The Bank of Spain also notes that families prepared for the rise in inflation half a year before the war, which completely dismantles the Government’s discourse

Spanish families began preparing for a spike in inflation long before the Russian invasion of Ukraine. Six months earlier, specifically, what completely dismantles the government’s discourse and his assertion that the price crisis is due exclusively to the war. And that crisis, which I know is undoubtedly that it has been aggravated by the pandemic, has an energy component that is unleashing a very complex situation for low incomes: they are already stopping consuming certain assets to be able to meet the electricity bill.

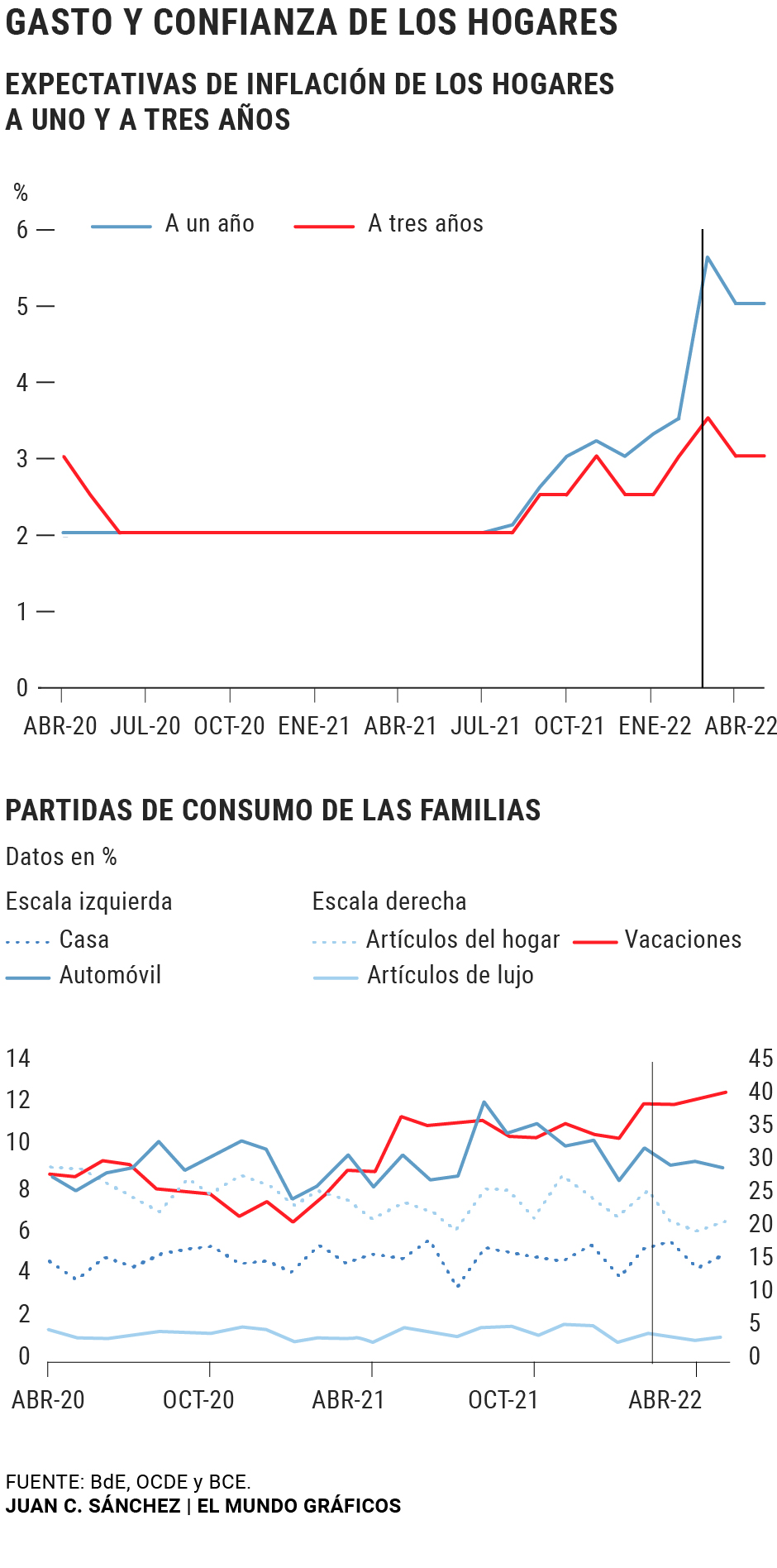

These conclusions are offered by the Bank of Spain in an analytical report on inflation and Spanish households that it published yesterday, and in which it points out that the distribution of the inflation rates that Spanish families anticipate for one and three years from now began to be revised upwards from summer 2021. Subsequently, the increase intensified as a result of the war, in line with the notable acceleration observed since then in the cost of raw materials and food, he adds, thus confirming that households detected an inflationary process much earlier than what is stated. the Executive.

The BdE also explains that when comparing the rates referring to a horizon of one and three years, it is observed that the former are well above the latter, which indicates that households anticipate that the current inflationary episode moderate substantially in the medium term. Most organizations forecast that prices will remain very high this year and that next year, indeed, they will begin to moderate, although according to Funcas the average figure for 2023 will still be a notable 4.8%.

And in reference to the strong impact that inflation and, specifically, the increase in energy prices are having especially on families with lower incomes, the BdE points out that families with a modest cushion of liquidity have reduced spending on other goods.

These homes are mostly low-income, which, in addition, are more exposed to variations in the price of energy, since for these households the energy bill absorbs a greater proportion of their income, deepens the organism. On the other hand, families that have a greater liquidity cushion have not substantially modified their levels of spending on other items in the face of an increase in these costs and, therefore, they would have temporarily reduced their savings rates to face them.

The report also states that the increase in uncertainty caused by the war in Ukraine has translated into a downward revision of the expectations of spending on durable goods by households, especially highlighting the downward adjustment in automobiles. That is, families are reducing, postponing or even canceling car purchases and spending on car maintenance.

This is also directly connected to the new employment formats, teleworking and even the transition process towards another type of mobility. The change in behavior and customs can only be confirmed if one attends to another report that was also published yesterday, in this case, EuroTaller. According to this document, families invested an average of 572 euros in car care last year, four times less than the investment made in bars and restaurants, which amounted to 2,299 euros. Thus, after the pandemic spending on leisure increased by 30.5%, double that spent on getting the car ready. In ten years, the cost of families in the maintenance of their vehicles has decreased by 8.34%, is added in that work collected by Europa Press.

According to the criteria of

Know more