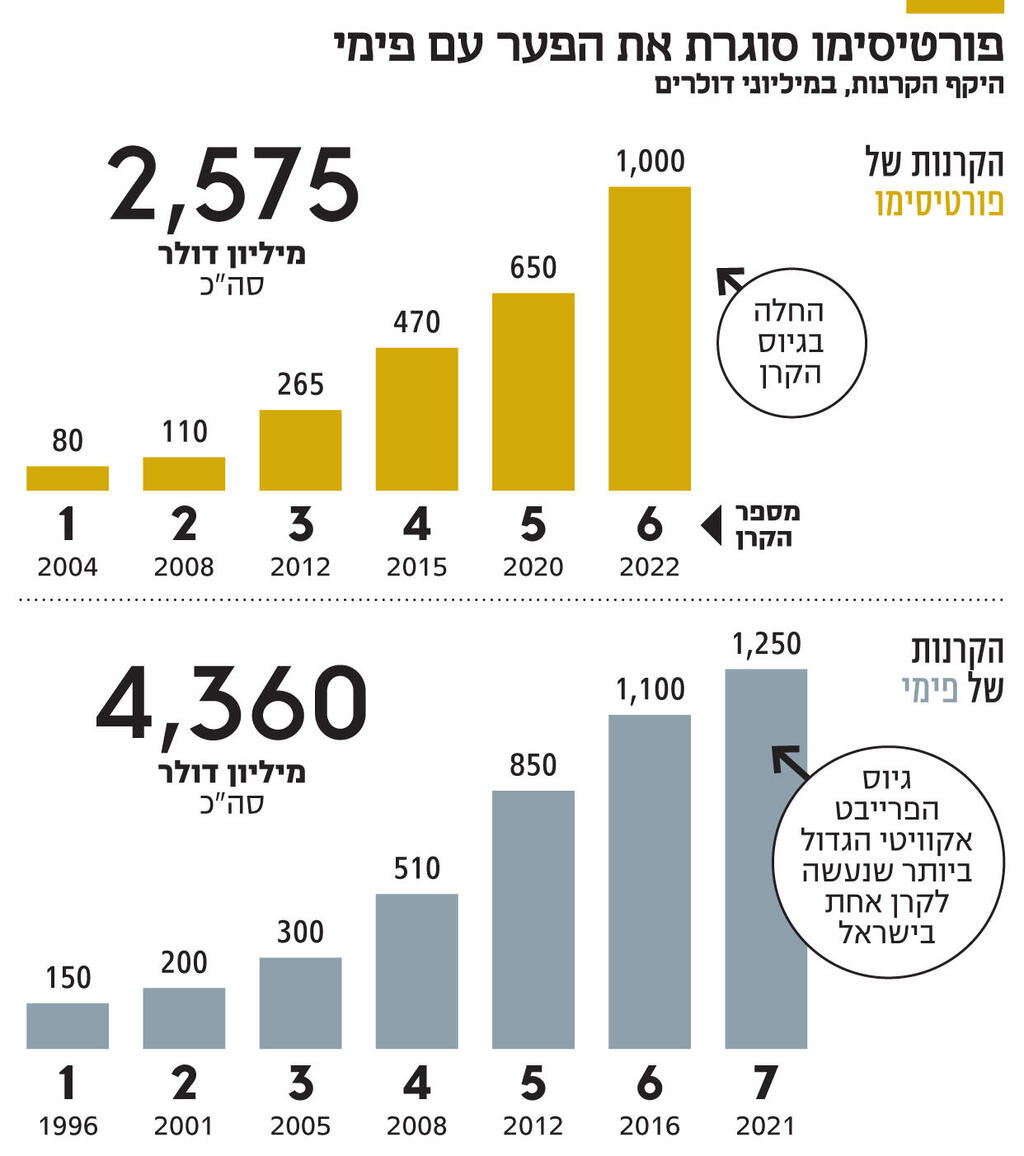

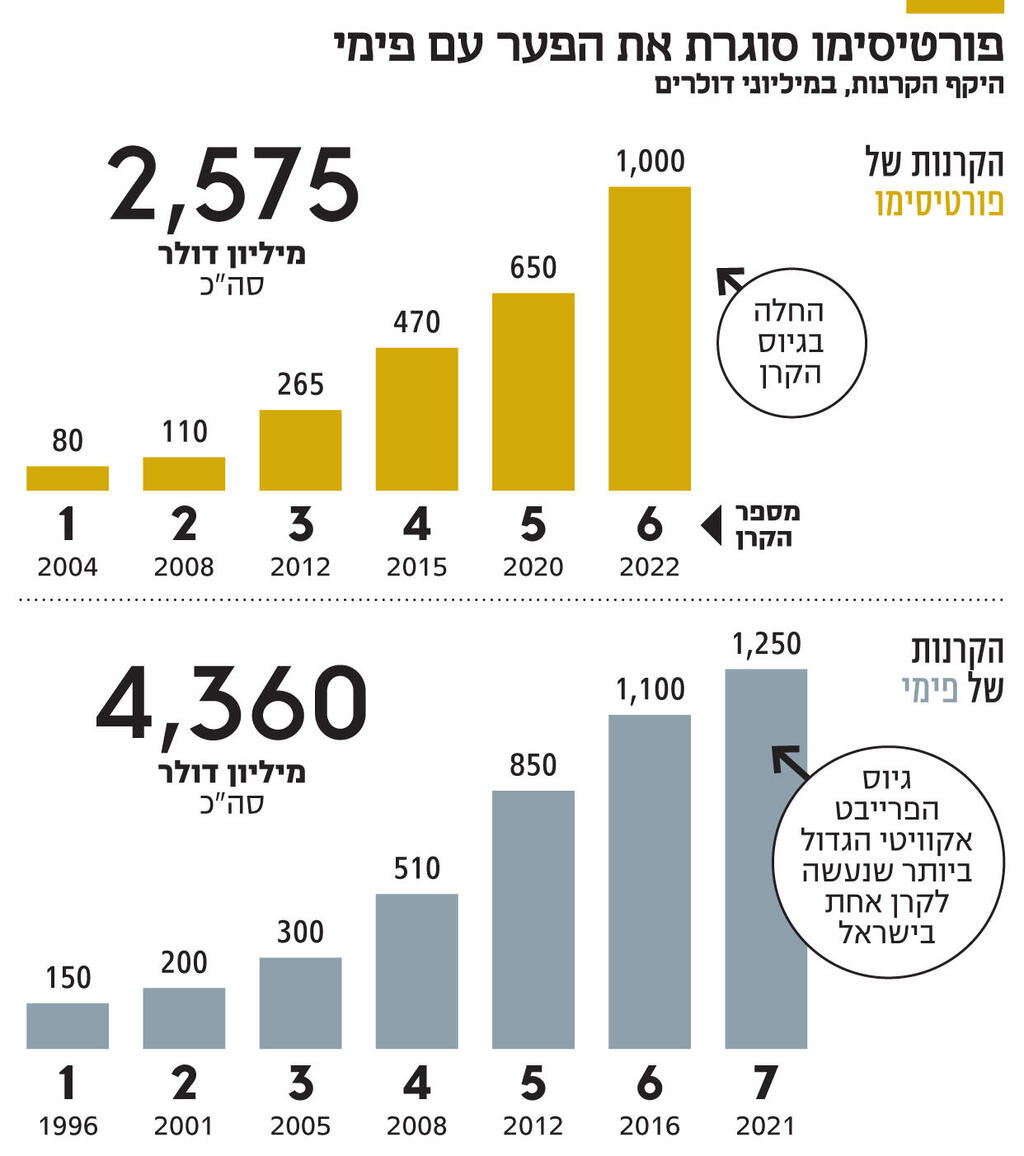

The Fortissimo investment fund is challenging the Pimi fund and is raising $ 1 billion in a sixth fund, Calcalist has learned.

Phimie is the only fund in the country to date to have crossed the $ 1 billion mark in the last two funds it raised in 2016 and 2020, amounting to $ 1.1 billion and $ 1.2 billion. Fortissimo, managed by Yuval Cohen, is the second fund to do so, thus effectively closing a gap on Yishai Davidi’s Phimie.

Read more in Calcalist:

Fortissimo raised its fifth fund in early 2020, and the sixth is raised after a significantly shorter time compared to the time periods that characterize funds between raises. The fund is expected to close between the end of the first quarter of 2022 and the beginning of the second, and will give priority to institutional investors from Israel. In the past, Fortissimo used to give priority to foreign investors, and provoked anger among local investors – a distortion that was already corrected in the fifth round.

The main reason for the large size of the fund and the timing of its recruitment is a change in attitude, in which Fortissimo makes follow-on acquisitions in companies it already controls. Subsequent acquisitions are significant, and some are made with additional capital that the fund flows into the acquired company. This is the case, for example, with Malach Ha’aretz, which the fund acquired at the beginning of 2019 from the Arison ministers for NIS 160 million. In September of that year, Malach Ha’aretz acquired Sugat from the British corporation Mann for $ 55 million, and then Shemen for NIS 142 million. Last August, after the triple merger, Fortissimo introduced Poalim Equity as a partner (20%) in the Salt of the Land category at a value of NIS 800 million. Another reason for increasing recruitment and scheduling is the intention to acquire significant shares in large companies as well, around 50% and more, which is only possible when the fund is large.

Fortissimo invests 70% of its funds in acquiring control or close control of family, collective or private companies, usually through financing. The remaining transactions (30%) are in Special Growth companies – technology companies in which considerable sums have been invested, but have not been able to rise, so they can be acquired or controlled with a relatively low investment of tens of millions of dollars.

Thus, Fortissimo invested $ 12 million at the end of 2020 in the software company GigaSpaces, which went through several crises, changed its business model and quadrupled its revenue. By then, $ 45 million had been invested in the company. Fortissimo has invested at a value of $ 30 million to the company. Last November, Giga Spaces raised another capital, partly from existing shareholders and partly from Bank Leumi – at double value.

2 View the gallery

Founder and co-manager of the Fortissimo Foundation Yuval Cohen

(Photo: Uriel Cohen)

A similar investment was made by Incredibuild, a company that has developed technology to accelerate software development processes in the local network. Fortissimo bought from the founders Uri Shaham and Uri Mish’ol about 90% of the company’s shares for $ 30 million and at a value of $ 38 million, and in March this year sold about 70% of the shares to the Insight Fund for $ 140 million and at a value of about $ 200 million, according to publications.

In both companies, Fortissimo changed the business model, helping them develop through their own means or acquisitions.

In a world where foreign funds are launching the value of Israeli start-ups within a few months to the value of Unicorn, Fortissimo is targeting various investments. Not those of 10% -20% while accompanying the existing management, but acquiring control of companies that have failed at lower values, entering the core of their activity, leading to new markets, making acquisitions and improving operational efficiency – through an eight-point plan that accompanies the companies it acquires.

The new fund’s investments will be mainly in Israel, but as Fortissimo acquired 85% of the Dutch healthcare company Prothya about 50 million years ago, for 50 million euros, it may make additional acquisitions abroad. Fortissimo’s investment team includes in addition to the founder and partner Director Yuval Cohen, Eli Ballet, Shmulik Brashi, Mark Laznik, Yochai Hacohen, Yoav Heinman, Uri Zehavi, Itamar Efal, Oren Batzri and Noni Glazer.

2 View the gallery

To date, Fortissimo has raised $ 1.6 billion for five institutional and financial institutions from Israel, the United States and Europe, and has made 60 acquisitions so far. To date, it has raised significantly lower amounts, ranging from $ 80 million for the first fund to $ 650 million for the latter. The fund’s IRR (internal rate of return) stands at 27% per annum, and the average multiplier in which it has realized its holdings over the years is four times. Tech, which earned her hundreds of millions of dollars.

But Fortissimo also had falls similar to that of Phimie, who was forced to sell her holding on the scale for no consideration. At Fortissimo it was Synergy Cables and Phenicia, who ran into difficulties. The fund says that they were able to recoup the investments in these companies as well, but they did not yield the return that the fund’s investors expected.

The new fund is expected to invest in software, digital printing, food and agriculture technologies, healthcare, industry and electronics. Fortissimo’s current portfolio companies include Slopark, Green Invoice, Bank of Biochemistry, Tottenaur, Motorad, Kramer Electronics and Anarchon.

In the current status of Fortissimo, it is difficult not to compare it to Phimie, who emphasizes that it is the largest private equity fund in Israel. The two often compete to acquire the same holding, as in the case of the Rivlis irrigation company, where Phimie overcame Fortissimo. But lately, the picture seems to be changing, and the Rhenium company, which Phimie also kept an eye on, preferred to sell 50% to Fortissimo in a deal worth hundreds of millions of shekels, which is perfect these days and was revealed in “Calcalist”. When the acquired companies choose a partner, the chemistry between the parties and DNA also has weight, and there are quite a few differences between the two companies – from the method of activity, through the investment areas to the dress code: Pimi takes care of suits and ties, and Fortissimo is more relaxed.

There is no doubt that the last two years have been the years of venture capital funds, such as Pitango and Carmel, which made billions of shekels in exits and overshadowed the returns of traditional investment funds. The question is whether in light of the changes in the markets these days investors will not return to traditional funds.

.