Korean Real Estate Rescue: Will the “Soft Landing” Strategy Work?

Table of Contents

Can South Korea pull off a financial tightrope walk? The Financial Supervisory Service (FSS) is betting on a “soft landing” for its troubled real estate Project Financing (PF) market. But with billions at stake, the question isn’t just if they can, but how, and what the ripple effects will be – even across the Pacific.

The Korean PF Crisis: A Swift Overview

Think of it like this: developers borrowed big to build, but now they’re struggling to repay those loans. The FSS is stepping in to restructure and reorganize these debts, aiming to prevent a full-blown financial meltdown.The initial spark? The 2022 Legoland Korea default, followed by Taeyoung Construction’s woes in late 2023. Now, the FSS is actively working to resolve insolvent projects identified since June 2024.

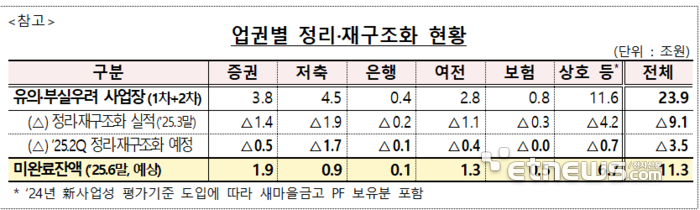

The numbers are notable: roughly ₩23.9 trillion (about $17.5 billion USD) in troubled PF loans, with about 38.1% already restructured. The goal is to reduce the remaining insolvency to ₩11.3 trillion (around $8.3 billion USD) by the end of June.

The FSS’s Playbook: Restructuring and Reconstruction

The FSS isn’t just throwing money at the problem. Their strategy involves a multi-pronged approach:

- Organizing Medium-Sized Sites: Expect to see a ₩1.6 trillion (approximately $1.2 billion USD) business site reorganized in the second quarter.

- Selling PF Credit: A ₩1.5 trillion (about $1.1 billion USD) sale of PF credit to the savings bank’s 4th PF normalization fund is in the works.

- Negotiating with Information Disclosure Platforms: Insolvent projects worth ₩400 billion (around $293 million USD) are currently under negotiation.

Who’s Holding the Bag?

the remaining insolvency is spread across various financial institutions:

- Banks: ₩100 billion (about $73 million USD)

- Insurance Companies: ₩500 billion (approximately $366 million USD)

- Savings Banks: ₩90 billion (around $66 million USD)

- Women’s Business Funds: ₩1.3 trillion (roughly $952 million USD)

- Securities Firms: ₩1.9 trillion (about $1.4 billion USD)

A significant portion remains within Saemaul Undong PFs, including mutual financial sectors, were large-scale sales are challenging due to the nature of small loans.

Potential Implications for the US Market

Why should Americans care about south Korean real estate? here’s why:

- Global Financial Contagion: A major crisis in korea could trigger a domino effect, impacting global financial markets, including the US.

- Investment Exposure: US institutional investors may have indirect exposure to Korean real estate through various investment vehicles.

- Economic Slowdown: A Korean economic downturn could affect US exports and supply chains.

Consider the 2008 financial crisis. Subprime mortgages in the US triggered a global recession. Similarly, problems in the Korean PF market could have unforeseen consequences worldwide.

The Road Ahead: Challenges and Opportunities

The FSS acknowledges that the “urgent fire” is being addressed,but the situation requires ongoing vigilance. They plan to maintain “power supervision,” including additional contributions from the second half of the year. On-site inspections will be crucial to identify potential new risks.

Han, Deputy director of the Small and Medium Finance Division of the Han -gu FSS, stated, “Now, the big fire has evolved, and now we will be on -site inspection to find a fire and fire source. We will promptly complement it if the PF loan process is confirmed by on -site inspection, and we will try to raise the level of soundness management and credit screening by sharing it.”

Potential Challenges:

- Hidden Risks: The FSS may not be aware of all the troubled projects.

- Market Sentiment: Negative sentiment could further depress the real estate market.

- Global Economic Conditions: A global recession could exacerbate the crisis.

Potential Opportunities:

- Distressed Asset Investing: Opportunities may arise for investors specializing in distressed assets.

- Structural Reforms: The crisis could lead to much-needed reforms in the Korean financial system.

- Increased Transparency: Greater transparency in the PF market could attract foreign investment.

The Bottom Line

The Korean real estate PF market is at a critical juncture. The FSS’s “soft landing” strategy faces significant challenges, but also presents potential opportunities. Weather they succeed will have implications not just for Korea, but for the global financial system.Keep a close watch on this situation – it could be a bellwether for broader economic trends.

Korean Real Estate Crisis: Will South Korea’s “Soft Landing” Strategy Work? A Q&A with Financial Expert Dr. Anya Sharma

Keywords: Korean Real Estate, project Financing, South Korea, FSS, Financial Crisis, Soft Landing, Global Economy, Investment, Risk Management, Financial Markets

Time.news: Dr. Anya Sharma, thank you for joining us today.The Korean real estate market is facing a significant challenge with its Project Financing (PF) loans. Can you provide our readers with a general overview of what exactly is happening in South korea?

Dr. Anya Sharma: Certainly. South Korea is currently grappling with a crisis in its real estate Project Financing market. Essentially, developers took out considerable loans to fund construction projects, but now many are finding it difficult to repay those loans. We’re seeing a situation where the Financial Supervisory Service (FSS) is actively intervening to restructure this debt and prevent what could be a major financial meltdown. The seeds of this were sown with events like the Legoland Korea default in 2022 and the issues surrounding Taeyoung Construction more recently.

Time.news: The article mentions the FSS is pursuing a “soft landing” strategy. What does that actually meen in this context?

Dr.Anya Sharma: “Soft landing” is the ideal scenario where the FSS manages to restructure this debt and stabilize the market without triggering a widespread financial crisis. It’s a delicate balancing act. The FSS is essentially trying to reorganize insolvent projects, sell off PF credit, and negotiate with relevant platforms to prevent a sudden and catastrophic collapse of the real estate sector. They are actively trying to minimize the fallout.

Time.news: The numbers mentioned are substantial – roughly ₩23.9 trillion in troubled PF loans. Who are the primary stakeholders feeling the pressure from these non-performing loans?

Dr. Anya Sharma: The remaining insolvency is spread across a surprisingly diverse range of financial institutions. While banks and insurance companies are exposed, we also see significant sums held by Women’s Business Funds and securities firms. A particularly concerning area is the volume held within saemaul Undong PFs, these mutual financial sectors. These frequently enough consist of smaller, harder-to-sell loans which presents a systemic risk.

Time.news: Why should our readers in the U.S., or really anywhere outside of Korea, be paying attention to this situation?

Dr. Anya Sharma: The interconnectedness of the global financial system is such that problems in one region can quickly ripple outwards.A major crisis in South Korea could lead to global financial contagion, impacting markets worldwide, including the US. US institutional investors might have indirect exposure to Korean real estate via various investment vehicles. Also, a Korean economic slowdown can negatively effect US exports and global supply chains. The 2008 financial crisis offers a stark reminder of how localized issues can quickly escalate into worldwide problems.

Time.news: The article highlights potential challenges the FSS faces: hidden risks, market sentiment, and global economic conditions. Which of these do you see as the most pressing?

Dr. Anya Sharma: While all three present real obstacles, I believe global economic conditions pose the greatest threat. South Korea is heavily dependent on exports. A global recession would significantly depress demand for Korean goods, further pressuring developers and making it much harder to achieve that “soft landing.” Market sentiment is also crucial. Negative news and a lack of confidence could create a self-fulfilling prophecy,worsening the crisis.

Time.news: On the flip side, what potential opportunities might arise from this situation?

Dr. Anya sharma: Distressed asset investing is definitely one area to watch. As developers struggle, opportunities may emerge for investors specializing in turning around troubled projects or acquiring assets at discounted prices. Also, this crisis could serve as a catalyst for structural reforms within the Korean financial system, leading to greater transparency and more robust risk management practices. Ultimately, it’s an opportunity to rebuild with a stronger foundation.

Time.news: The article mentions Deputy director Han of the FSS planning for on-site inspections. Is this typical, and what might those inspections uncover?

dr. Anya sharma: On-site inspections are essential to properly evaluate the situation. They are frequently enough used in cases like this. These inspections are important for uncovering any hidden risks or weaknesses in the Project financing loan process.By closely examining these processes, and if there are any problems, the FSS can take swift action by improving risk and credit screening and raise the level of soundness to the project.

Time.news: Dr. Sharma, what key takeaway or piece of advice would you give our readers concerning the Korean Real Estate Project Financing crisis?

Dr. anya sharma: Understand that even seemingly localized financial issues can impact the global economy. Stay informed, particularly regarding the performance of Saemaul Undong PFs – as their struggles will reflect the overall health of the Korean financial system. For investors, recognize both the potential risks and the opportunities that can arise from distressed assets, but proceed with extreme caution and conduct thorough due diligence. Think globally, but act locally, and keep a close eye on how the FSS manages this challenge – it will tell us a great deal about where the global economy may be headed.

Time.news: Dr. Sharma, thank you for insights to explain this real estate situation in South Korea.