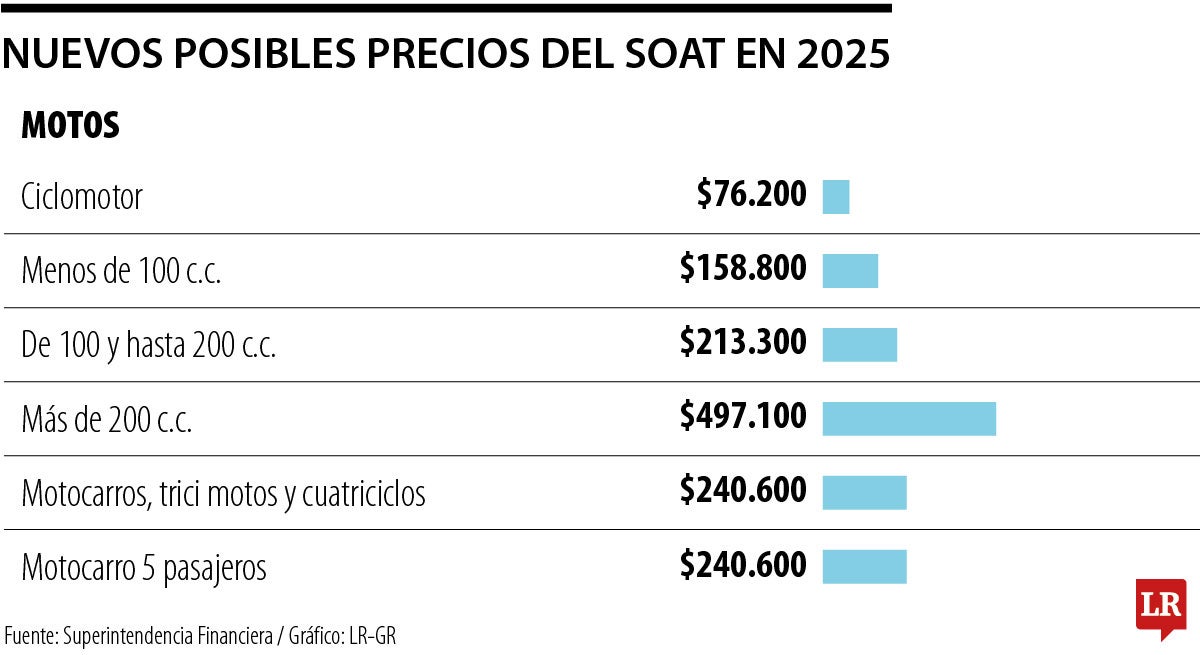

The financial Supervision has unveiled a draft proposal for the new Compulsory Traffic Accident Insurance (SOAT) rates set to take effect in 2025. This initiative aims to gather feedback from stakeholders in the road sector before finalizing the rates. Among the proposed changes, motorcycle insurance rates will see significant adjustments, with costs ranging from $76,200 for mopeds to $497,100 for larger motorcycles. Additionally, private vehicle rates will also change, with family cars facing new premiums based on engine size adn age, such as $291,400 for vehicles under 1,500 cc that are less than ten years old. The Superfinanciera is expected to announce the final rates after reviewing public comments, ensuring that the new SOAT values reflect the needs of all road users.

Q&A: Discussing the New SOAT Rates for 2025 with Industry Expert

Editor of time.news: Thank you for joining us today to discuss the newly proposed rates for the compulsory Traffic Accident Insurance (SOAT) in Colombia, which are set to take effect in 2025. To start, could you provide an overview of these proposed changes?

Expert: Absolutely! the Superintendencia Financiera de Colombia has released a draft proposal for the SOAT rates that aims to adjust premiums based on the needs of different vehicle categories. Notably, while many motorcycle insurance rates will increase significantly, particularly for larger types, the costs for mopeds will start as low as $76,200, and family cars under 1,500 cc that are less than ten years old will see premiums around $291,400. This adjustment reflects the ongoing challenges in the insurance market as well as the need to better address the risks associated with various types of vehicles on the road.

Editor of Time.news: It’s enlightening to hear about the differentiation in rates based on vehicle size and age. How do you see these adjustments impacting vehicle owners, particularly motorcyclists?

Expert: The impact will vary significantly by vehicle type. For motorcyclists, the proposed increases may lead to financial strain, especially for those riding larger motorcycles, which could see premiums rise to $497,100.This is a sharp increase that will require some riders to reassess their financial commitments. It’s essential for motorcyclists to actively engage with the feedback process initiated by the Superintendencia to voice their concerns and possibly advocate for more balanced rates. The final rates will reflect the feedback received,which means participation is crucial.

Editor of Time.news: That’s a crucial point. Speaking of participation, how significant is stakeholder feedback in this process?

Expert: Stakeholder feedback is vital. The Superintendencia’s initiative to gather comments from all sectors involved, including vehicle owners, insurers, and road safety advocates, ensures that the new rates are fair and effective. This provides an possibility for the community to express how these changes could affect them, allowing for adjustments before the rates are finalized. Engaging in this dialog can lead to better outcomes not just for individual owners, but for the broader road safety framework in Colombia.

Editor of Time.news: What advice would you offer to vehicle owners as they prepare for these potential changes?

Expert: I would advise vehicle owners to stay informed about the discussions around the new SOAT rates and to participate in the consultation process. Additionally, it’s beneficial to review their current insurance and assess how the changes might affect their total costs. Exploring options for bundling insurance or seeking out different providers may help mitigate some of the financial impacts. ensuring that their vehicles meet safety standards can also help reduce premiums and enhance overall road safety.

Editor of Time.news: what do you think the long-term implications of these new SOAT rates could be for road safety in Colombia?

Expert: The adjustments in SOAT rates could significantly influence road safety by ensuring that the insurance system remains sustainable and capable of covering accident-related costs for victims. By aligning premiums more closely with the actual risk posed by different vehicle types, we can encourage safer driving behaviors and reduce accident rates. If done thoughtfully, this could ultimately lead to a decreasing trend in road-related injuries and fatalities, benefiting everyone on the road.

Editor of Time.news: Thank you for sharing your insights today. It’s clear that the upcoming changes to SOAT are not just figures on a spreadsheet, but they carry weighty implications for safety and financial planning for vehicle owners throughout Colombia.

Expert: Thank you for having me. it’s always important to discuss these topics openly and keep our audience informed.