At the annual meeting of Berkshire Hathaway investors in Nebraska last weekend, shareholders had their first personal meeting with billionaire founder Warren Buffett since the global plague broke out.

Read more in Calcalist:

A group of institutional investors urging Berkshire to address a broader climate issue has received little attention, while the 91-year-old Buffett makes it clear he can waive board approval when it comes to closing big deals, contrary to the conduct required of most U.S. CEOs.

“If Warren thinks a deal is good, then the deal is good,” Buffett said of the board’s mindset. This is while welcoming the audience of his followers at a meeting that reminded shareholders that Berkshire is still first and foremost Warren’s show. “I can close a deal with anyone and she is not harmed during the process.”

While many investors benefited from Buffett’s relaxed style of managing Berkshire, in the first meeting in Omaha since the outbreak of the corona plague, they were given a glimpse of the changes that may occur once the billionaire is no longer in control.

His intended successor, Greg Abel, Berkshire’s deputy chairman who runs the company’s broad collection of activities outside the insurance sector, was able to move around among those present without being identified, while talking to Berkshire’s subsidiaries.

3 View the gallery

Berkshire Vice President Greg Abel. Does not cultivate aura

(Photo: Reuters)

To reporters who approached him, Abel offered nothing more than a nimble handshake. The senior executive, who Buffett promoted to vice president in 2018 along with insurance division manager Agit Jane, is not as preoccupied with cultivating a halo around him as Buffett and Charlie Manger, his Berkshire co-builder, did.

Some shareholders said they were disappointed with Abel’s answers to questions addressed to him, including on the issue of the functioning of the Burlington Northern Railway Company (BNSF) which he oversees, and which lags behind competitors.

“The treatment of everything related to Abel was awkward,” said Cole Smith, president of Smith Capital Management, a longtime Berkshire shareholder who in recent years has reduced his holdings.

Buffett added to Abel’s response to the BNSF, noting that the group was thoroughly involved in making changes to some 32,000 km of tracks under its management.

A number of investors and analysts have said that the trust Buffett has built over the decades in which he has run the $ 713 billion corporation in his personal style is not likely to be Able’s share.

3 View the gallery

The signs of change are already evident. The Berkshire Corporation has agreed to split the CEO and chairman positions, both by Buffett, after his departure.

Smith is troubled that the move could cumbersome Berkshire, which over the years has relied on Buffett being able to concoct deals worth tens of billions of dollars within days. “Part of Berkshire’s power is rooted in the speed of decision – making,” he noted. Buffett and Manger have an “achievement list that gives the board confidence.”

That fact played into Berkshire’s favor last March when the corporation approved the $ 11.6 billion takeover of Alghani Insurance Company. After expressing his interest in the company during a dinner with Alghani CEO, the deal was quickly completed. But shareholders are worried that Abel will not enjoy the same room for maneuver.

Buffett said he was “guessing” that his successor would have to deal with a different board of directors, one in which “there are more restrictions or there will be more consultations than he has with me, on certain issues.”

Cathy Seifert, an analyst at CFRA Investment Research Group, hopes such consultations will also take place on the issue of disclosing environmental information, an issue that Berkshire investors – Calpers, Federated Hermes and the Canadian Pension Fund have officially sought to address.

3 View the gallery

Berkshire shareholders at a meeting in Nebraska, on Friday

(Photo: AFP)

Buffett, who argued that the investment managers who submitted the application did not really represent the views of the retirees whose money they are managing, noted – “all they care about is that V is made on these sections.”

Seifert described Buffett’s response as “slightly disturbing”, adding: “This is not how a manager of a large company should behave. It should be taken very very seriously.” The request to address climate issues was denied.

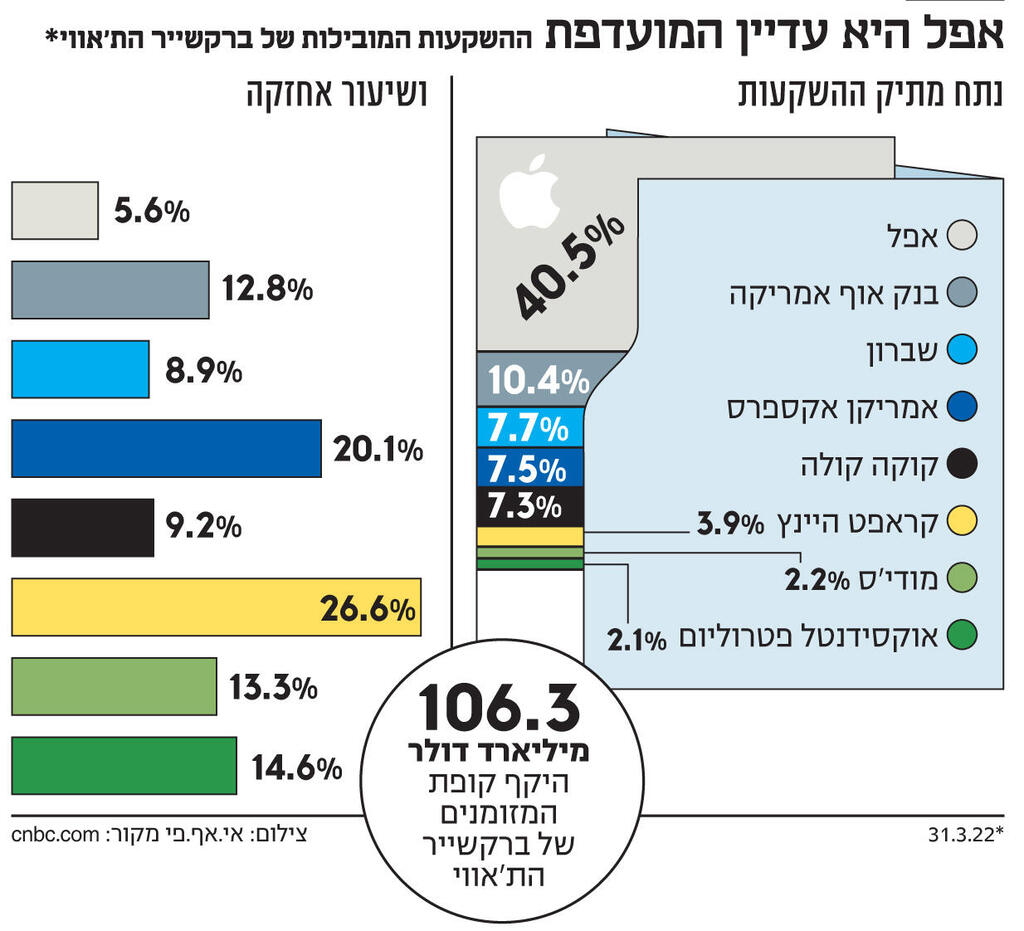

With the publication of Berkshire Hathaway’s latest reports, it emerged that the group flowed $ 51.1 billion to the U.S. stock market last quarter and posted a slightly larger operating profit over the same period last year, Buffett fiercely defended the company’s conduct. “Berkshire is simply different He told shareholders, adding that the board “understands that our culture is responsible for 99.99% of the management of the business.”

An issue that came up at Saturday’s shareholders’ meeting was whether the fact that a significant portion of Abel’s capital is invested in Berkshire Hathaway’s energy division, rather than in the parent company, creates a conflict of interest. Abel joined Berkshire in 2000 when the corporation acquired Mid-American Energy, an infrastructure company that was a partner in its management.

Buffett noted before the corporate governance committee of the board of directors that this issue would one day be required for examination. Manger, who is sometimes sharper than his longtime partner, noted that he would have wished the corporation “20 more conflicts of interest just like that.”

Buffett acknowledges that change will be inevitable after he leaves, but some investors say the board has already taken steps to preserve the culture that helps unite the thriving corporation that employs more than 370,000 people.

Last year, Berkshire added Chris Davis, an accountant and third-generation Berkshire shareholders to the board. Buffett’s daughter was also elected to the board.

“The changes in the board of directors are about ensuring the continuity of values and heritage,” said Christopher Rosbach, chief investment officer at Jay Stern Group, a longtime Berkshire shareholder. It will continue to demonstrate the flexibility it needs to preserve the nature of its investments. “