“`html

Table of Contents

- Navigating Market Uncertainty: Will Trade Tensions Derail the Bull Run?

- The Ibex 35: A Microcosm of Global Anxiety

- Global Markets: A Sea of Mixed Signals

- Trump’s Tariff Rollercoaster: A Wild Ride for Investors

- Key Events to Watch This Week

- analyst Perspectives: navigating the Uncertainty

- Debt, Currencies, and Commodities: A Snapshot

- FAQ: Navigating Market Uncertainty

- Pros and Cons of Investing in the Current Market

- Navigating Market Uncertainty: An Expert’s take on Trade Tensions and Investment Strategies

Are you feeling whiplash from the market’s daily swings? You’re not alone. Contradictory signals on US-China trade negotiations are keeping investors on edge, and the market’s rebound is losing steam. Let’s dive into what’s happening and what it means for yoru portfolio.

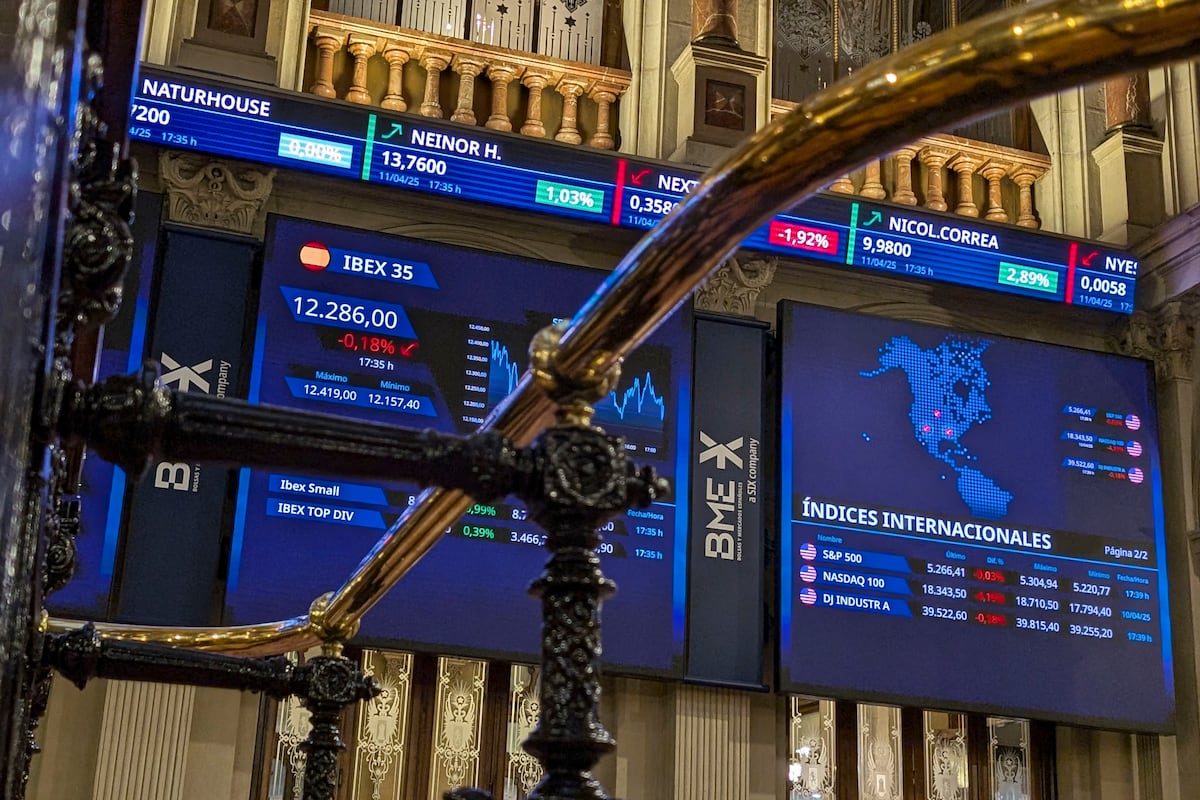

The Ibex 35: A Microcosm of Global Anxiety

The Spanish Ibex 35 index offers a glimpse into the broader market sentiment. It’s currently battling too stay above 13,400 points, a level it briefly touched before succumbing to the early April tariff anxieties. Can it hold its ground?

Key Performers and Laggards

Here’s a quick rundown of the Ibex 35’s movers and shakers:

- Top Gainers: Sabadell (1.7%), Acciona (1.6%), Cellnex (1.3%)

- Underperformers: mapfre (-1.3%), Iberdrola (-0.3%)

These individual stock movements reflect sector-specific trends and investor reactions to company news. Keep an eye on these names as potential indicators of broader market shifts.

Global Markets: A Sea of Mixed Signals

European markets are showing cautious optimism, with the German Dax, London’s FTSE 100, and the French CAC all posting gains. However, Asian markets are more subdued, with the Shanghai Composite slightly down.This divergence highlights the uneven impact of trade tensions across different regions.

China’s Balancing Act

China’s government is attempting to cushion the blow of the trade war by promising support for struggling exporters. Deputy Minister of Commerce SHENG QIUPING announced measures like property tax exemptions and reduced burdens. Will these efforts be enough to offset the impact of tariffs?

Trump’s Tariff Rollercoaster: A Wild Ride for Investors

Donald Trump’s unpredictable approach to trade policy continues to inject volatility into the markets. His tendency to change his mind on tariffs keeps everyone guessing,making long-term investment strategies a challenge.

Potential Tax cuts Fueled by Tariffs?

Trump has suggested that tariff revenue could fund income tax cuts, potentially benefiting those earning under $200,000 per year. This proposal adds another layer of complexity to the trade debate, raising questions about the true purpose and impact of tariffs.

Key Events to Watch This Week

This week is packed with events that could significantly influence market direction:

- BBVA-Sabadell Merger: The Spanish National Commission of Markets and Competition (CNMC) is expected to rule on BBVA’s proposed acquisition of Sabadell. This decision could reshape the Spanish banking landscape.

- White House Trade Talks: The White House reportedly plans to hold trade talks with six countries each week until July 9th.The market is betting that a tariff peak has been reached and that Trump will eventually ease tensions with China.

- Earnings season in full Swing: Over 180 S&P 500 companies, representing over 40% of the index’s market value, will release their earnings this week.This includes tech giants like Apple,Microsoft,and Amazon.

- Spanish Earnings Reports: Major Spanish companies like BBVA, Caixabank, Santander, Iberdrola, and Repsol will also report their earnings.

Apple’s iPhone Sales: A Bellwether for Global Demand

All eyes will be on Apple’s iPhone sales and the impact of tariffs on its supply chains. A strong performance could signal resilience in the face of trade headwinds,while a weak showing could trigger broader market concerns.

Experts are divided on the market’s outlook, reflecting the inherent uncertainty of the current habitat.

Macroyield’s Cautious Stance

Macroyield warns that in the absence of clear progress in the trade war, particularly with China, risks remain elevated.They point to potentially unfavorable economic indicators and corporate earnings as additional headwinds.

Axa Investment’s Warning: “Trump’s Shock Has Not Ended”

Chris Iggo,director of Axa investment investments,cautions that further market declines are possible.He emphasizes Trump’s unpredictability and the increased risk of recession. “The risk of recession has increased,” Iggo states. “The recessions usually make market rates that make performance rates for the U. US credit returns to the narrow levels that we have seen in january and February of this year.”

Franklin Templeton’s Central bank Concerns

Franklin Templeton Fixed Income (FTFI) believes that the US trade policy is causing “restlessness among the central banks.” They argue that the unpredictable nature of US trade policy has “blurred the process of central bankers all over the world.”

Debt, Currencies, and Commodities: A Snapshot

Here’s a quick look at the performance of key assets:

- euro vs. Dollar: The euro remains stable against the dollar at 1.1376.

- Brent Oil: Brent crude is up 0.4%, trading above $66 per barrel.

- Spanish 10-Year Bond: The yield on the Spanish 10-year bond has increased by more than 1% to 3.126%.

Oil Prices: Geopolitical Wildcard

Rising oil prices can reflect both increased demand and geopolitical tensions. Keep an eye on developments in the Middle East, as they can significantly impact oil supply and prices.

What is causing the current market uncertainty?

The primary driver of market uncertainty is the ongoing trade negotiations between the United States and China. Contradictory signals and unpredictable policy decisions are keeping investors on edge.

How are European markets reacting to the trade tensions?

European markets are showing cautious optimism, with major indices like the German Dax, London’s FTSE 100, and the French CAC posting gains. Though, the overall sentiment remains fragile due to the global nature of the trade war.

What are some key events to watch this week?

Key events include the CNMC’s decision on the BBVA-Sabadell merger,White house trade talks with multiple countries,and earnings releases from major US and Spanish companies,including Apple,Microsoft,Amazon,BBVA,and Santander.

What is the potential impact of tariffs on US consumers?

Tariffs can lead to higher prices for imported goods, potentially impacting US consumers. However, the Trump administration has suggested that tariff revenue could be used to fund income tax cuts, which could offset some of the negative effects.

Pros and Cons of Investing in the Current Market

Pros:

- Potential for High Returns: Market volatility can create opportunities for savvy investors to buy undervalued assets.

- Strong Corporate Earnings: Despite the uncertainty, many companies are still reporting strong earnings, indicating underlying economic strength.

- Low Interest Rates: Low interest rates make borrowing cheaper, which can stimulate economic growth.

Cons:

- Trade war Uncertainty: The ongoing trade war creates significant uncertainty and can negatively impact global economic growth.

- Recession Risk: Some analysts are warning of an increased risk of recession, which could lead to market declines.

- Political Instability: Political instability in various regions of the world can create market volatility.

Time.news sits down with financial analyst, Dr.Anya Sharma, to discuss the current market landscape and offer insights for investors.

Time.news: Dr. Sharma, thanks for joining us. The markets seem to be on a rollercoaster ride lately. what’s driving this market uncertainty?

Dr. Anya Sharma: Thanks for having me. the primary culprit is undoubtedly the ongoing trade tensions, particularly between the U.S.and China. It’s not just the tariffs themselves, but the inconsistent messaging and unpredictable policy shifts that create anxiety. Investors are struggling to price in the potential impacts.

Time.news: The article mentions the Ibex 35 as a “microcosm of global anxiety.” Can you elaborate on that?

Dr. Sharma: Absolutely. The Ibex 35, like many global indices, reflects overall market sentiment. Its struggle to stay above 13,400 points highlights the fragility of the current rally. The early April tariff anxieties clearly impacted it [and othre markets]. Observing the performance of its key components, like Sabadell, Acciona, and Mapfre, can provide early signals about changing investor preferences and sector-specific vulnerabilities.

Time.news: We’re seeing mixed signals globally, with Europe showing cautious optimism while Asian markets appear more subdued. How do you interpret this divergence?

Dr. Sharma: This divergence underscores the uneven impact of trade tensions. European markets might be benefiting from factors like stronger regional demand or specific policy initiatives. However, Asian economies, particularly those heavily reliant on exports to the U.S., coudl be feeling the pinch more acutely. China’s efforts to support exporters with measures like property tax exemptions are a testament to this [1].

Time.news: China’s strategy of boosting domestic consumption seems significant. Is this a long-term shift?

Dr. Sharma: It certainly points to a long-term strategy. While external demand is crucial, fostering internal consumption provides a buffer against global economic shocks. It’s a prudent move given the current geopolitical climate.

Time.news: The article highlights Trump’s tariff policies.What are the main concerns for investors?

Dr. Sharma: Unpredictability is the biggest challenge. Constant shifts in policy make long-term planning incredibly difficult. The idea of funding tax cuts with tariff revenue adds another layer of complexity. It raises questions about the true objectives and potential consequences of these trade measures. US farmers may especially hurt from the trade war [2].

Time.news: This week is packed with potential market-moving events. Which ones should investors pay close attention to?

Dr. Sharma: The CNMC’s decision on the BBVA-Sabadell merger will be critical for the Spanish banking sector. The White House is planning trade talks, and the outcome could sway market sentiment dramatically. China is not backing down despite US tariffs [3]. Though,I’d argue that earnings season,especially for tech giants like Apple,Microsoft,and Amazon,will offer valuable insights into the overall health of the economy and the impact of tariffs on supply chains. Also, major Spanish companies like BBVA, Caixabank and Santander will release their earnings.

Time.news: Speaking of Apple, its iPhone sales are being considered a bellwether. Why is that?

Dr. Sharma: Apple’s supply chain is heavily reliant on China. If iPhone sales are strong despite the tariffs, it could indicate resilience. Weak sales, conversely, could spark broader market concerns about the impact of trade tensions.

Time.news: What’s your advice for investors navigating this uncertain market?

Dr. Sharma: Don’t panic! Focus on the long-term fundamentals of the companies you invest in. Diversify your portfolio to mitigate risk. As the article mentions,experts are divided on the market’s outlook,so a balanced approach is key.

Time.news: The article touches on debt, currencies, and commodities.What’s the key takeaway there?

dr. Sharma: Keep an eye on oil prices, especially given geopolitical tensions in the middle East. Rising oil prices can have ripple effects across the economy. Also, monitor bond yields; an increase in the Spanish 10-year bond yield, for example, can signal changing investor expectations about inflation and economic growth. The Euro and the dollar have been stable.

Time.news: what are the pros and cons of investing in the current market environment?

Dr. Sharma: The potential for high returns exists due to market volatility. Strong corporate earnings in certain sectors are also encouraging. Low interest rates make borrowing cheaper, which can stimulate economic growth. However,the trade war creates significant uncertainty,and the risk of recession looms.Political instability adds another layer of complexity. It’s a mixed bag, requiring careful consideration and a well-thought-out investment strategy.