dollar currencies, which would boost the value of their EMEA and Asia business. Though,relying solely on currency fluctuations is risky. The “planned mitigations” are key, but Pemble’s vagueness leaves analysts and investors wanting more details.

Time.news: One mitigation strategy seems to be the push toward subscription services like Garmin Connect Plus. What’s your take on this strategic shift?

Dr. thorne: subscription models are a double-edged sword. On one hand, they provide a predictable and recurring revenue stream, making post-launch updates more profitable and offering a buffer against fluctuating hardware sales and tariff pressures. on the other hand,they can alienate customers accustomed to one-time purchases. The key for Garmin is to offer compelling value that justifies the ongoing cost. This means premium features, exclusive content, and seamless integration with their hardware ecosystem. It’s good that Pemble is emphasizing that the AI boom made it the “right time” to launch Connect plus and that its a “very significant part of our Fitness segment going forward.”

Time.news: Garmin’s “Outdoor” segment also contributes considerably to revenue, particularly through popular products like the Fenix 8 and the new Instinct 3. How does product innovation factor into tariff mitigation?

Dr. Thorne: Strong product sales always provide a solid financial foundation. The continued popularity of their existing lines, coupled with innovative new products like the Instinct 3 with its AMOLED display and improved battery life, help offset potential losses from tariffs. Creating products people want will always be the first and best defense for companies.

Time.news: What are the main risks and opportunities facing Garmin as it navigates this complex economic landscape?

Dr. Thorne: The biggest risks are customer backlash against subscription services, the lack of transparency regarding specific tariff mitigation strategies, and the vulnerability to U.S. dollar weakness. Opportunities lie in successfully diversifying revenue streams, effectively hedging against currency fluctuations, and continuing to innovate and release compelling products that maintain strong customer loyalty.

Time.news: what advice would you give our readers who are Garmin customers or potential investors?

Dr. Thorne: For customers,carefully evaluate the value proposition of Garmin’s subscription services. If the features and benefits align with your needs and usage patterns,the subscription could be worthwhile. If you prefer one-time purchases, consider focusing on Garmin’s core product offerings.

For investors, monitor Garmin’s progress in implementing its tariff mitigation strategies and pay close attention to customer response to the subscription model. Look for signs of transparency and concrete plans to address the challenges. If Garmin can successfully navigate these challenges and maintain its innovation momentum,the long-term outlook remains positive.

Time.news: Dr. Thorne, thank you for your insights.

Dr. Thorne: You’re welcome.