On March 24 of this year, the Central Bank revoked the license of “Varks AM” CJSC credit organization for not maintaining the minimum amount of total capital. The 1lurer.am website of the public television company investigated what other persons and organizations this company was connected with and who is behind a number of fast loan companies.

“Credit” and not only. credit organizations of Latvian origin in RA

The credit organization started its activity in Armenia in 2016. We learn from the company’s website that the board members of “Varks” are Latvians, and the executive director is Vardan Hovsepyan. Before that, the latter was a specialist of the banking supervision department of the Central Bank, the head of the internal audit of “Araratbank”, the executive director of another credit organization, “Fast Credit”. The authorized capital of “Varks” is 600 million drams, the company has 52 branches. 95 percent of the shares of “Varks” belong to the company “AST AG Invest”. “TG Invest” is registered in Riga, the capital of Latvia, at Skantses 52. According to the register of Latvian companies, this “T.I.G. investi”. The beneficial owner (beneficiary) of the company is Latvian citizen Aigars Kesenfeld. Later, the Latvian credit organization was reorganized under the name of another company, “Finko Invest”. The share capital of the latter exceeds 1.5 million euros.

Since 2012, the “Goodcredit” universal credit organization has been operating in Armenia, which has five branches, only in Yerevan. The main activity of “Goodcredit” is providing consumer loans. We learn from the company’s website that the credit organization is actually newly formed, because first it was the successor of “Avangard Invest UMC CJSC”, and in 2012, according to the decision of the Central Bank, it was renamed “Goodcredit” UMC CJSC.

The chief director of this credit organization is economist Artashes Tonoyan, and 100 percent of the shares belong to the company 4 Finance Holding SA, which is registered in Luxembourg. 4 Finance was founded in 2008 in Riga, the capital of Latvia, the registered capital of the company was more than 3 million dollars. 4Finance was later reshaped, seriously expanded its activities throughout the world, and was also introduced in Armenia. 4 Finance has already concluded more than 20 million credit agreements worldwide. As in the case of the shareholder of “Varks” TIG Invest, here too we find the name of the Latvian Aigars Kesenfeld as the founder of the company. “Goodcredit” represents another brand in Armenia: “Vivus”. It provides consumer loans of 10-300,000 drams. “Vivus” has four branches, it provides an opportunity to apply for a loan online.

.jpg)

“Mogo”. From Armenia to Luxembourg

“Mogo” universal credit organization has been operating in Armenia since 2017 based on the license received from the Central Bank. “Mogo” has the largest number of loan disbursement points in Armenia, in total there are 327 loan disbursement points throughout the country, most of the disbursement of loans is done at Haymamul kiosks. “Mogo” operates in neighboring Georgia, as well as in Latvia, Lithuania, Estonia, Romania, Moldova, and Bulgaria. A loan is provided in the amount of 350,000-20,000,000 AMD. “Mogo” the general director is Mesrop Arakelyan, who is also the public adviser of Prime Minister Nikol Pashinyanand the shareholder is “Mogo Baltics and Caucasus” company, whose beneficiary is again Aigars Kesenfeld. The roots of this company are also in Latvia, it was founded in 2012. The shareholder of “Mogo Baltics and Caucasus” is Mogo Finance SA registered in Luxembourg.

Mogo Finance SA, registered in Luxembourg, is, in fact, the parent company of “Mogos” operating worldwide. “Mogos” have a wide geography: they are also represented in Kenya, Uganda, Uzbekistan, Kazakhstan, Ukraine, Germany, Holland, Belgium and elsewhere. From the report of Mogo Finance, we learn that Armenian and Georgian “Mogos” have opened several large credit lines in “Ardshinbank”. In February 2018, “Ardshinbank” provided a loan of 1 million euros to Georgian “Mogo” with an interest rate of 7.8 and a repayment period of 3 years. In September 2017, the bank lent 200 million drams to the Armenian “Mogo” at a 12 percent interest rate. The repayment period of the loan is October of this year. According to another credit agreement of 2017, “Mogo” received a loan of 3.8 billion drams from “Ardshinbank”, the repayment term of which is November of this year.

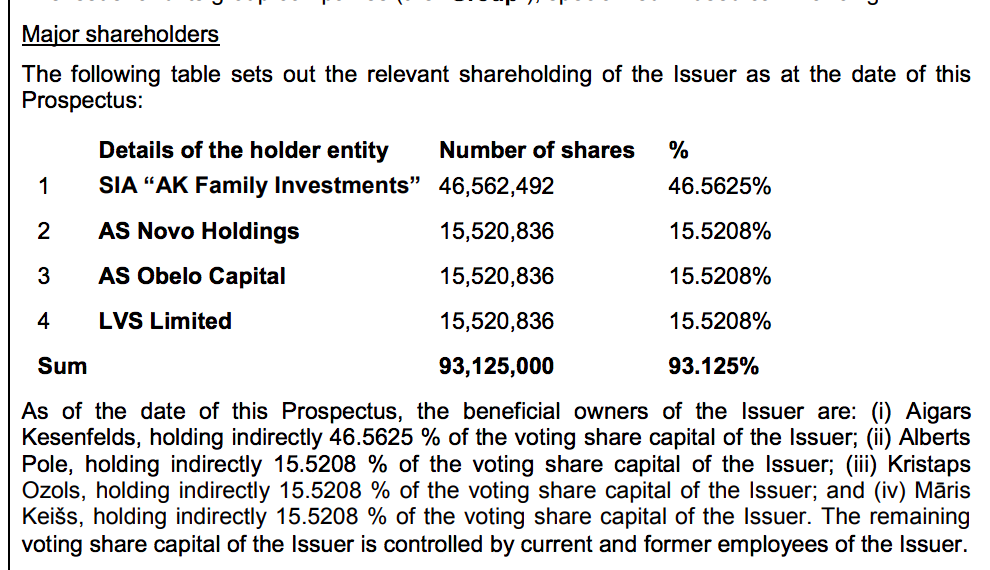

According to the 2019 report, the company had 4 legal entities-shareholders, three of which were registered in Latvia. The largest shares were held by Aigars Kesenfeld’s SIA AK Family investments company, Alberts Pol, Kristas Ozols, and Maris Case companies also have shares. All are Latvians.

The Black Sea media platform published an investigation into the business activities of Russian billionaire Oleg Boyko, and part of the publication referred to Eigars Kesenfeld. We present it below.

“In February 2008, four Latvian classmates from the Stockholm School of Economics founded AS OC Finance credit startup in Riga. 4 friends were Aigars Kesenfeld, Alberts Paul, Kristas Ozols and Maris Keys. They provided small loans to customers through the Internet and text messages. Later, 4 new shareholders joined them, establishing the company Fatcat investments limited in Malta, and in 2011 the company was renamed 4Finance (the company that owns the shares of “Goodcredit” in RA). In October 2011, Russian billionaire Oleg Boyko buys 75 percent of Fatcat investments, paying 55 million dollars, and later Boyko completely acquires 4Finance. Kesenfeld invests the received money in new projects, establishing “Mogo” and investing there.

According to Forbes, Oleg Boyko’s property is 1.1 billion dollars. He is one of the famous actors of casinos and gaming business in Russia.

Among the current shareholders of 4Finance are Vera Boyko, according to the media the mother of Oleg Boyko, Edgar Dupats, who was the assistant and relative of the former Prime Minister of Latvia Andris Shkele. One of the members of 4Finance’s supervisory committee and audit committee, by the way, is an Armenian by nationality, Konstantin Ter-Martirosyan, who also worked in Oleg Boyko’s other financial company, Finstar.

New credit institutions from the same source

Returning to Armenia, we should note that “Varks” shareholder “Finco Invest” referred to the depriving of the credit organization’s license, stating that “Varks” was a profitable company, one of the 100 largest taxpayers in Armenia. “We are disappointed to face the fact that the decision of the Central Bank may call into question the availability of 400 jobs in the country, most of which are in the marzes where there is a high level of unemployment, and many of the employees were at the starting point of their career development,” the company said.

Despite all this, Latvian companies continue to show interest in the Armenian market. Last month, he founded “Mogo UVK” LLC and became a shareholder in “Hima Finance” LLC. whose director is Mesrop Arakelyan. The authorized capital of the company is 310 million drams.

In November 2019, “TG Invest” owned by Aygars Kesenfelds established “elemes” LLC (Loan management services) in Armenia and became a sole shareholder there. Examining the company’s Facebook page, it becomes clear that the credit organization is currently in the process of staff recruitment. And still in 2018, “Longo” LLC was founded, whose shareholder is “Mogo Baltics and Caucasus”, one of the links in the chain of “Mogo” shareholders.

Author of the investigation: Mkrtich Karapetyan.

Details here.

(function(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//connect.facebook.net/ru_RU/sdk.js#xfbml=1&version=v2.6&appId=403315783090535”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));(function(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//connect.facebook.net/en_US/all.js#xfbml=1&appId=429534133762584”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));

.jpg?w=1170&resize=1170,99999&ssl=1)