| Dr. Gil Befman, Chief Economist of Bank Leumi

The price of oil rose last week: the price of type oil rose to about $ 76.14 per barrel at the end of the trading day on 12/24/2021 and the price of type barrel rose to about $ 73.79. This increase occurred despite the spread of the Americon variant in Europe and the United States, which began to tighten restrictions in some countries and even to close in a small number of countries.

Since so far the main impact has been on the aviation industry, and so far there has been no significant reduction in vehicle traffic loads in major European cities, the relatively strong demand for fuels continues.

At the same time, the positive sentiment in the market was supported by a change in the position of the democratic senator Joe Manchin, Which opposes the current wording of the Biden administration’s economic plan Build Back Better Which could, among other things, support green energy and contribute in the medium and long term to shifting demand from oil to various types of cleaner energy.

| Global supply

Group OPEC+ Has not changed its position so far and we estimate that it will continue to increase its oil supply in January 2022, provided there is no significant tightening of restrictions in a large number of countries which will lead to a significant drop in demand. However, the group has warned that it may react quickly to market developments, so that if a large number of countries tighten the restrictions that will lead to a decline in demand, the group can stop the increase in supply in the market and even reduce it if necessary.

Libya is trying to increase its to 1.4 million barrels per day by the second half of 2022 and it is expected to present to the country’s oil companies contracts that will encourage them to meet this target. However, even though the civil war in Libya is over, there are still effects that sometimes disrupt oil production, so the country’s success in increasing oil production depends very much on developments within the country and the observance of the ceasefire agreement.

It is also having difficulty increasing its oil production and is producing less than its allowable quotas OPEC+. Nigeria’s oil output could fall in December, after a company Shell Declared a “force majeure” and stopped oil shipments through the seaport near the mouth of a river pitchforks In Nigeria. This port is responsible for the export of more than 200,000 barrels of oil per day and stopping its activities could hurt Nigeria’s oil exports.

In the US it decreased in the week ending 17/12/2021 by 4.7 million barrels, after a similar decrease in the previous week, and it reached about 424 million barrels. This decrease occurred despite the increase in net imports, which was mainly due to an increase in oil exports The decline in gross oil imports, on the other hand, the oil inventory in the reservoir continued the recovery trend and rose to about 34 million barrels.

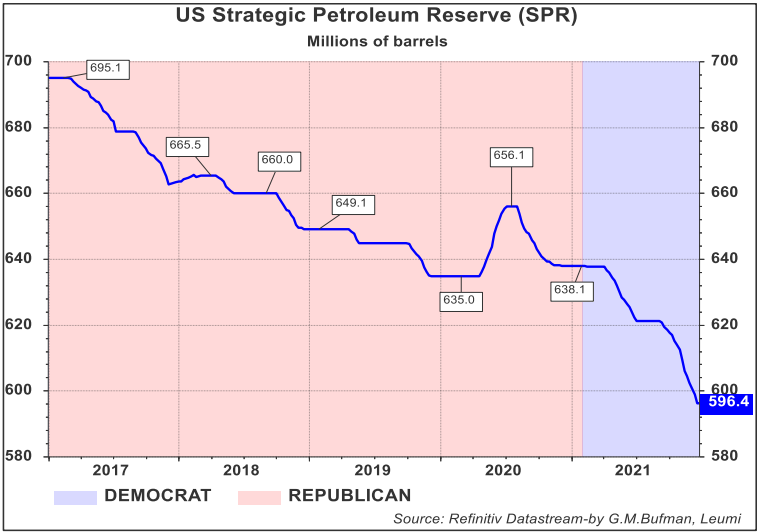

U.S. oil supplies from strategic reservoirs continue, and in early January a tender is expected for the supply of an additional 18 million barrels of oil to be supplied during the first quarter of the year, as part of the U.S. plan to supply its strategic reservoirs to reduce inflationary pressures and lower prices. Fuel for consumers. Additional countries are expected to join this move and also supply oil from their strategic reservoirs, in order to alleviate the global shortage and prevent a significant rise in the price of oil. South Korea is expected to start supplying oil by the beginning of 2022 from its strategic reservoirs and it is expected to sell about 2 million barrels of oil to the country’s refineries and about one million barrels of petroleum distillates and its products.

Global demand

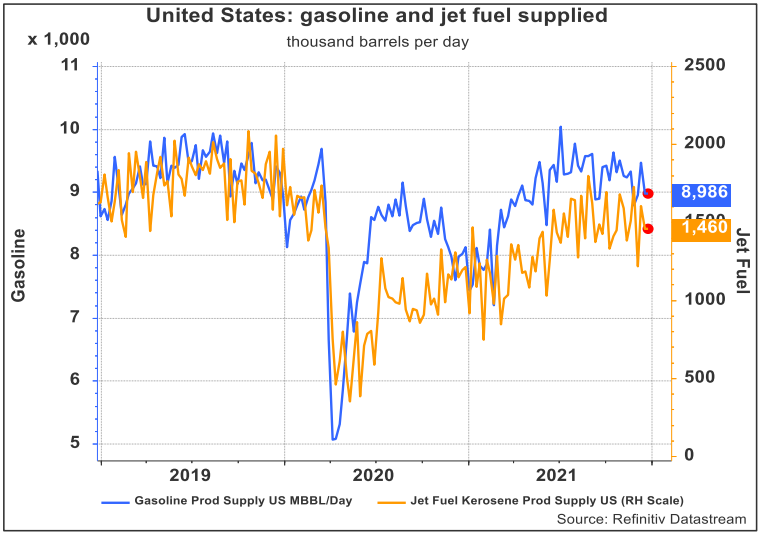

Demand for car fuel in the U.S. fell in the week ending Dec. 17 to about 9.0 million barrels a day, but remains high relative to the period of the first year of the corona crisis. Increasing the use of transportation and increasing the demand for fuel, on the other hand, the continued spread of the virus is expected to hamper the recovery of demand in early 2022 and support the US administration’s efforts to lower the price of fuel to the consumer.

Demand for aircraft fuel also declined during this period, but it remained at a level higher than 1.4 million barrels per day. In our opinion, the increase in morbidity and the tightening of restrictions, with an emphasis on restrictions on international air traffic, is expected to reduce the demand for jet fuel.

China’s diesel exports began to recover in November and rose to about 149,200 barrels per day, an increase of about 11% from the October level and a 69% increase from the same period last year. This increase occurred after the Chinese government feared a shortage of diesel in the country and allowed manufacturers to increase their diesel production, thus creating an excess supply of diesel in the country that supported an increase in exports.

| Natural gas economy

US Price (Henry Hub), Continued to decline slightly over the past week, as a continuation of the sharper declines that were from the end of November, reaching $ 3.73 toMMBTU. This is against the background of the spread of the coronavirus virus’ emericon variant alongside the increase in oil supply from the US administration, which may in some cases be used as an alternative energy to natural gas. At the same time, the amount of natural gas in the reservoirs has decreased compared to the same period last year in the direction of the average inventory level in the last five years.

The decline in inventories also reflects the continued expansion of U.S. natural gas exports. Over the next year, the U.S. is expected to reach the status of a liquefied natural gas exporter (LNG) Largest in the world and thus surpass Australia and Qatar. At the same time, the volume of natural gas production in the US is expected to peak during 2022. For exports of LNG From the US there is a growing weight in aid to Europe in dealing with the gas shortage there. Recently a relatively large number of ships have been launched LNG In the US to Europe to balance the reduction of gas flow from Russia to Europe.

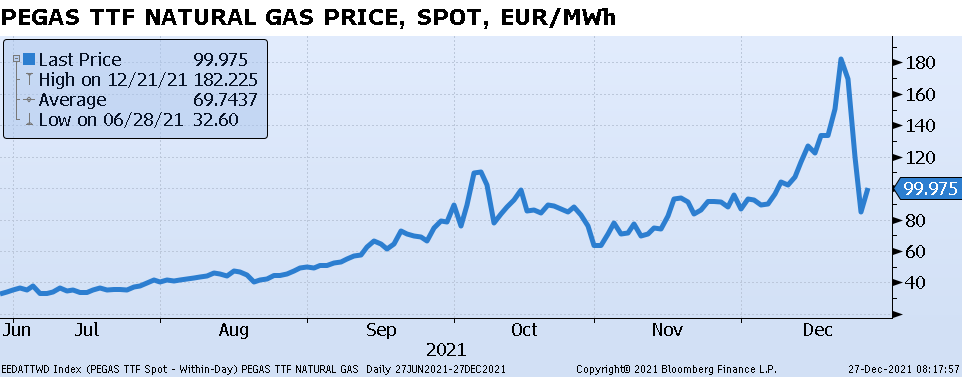

European natural gas price (TTF) Has been very volatile in the last month. From the beginning of the month until the beginning of the previous week, the price of European gas rose by more than 85%, due to the shortage of natural gas and low gas supplies from Russia due to delays in regulatory approvals for the operation of the Russian gas pipeline. Nord Stream 2. But in the last week the price of European gas has fallen sharply from about 182 to about 100 euros perMWh. This, against the background of an increase in the supply of liquefied natural gas (LNG), Mainly from the United States but also from other sources in the world, in response to the sharp rise in the price of European gas, which reached a peak 13 times higher than the price in the United States.

| Expect to the medium term

Group OPEC+ Is expected to increase oil production, in accordance with the decision made. If the spread of the omicron variant leads to further tightening of restrictions, which will reduce energy demand and destabilize the market around the current price level, it may overturn the decision to further increase production in early 2022. This is in line with the current strategy Without giving preliminary hints.

At the same time, theIEA Estimates that the tightening of restrictions in Europe is expected to lead to an excess supply in the market in 2022, based, apparently, on giving significant weight to the increase in morbidity resulting from the spread of the coronavirus variant of omicron and exacerbation of restrictions. However, if the “life alongside the corona” routine does not significantly hurt economic activity, the aggregate level of demand will be maintained and this may support the current oil price.

Price of European natural gas (TTF), Which has risen sharply in recent months due to its current shortage, is expected to remain in the coming months at a significantly high level compared to the past average – of about 20 euros per MWh – This is until the inventory problem is solved, both on the demand side and the supply side, and the inventories will rise again. In the event of various difficulties, Russia will operate the gas pipeline Nord Stream To a sufficient extent for Europe, this will reduce the price from peak levels and prevent the transition of natural gas demand to oil, with the potential for a moderate effect on the price of oil as early as 2022.

Tensions between Russia and Ukraine could develop into sanctions on Russian energy companies. Such a move could lead to European countries being limited in the volume of energy purchases from Russia, while supporting the high price level and diversion of natural gas users to oil, which is an alternative energy source, which will support the current oil price.

Another important factor is the climatic factor and the severity of the coming winter and the extent of consumption for heating purposes. Given the low flexibility of gas demand in Europe in relation to price, and at the same time the volume of domestic output in Europe is relatively limited, a solution to natural gas shortages in Europe is mainly based on imports, whether from Russia or the rest of the world. The gas purchased from Russia.

Oil futures indicate a certain drop in price in the first half of 2022 and a further drop during 2023. This is probably due to expectations that oil supply will increase in 2022, and there may even be a certain excess supply, alongside fears of the Corona virus continuing to affect economic activity.

PDF document: Leumi’s full weekly energy review

The writer is the chief economist of Bank Leumi. The data, information, opinions and forecasts in the review are provided as a service to readers, and do not necessarily reflect the official position of the Bank. They should not be construed as a recommendation or substitute for the reader’s independent discretion, or an offer or invitation to receive offers, or advice to purchase and / or make any investments and / or actions or transactions. Errors may occur in the information and changes may occur. The Bank and / or its subsidiaries and / or companies related to it and / or the controlling shareholders and / or stakeholders in which of them may from time to time have an interest in the information presented in the review, including financial assets presented in it.