The Nomad Bridge Hack: Justice Catches Up, But What’s Next for DeFi Security?

Table of Contents

- The Nomad Bridge Hack: Justice Catches Up, But What’s Next for DeFi Security?

- Unraveling the nomad Exploit: A perfect Storm of Vulnerability and Greed

- Osei Morrell’s Role: More Than Just a Copy-paster?

- The Arrests: A Turning Point for Crypto Regulation?

- The Future of DeFi Security: A Call for Innovation and Vigilance

- Pros and Cons of Increased Regulation: A Balancing Act

- Looking Ahead: A More Secure and Sustainable DeFi ecosystem?

- The nomad Bridge Hack: An Expert Weighs In on DeFi Security and Regulation

The arrest of Osei Morrell, an American-Israeli national, in connection with the $190 million Nomad bridge exploit in 2022 sends a chilling message to crypto criminals: the long arm of the law is reaching into the decentralized world. But this arrest, along with that of Alexander Gurevich, begs the question: is this just the beginning of a crackdown, and what does it mean for the future of decentralized finance (DeFi) security?

Unraveling the nomad Exploit: A perfect Storm of Vulnerability and Greed

The Nomad bridge, designed to facilitate the transfer of assets between different blockchains, suffered a catastrophic failure. A seemingly simple misconfiguration in its smart contract’s ‘process()’ function allowed attackers to bypass crucial verification checks. The result? A free-for-all where anyone could copy-paste a transaction format and siphon funds. It was, as described, a “mob-style” attack, and it exposed a critical weakness in the bridge’s architecture.

The “Mob-Style” Attack: A DeFi Nightmare

The ease with which the exploit could be leveraged attracted a wide range of participants, from those with minimal technical skills to refined actors, including, allegedly, North Korean state-sponsored hackers. This highlights a significant challenge in DeFi: even a single point of failure can be exploited by a multitude of actors, amplifying the damage exponentially.

Rapid Fact: The Nomad bridge hack was one of the largest exploits in DeFi history,highlighting the immense risks associated with cross-chain communication.

Osei Morrell’s Role: More Than Just a Copy-paster?

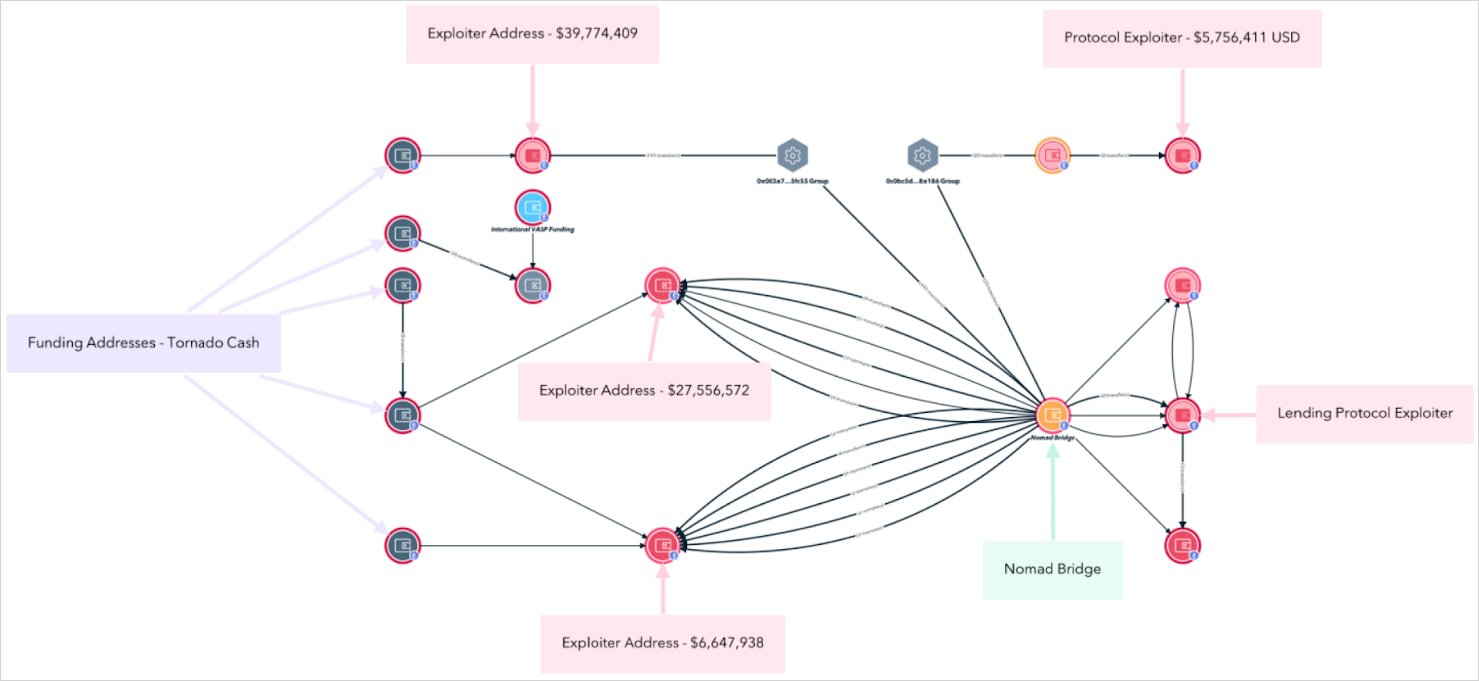

While Morrell is not believed to have initiated the exploit, TRM Labs’ investigation suggests he played a “central role” in laundering the stolen funds. His alleged methods – chain-hopping, using Tornado Cash, swapping ETH for Monero and Dash, and utilizing non-custodial exchanges with lax KYC standards – paint a picture of a sophisticated operation designed to obfuscate the origin of the illicit funds.

The Laundering Trail: A Glimpse into Crypto Crime

Morrell’s alleged use of chain-hopping (moving funds across different blockchains) and privacy-enhancing cryptocurrencies like Monero (XMR) and Dash demonstrates the lengths to which criminals will go to cover their tracks. This highlights the ongoing tension between privacy and security in the crypto space.

Expert Tip: Always be wary of DeFi platforms that promise anonymity. While privacy is crucial,it should not come at the expense of security and regulatory compliance.

The Arrests: A Turning Point for Crypto Regulation?

The arrests of Morrell and Gurevich signal a potential shift in how law enforcement approaches crypto crime. The collaboration between Israeli police, the DOJ, the FBI, and Interpol demonstrates a growing international effort to hold perpetrators accountable. But will these arrests be enough to deter future attacks?

The American angle: Implications for US Crypto Policy

with Morrell facing extradition to the United States, this case could set a precedent for how the US government prosecutes crypto-related crimes. It also raises questions about the role of US-based crypto exchanges and service providers in preventing money laundering. Will we see increased regulatory scrutiny and stricter enforcement measures?

The Future of DeFi Security: A Call for Innovation and Vigilance

The Nomad bridge hack serves as a stark reminder of the vulnerabilities inherent in DeFi. While the arrests of Morrell and Gurevich are a step in the right direction, they are not a silver bullet. The industry needs to prioritize security audits, bug bounty programs, and robust risk management frameworks to prevent future exploits.

Beyond Audits: A Holistic Approach to Security

Security audits are crucial, but they are not enough. DeFi projects need to adopt a holistic approach to security that includes continuous monitoring, threat intelligence, and incident response planning. They also need to foster a culture of security awareness among their users.

Did you know? Many DeFi projects offer bug bounty programs, rewarding individuals who identify and report vulnerabilities in their code. This is a valuable way to crowdsource security expertise.

Pros and Cons of Increased Regulation: A Balancing Act

The Nomad bridge hack has reignited the debate about the need for increased regulation in the DeFi space. While regulation could help to protect investors and prevent illicit activity, it could also stifle innovation and drive advancement offshore. Finding the right balance will be crucial.

The Case for Regulation: Investor Protection and Market Integrity

Proponents of regulation argue that it is necessary to protect investors from fraud and manipulation, and to ensure the integrity of the DeFi market. They point to the Nomad bridge hack as an example of the risks associated with unregulated DeFi platforms.

The Case Against Regulation: Innovation and Decentralization

Opponents of regulation argue that it could stifle innovation and drive development offshore. They believe that defi should be allowed to evolve organically, without government interference. They also argue that regulation could undermine the decentralized nature of defi.

Looking Ahead: A More Secure and Sustainable DeFi ecosystem?

The Nomad bridge hack was a painful lesson, but it also presents an opportunity for the DeFi industry to learn and grow. By prioritizing security, fostering collaboration, and engaging with regulators, the industry can build a more secure and sustainable ecosystem that benefits everyone.

What are your thoughts on the future of DeFi security? Share your comments below!

The nomad Bridge Hack: An Expert Weighs In on DeFi Security and Regulation

the recent arrest of Osei Morrell in connection with the $190 million Nomad bridge hack has sent ripples through the DeFi world. To understand the implications of this event and what it means for the future of decentralized finance, we spoke with Eleanor Vance, a leading cybersecurity expert specializing in blockchain technology.

Time.news: Eleanor,thanks for joining us. The Nomad bridge hack was a significant event. What exactly happened and why was it so impactful?

Eleanor Vance: The Nomad bridge hack,which occurred in August 2022 [[1]][[2]][[3]], exposed a critical vulnerability in the bridge’s smart contract. A misconfiguration in the ‘process()’ function allowed attackers to bypass verification checks, effectively creating a situation where anyone could copy transactions and siphon funds. It was a “mob-style” attack [[2]][[3]], meaning even those with limited technical skills could participate once the exploit became publicknowledge. The scale of the attack, draining almost $200 million [[1]][[2]][[3]],highlighted the immense risks associated with cross-chain dialog in DeFi (Decentralized Finance).

Time.news: The arrest of Osei Morrell is a significant progress. What was his role in the exploit?

Eleanor Vance: While Morrell is not believed to have initiated the actual exploit, investigations suggest he played a crucial role in laundering the stolen funds. He allegedly used sophisticated techniques like chain-hopping (moving funds across different blockchains), Tornado Cash, and privacy-enhancing cryptocurrencies like Monero and Dash to obfuscate the source of the funds. This highlights the lengths to which criminals will go to cover their tracks within the crypto landscape. This case realy underscores the tension between privacy and security in the crypto space.

Time.news: These arrests are a first step. Do you think they signal a shift in how law enforcement is approaching crypto crime?

Eleanor Vance: Absolutely. The arrests demonstrate a growing international collaboration between law enforcement agencies, like the FBI, DOJ, Interpol and Israeli Police, to hold crypto criminals accountable. Morrell’s potential extradition to the US specifically could set a precedent for how the US government prosecutes crypto-related crimes, potentially leading to increased regulatory scrutiny and stricter enforcement measures for crypto platforms and service providers. It’s likely we’ll see a greater emphasis on KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

Time.news: The article mentions a need for a holistic approach to DeFi security, going beyond just audits. What does this entail?

Eleanor Vance: You’re right, audits alone are not enough. While security audits are essential, DeFi projects need to adopt a more thorough security strategy. This includes continuous monitoring, threat intelligence gathering, and robust incident response planning. Furthermore, it’s vital to foster a culture of security awareness among users.Encouraging responsible practices to mitigate any future exploits.

Time.news: How can DeFi projects build this “culture of security awareness,” and what practical advice can you offer to users?

Eleanor Vance: DeFi projects can launch bug bounty programs. Rewarding individuals who identify and report vulnerabilities is a great way to crowdsource security expertise.

Expert tip: Users should be wary of DeFi platforms that promise complete anonymity. Privacy is important, but it shouldn’t come at the expense of security and regulatory compliance. Always do your research, understand the risks involved, and only invest what you can afford to lose.

Time.news: what are your thoughts on the ongoing debate about increased regulation in the DeFi space?

Eleanor Vance: It’s a complex issue with valid arguments on both sides. Proponents of regulation argue that it’s necessary to protect investors from fraud and manipulation and ensure market integrity. The Nomad bridge hack is a prime example of the risks associated with unregulated DeFi platforms. Though, opponents argue that regulation could stifle innovation and drive development offshore. Finding the right balance is crucial.Overly restrictive regulations could undermine the decentralized nature of DeFi, which is one of its core strengths. The goal should be smart regulation that protects users without hindering innovation. We need further refinement with innovative approaches, as this is a growing and critically important section of technology.

time.news: Eleanor, thank you for your insights. They provide a valuable outlook on the challenges and opportunities facing the DeFi industry as it moves forward.